Sale of Stock for Personal Property is a transaction in which a person or business sells a certain type of stock or other security for personal use. This type of transaction can be used to liquidate an asset, such as a real estate property, or to raise capital for a business. The terms of the sale and the value of the stock or security will depend on the buyer and seller. There are two main types of Sale of Stock for Personal Property: public sale and private sale. In a public sale, the stock is offered for sale on a publicly-traded exchange, and the terms and conditions of the sale are determined by the stock exchange. In a private sale, the stock is offered for sale directly between the buyer and seller, and the terms and conditions of the sale are determined by the parties involved.

Sale of Stock for Personal Property

Description

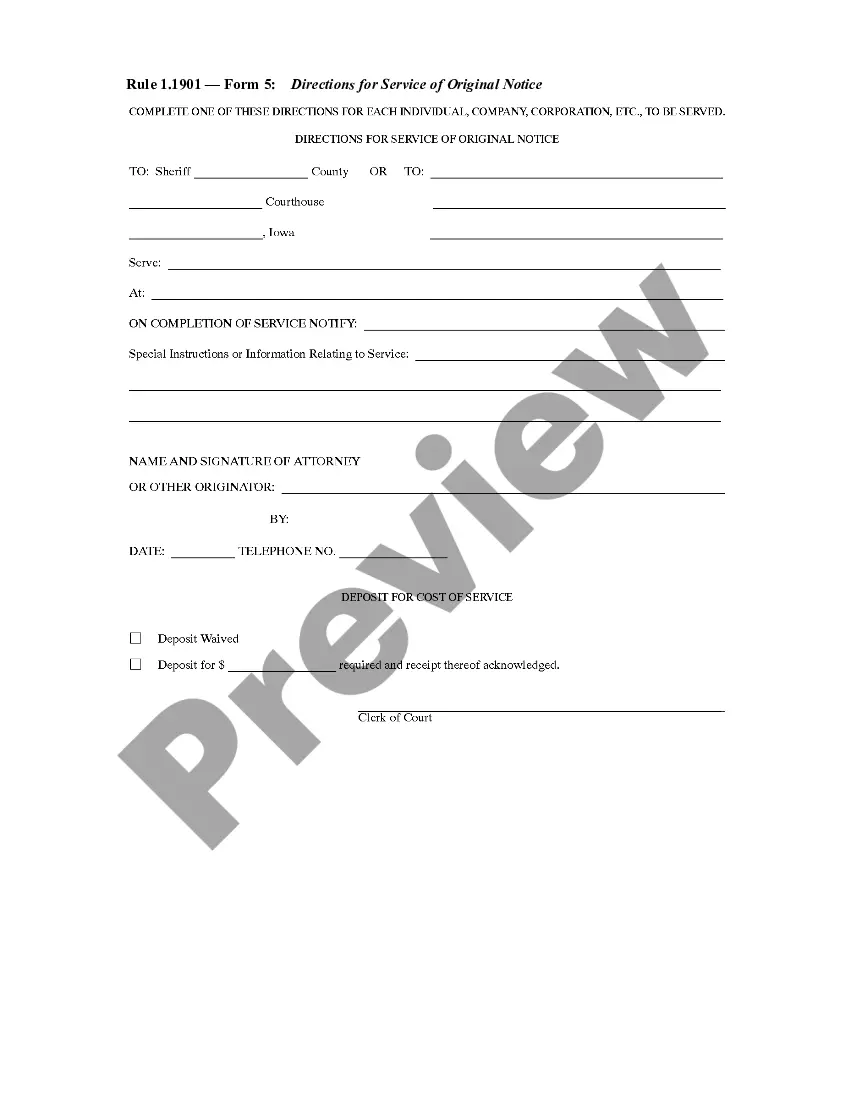

How to fill out Sale Of Stock For Personal Property?

Preparing official paperwork can be a real burden if you don’t have ready-to-use fillable templates. With the US Legal Forms online library of formal documentation, you can be certain in the blanks you find, as all of them correspond with federal and state regulations and are verified by our specialists. So if you need to complete Sale of Stock for Personal Property, our service is the best place to download it.

Getting your Sale of Stock for Personal Property from our catalog is as simple as ABC. Previously authorized users with a valid subscription need only sign in and click the Download button after they locate the correct template. Afterwards, if they need to, users can use the same blank from the My Forms tab of their profile. However, even if you are unfamiliar with our service, signing up with a valid subscription will take only a few moments. Here’s a brief guideline for you:

- Document compliance check. You should carefully examine the content of the form you want and make sure whether it suits your needs and complies with your state law requirements. Previewing your document and looking through its general description will help you do just that.

- Alternative search (optional). Should there be any inconsistencies, browse the library through the Search tab above until you find an appropriate blank, and click Buy Now once you see the one you want.

- Account creation and form purchase. Register for an account with US Legal Forms. After account verification, log in and select your preferred subscription plan. Make a payment to continue (PayPal and credit card options are available).

- Template download and further usage. Select the file format for your Sale of Stock for Personal Property and click Download to save it on your device. Print it to fill out your papers manually, or take advantage of a multi-featured online editor to prepare an electronic version faster and more effectively.

Haven’t you tried US Legal Forms yet? Subscribe to our service today to obtain any formal document quickly and easily whenever you need to, and keep your paperwork in order!

Form popularity

FAQ

If you sell stocks for a profit, you'll likely have to pay capital gains taxes. Generally, any profit you make on the sale of a stock is taxable at either 0%, 15% or 20% if you held the shares for more than a year, or at your ordinary tax rate if you held the shares for a year or less.

When selling your stocks, it is possible to pick your cost basis on the shares that you sell. By handpicking the individual shares, you may be able to avoid capital gains taxes by selling shares that are at a loss (or at least have lower gains), even if your overall position in that investment has made money.

Property held for personal use only, rather than for investment, is a capital asset, and you must report a gain from its sale as a capital gain. However, you cannot deduct a loss from selling personal use property.

You'll have to file a Schedule D form if you realized any capital gains or losses from your investments in taxable accounts. That is, if you sold an asset in a taxable account, you'll need to file. Investments include stocks, ETFs, mutual funds, bonds, options, real estate, futures, cryptocurrency and more.

A personal use asset is: a CGT asset, other than a collectable, that you use or keep mainly for the personal use or enjoyment of yourself or your associates. an option or a right to acquire a personal use asset. a debt resulting from a CGT event involving a CGT asset kept mainly for your personal use or enjoyment.

If you or your family use the home for more than two weeks a year, it's likely to be considered personal property, not investment property.15 This makes it subject to taxes on capital gains, as would any other asset other than your principal residence.

Capital gains apply to any type of asset, including investments and those purchased for personal use. The gain may be short-term (one year or less) or long-term (more than one year) and must be claimed on income taxes.

The gain on the sale of a personal item is taxable. You must report the transaction (gain on sale) on Form 8949, Sales and Other Dispositions of Capital AssetsPDF, and Form 1040, U.S. Individual Income Tax Return, Schedule D, Capital Gains and LossesPDF.