Legend on Stock Certificate Giving Notice of Restriction on Transfer due to Stock Redemption Agreement Requiring First an Offer to the Corporation and then an Offer to other Stockholders

Description Stock Restriction Transfer Agreement

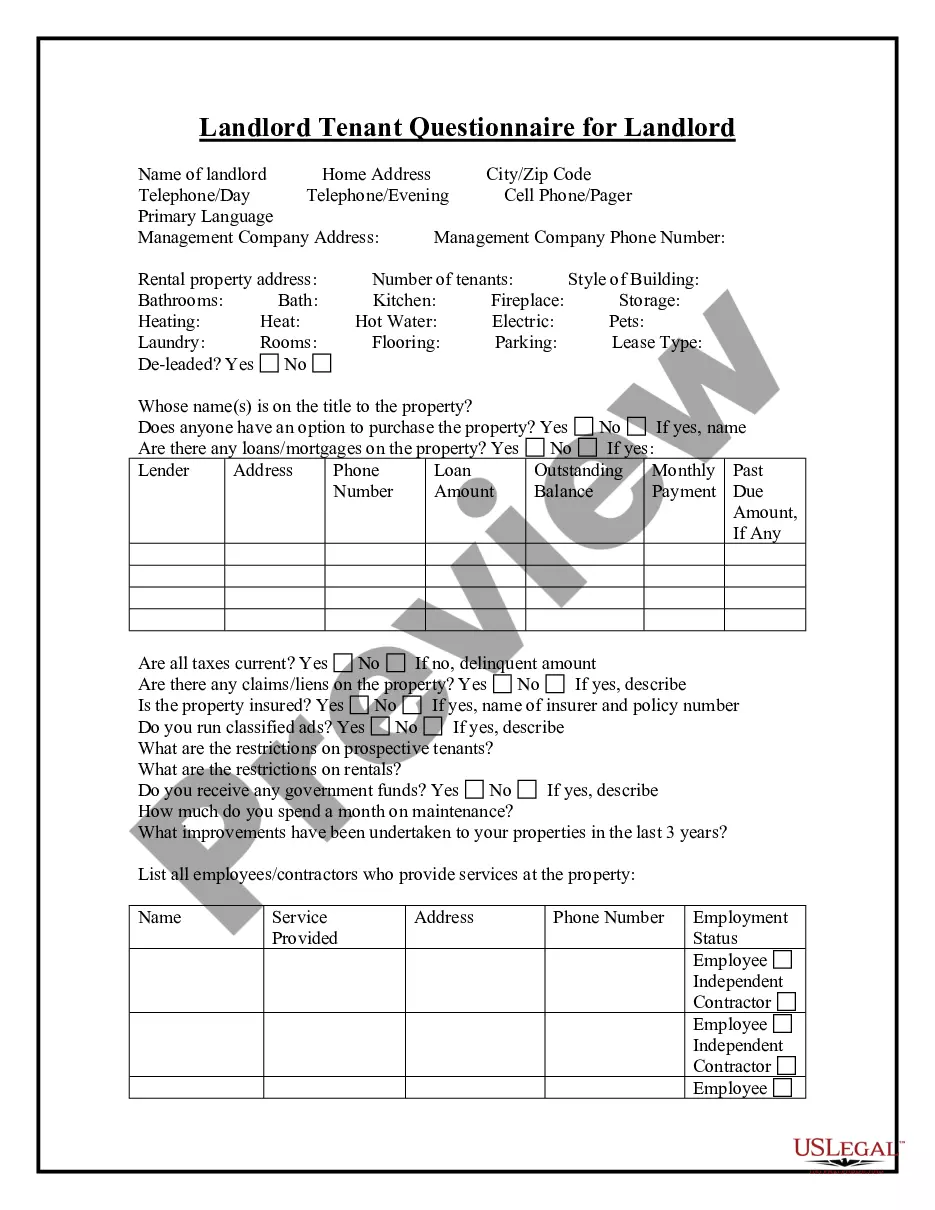

How to fill out Legend On Stock Certificate Giving Notice Of Restriction On Transfer Due To Stock Redemption Agreement Requiring First An Offer To The Corporation And Then An Offer To Other Stockholders?

Employ the most extensive legal library of forms. US Legal Forms is the best platform for getting up-to-date Legend on Stock Certificate Giving Notice of Restriction on Transfer due to Stock Redemption Agreement Requiring First an Offer to the Corporation and then an Offer to other Stockholders templates. Our service offers a huge number of legal forms drafted by licensed attorneys and grouped by state.

To obtain a template from US Legal Forms, users just need to sign up for an account first. If you’re already registered on our service, log in and choose the template you are looking for and purchase it. After buying templates, users can see them in the My Forms section.

To obtain a US Legal Forms subscription on-line, follow the steps listed below:

- Find out if the Form name you’ve found is state-specific and suits your requirements.

- If the form has a Preview function, utilize it to review the sample.

- In case the sample does not suit you, make use of the search bar to find a better one.

- PressClick Buy Now if the sample meets your needs.

- Choose a pricing plan.

- Create an account.

- Pay with the help of PayPal or with the credit/credit card.

- Choose a document format and download the template.

- Once it’s downloaded, print it and fill it out.

Save your effort and time with our service to find, download, and complete the Form name. Join a large number of satisfied clients who’re already using US Legal Forms!

Stock Notice Transfer Form popularity

Stock Giving Corporation Other Form Names

Certificate Transfer Agreement FAQ

Restricted stock is given by a corporation, while common stock can be bought and sold at any time.This makes the recipient of the stock liable for income-tax consequences immediately but establishes a cost basis.

Gather the necessary documents. Get an endorsement of the share. Deliver the stock certificate with a Deed showing the proof of transfer. Record the transfer in the books. Learn more about owning and transferring shares of stock in the Philippines.

Restricted stock units are often offered as part of a compensation package to attract and retain key employees They are restricted in that certain requirements must be met before the employee can obtain full ownership rights to the value of the units.

A restricted stock purchase agreement is a type of written agreement that places restrictions on the stockholder's rights with respect to the shares being issued.of the shares and grant a series of rights in favor of the Company to buyback shares, exercise a right of first refusal, and others.

A stock restriction agreement (SRA) is a legal contract made between a company and its founders for an allotment of unvested shares of stock with certain restrictions on when it can be sold.

Request a Transfer of Stock Ownership form from your stockbroker or directly from the brokerage company. Write a letter with the instructions on the means of transfer to include with your Transfer of Stock Ownership form.

Request a Transfer of Stock Ownership form from your stockbroker or directly from the brokerage company. Write a letter with the instructions on the means of transfer to include with your Transfer of Stock Ownership form.

RSUs give an employee interest in company stock but they have no tangible value until vesting is complete.Upon vesting, they are considered income, and a portion of the shares is withheld to pay income taxes. The employee receives the remaining shares and can sell them at their discretion.

This is a clear and straightforward process. Surrender your share certificate to the Corporation's transfer agent. Wait for the transfer agent to issue a certificate to a new shareholder, thereby transferring the shares. Waif for the transfer agent to cancel your old certificate.