Some cross-purchase agreements use a dollar amount to calculate the buy-out price, while others use a formula. A valuation of the interest that is the subject of the agreement should be made periodically.

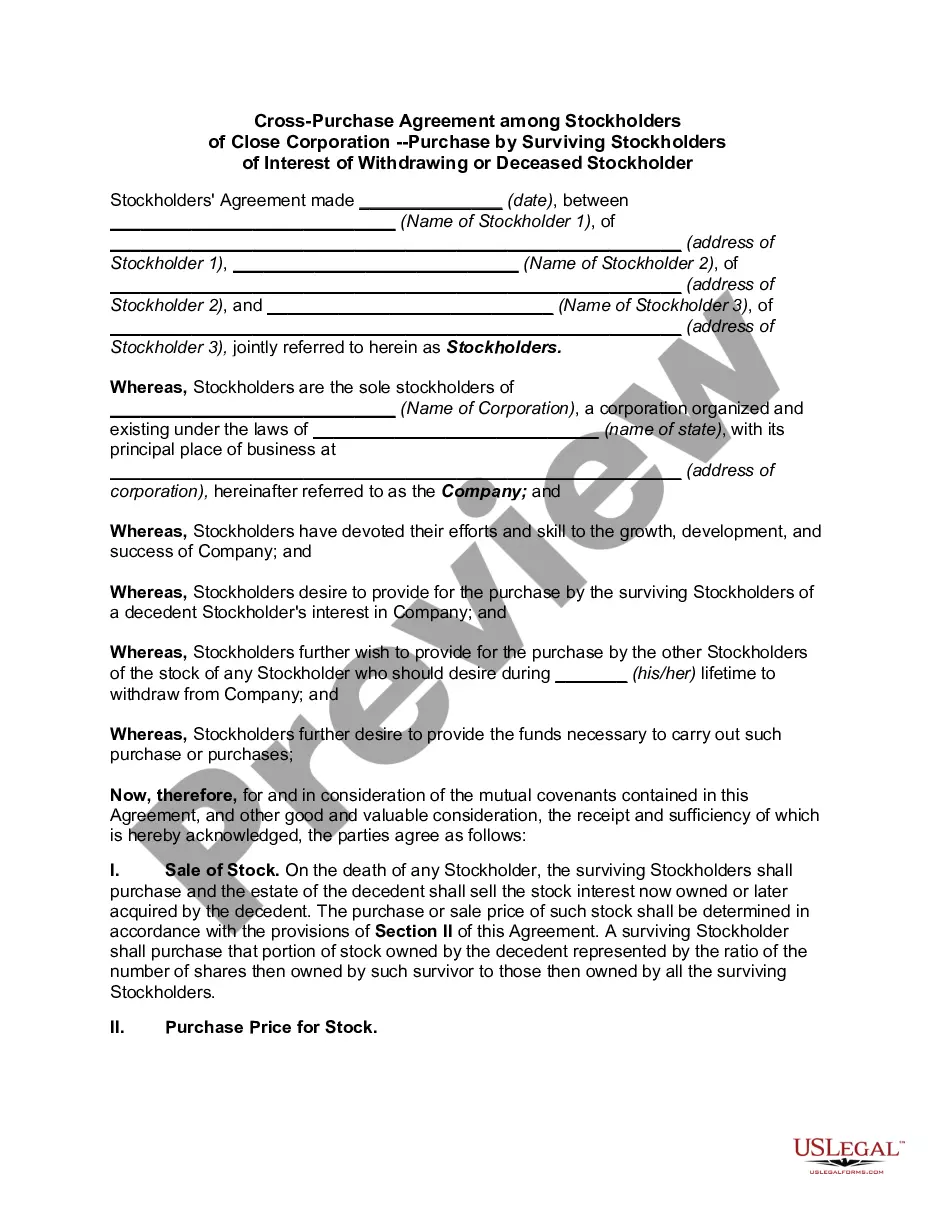

A Cross-Purchase Agreement among Stockholders of Close Corporation with Option to Purchase with Definite Expiration Date (often referred to as a cross-purchase agreement) is a contractual agreement between shareholders of a close corporation that allows the shareholders to purchase the stock of another shareholder upon the occurrence of certain specified events. The agreement will typically include the option to purchase the stock of another shareholder, the amount of the purchase price, and a definite expiration date, at which time the agreement is no longer valid. The types of Cross-Purchase Agreement among Stockholders of Close Corporation with Option to Purchase with Definite Expiration Date include Right of First Refusal Agreement, Put and Call Agreement, and Hybrid Agreement. A Right of First Refusal Agreement is an agreement between the shareholders of a close corporation that grants one shareholder the right to match any offer of another shareholder to purchase the stock of the close corporation. A Put and Call Agreement is an agreement between two or more shareholders of a close corporation, wherein one shareholder agrees to purchase the stock of another shareholder upon the occurrence of a specified event, such as the death of a shareholder. A Hybrid Agreement combines elements of both the Right of First Refusal Agreement and the Put and Call Agreement.