General Form of Assignment to Benefit Creditors

Description General Creditors

How to fill out General Form Of Assignment To Benefit Creditors?

Employ the most comprehensive legal catalogue of forms. US Legal Forms is the perfect place for getting up-to-date General Form of Assignment to Benefit Creditors templates. Our platform provides 1000s of legal documents drafted by certified legal professionals and grouped by state.

To obtain a sample from US Legal Forms, users simply need to sign up for an account first. If you are already registered on our service, log in and choose the document you need and buy it. After buying forms, users can see them in the My Forms section.

To get a US Legal Forms subscription on-line, follow the guidelines listed below:

- Find out if the Form name you have found is state-specific and suits your needs.

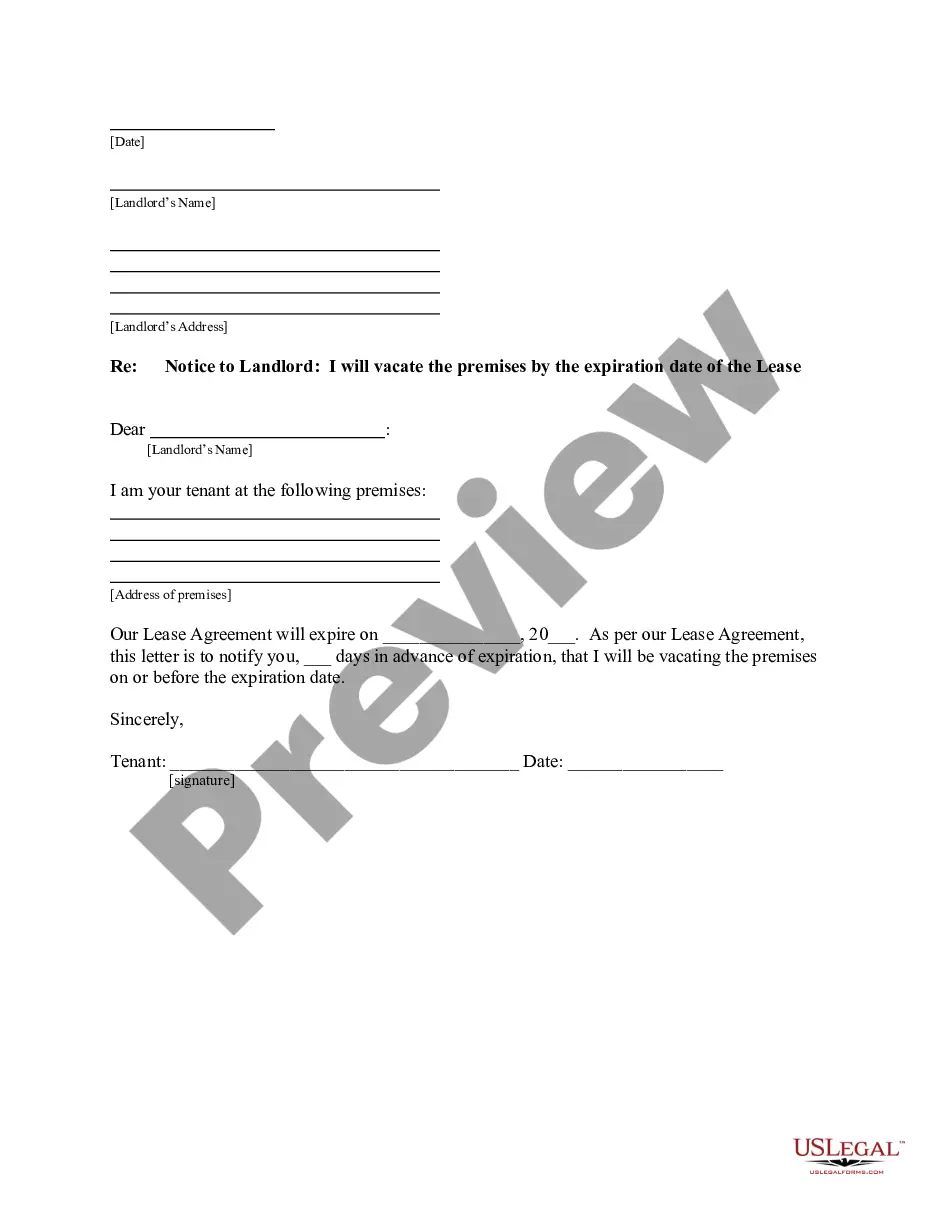

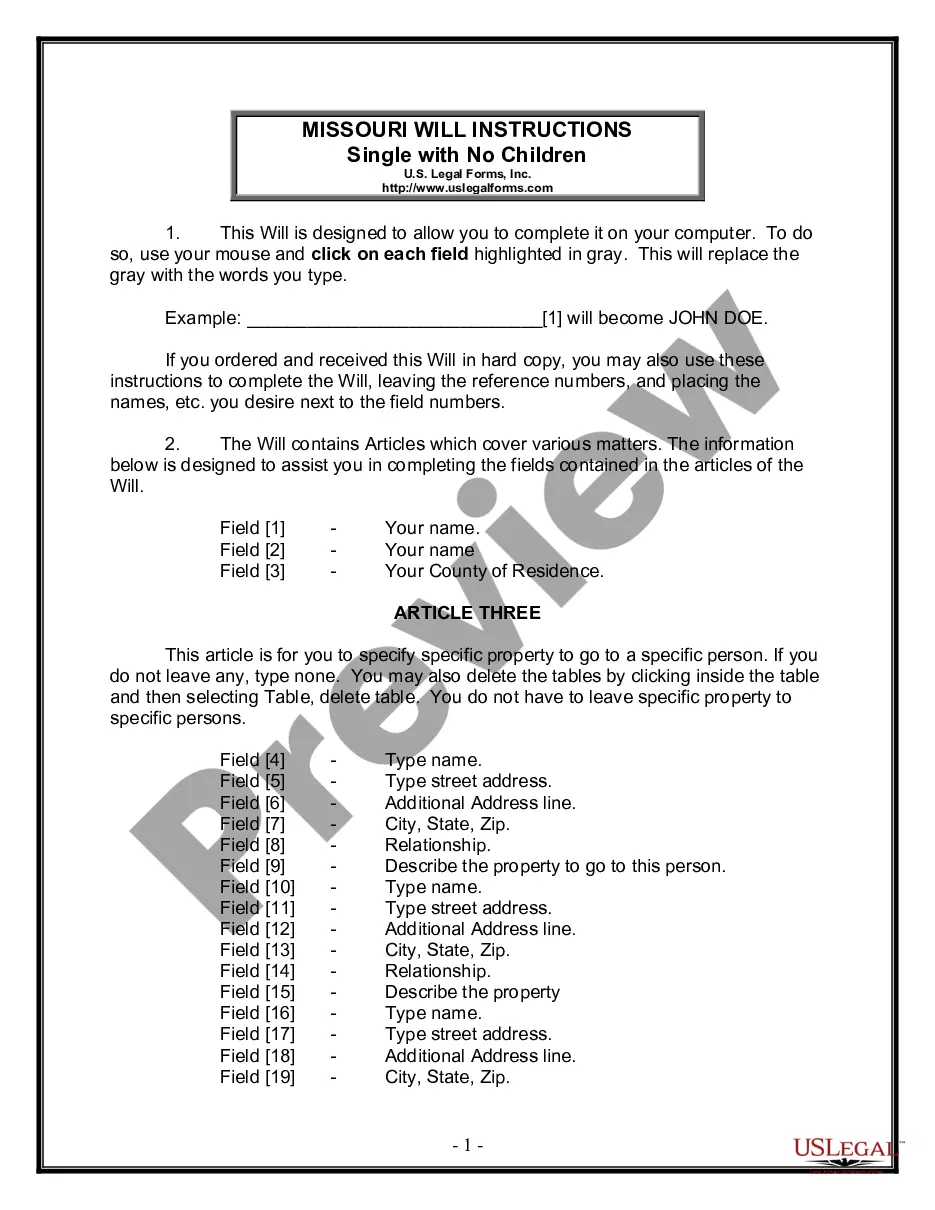

- When the form features a Preview function, use it to check the sample.

- If the sample doesn’t suit you, use the search bar to find a better one.

- PressClick Buy Now if the template corresponds to your requirements.

- Choose a pricing plan.

- Create a free account.

- Pay with the help of PayPal or with the debit/bank card.

- Select a document format and download the template.

- When it is downloaded, print it and fill it out.

Save your time and effort with our platform to find, download, and complete the Form name. Join a large number of pleased clients who’re already using US Legal Forms!

Form Assignment Creditors Form popularity

Benefit Creditors Template Other Form Names

Assignment Creditors FAQ

Preferred Creditors vs. Unsecured creditors are generally placed into two categories: priority unsecured creditors and general unsecured creditors.

Basically, the ABC company will liquidate your assets and pay off your creditors (for a percentage of what it is able to sell your assets for), while you and your co-owners move forward with your lives. This option generally works well if your business is a corporation or LLC with a lot of debts and assets.

An assignment for the benefit of creditors (ABC) is a business liquidation device available to an insolvent debtor as an alternative to formal bankruptcy proceedings. In many instances, an ABC can be the most advantageous and graceful exit strategy.

An assignment for the benefit of creditors (ABC) is a contract by which an economically troubled entity ("Assignor") transfers legal and equitable title, as well as custody and control, of its assets and property to an independent third party ("Assignee") in trust, who is required to apply the proceeds of sale of the

For creditors, an ABC process generally involves the submission to the assignee of a proof of claim by a stated deadline or bar date, similar to bankruptcy.Unlike bankruptcy, there generally is no cap imposed on a landlord's claim for breach of a real property lease in an ABC. Sale Of Assets.

A secured creditor is generally a bank or other asset-based lender that holds a fixed or floating charge over a business asset or assets.Unsecured creditors can include suppliers, customers, HMRC and contractors. They rank after secured and preferential creditors in an insolvency situation.