A Revolving Credit Agreement is a type of loan that allows borrowers to access a set amount of funds that can be accessed, repaid, and used again. It is a flexible loan option that is designed to provide borrowers with access to funds as needed. Revolving Credit Agreements can be used for a variety of purposes, including purchasing goods or services, covering unexpected expenses, and more. There are two main types of Revolving Credit Agreements: open-end and closed-end. Open-end agreements are also known as lines of credit and are typically used for larger purchases. They allow borrowers to access funds up to a pre-determined limit and make payments as needed. Closed-end agreements are typically used for smaller purchases and require borrowers to make a set minimum payment each month. The loan is usually paid off in full within a set period of time.

Revolving Credit Agreement

Description

How to fill out Revolving Credit Agreement?

How much time and resources do you typically spend on drafting official documentation? There’s a greater option to get such forms than hiring legal experts or wasting hours browsing the web for a suitable template. US Legal Forms is the top online library that provides professionally drafted and verified state-specific legal documents for any purpose, such as the Revolving Credit Agreement.

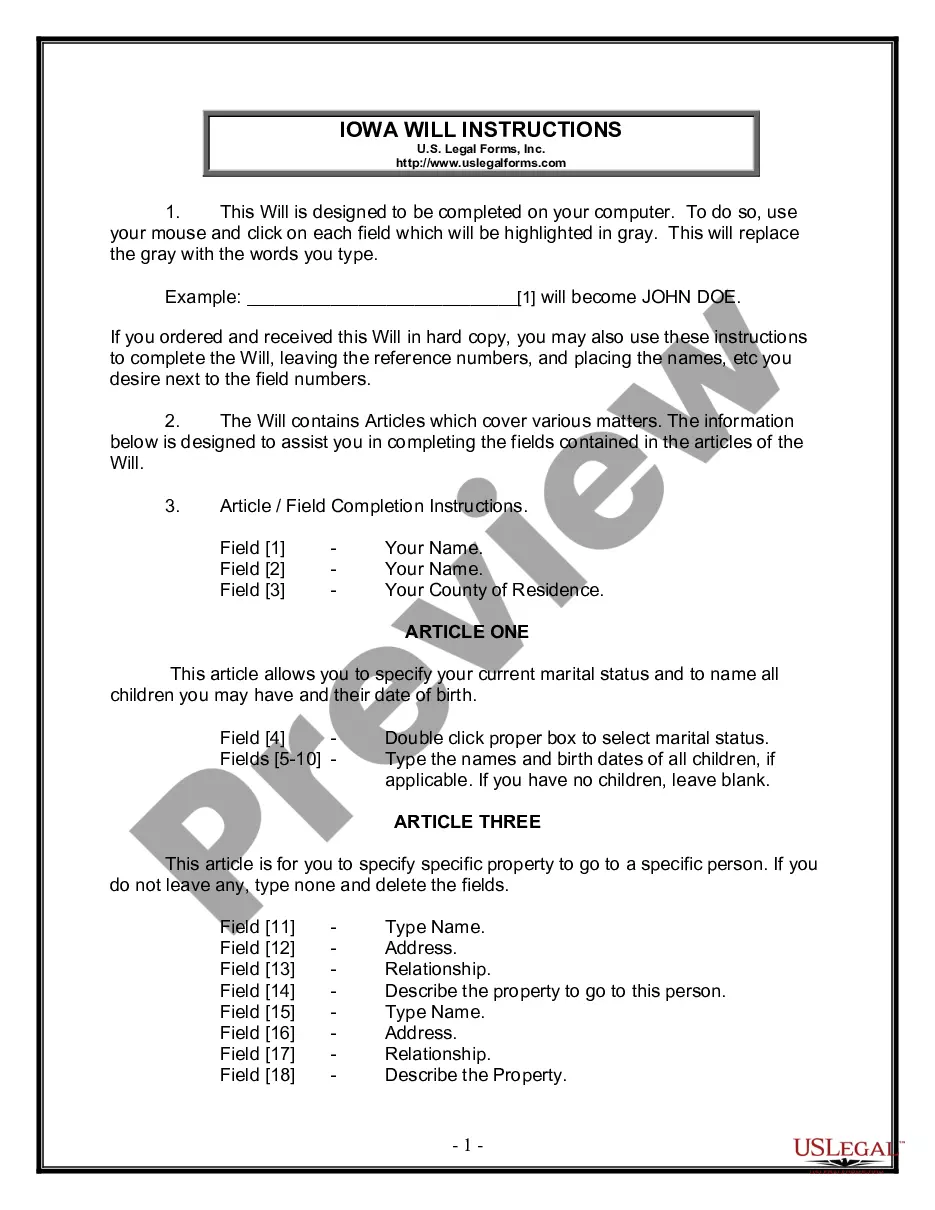

To acquire and complete an appropriate Revolving Credit Agreement template, follow these easy steps:

- Examine the form content to make sure it meets your state laws. To do so, read the form description or utilize the Preview option.

- If your legal template doesn’t satisfy your needs, locate another one using the search bar at the top of the page.

- If you already have an account with us, log in and download the Revolving Credit Agreement. If not, proceed to the next steps.

- Click Buy now once you find the correct blank. Select the subscription plan that suits you best to access our library’s full opportunities.

- Create an account and pay for your subscription. You can make a payment with your credit card or through PayPal - our service is absolutely secure for that.

- Download your Revolving Credit Agreement on your device and fill it out on a printed-out hard copy or electronically.

Another benefit of our library is that you can access previously purchased documents that you safely store in your profile in the My Forms tab. Pick them up anytime and re-complete your paperwork as frequently as you need.

Save time and effort preparing official paperwork with US Legal Forms, one of the most trusted web solutions. Sign up for us now!

Form popularity

FAQ

Primary tabs. Revolving credit facilities are a type of committed credit facility which allow the borrower to borrow on an ongoing basis while repaying the balance in regular payments. Each repayment of the loan, minus interest and fees, replenishes the amount available to the borrower.

Two of the most common types of revolving credit come in the form of credit cards and personal lines of credit.

Three examples of revolving credit are a credit card, a home equity line of credit (HELOC) and a personal line of credit. Revolving credit is credit you can use repeatedly up to a certain limit as you pay it down.

The most common types of revolving credit are credit cards, personal lines of credit and home equity lines of credit.

Common Examples Of Revolving Debt Credit cards, lines of credit and home equity lines of credit (HELOCs) are the most common examples of revolving credit, which turns into revolving debt if you carry a balance month-to-month.

Revolving credit is a type of loan that gives you access to a set amount of money. You can access money until you've borrowed up to the maximum amount, also known as your credit limit. As you repay the outstanding balance, plus any interest, you unlock the ability to borrow against the account again.

Revolving credit facility vs term loan In other words, a term loan is a type of loan that is lent for a specific amount of time (the term). With a revolving facility, the lender stipulates the maximum amount you can spend, however within that you have the freedom to decide how much you borrow and pay back every month.

A revolving loan is considered a flexible financing tool due to its repayment and re-borrowing accommodations. It is not considered a term loan because, during an allotted period of time, the facility allows the borrower to repay the loan or take it out again.

Unlike a term loan, a revolving credit facility does not have a fixed repayment schedule. The borrower only pays interest on the funds that are actually used, and the credit limit can be renewed once the outstanding balance is paid down.