Sample Letter for Insufficient Amount to Reinstate Loan

Description Reinstatement Letter Mortgage

How to fill out Sample Letter For Insufficient Amount To Reinstate Loan?

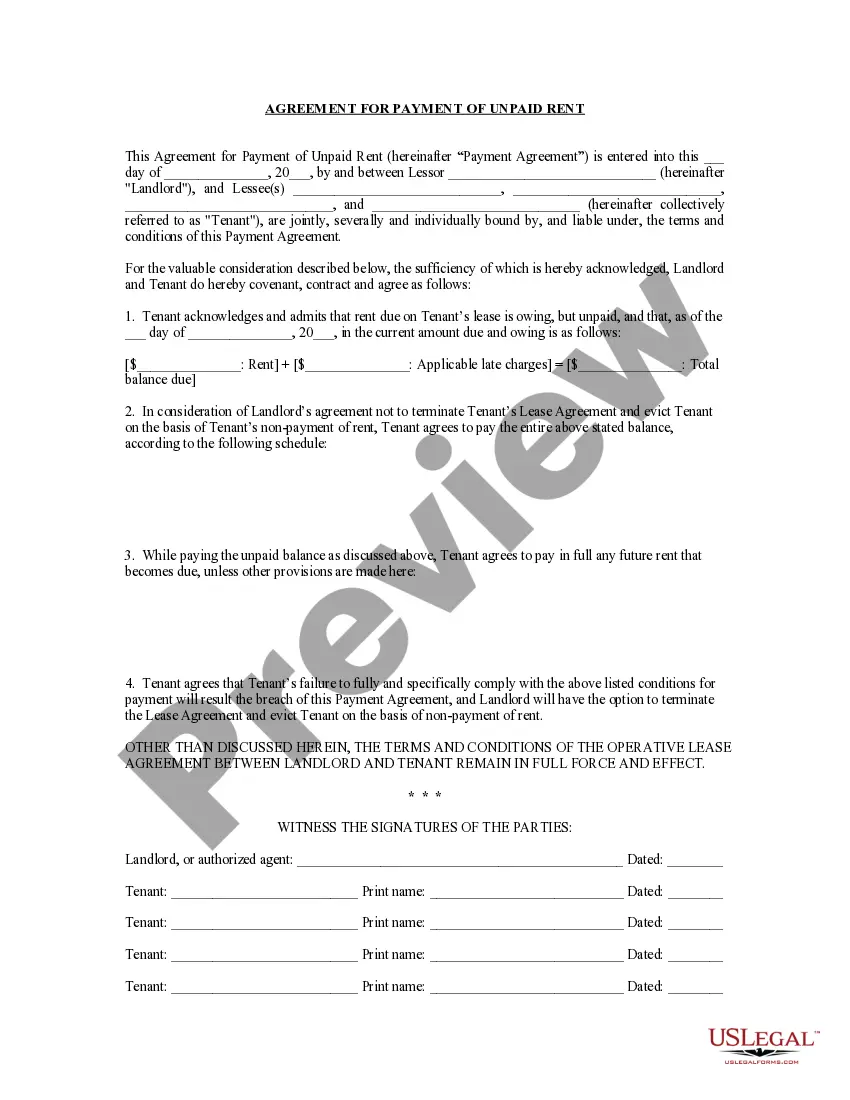

Use US Legal Forms to get a printable Sample Letter for Insufficient Amount to Reinstate Loan. Our court-admissible forms are drafted and regularly updated by skilled lawyers. Our’s is the most complete Forms catalogue on the internet and provides affordable and accurate templates for customers and attorneys, and SMBs. The documents are grouped into state-based categories and a number of them can be previewed prior to being downloaded.

To download templates, users must have a subscription and to log in to their account. Press Download next to any form you need and find it in My Forms.

For people who don’t have a subscription, follow the tips below to easily find and download Sample Letter for Insufficient Amount to Reinstate Loan:

- Check out to make sure you have the proper template with regards to the state it’s needed in.

- Review the form by looking through the description and using the Preview feature.

- Press Buy Now if it’s the template you want.

- Generate your account and pay via PayPal or by card|credit card.

- Download the template to the device and feel free to reuse it multiple times.

- Make use of the Search field if you need to get another document template.

US Legal Forms provides a large number of legal and tax samples and packages for business and personal needs, including Sample Letter for Insufficient Amount to Reinstate Loan. Above three million users have used our platform successfully. Select your subscription plan and get high-quality forms in a few clicks.

Loan Reinstatement Letter Sample Form popularity

Sample Reinstatement Letter Other Form Names

FAQ

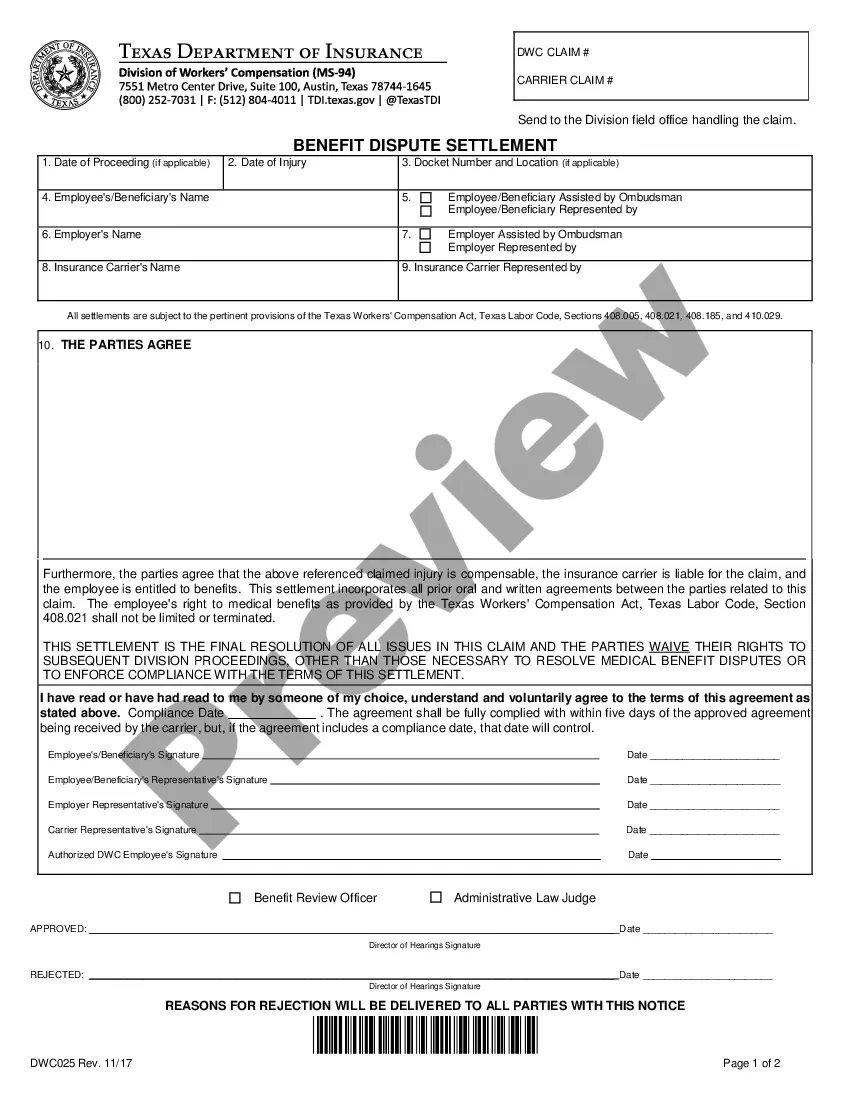

Reinstatement involves making a single payment to catch up with everything due on a loan. By contrast, payoff involves paying the lender the total remaining balance of the loan. (Payoff before a foreclosure sale is commonly known as redemption, which is an equitable right available in every state.)

You may immediately reinstate your mortgage loan account by paying the mortgage lender the total past-due amount in full.If this is your situation, you may be able to negotiate a reinstatement repayment plan with the mortgage lender.

Suspend past due amounts. Bring your account current. Adjust your interest rate. Lower your minimum payments. Modify your loan. Agree to a short sale of a home. Consider a settlement option.

Reinstatement is designed to get a borrower back to current status on his or her mortgage. Once the loan is reinstated, the borrower must continue to make his or her regularly scheduled payments. The right to reinstatement usually expires within ninety days of being served with a summons for a foreclosure action.

Most states, including California, allow property owners defaulting on their mortgages to reinstate their loans and avoid threatened foreclosure. For example, if you're eight months delinquent on mortgage payments, you can catch them up, pay late fees and other costs, and the lender can't foreclose.

A hardship letter explains why a homeowner is defaulting on their mortgage and needs to sell their home for less than what's owed. The best letters read like an attorney's pleading. They establish facts in a way as to convince a mortgage lender to grant a short sale or loan modification instead of a foreclosure.

Reinstatement involves making a single payment to catch up with everything due on a loan. By contrast, payoff involves paying the lender the total remaining balance of the loan. (Payoff before a foreclosure sale is commonly known as redemption, which is an equitable right available in every state.)

Reinstatement is the restoration of a person or thing to a former position. Regarding insurance, reinstatement allows a previously terminated policy to resume effective coverage.

A reinstatement quote is what is given to a borrower that outlines what they owe. This will typically include: Back and current payments. Any late fees. Cost of property inspections.