Investment Club Partnership Agreement

Description

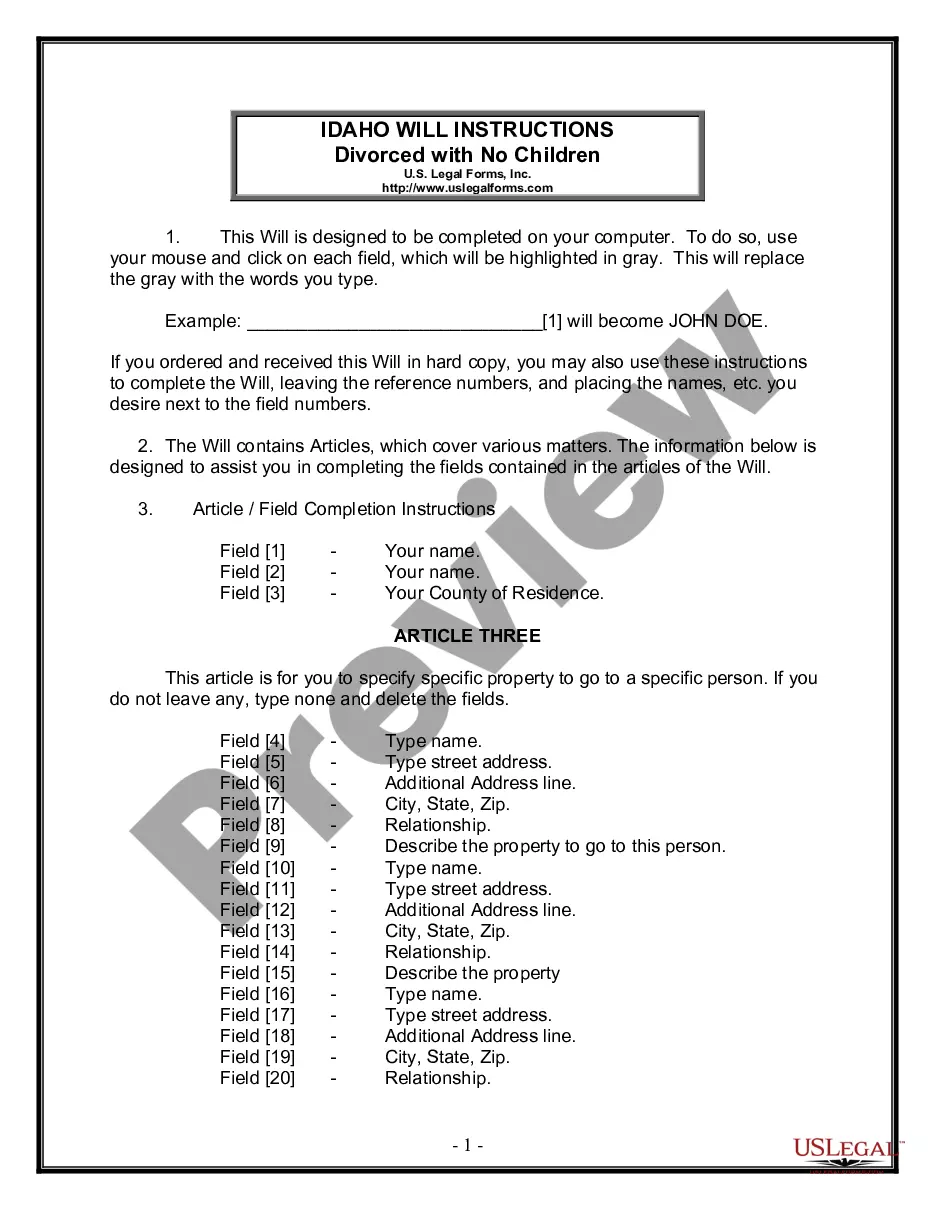

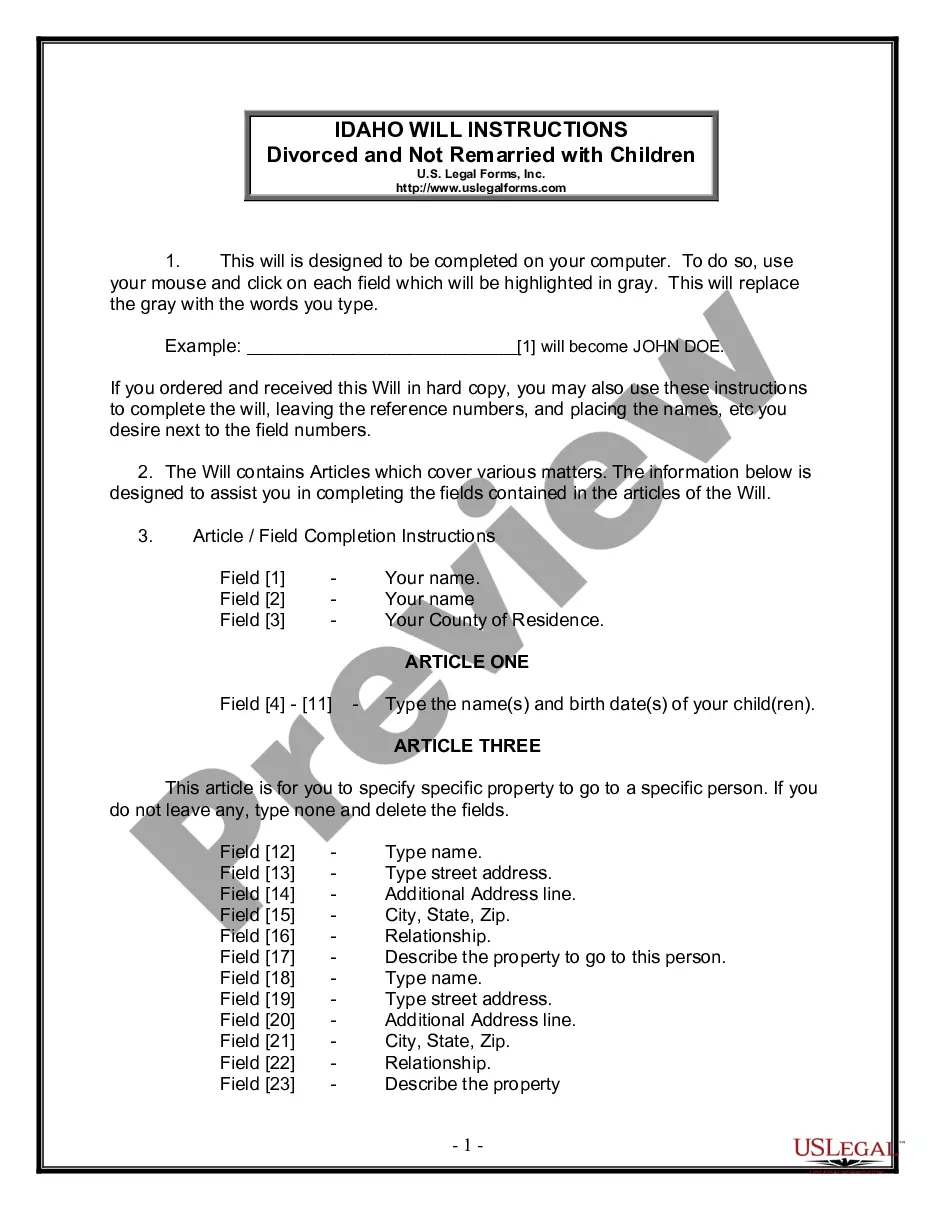

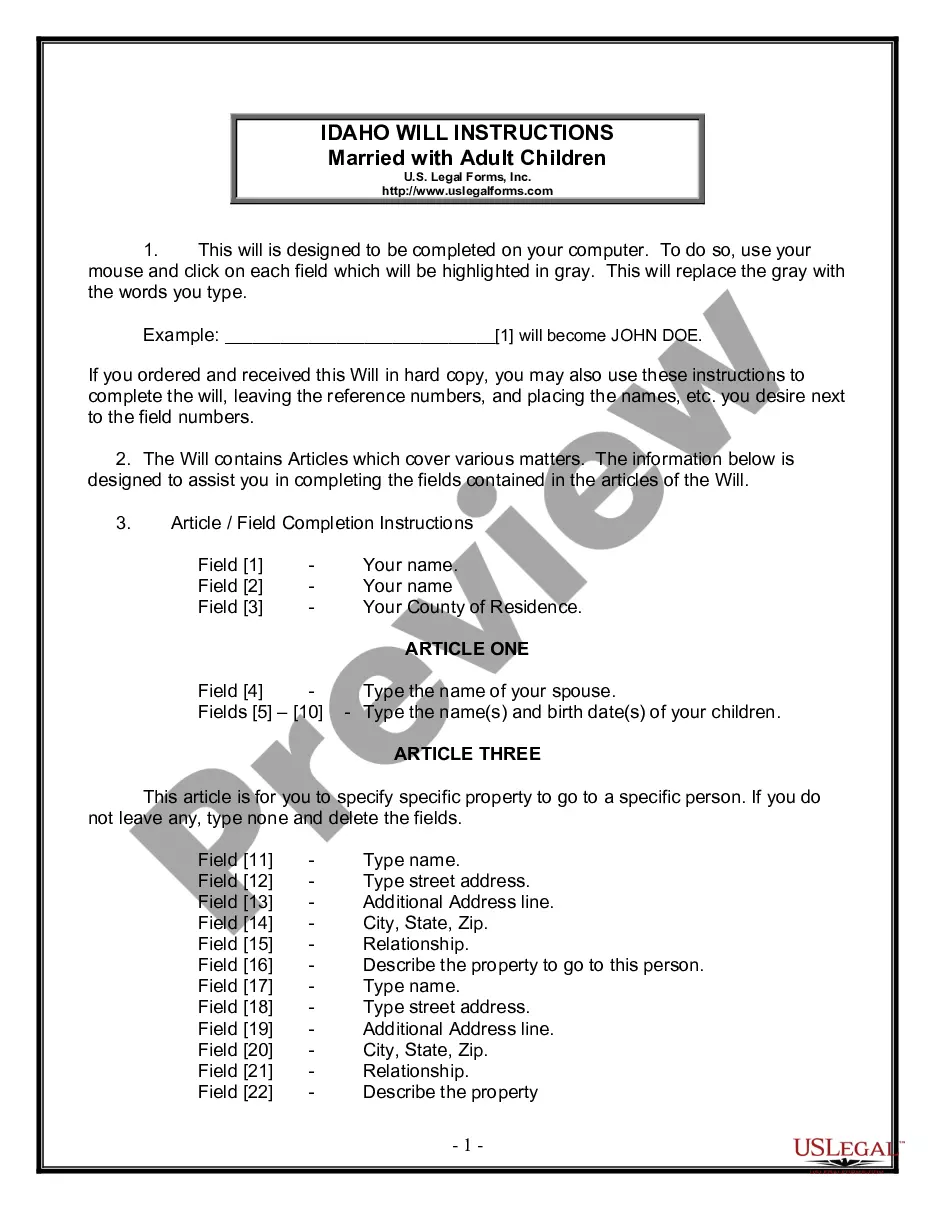

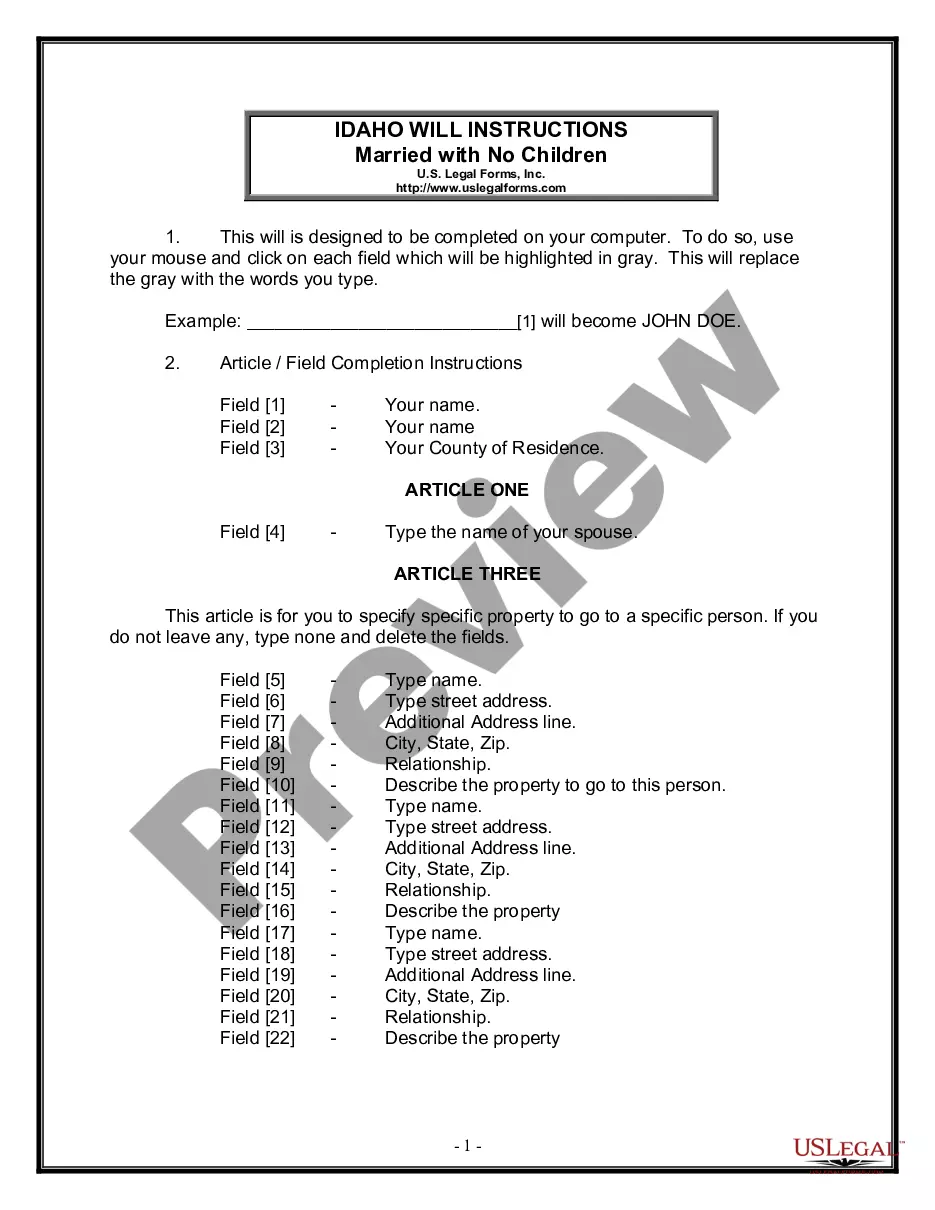

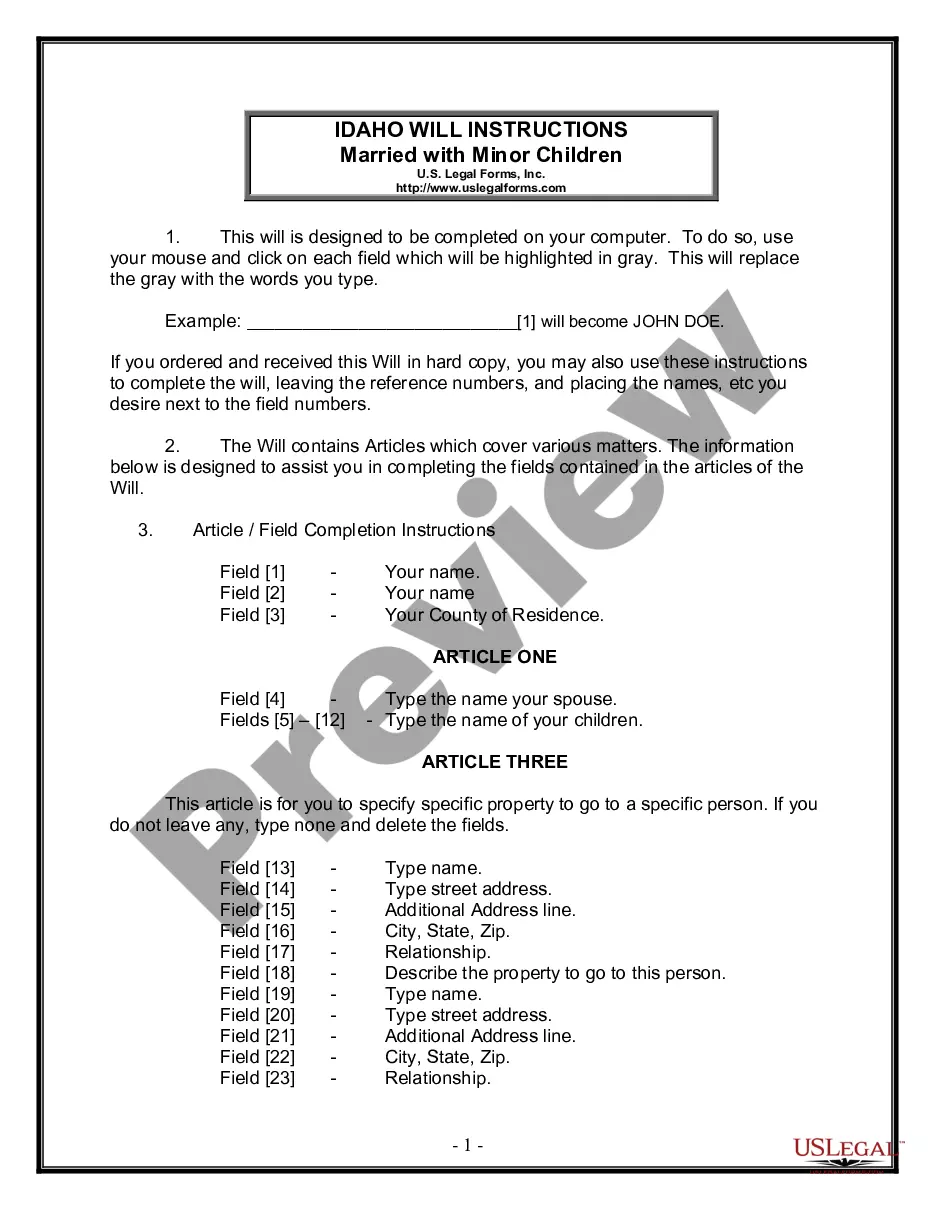

How to fill out Investment Club Partnership Agreement?

Make use of the most extensive legal catalogue of forms. US Legal Forms is the perfect place for getting up-to-date Investment Club Partnership Agreement templates. Our service provides 1000s of legal documents drafted by licensed legal professionals and grouped by state.

To get a sample from US Legal Forms, users just need to sign up for an account first. If you are already registered on our service, log in and choose the document you need and purchase it. After buying forms, users can see them in the My Forms section.

To get a US Legal Forms subscription online, follow the guidelines below:

- Find out if the Form name you’ve found is state-specific and suits your requirements.

- In case the form features a Preview option, use it to check the sample.

- In case the sample doesn’t suit you, use the search bar to find a better one.

- Hit Buy Now if the template corresponds to your expections.

- Select a pricing plan.

- Create an account.

- Pay with the help of PayPal or with yourr debit/credit card.

- Choose a document format and download the template.

- When it is downloaded, print it and fill it out.

Save your effort and time with our platform to find, download, and fill in the Form name. Join a huge number of delighted clients who’re already using US Legal Forms!

Form popularity

FAQ

Name of the partnership. Contributions to the partnership. Allocation of profits, losses, and draws. Partners' authority. Partnership decision-making. Management duties. Admitting new partners. Withdrawal or death of a partner.

Although there's no requirement for a written partnership agreement, often it's a very good idea to have such a document to prevent internal squabbling (about profits, direction of the company, etc.) and give the partnership solid direction. Limited liability partnerships do have a writing requirement.

Although each partnership agreement differs based on business objectives, certain terms should be detailed in the document, including percentage of ownership, division of profit and loss, length of the partnership, decision making and resolving disputes, partner authority, and withdrawal or death of a partner.

Percentage of ownership. Allocation of profits and losses. Who can bind the partnership? Making decisions. The death of a partner. Resolving disputes.

Here's how to successfully navigate the process of. starting an investment club. Assemble an appropriately sized group with a common goal. Make sure all members are on the same page. Set up the structure and elect officers. Dennis M. Get tax forms and accounts in order. Open checking brokerage accounts.

Name of your partnership. Contributions to the partnership and percentage of ownership. Division of profits, losses and draws. Partners' authority. Withdrawal or death of a partner.

Like any contractual agreement, partnership agreements do not have to be in writing, as verbal agreements are also legally binding.In a partnership, each person is liable for the debts and actions of the other partners, so the contractual relationship and obligations need to be completely transparent.

In general, investment clubs are unregulated. In United States, the SEC requires any entity with more that $25 million to register under the Investment Advisers Act of 1940. 3 Individual states may require registration but generally investment clubs do not have to if they have a small number of clients or participants.

Your Partnership's Name. Partnership Contributions. Allocations profits and losses. Partners' Authority and Decision Making Powers. Management. Departure (withdrawal) or Death. New Partners. Dispute Resolution.