Net Lease of Equipment is a type of lease agreement in which the lessee (the party renting the equipment) pays the lessor (the party owning the equipment) for the cost of the equipment, plus a predetermined amount for taxes, insurance, and maintenance. The lessee is responsible for all operating costs associated with the equipment, such as fuel and labor. The lessor is responsible for any repairs or upgrades necessary for the equipment to remain in good condition. The lessee pays a fixed monthly or quarterly lease payment to the lessor for the duration of the lease. There are two types of Net Lease of Equipment: a single-net lease and a triple-net lease. In a single-net lease, the lessee is responsible for taxes, insurance, and maintenance costs, in addition to the monthly lease payment. In a triple-net lease, the lessee is responsible for all three costs, plus any operating costs associated with the equipment.

Net Lease of Equipment

Description

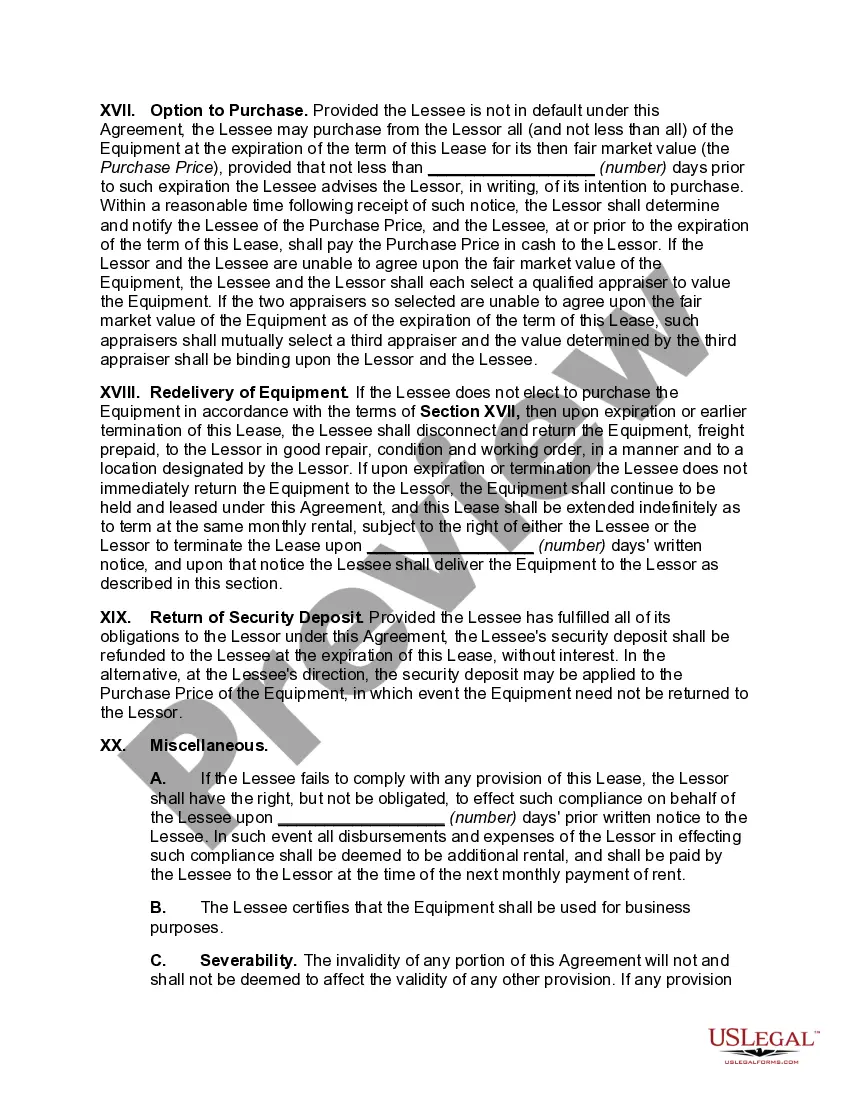

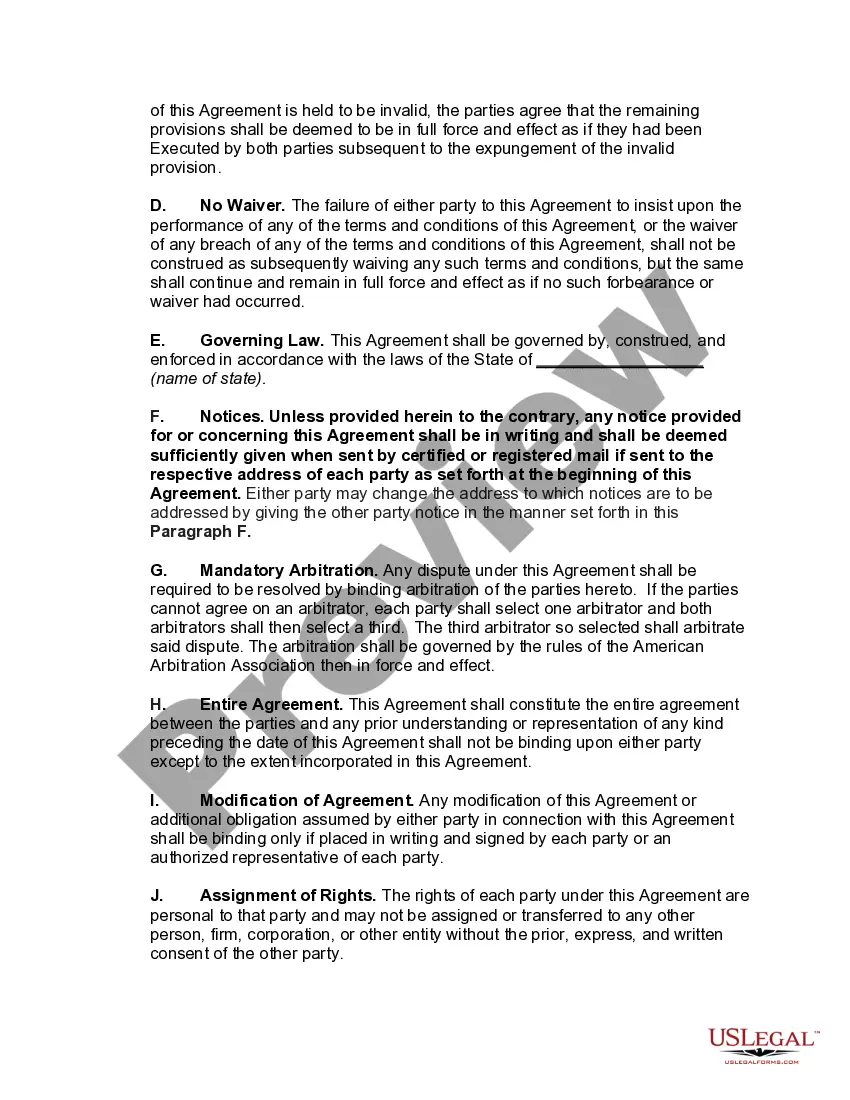

How to fill out Net Lease Of Equipment?

Coping with legal documentation requires attention, precision, and using properly-drafted templates. US Legal Forms has been helping people countrywide do just that for 25 years, so when you pick your Net Lease of Equipment template from our library, you can be sure it complies with federal and state regulations.

Dealing with our service is simple and quick. To get the necessary paperwork, all you’ll need is an account with a valid subscription. Here’s a brief guide for you to find your Net Lease of Equipment within minutes:

- Remember to attentively examine the form content and its correspondence with general and law requirements by previewing it or reading its description.

- Search for an alternative official blank if the previously opened one doesn’t suit your situation or state regulations (the tab for that is on the top page corner).

- Log in to your account and download the Net Lease of Equipment in the format you prefer. If it’s your first time with our website, click Buy now to continue.

- Register for an account, select your subscription plan, and pay with your credit card or PayPal account.

- Decide in what format you want to obtain your form and click Download. Print the blank or upload it to a professional PDF editor to prepare it paper-free.

All documents are drafted for multi-usage, like the Net Lease of Equipment you see on this page. If you need them in the future, you can fill them out without re-payment - simply open the My Forms tab in your profile and complete your document whenever you need it. Try US Legal Forms and accomplish your business and personal paperwork quickly and in full legal compliance!

Form popularity

FAQ

How do you Calculate a Triple Net Lease. First, add annual property taxes and insurance for the building, then divide the total by the building's total amount of rental square footage.

A Table Of Contents On Triple Net Leases Pros. Reliable Income Source. Tenant Controls Their Vision. Limits Overhead Costs. Passive Management Role. Equity Building Investment. Cons. Earnings Cap. Vacancy Costs. Protecting Your Investment.

These lease agreements are a popular tool for commercial real estate investors who buy properties for the income and do not want the headaches of arranging maintenance, paying municipal taxes, and so on. Property owners use net leases to shift the burden of managing taxes, insurance, and fees to the tenant.

The most obvious benefit of using a triple net lease for a tenant is a lower price point for the base lease. Since the tenant is absorbing at least some of the taxes, insurance, and maintenance expenses, a triple net lease features a lower monthly rent than a gross lease agreement.

Net Lease Example Under a triple net lease, the tenant pays property taxes, insurance, and maintenance costs, plus their monthly rent payment. Property taxes on the building are $1,000 per month, insurance premiums are $500 per month, and maintenance costs are $500 per month for a total of $2,000.

Net Lease. In a net lease, the tenant pays some or all of the expenses. For example, in a triple net lease, the tenant pays all of the expenses in addition to the rent. A net lease, in particular a triple net lease, is commonly used by commercial tenants.

There are two primary types of equipment leases: operating leases and financial leases.

Rents are generally lower with net leases than traditional leases?the more expenses a tenant has to bear, the lower base rent a landlord charges. But triple net leases are usually bondable leases, which means a tenant cannot back out because the costs?especially maintenance costs?may be higher.