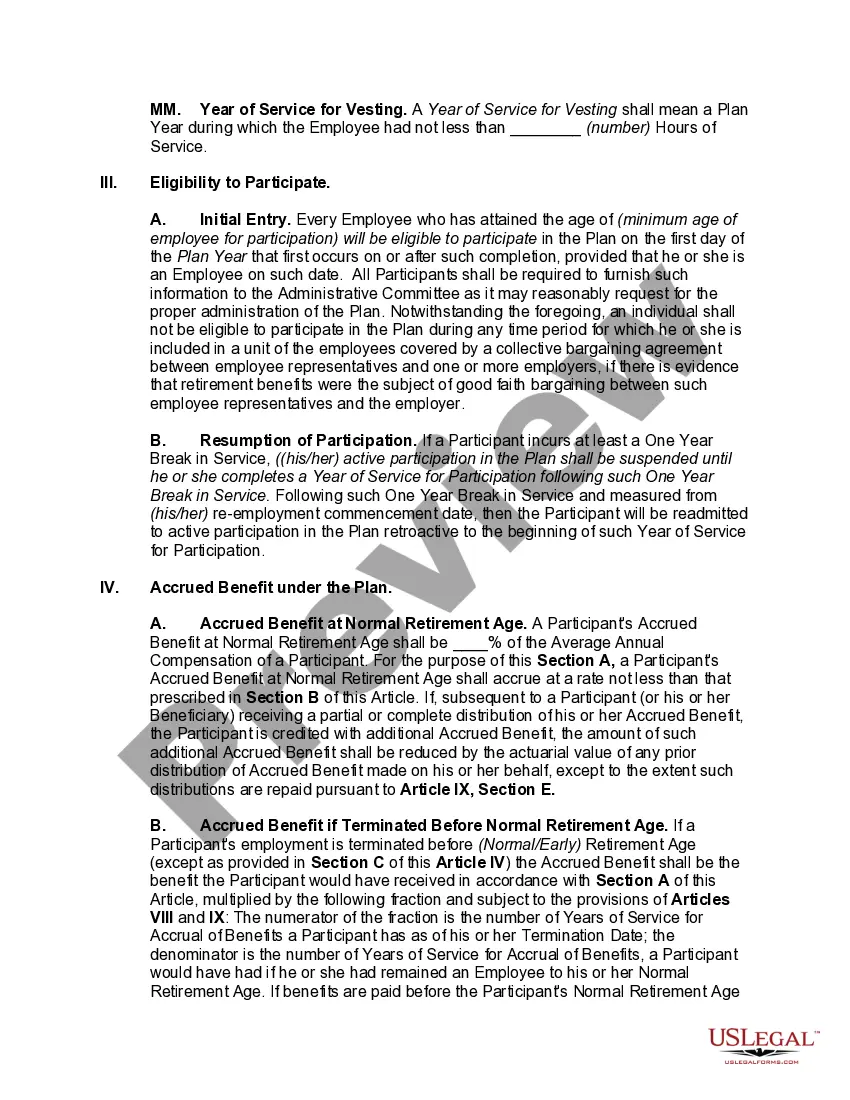

Defined-Benefit Pension Plan and Trust Agreement

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Defined-Benefit Pension Plan And Trust Agreement?

Employ the most extensive legal catalogue of forms. US Legal Forms is the best place for finding updated Defined-Benefit Pension Plan and Trust Agreement templates. Our platform offers a huge number of legal documents drafted by certified attorneys and grouped by state.

To get a template from US Legal Forms, users only need to sign up for an account first. If you’re already registered on our service, log in and select the document you need and buy it. After buying forms, users can find them in the My Forms section.

To obtain a US Legal Forms subscription online, follow the guidelines below:

- Find out if the Form name you have found is state-specific and suits your requirements.

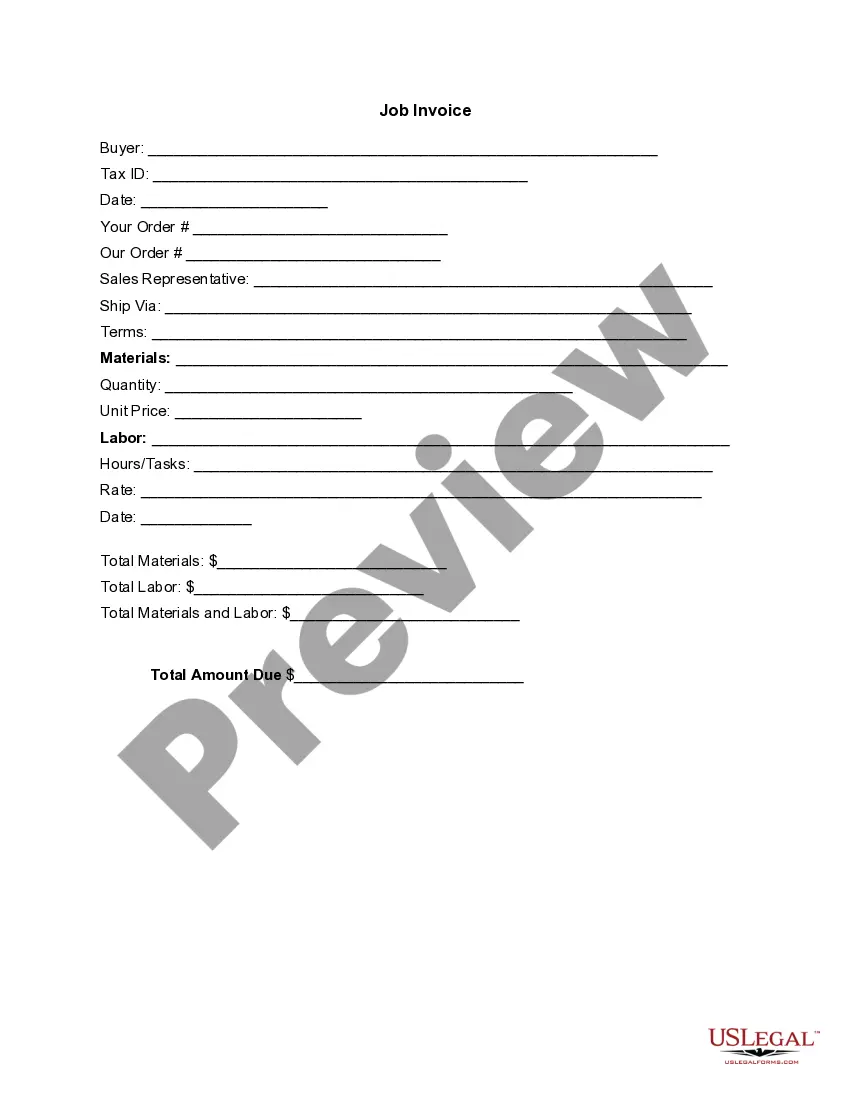

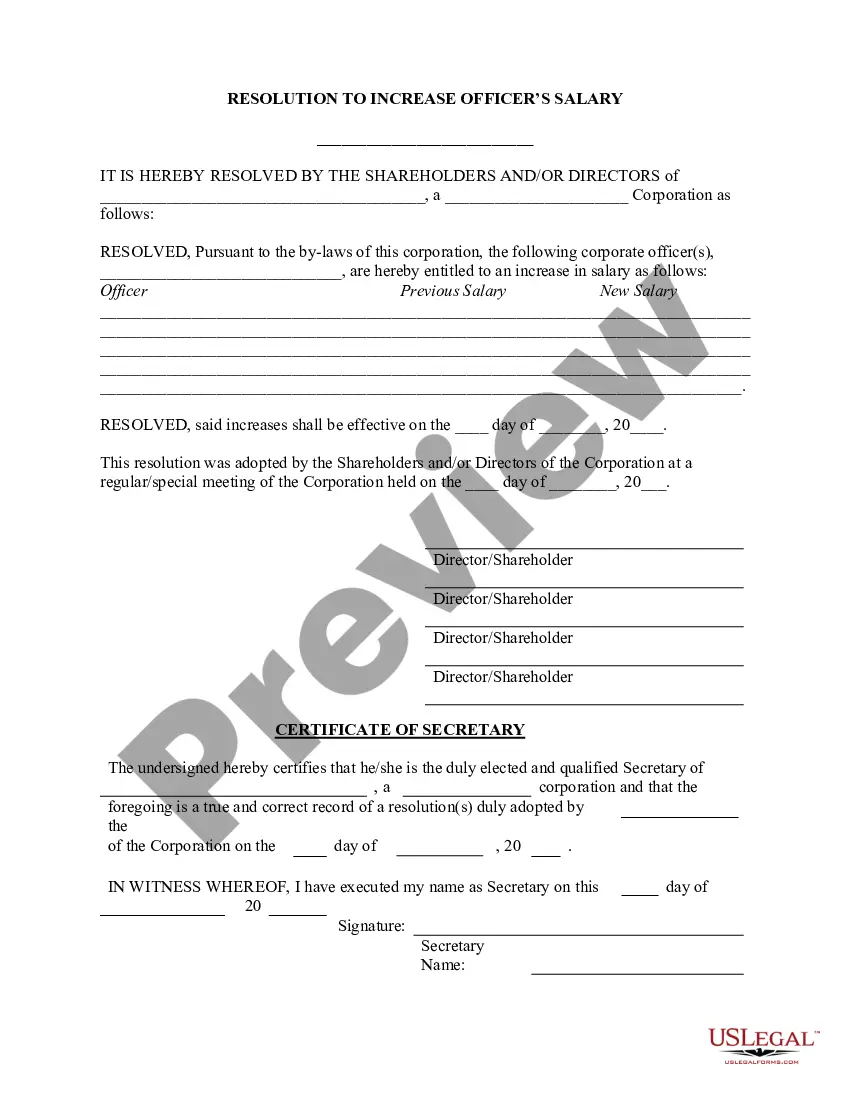

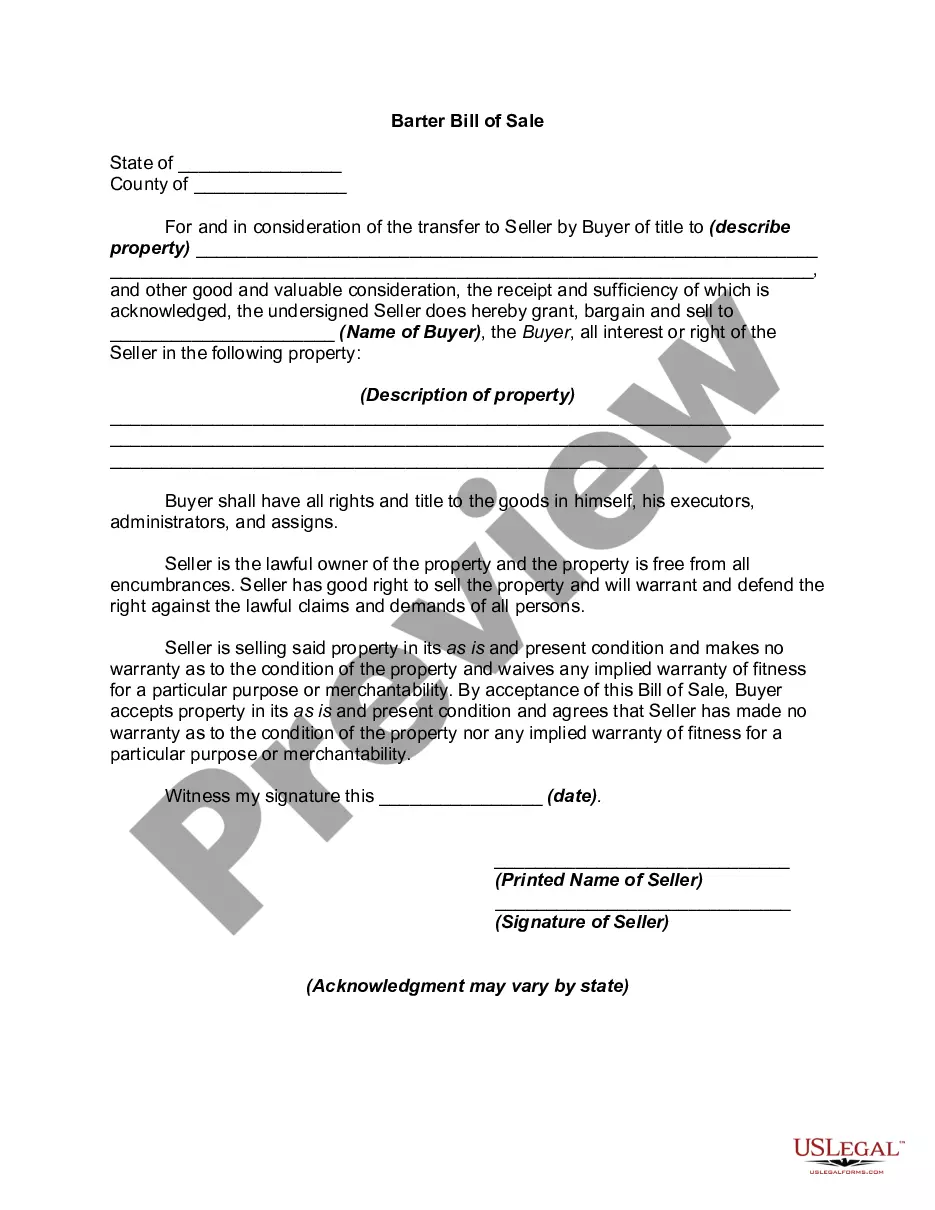

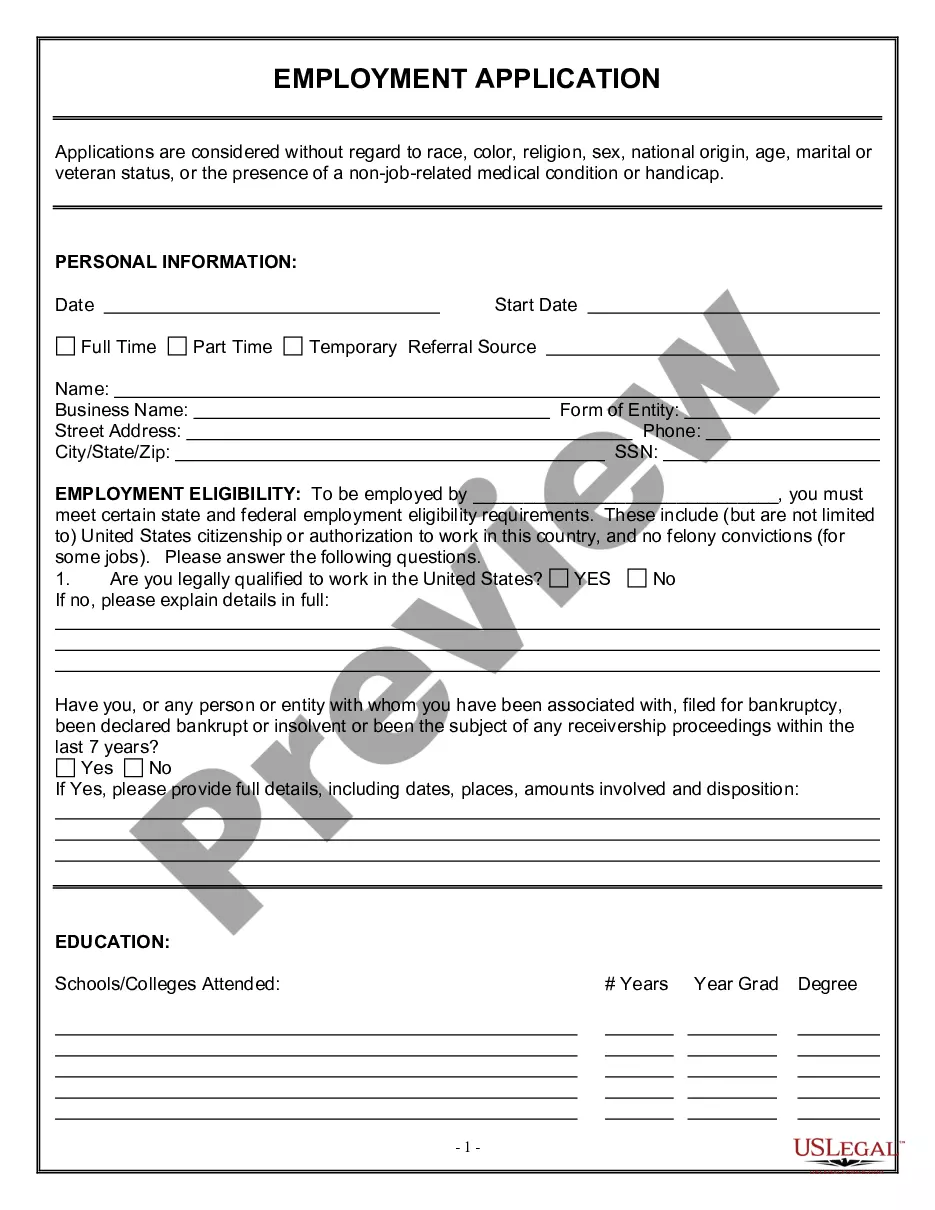

- In case the form features a Preview function, use it to check the sample.

- In case the template doesn’t suit you, utilize the search bar to find a better one.

- Hit Buy Now if the template meets your expections.

- Choose a pricing plan.

- Create a free account.

- Pay via PayPal or with the debit/credit card.

- Choose a document format and download the sample.

- When it’s downloaded, print it and fill it out.

Save your time and effort with our platform to find, download, and fill out the Form name. Join a huge number of pleased subscribers who’re already using US Legal Forms!

Form popularity

FAQ

All pension plans are trusts; therefore, a trust account at a bank or brokerage firm must be opened in the name of the defined benefit plan using the EIN (Employer Identification Number) provided specifically for the plan. Do not use the company's EIN or the social security number of any individual.

Another tool to have in the pensions planning toolkit is for the death benefits to go into trust (this is sometimes known as a spousal bypass trust). The trust receives a lump sum death benefit from the pension scheme and then the trustees administer it.

The Employee Retirement Income Security Act (ERISA) covers two types of retirement plans: defined benefit plans and defined contribution plans. A defined benefit plan promises a specified monthly benefit at retirement.

A defined-contribution plan allows employees and employers (if they choose) to contribute and invest funds to save for retirement, while a defined-benefit plan provides a specified payment amount in retirement. These crucial differences determine whether the employer or employee bears the investment risks.

A defined-contribution plan allows employees and employers (if they choose) to contribute and invest funds to save for retirement, while a defined-benefit plan provides a specified payment amount in retirement.

You should put your retirement accounts in a living trust only for personally specific reasons. Since there are no additional tax benefits, only potential tax problems, from using a living trust for retirement accounts, consider your reasons carefully.

The process of funding your living trust by transferring your assets to the trustee is an important part of what helps your loved ones avoid probate court in the event of your death or incapacity. Qualified retirement accounts such as 401(k)s, 403(b)s, IRAs, and annuities, should not be put in a living trust.

Another tool to have in the pensions planning toolkit is for the death benefits to go into trust (this is sometimes known as a spousal bypass trust). The trust receives a lump sum death benefit from the pension scheme and then the trustees administer it.

A participant in a retirement account, whether it is an IRA, 401(k), 457, 403b, Profit Sharing Plan, Defined Benefit Plan, or any other Profit Sharing / Pension Plan may designate an individual, Trust, estate as beneficiary to receive the annual distributions on the death of the participant owner.