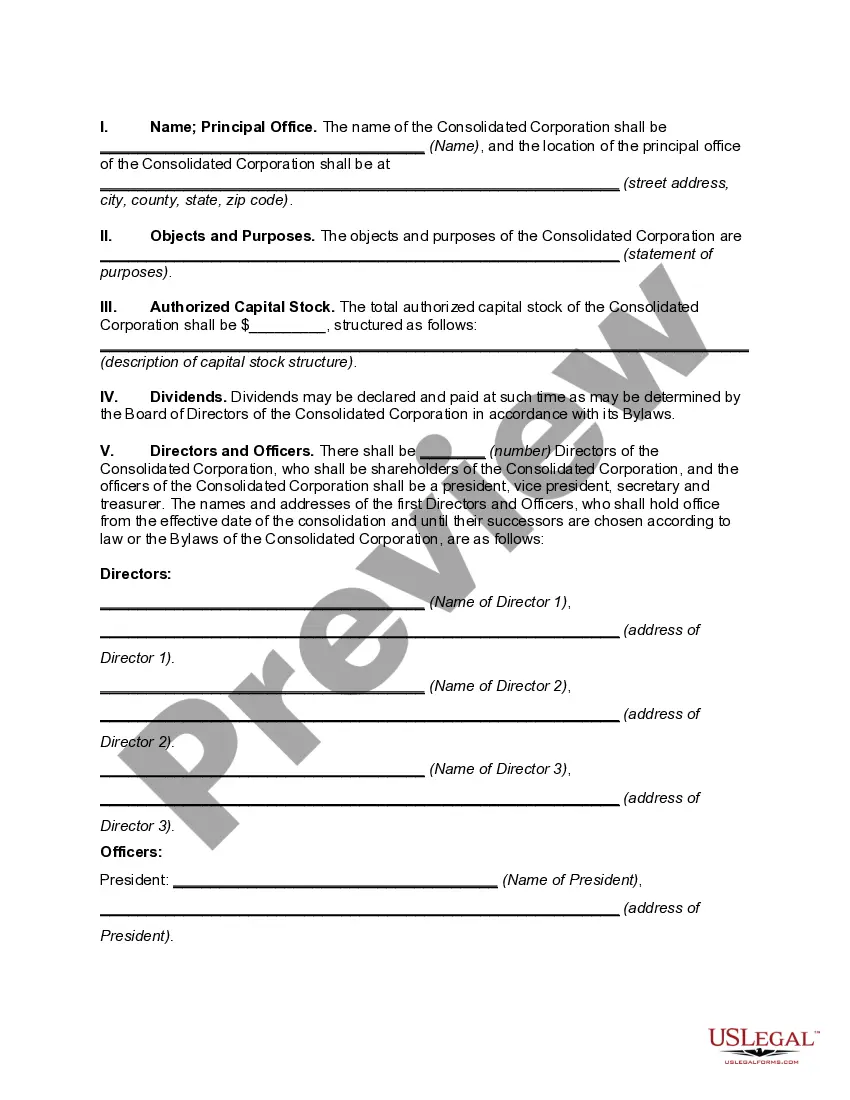

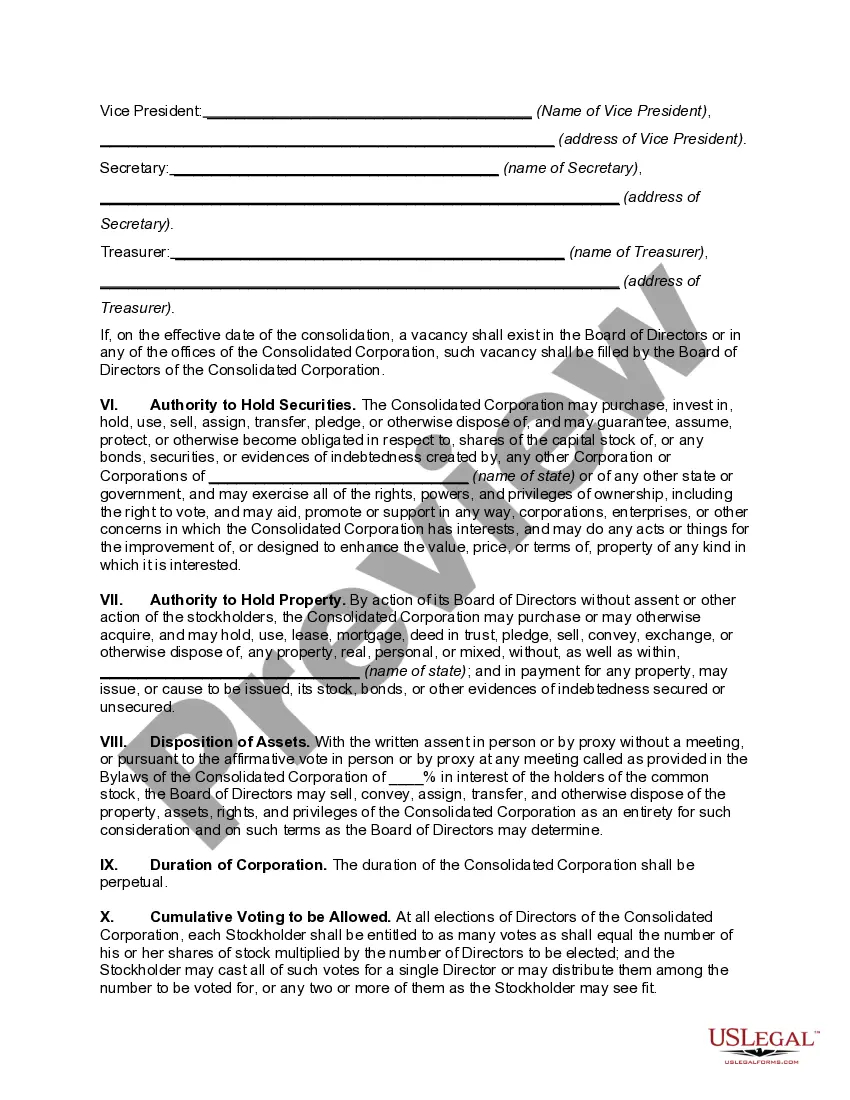

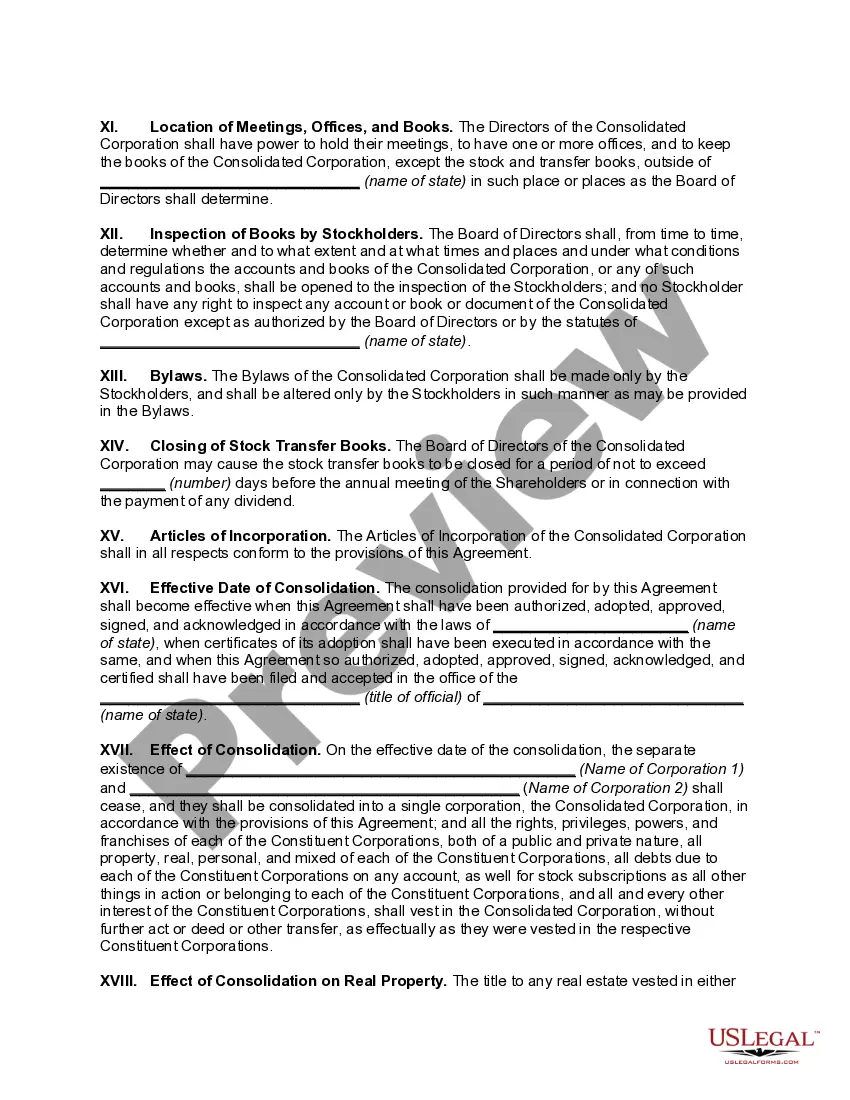

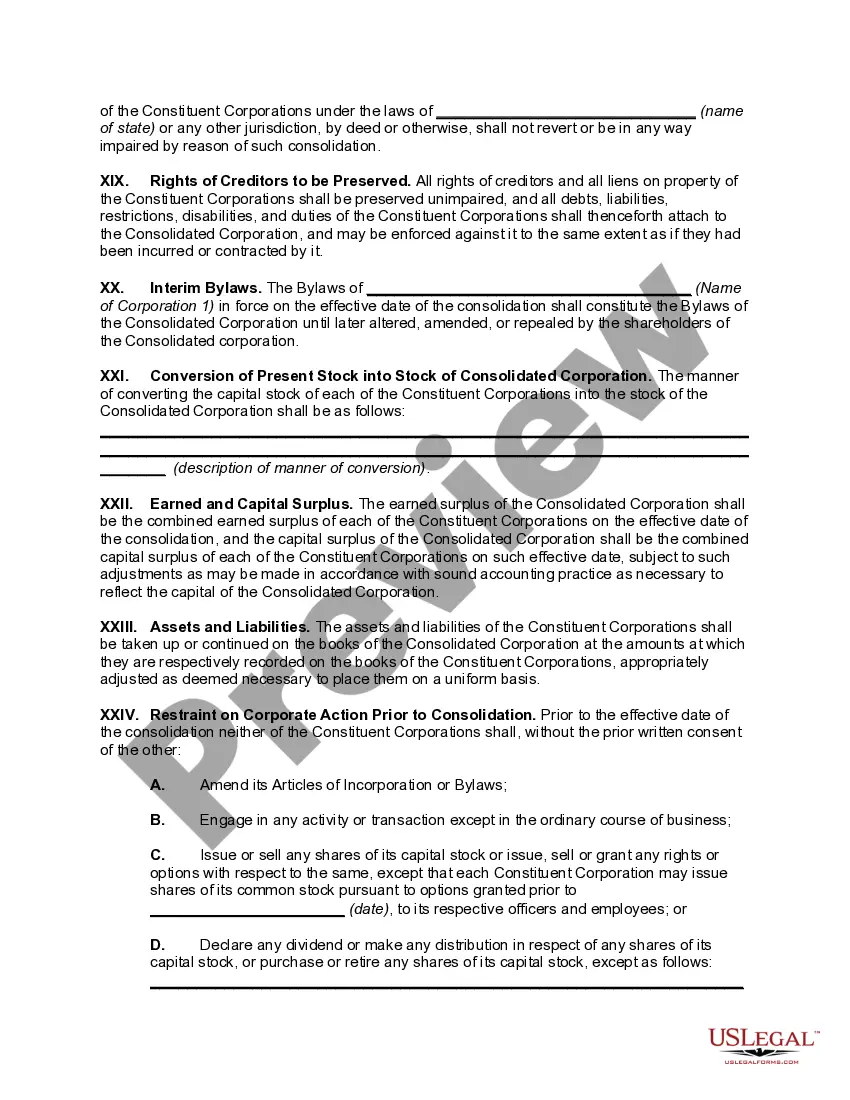

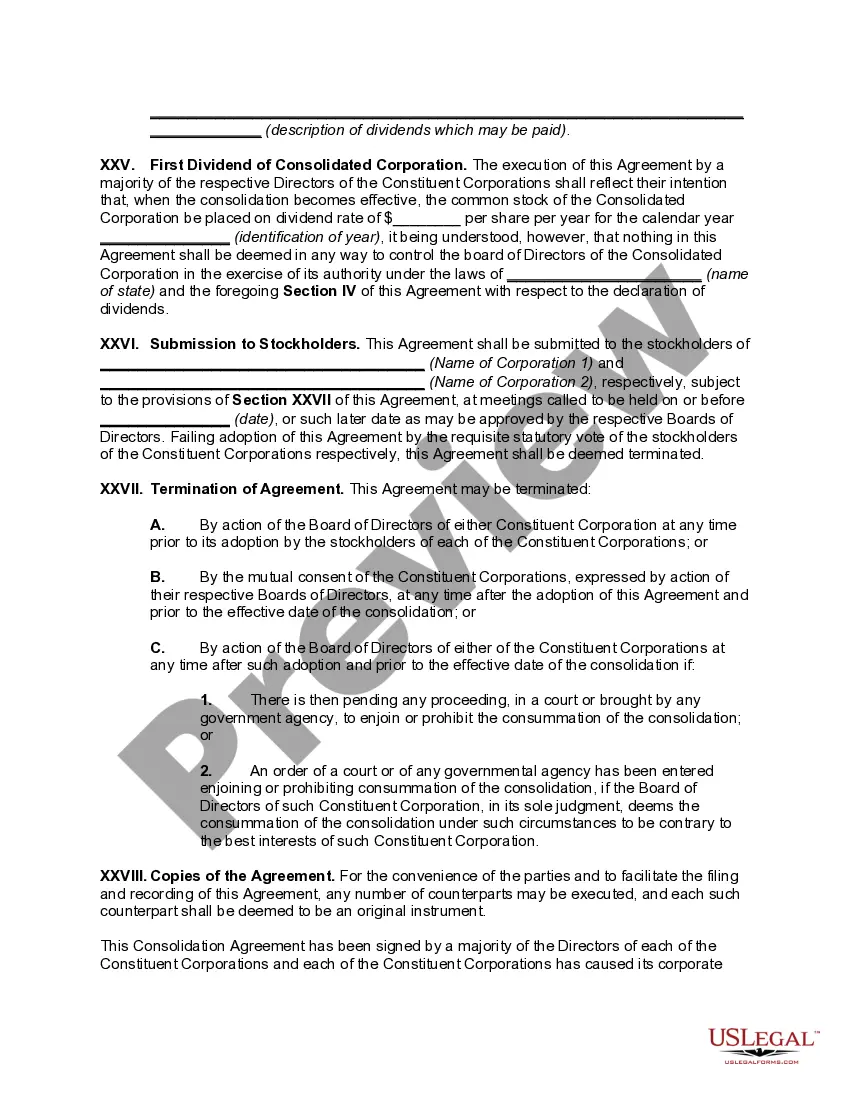

Consolidation Agreement Between Two Corporations is a legally binding agreement that is used when two or more companies merge to form a new corporation. This agreement outlines the terms and conditions of the consolidation, such as the type of corporate entity that will be formed, the share exchange ratio, and the roles and responsibilities of each party. It also details the liabilities and assets that each party will be responsible for, as well as any specific rights and obligations of the parties. There are several types of Consolidation Agreement Between Two Corporations, including Merger Agreement, Stock Purchase Agreement, and Asset Purchase Agreement. A Merger Agreement is used when two companies combine to form a new single entity, in which each company retains its separate legal identity. This agreement outlines the terms of the merger, such as the exchange ratio, the allocation of shares, and the distribution of ownership rights and liabilities. A Stock Purchase Agreement is used when one company acquires the stock of another company. This agreement outlines the terms of the purchase, such as the purchase price, the number of shares to be exchanged, and the rights and obligations of the parties. An Asset Purchase Agreement is used when one company acquires the assets of another company. This agreement outlines the terms of the purchase, such as the purchase price, the assets to be exchanged, and the rights and obligations of the parties.

Consolidation Agreement Between Two Corporations

Description

How to fill out Consolidation Agreement Between Two Corporations?

US Legal Forms is the most straightforward and affordable way to find suitable legal templates. It’s the most extensive online library of business and individual legal paperwork drafted and checked by lawyers. Here, you can find printable and fillable blanks that comply with national and local laws - just like your Consolidation Agreement Between Two Corporations.

Getting your template requires just a couple of simple steps. Users that already have an account with a valid subscription only need to log in to the web service and download the document on their device. Afterwards, they can find it in their profile in the My Forms tab.

And here’s how you can get a properly drafted Consolidation Agreement Between Two Corporations if you are using US Legal Forms for the first time:

- Look at the form description or preview the document to ensure you’ve found the one corresponding to your requirements, or locate another one utilizing the search tab above.

- Click Buy now when you’re certain about its compatibility with all the requirements, and choose the subscription plan you prefer most.

- Register for an account with our service, log in, and purchase your subscription using PayPal or you credit card.

- Decide on the preferred file format for your Consolidation Agreement Between Two Corporations and save it on your device with the appropriate button.

After you save a template, you can reaccess it whenever you want - just find it in your profile, re-download it for printing and manual completion or import it to an online editor to fill it out and sign more efficiently.

Benefit from US Legal Forms, your trustworthy assistant in obtaining the required formal paperwork. Try it out!

Form popularity

FAQ

A merger is a combination of two or more business entities in which the assets and liabilities of all the entities are transferred to one, which continues in existence, while all the others cease to exist.

For example, if company ABC acquires XYZ, then the combined income statement cannot include sales from ABC to XYZ, nor can it include payment for services from XYZ to ABC. However, if ABC or XYZ sells to an external business entity, then those revenues are part of the consolidated income statement.

In other words, it's when two companies (or more) merge and become one. Many of the world's largest corporations were formed by business consolidation, while more recent examples include Facebook's acquisition of Instagram and Disney's acquisition of Fox.

To consolidate (consolidation) is to combine assets, liabilities, and other financial items of two or more entities into one. In the context of financial accounting, the term consolidate often refers to the consolidation of financial statements wherein all subsidiaries report under the umbrella of a parent company.

Consolidation in business can mean combining separate companies. For example, combining product lines or functional areas into one. It is a type of merger, but in this case, we create a new legal entity. For example, in 1996, two Swiss pharmaceutical companies ? Sandoz and Ciba-Geigy ? merged.

Consolidation happens when two or more companies merge to become one. Also known as amalgamation, business consolidation is most often associated with M&A activity. 1 This generally happens when several similar, smaller businesses combine to form a new, larger legal entity.

How to conduct a merger Consider company value. Before deciding whether to merge companies, the leadership teams and, if applicable, the boards of directors for both businesses carefully analyze the value of the two companies and their financial positions.Create a merger agreement.Restructure departments.