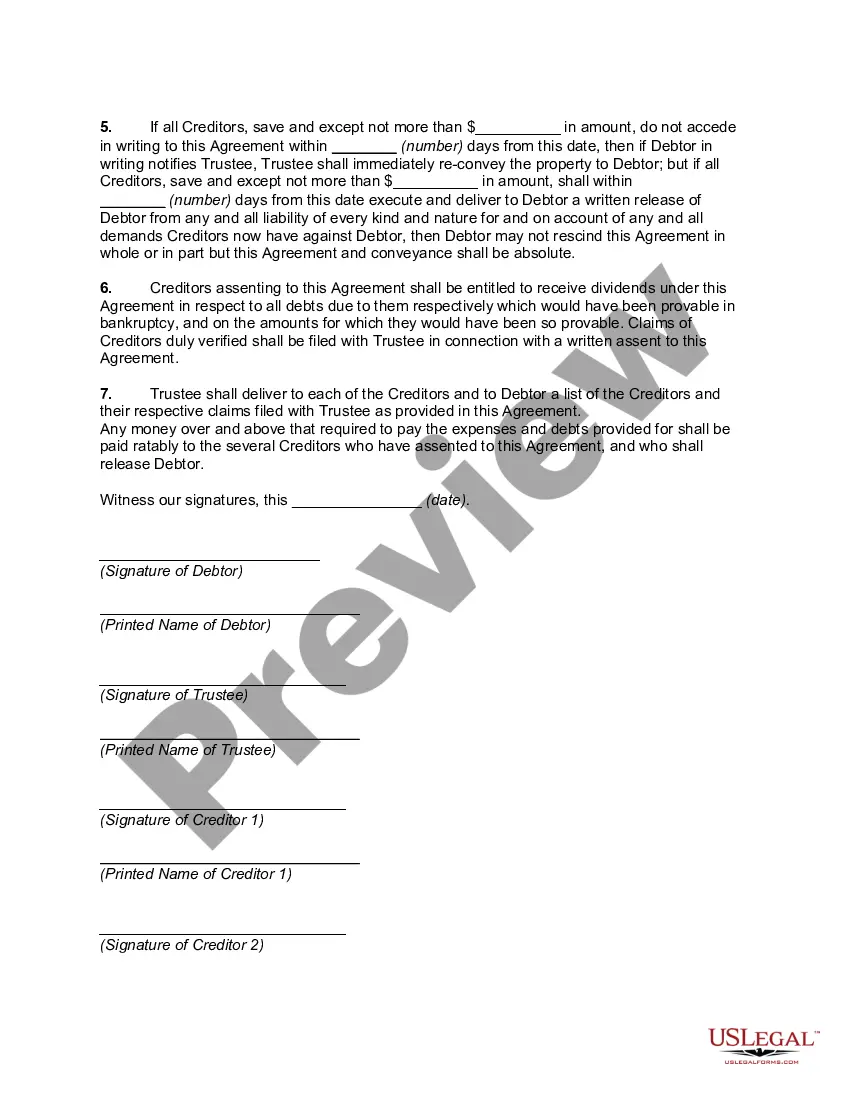

Composition with Creditors -- Transfer of Property to Trustee for Benefit of Creditors is a process in which an insolvent debtor transfers all of its assets to a trustee, who is an independent third party. The trustee then liquidates the assets and distributes the proceeds to the debtor's creditors according to a prearranged agreement. This type of arrangement is typically used when a debtor cannot pay its debts in full, and allows creditors to get something rather than nothing. There are two types of Composition with Creditors -- Transfer of Property to Trustee for Benefit of Creditors: a voluntary arrangement and an involuntary arrangement. A voluntary arrangement is one where the debtor and creditors agree to the terms of the transfer of property to the trustee and the distribution of the proceeds. An involuntary arrangement is one where the creditors force the transfer of property to the trustee and the distribution of the proceeds, without the debtor's consent.

Composition with Creditors -- Transfer of Property to Trustee for Benefit of Creditors

Description

How to fill out Composition With Creditors -- Transfer Of Property To Trustee For Benefit Of Creditors?

Preparing legal paperwork can be a real burden if you don’t have ready-to-use fillable templates. With the US Legal Forms online library of formal documentation, you can be certain in the blanks you find, as all of them comply with federal and state laws and are verified by our experts. So if you need to fill out Composition with Creditors -- Transfer of Property to Trustee for Benefit of Creditors, our service is the perfect place to download it.

Obtaining your Composition with Creditors -- Transfer of Property to Trustee for Benefit of Creditors from our service is as easy as ABC. Previously registered users with a valid subscription need only sign in and click the Download button after they locate the proper template. Later, if they need to, users can pick the same blank from the My Forms tab of their profile. However, even if you are unfamiliar with our service, signing up with a valid subscription will take only a few minutes. Here’s a quick guide for you:

- Document compliance check. You should attentively review the content of the form you want and ensure whether it suits your needs and complies with your state law requirements. Previewing your document and looking through its general description will help you do just that.

- Alternative search (optional). If there are any inconsistencies, browse the library through the Search tab on the top of the page until you find a suitable template, and click Buy Now once you see the one you want.

- Account creation and form purchase. Create an account with US Legal Forms. After account verification, log in and choose your preferred subscription plan. Make a payment to continue (PayPal and credit card options are available).

- Template download and further usage. Choose the file format for your Composition with Creditors -- Transfer of Property to Trustee for Benefit of Creditors and click Download to save it on your device. Print it to complete your paperwork manually, or take advantage of a multi-featured online editor to prepare an electronic copy faster and more effectively.

Haven’t you tried US Legal Forms yet? Sign up for our service now to obtain any official document quickly and easily any time you need to, and keep your paperwork in order!

Form popularity

FAQ

Liquidation means to shut down the business so that the business stops operating and sells its assets in order to pay its debts; insolvency means that a business goes into administration to help sort out its options to stay afloat.

The agreement is that the debtor will pay the creditors less than what they owe in order to settle the debt. This is called a composition. The creditors agree to this because they would rather get some of their money back than none at all.

Assignment for the benefit of the creditors (ABC)(also known as general assignment for the benefit of the creditors) is a voluntary alternative to formal bankruptcy proceedings that transfers all of the assets from a debtor to a trust for liquidating and distributing its assets.

This goal is accomplished through the bankruptcy discharge, which releases debtors from personal liability from specific debts and prohibits creditors from ever taking any action against the debtor to collect those debts.

Liquidation is the process of closing a business and distributing its assets to claimants. The sale of assets is used to pay creditors and shareholders in the order of priority.

WHAT IS A COMPOSITION? A creditor composition agreement is a non-statutory, out-of-court arrangement in which a debtor negotiates and enters into a settlement of its unsecured liabilities with its vendors, landlords, and other large creditors to provide debt relief and a restructuring.

A lien is a security interest or legal claim against property that is used as collateral to satisfy a debt. In other words, liens enable creditors to assert their rights over property.

The first type of workout between a debtor and multiple creditors is called a composition. This is an agreement between a debtor and two or more creditors that each creditor will take less than the full amount owed in settlement of the debt.