Contractor's Performance Bond with Limitation of Right of Action

Description

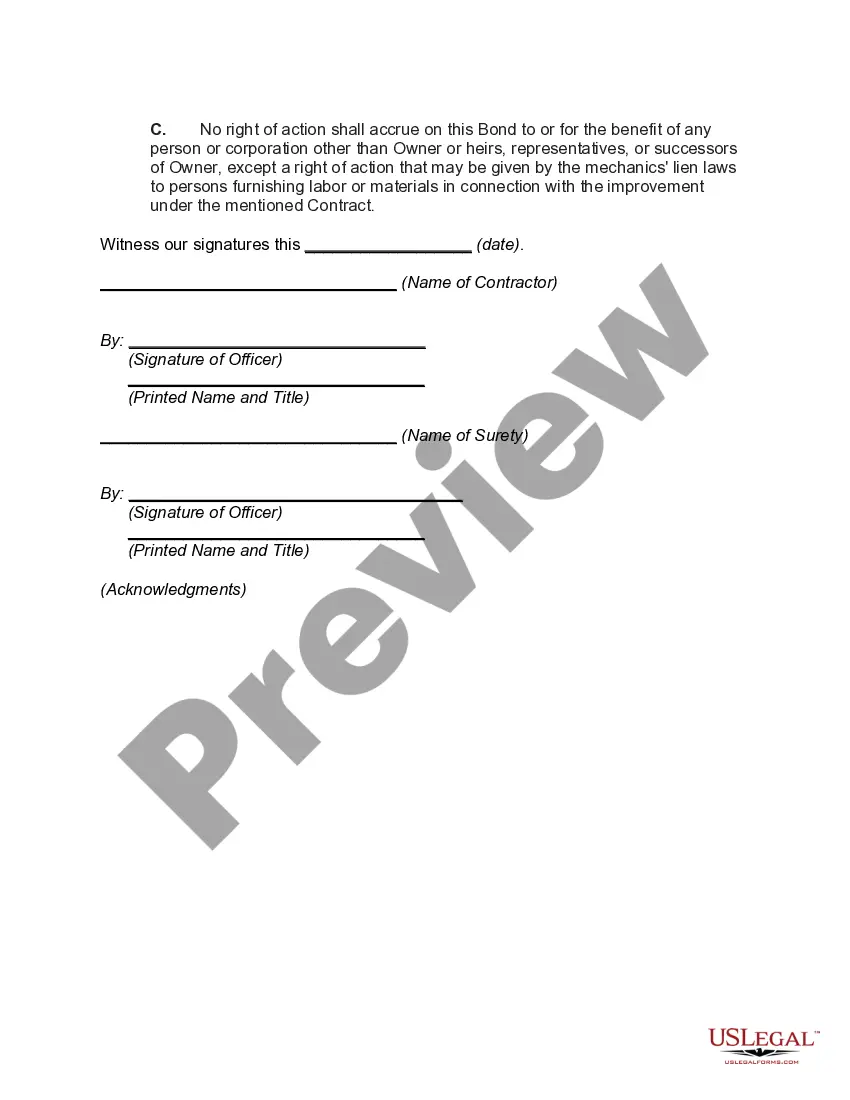

How to fill out Contractor's Performance Bond With Limitation Of Right Of Action?

Make use of the most complete legal catalogue of forms. US Legal Forms is the best platform for getting updated Contractor's Performance Bond with Limitation of Right of Action templates. Our service offers a huge number of legal forms drafted by licensed attorneys and sorted by state.

To download a template from US Legal Forms, users just need to sign up for a free account first. If you are already registered on our platform, log in and select the template you need and purchase it. After buying templates, users can find them in the My Forms section.

To obtain a US Legal Forms subscription on-line, follow the guidelines below:

- Check if the Form name you have found is state-specific and suits your requirements.

- If the form features a Preview option, use it to review the sample.

- If the sample doesn’t suit you, make use of the search bar to find a better one.

- PressClick Buy Now if the template corresponds to your requirements.

- Select a pricing plan.

- Create an account.

- Pay with the help of PayPal or with the credit/bank card.

- Choose a document format and download the template.

- When it’s downloaded, print it and fill it out.

Save your time and effort using our platform to find, download, and fill out the Form name. Join a huge number of satisfied clients who’re already using US Legal Forms!

Form popularity

FAQ

Duration of Surety Bonds Almost every surety bond has an expiration date. However, not all surety bonds are created equal and the duration of surety bonds can vary wildly from one to the next. You may have a performance bond that lasts a year, a payment bond that lasts two years, or a range of other expiration dates.

What is the limit of liability of a surety if the contractor defaults? The surety can recover the debt from the contractor, the surety can sue the owner for claims that the contractor could have easily made, or they can try to get the retainage held by the owner.

A performance bond is a bond that guarantees that the bonded contractor will perform its obligations under the contract in accordance with the contract's terms and conditions. Performance bonds are typically in the amount of 50% of the contract amount, but can also be issued for 100% of the contract amount.

A performance bond is issued to one party of a contract as a guarantee against the failure of the other party to meet obligations specified in the contract.A performance bond is usually provided by a bank or an insurance company to make sure a contractor completes designated projects.

Surety bond claims come with a price. If the claim is determined to be valid, the surety bond company will pay the claimant up to the full amount of the bond. The surety company will then come to you for repayment. You are responsible for repaying the surety company every penny they paid out on your bond claim.

A performance bond provides assurance that the obligee will be protected if the principal fails to perform the bonded contract. If the obligee declares the principal in default and terminates the contract, it can call on the surety to meet the surety's obligations under the bond.

A performance bond is issued to one party of a contract as a guarantee against the failure of the other party to meet obligations specified in the contract.A performance bond is usually provided by a bank or an insurance company to make sure a contractor completes designated projects.

If the Principal fails to perform his or her duties under the contract specifications, the Obligee may call upon the Surety to cure the problem or make payment(s) out of the Performance Bond. These payments are for damages up to the limit of the Performance Bond.

Collect the funds owed from the performance bond from the bank or brokerage house holding the bond. You may obtain a cashier's check or request a wire transfer into a designated account.