Guaranty of Payment of Dividends on Stocks

Description

How to fill out Guaranty Of Payment Of Dividends On Stocks?

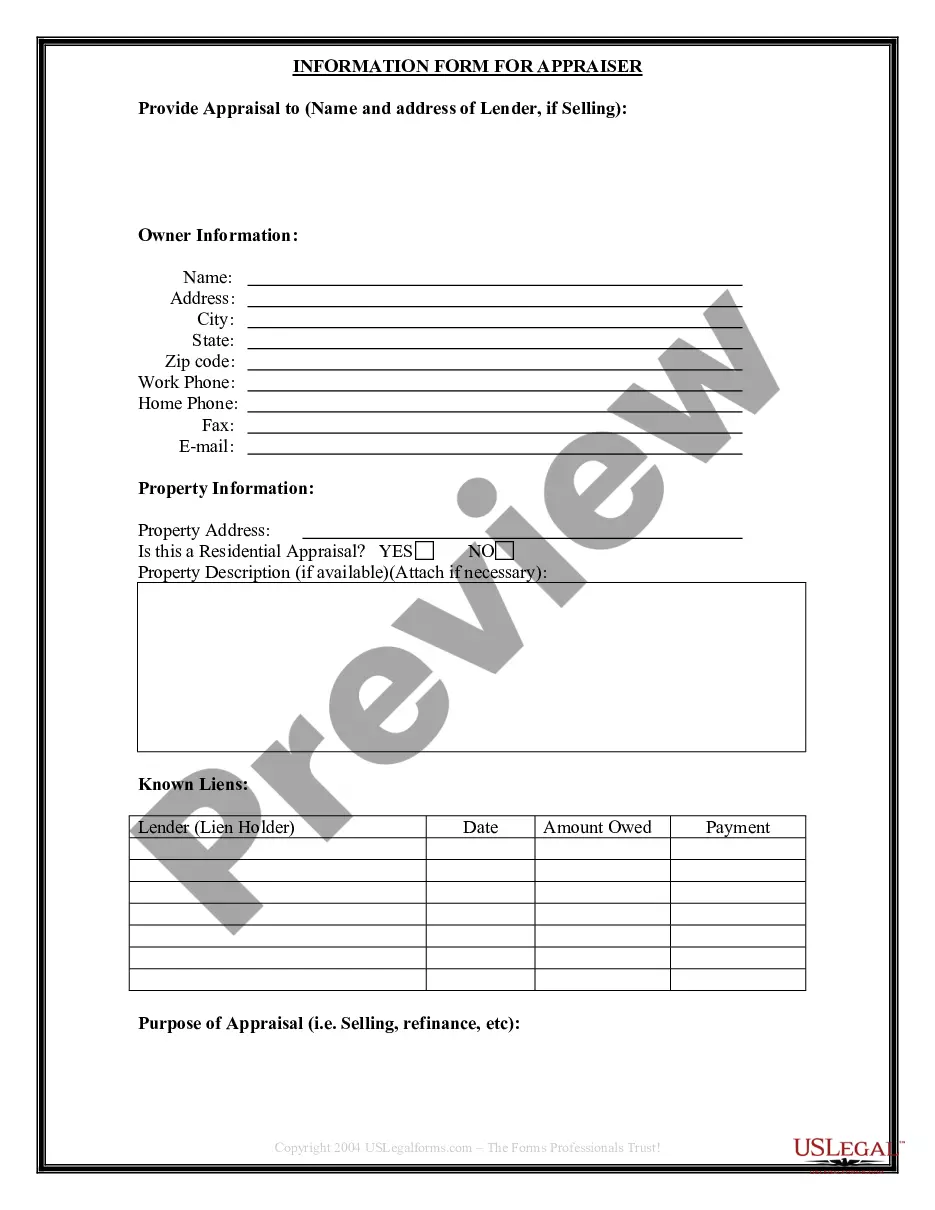

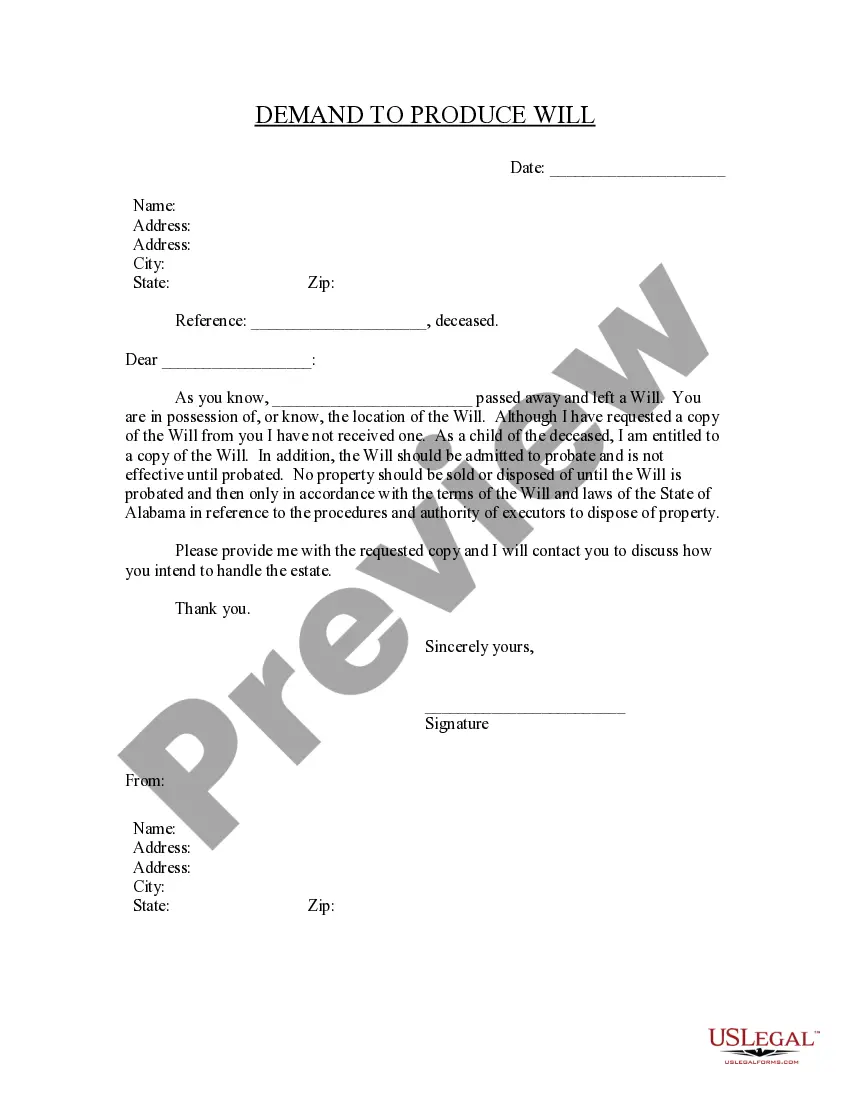

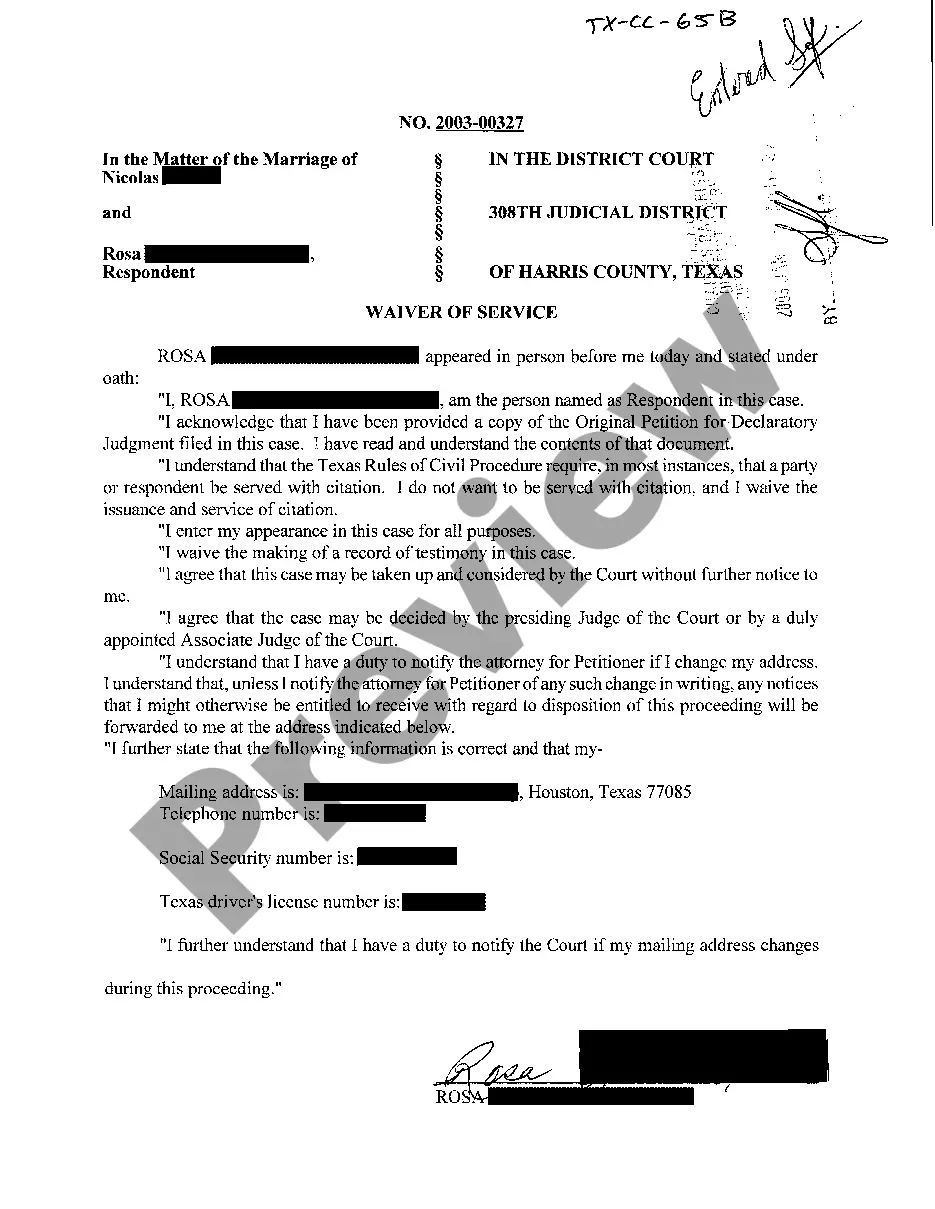

Utilize the most complete legal catalogue of forms. US Legal Forms is the perfect place for finding updated Guaranty of Payment of Dividends on Stocks templates. Our service provides a huge number of legal documents drafted by certified attorneys and grouped by state.

To download a sample from US Legal Forms, users just need to sign up for a free account first. If you’re already registered on our platform, log in and select the document you are looking for and buy it. After purchasing forms, users can find them in the My Forms section.

To get a US Legal Forms subscription online, follow the steps below:

- Find out if the Form name you’ve found is state-specific and suits your needs.

- When the template features a Preview option, use it to check the sample.

- In case the sample doesn’t suit you, use the search bar to find a better one.

- Hit Buy Now if the sample meets your needs.

- Select a pricing plan.

- Create your account.

- Pay with the help of PayPal or with yourr debit/visa or mastercard.

- Choose a document format and download the sample.

- Once it’s downloaded, print it and fill it out.

Save your time and effort with the service to find, download, and fill out the Form name. Join thousands of delighted customers who’re already using US Legal Forms!

Form popularity

FAQ

Stocks that pay regular dividends (simply called dividend-paying stocks, or dividend stocks) have numerous benefits, and are typically a part of a well-balanced stock portfolio due to those benefits.

With dividend stocks, you can lose money in any of the following ways: Share prices can drop. This situation is possible regardless of whether the company pays dividends. Worst-case scenario is that the company goes belly up before you have the chance to sell your shares.

A stock in a company for which another company or bank promises to pay dividends in case the issuing company defaults. Because guaranteed stocks carry lower risk, they are usually more expensive than non-guaranteed stocks.

Key Takeaways. Dividends represent the distribution of corporate profits to shareholders, based upon the number of shares held in the company. Shareholders expect the companies that they invest in to return profits to them, but not all companies pay dividends.

If you own shares of a company's common stock and that company announces that it will pay a dividend to its shareholders, then you will receive the dividend. However, holders of common stock are not necessarily guaranteed a dividend. The company can simply choose not to pay any dividends in a given quarter -- or ever.

(Only preferred stock shares guarantee dividends, and these types of shares are a kind of hybrid of a stock and a bond.) There are, however, some companies that are considered dividend stars because of their steady and generous dividend payments to common shareholders.

A: Dividends are not guaranteed. Investors must be 100% clear on the fact that dividends, by definition, are up to the discretion of companies and can stop at any time.And with some types of dividends, specifically preferred-stock dividends, a company must make up for any missed dividends if they're cut.

Companies pay dividends to distribute profits to shareholders, and which also signals corporate health and earnings growth to investors.After a stock goes ex-dividend, the share price typically drops by the amount of the dividend paid to reflect the fact that new shareholders are not entitled to that payment.