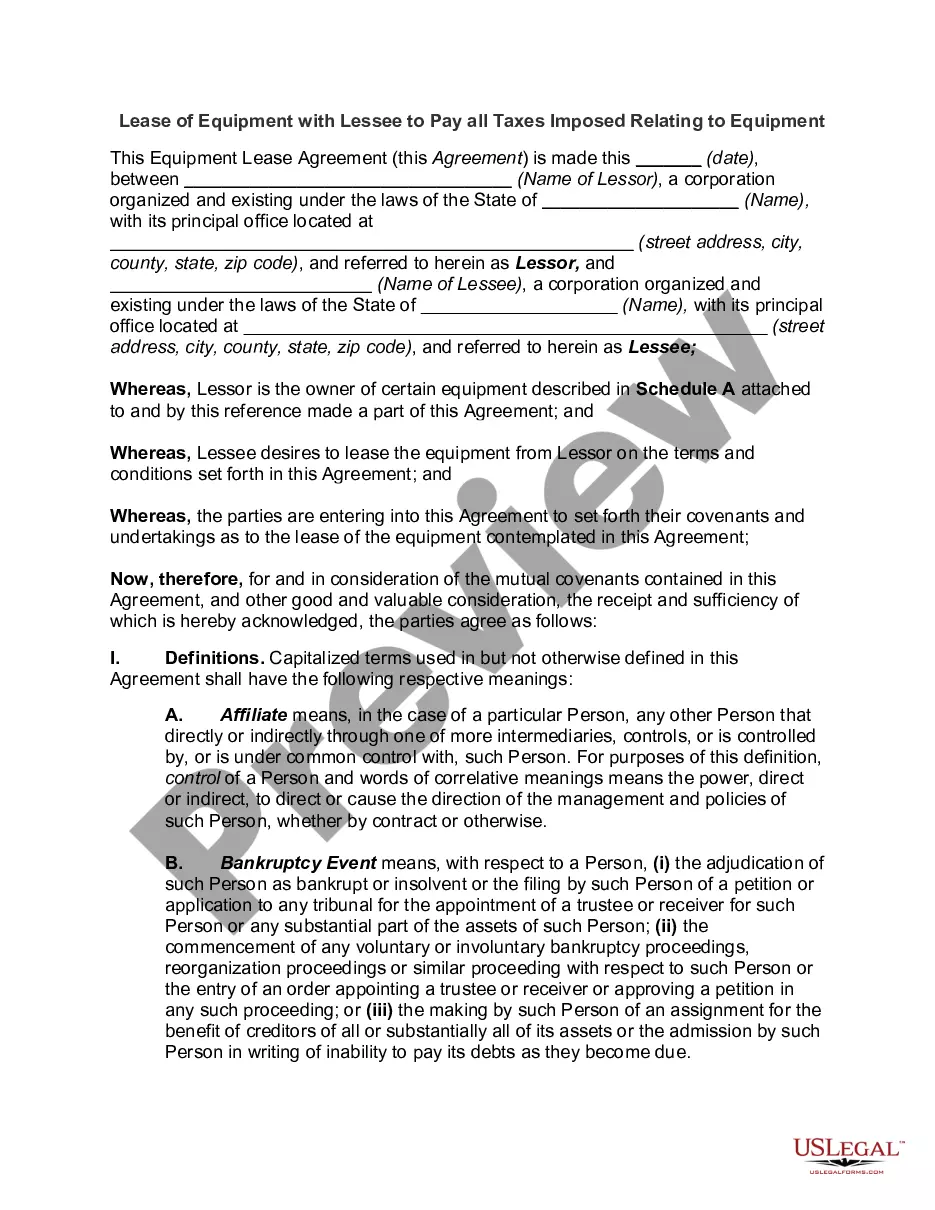

Lease of Equipment with Lessee to Pay all Taxes Imposed Relating to Equipment is a type of lease agreement between a lessor and a lessee whereby the lessee is responsible for paying all taxes imposed on the equipment being leased. The lessee agrees to pay all taxes that are imposed by the relevant tax authorities relating to the equipment being leased. This type of lease agreement is often used when the lessor does not want to assume the responsibility of paying taxes and would prefer to transfer this obligation to the lessee. Types of Lease of Equipment with Lessee to Pay all Taxes Imposed Relating to Equipment include: • Operating Lease: An operating lease is a lease agreement in which the lessor retains ownership of the equipment and the lessee pays all taxes imposed on the equipment. • Finance Lease: A finance lease is a lease agreement in which the lessor transfers ownership of the equipment to the lessee and the lessee are responsible for paying all taxes imposed on the equipment. • Capital Lease: A capital lease is a lease agreement in which the lessor transfers ownership of the equipment to the lessee and the lessee are responsible for paying all taxes imposed on the equipment. • Sale and Leaseback: A sale and leaseback is a lease agreement in which the lessor purchases the equipment from the lessee and the lessee are responsible for paying all taxes imposed on the equipment.

Lease of Equipment with Lessee to Pay all Taxes Imposed Relating to Equipment

Description

How to fill out Lease Of Equipment With Lessee To Pay All Taxes Imposed Relating To Equipment?

US Legal Forms is the most straightforward and cost-effective way to find appropriate formal templates. It’s the most extensive web-based library of business and personal legal paperwork drafted and checked by attorneys. Here, you can find printable and fillable templates that comply with federal and local regulations - just like your Lease of Equipment with Lessee to Pay all Taxes Imposed Relating to Equipment.

Getting your template requires just a few simple steps. Users that already have an account with a valid subscription only need to log in to the website and download the document on their device. Afterwards, they can find it in their profile in the My Forms tab.

And here’s how you can get a professionally drafted Lease of Equipment with Lessee to Pay all Taxes Imposed Relating to Equipment if you are using US Legal Forms for the first time:

- Read the form description or preview the document to ensure you’ve found the one corresponding to your needs, or locate another one using the search tab above.

- Click Buy now when you’re certain about its compatibility with all the requirements, and select the subscription plan you prefer most.

- Register for an account with our service, sign in, and purchase your subscription using PayPal or you credit card.

- Choose the preferred file format for your Lease of Equipment with Lessee to Pay all Taxes Imposed Relating to Equipment and save it on your device with the appropriate button.

Once you save a template, you can reaccess it whenever you want - simply find it in your profile, re-download it for printing and manual fill-out or import it to an online editor to fill it out and sign more effectively.

Take advantage of US Legal Forms, your reliable assistant in obtaining the corresponding formal documentation. Try it out!

Form popularity

FAQ

There are two primary types of equipment leases: operating leases and financial leases.

An operating lease is treated like renting -- payments are considered operational expenses and the asset being leased stays off the balance sheet. In contrast, a capital lease is more like a loan; the asset is treated as being owned by the lessee so it stays on the balance sheet.

A capital lease is a lease in which the lessor only finances the leased asset, and all other rights of ownership transfer to the lessee. This results in the recordation of the asset as the lessee's property in its general ledger, as a fixed asset.

A capital lease is a lease of business equipment that represents ownership, for both accounting and tax purposes. The terms of a capital lease agreement show that the benefits and risks of ownership are transferred to the lessee.

Let's start with a Capital Lease. A capital lease is where the company / lessee want the equipment to appear on the balance sheet as an asset, but also wants to spread out the payments. The equipment leased is considered part of the company's assets (i.e., ?capital?, hence the name).

A triple net lease (triple-net or NNN) is a lease agreement on a property whereby the tenant or lessee promises to pay all the expenses of the property, including real estate taxes, building insurance, and maintenance. These expenses are in addition to the cost of rent and utilities.

Understanding Capital Lease the life of the lease must be 75% or greater for the asset's useful life. the lease must contain a bargain purchase option for a price less than the market value of an asset. the lessee must gain ownership at the end of the lease period.

Tax Benefits of Equipment Leasing Leased equipment can also be eligible for Section 179. You can write off the entire lease payment as a business expense by deducting the monthly lease payments on your taxes, as long as your lease meets the qualifications.