If you’re looking for a way to appropriately prepare the Corporate Cross Purchase Agreement without hiring a legal representative, then you’re just in the right place. US Legal Forms has proven itself as the most extensive and reputable library of official templates for every individual and business scenario. Every piece of documentation you find on our web service is drafted in accordance with federal and state regulations, so you can be sure that your documents are in order.

Adhere to these straightforward instructions on how to obtain the ready-to-use Corporate Cross Purchase Agreement:

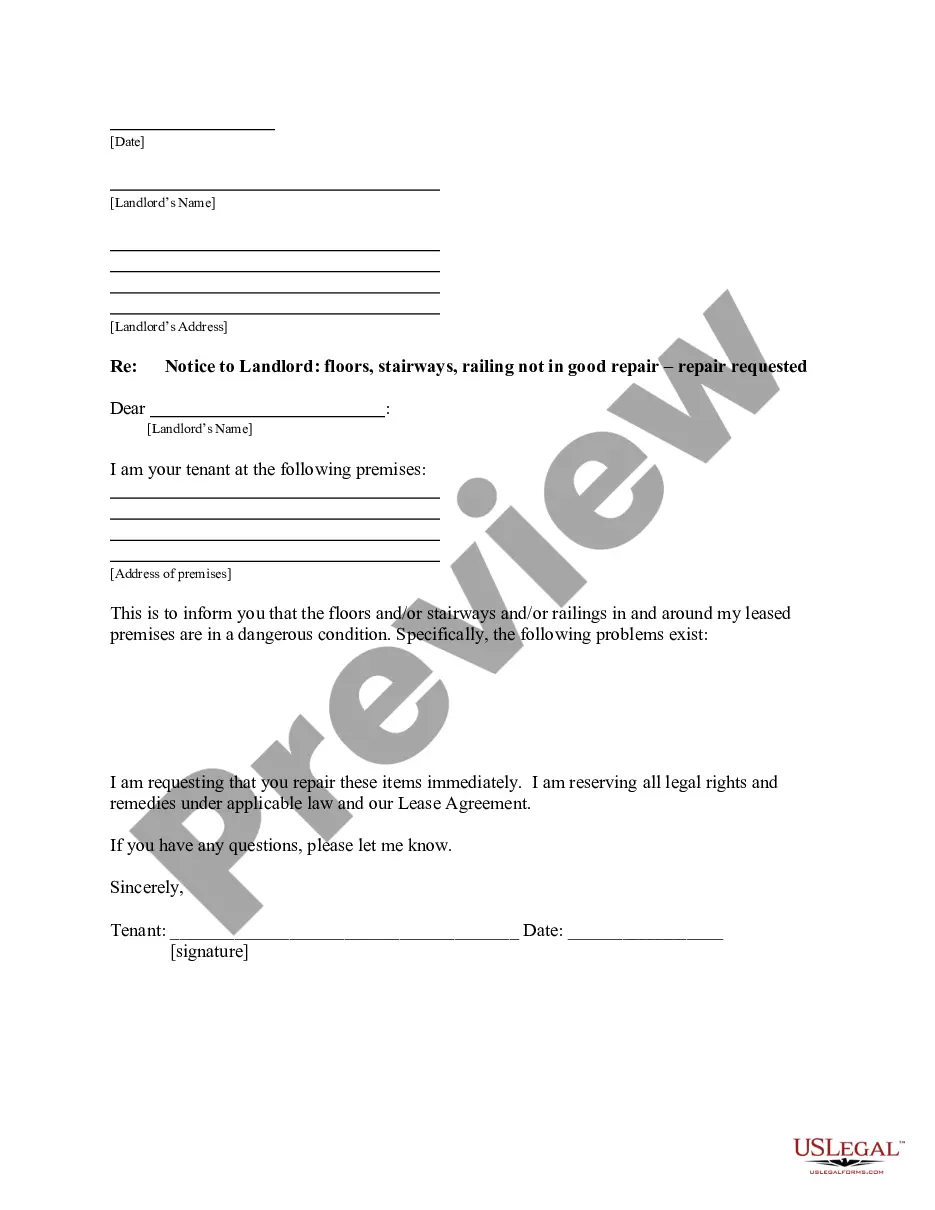

- Ensure the document you see on the page meets your legal situation and state regulations by checking its text description or looking through the Preview mode.

- Enter the document title in the Search tab on the top of the page and select your state from the list to find an alternative template in case of any inconsistencies.

- Repeat with the content verification and click Buy now when you are confident with the paperwork compliance with all the requirements.

- Log in to your account and click Download. Sign up for the service and opt for the subscription plan if you still don’t have one.

- Use your credit card or the PayPal option to purchase your US Legal Forms subscription. The document will be available to download right after.

- Choose in what format you want to save your Corporate Cross Purchase Agreement and download it by clicking the appropriate button.

- Add your template to an online editor to complete and sign it quickly or print it out to prepare your paper copy manually.

Another great advantage of US Legal Forms is that you never lose the paperwork you acquired - you can pick any of your downloaded templates in the My Forms tab of your profile whenever you need it.

Purchase agreement is a document that allows a company's partners or other shareholders to purchase the interest of a partner. A cross purchase agreement allows a smooth transition of ownership from departing partners or shareholders to others in the company.This CROSS PURCHASE AGREEMENT is dated as of May 16, 2012 (this "Agreement") and is among HICKS ACQUISITION COMPANY II, INC. In this form, the business is obligated to purchase the business interest from a departing or deceased owner or shareholder. One of the main benefits of this document is that it allows the remaining partners in a business to purchase the shares of a partner who is leaving the company. In a cross purchase buy-sell agreement, each business owner buys a life insurance policy on the other owner(s). A cross purchase agreement is a form of buysell agreement, a legal contract between the owners of a closely held business. The. Purchase buysell agreement allows each business partner or shareholder to purchase the interest of a partner if one of several conditions occurs. September 2022 Update. Added together, the policies insuring each owner total the purchase price for that owner's share of the business.