A Type F reorganization plan is defined in the Internal Revenue Code as "a mere change in identity, form or place of organization of one corporation, however (a)ffected." F reorganization rules generally apply to a corporation that changes its name, the state where it does business or if it makes changes in the company's corporate charter, in which case a transfer is deemed to occur from the prior corporation to the new company.

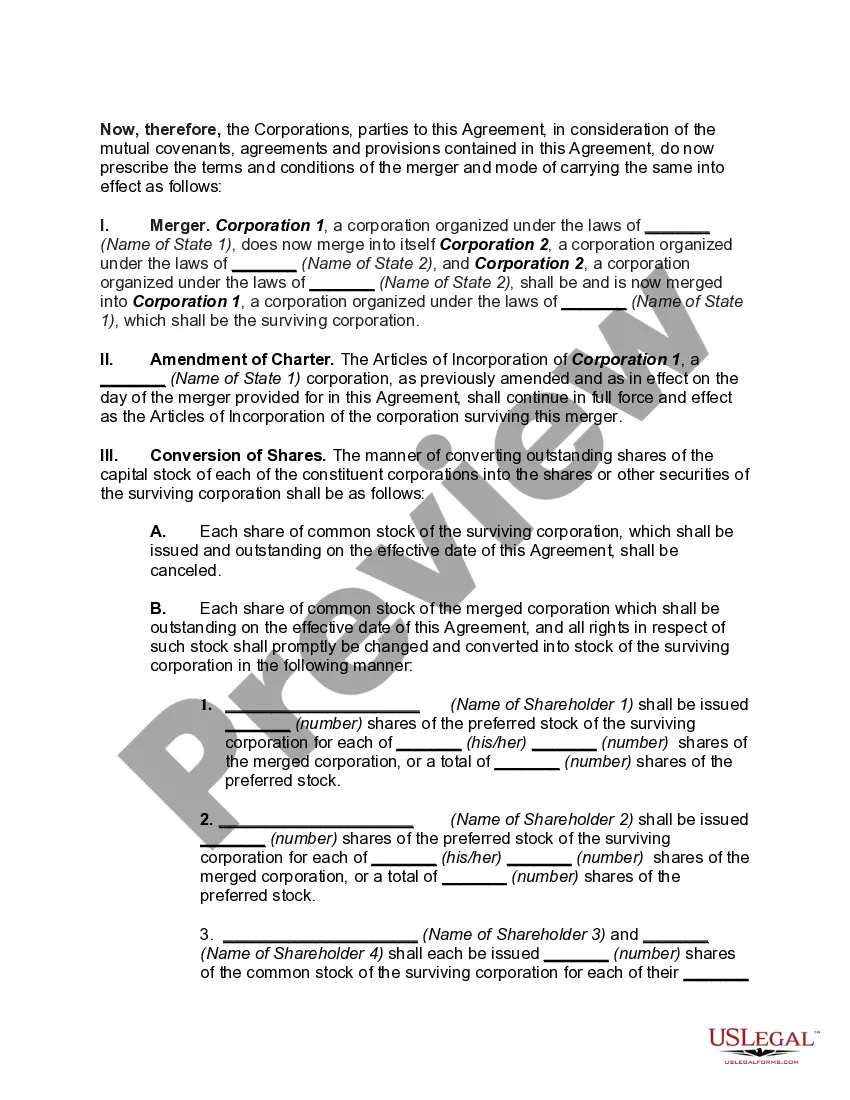

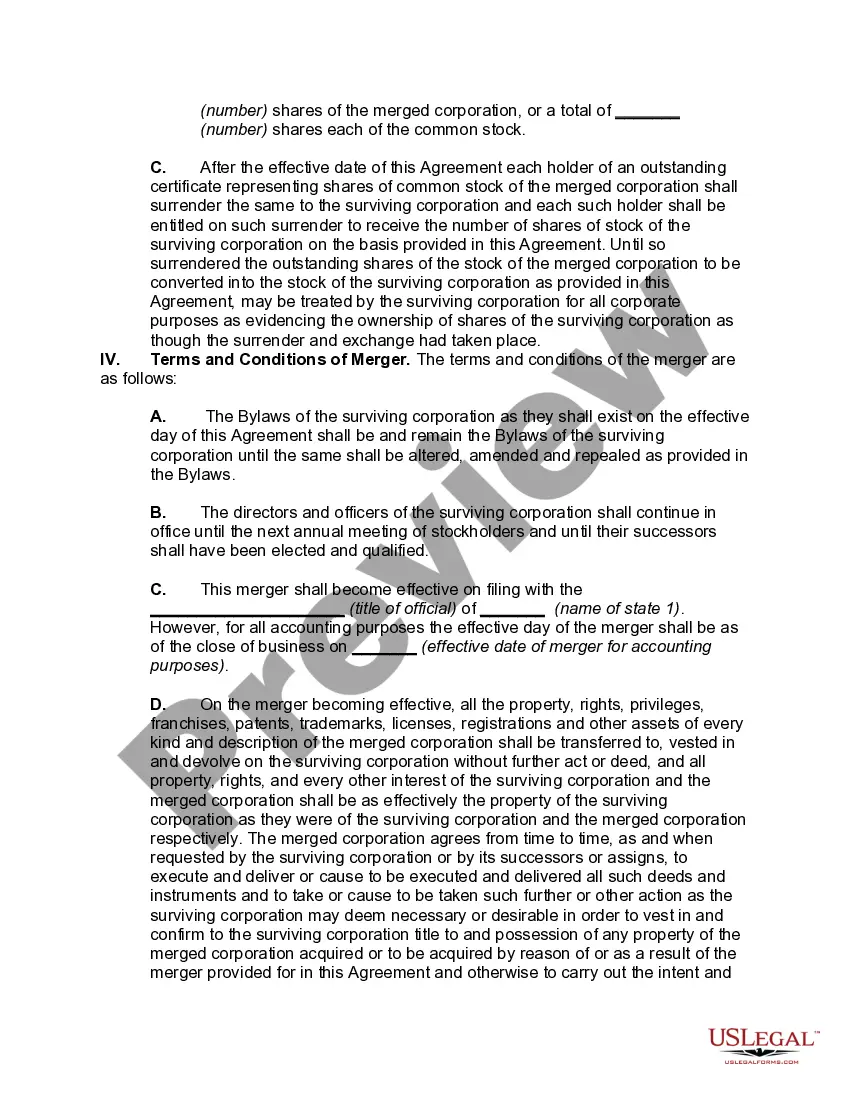

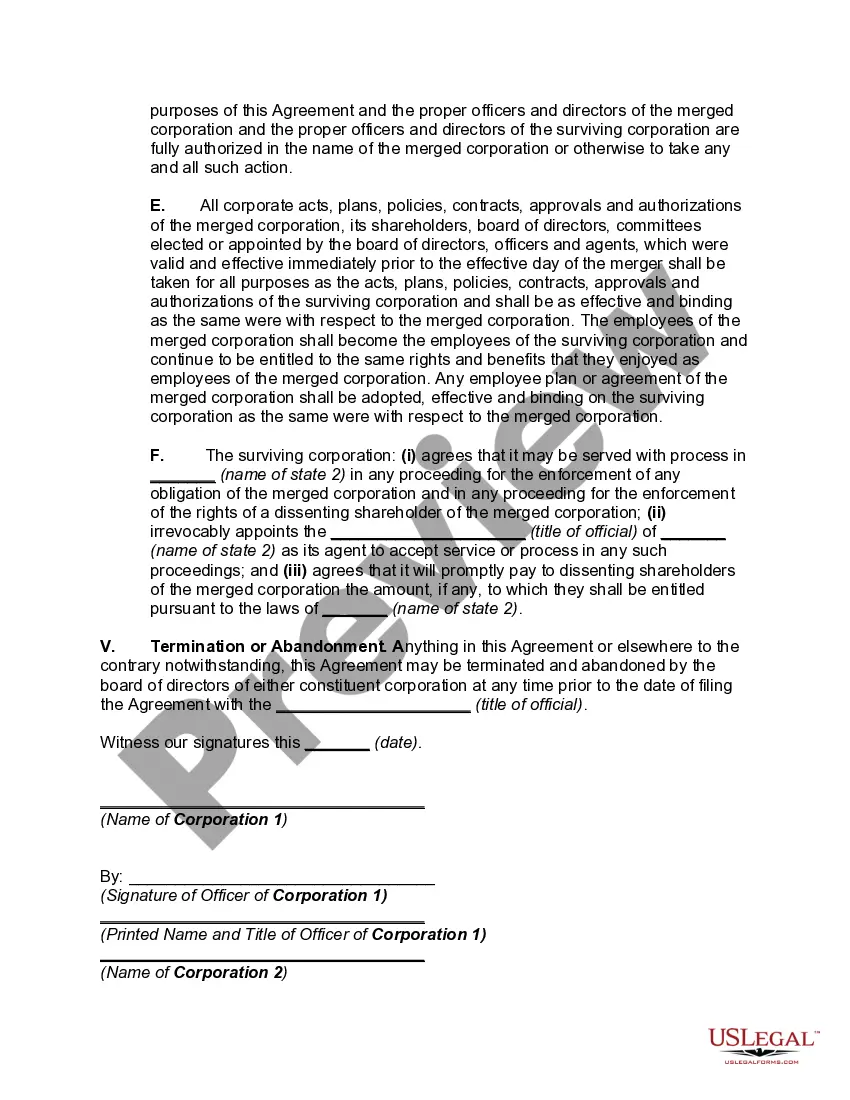

An Agreement and Plan of Merger with Change in Corporations' Identity, Form or Place of Organization (Type F Reorganization) is a legal document by which two or more corporations merge, with one corporation absorbing the assets and liabilities of the other and changing its identity, form or place of organization in the process. This type of corporate reorganization involves the consolidation of two or more corporations under one name, the creation of a new corporation to hold all the assets and liabilities of the merged corporations, the transfer of the assets and liabilities of the merged corporations to the new corporation, and the dissolution of the original corporations. There are two types of Agreement and Plan of Merger with Change in Corporations' Identity, Form or Place of Organization (Type F Reorganization): Forward Triangular Mergers and Reverse Triangular Mergers. In a Forward Triangular Merger, the acquiring corporation is the surviving entity and the target corporation is the disappearing entity. In a Reverse Triangular Merger, the target corporation is the surviving entity and the acquiring corporation is the disappearing entity. In both cases, the target corporation is the one that undergoes the identity, form or place of organization change.