A secured transaction involves a sale on credit or lending money where a creditor is unwilling to accept the promise of a debtor to pay an obligation without some sort of collateral. The creditor requires the debtor to secure the obligation with collateral so that if the debtor does not pay as promised, the creditor can take the collateral, sell it, and apply the proceeds against the unpaid obligation of the debtor.

A security interest is an interest in personal property or fixtures that secures payment or performance of an obligation. Personal property is basically anything that is not real property. A fixture is personal property that has become so attached or adapted to real estate that it has lost its character as personal property and is deemed to be part of the real estate. An example would be a central air conditioning unit within a commercial building.

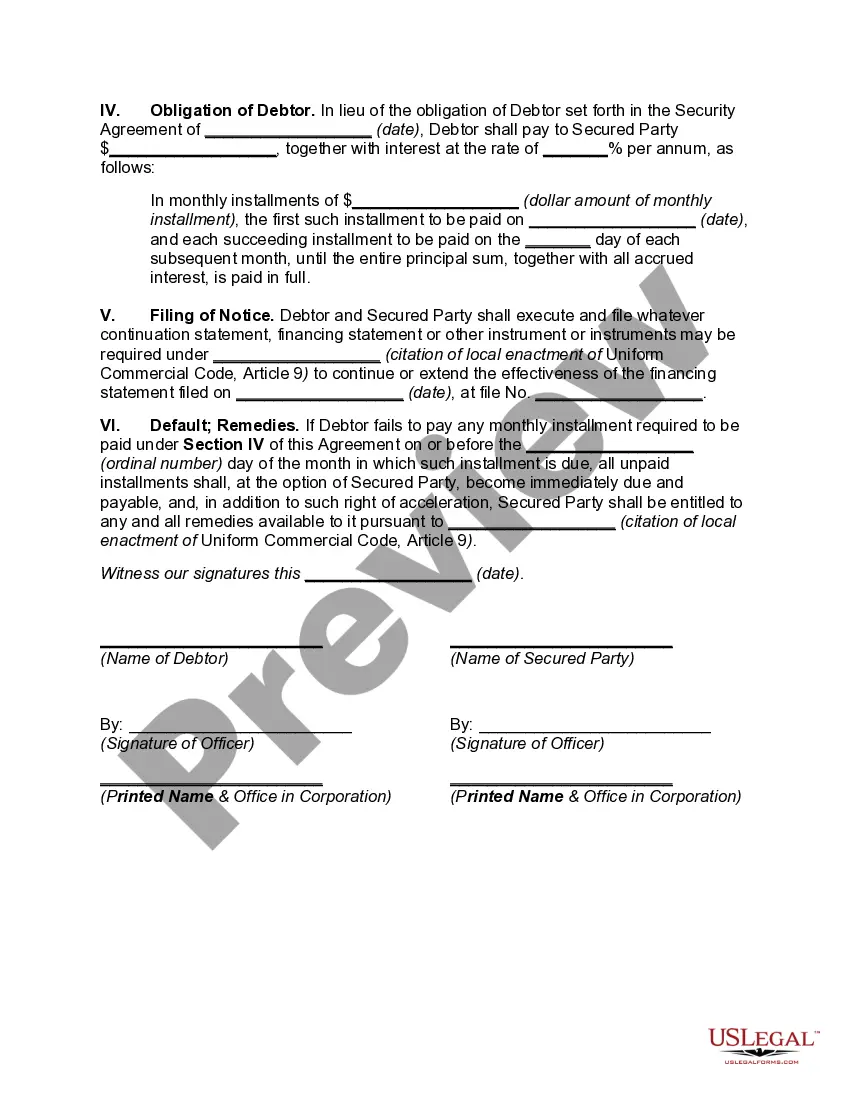

An Agreement to Extend Security Interest is a legal document that is used to extend the term of an existing security interest. A security interest is a type of lien that establishes a claim over an asset in order to secure the payment of a debt or other obligation. An Agreement to Extend Security Interest is used to extend the duration of the security interest beyond the original term of the security agreement. The types of Agreement to Extend Security Interest include mortgage extension agreements, automobile loan extension agreements, and equipment loan extension agreements. Mortgage extension agreements are used to extend the term of an existing mortgage. Automobile loan extension agreements are used to extend the term of an existing auto loan. Equipment loan extension agreements are used to extend the term of an existing loan for equipment. All of these agreements must be signed by both the lender and the borrower in order to be valid.