Notice of Special Stockholders' Meeting to Consider Recapitalization

Description

How to fill out Notice Of Special Stockholders' Meeting To Consider Recapitalization?

Use the most complete legal catalogue of forms. US Legal Forms is the perfect place for getting up-to-date Notice of Special Stockholders' Meeting to Consider Recapitalization templates. Our platform offers a huge number of legal forms drafted by certified attorneys and grouped by state.

To obtain a template from US Legal Forms, users just need to sign up for a free account first. If you’re already registered on our service, log in and select the document you need and purchase it. After purchasing forms, users can find them in the My Forms section.

To obtain a US Legal Forms subscription online, follow the steps below:

- Find out if the Form name you have found is state-specific and suits your needs.

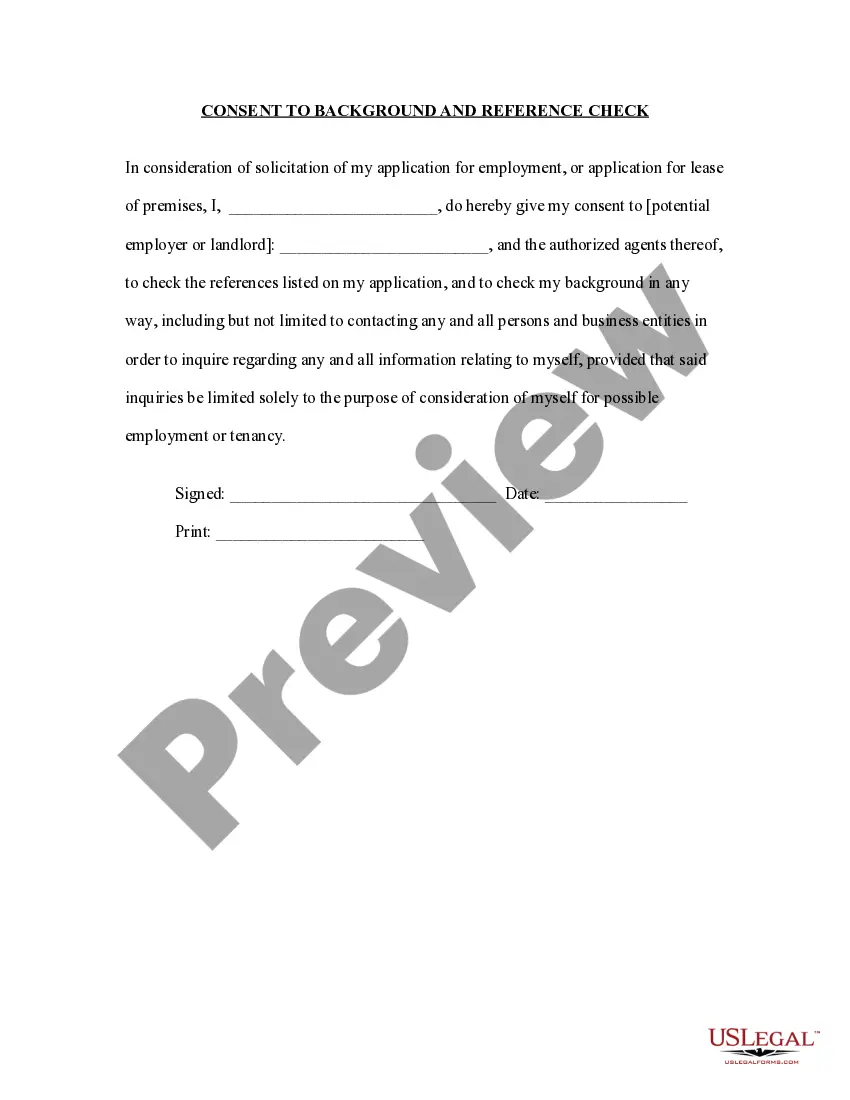

- In case the form has a Preview function, use it to check the sample.

- If the template doesn’t suit you, make use of the search bar to find a better one.

- Hit Buy Now if the template corresponds to your requirements.

- Choose a pricing plan.

- Create your account.

- Pay via PayPal or with yourr debit/credit card.

- Select a document format and download the template.

- When it is downloaded, print it and fill it out.

Save your effort and time using our platform to find, download, and complete the Form name. Join a huge number of delighted customers who’re already using US Legal Forms!

Form popularity

FAQ

Recapitalization is the process of restructuring a company's debt and equity mixture, often to stabilize a company's capital structure. The process mainly involves the exchange of one form of financing for another, such as removing preferred shares from the company's capital structure and replacing them with bonds.

Bank recapitalisation, means infusing more capital in state-run banks so that they meet the capital adequacy norms. The government, using different instruments, infuses capital into banks facing shortage of capital.

Bank recapitalization is the act of beefing up the long-term capital of a bank to the level at least required by the monetary authorities and to ensure the security of shareholders fund (equity plus reserve).

The term 'recapitalisation' refers to a company changing the proportions of its debt and equity, something which can be achieved in a variety of ways.

A dividend recapitalization is often undertaken as a way to free up money for the PE firm to give back to its investors, without necessitating an IPO, which might be risky. A dividend recapitalization is an infrequent occurrence, and different from a company declaring regular dividends, derived from earnings.

Consequently, a recapitalization is only good news for investors willing to take the special dividend and run, or in those cases where it is a prelude to a deal that is actually worthy of the debt load and the risks it brings. (To learn more, see Evaluating a Company's Capital Structure.)

An equity recapitalization represents an alternative to a complete sale of a company. The original owner can continue as a partner and/or manager of the company, while the new partner is a private equity firm that shares the business owner's culture and vision for the future.