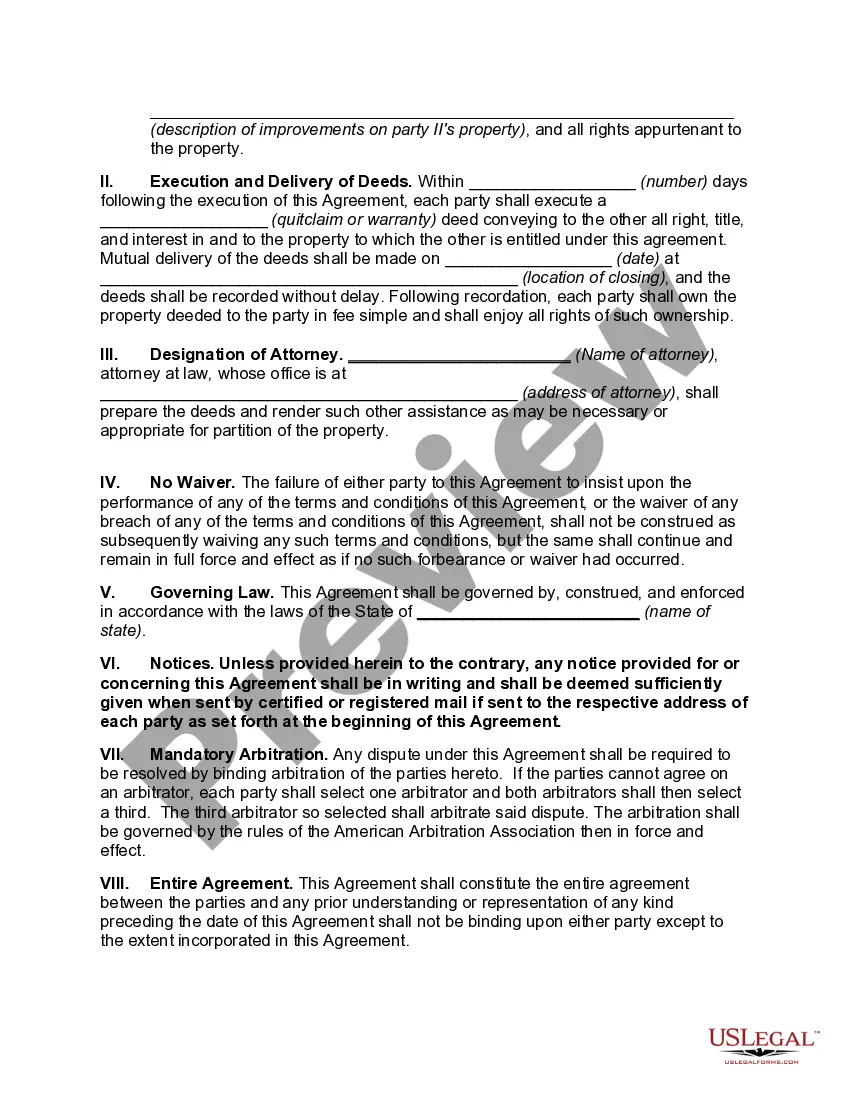

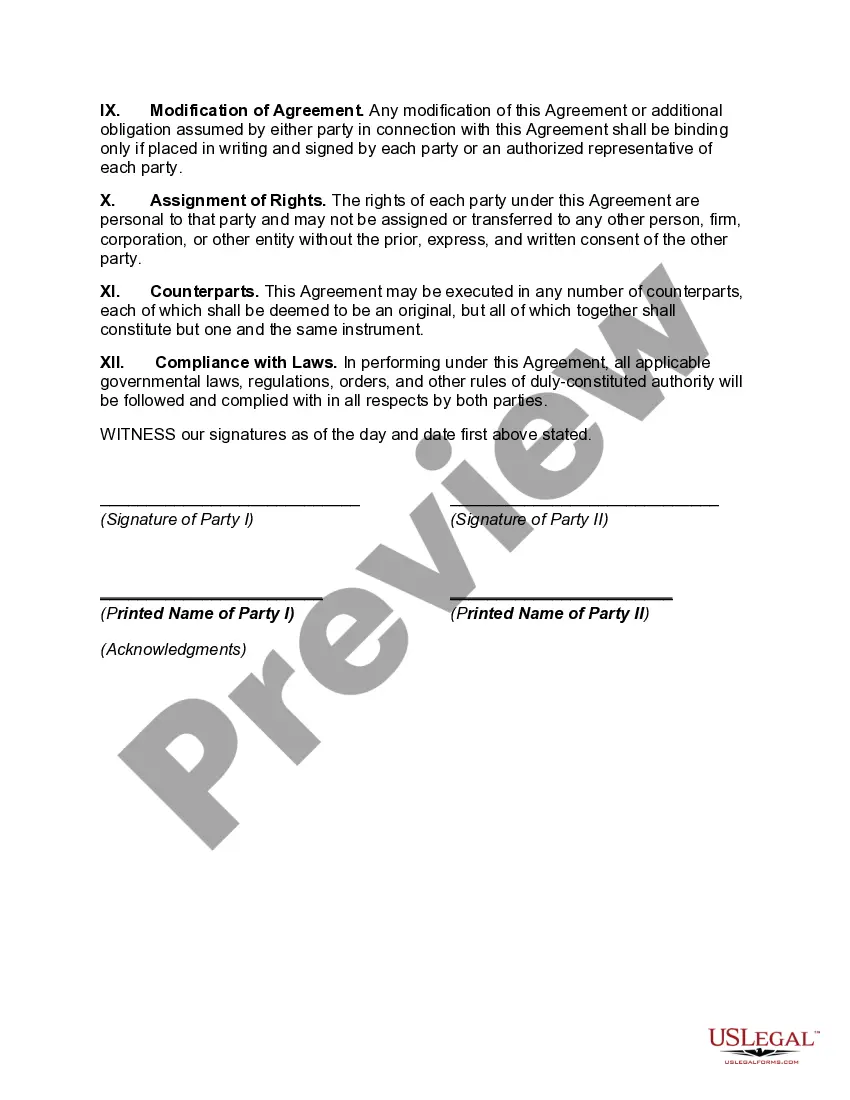

Agreement to Partition Real Property Between Children of Decedent

Description

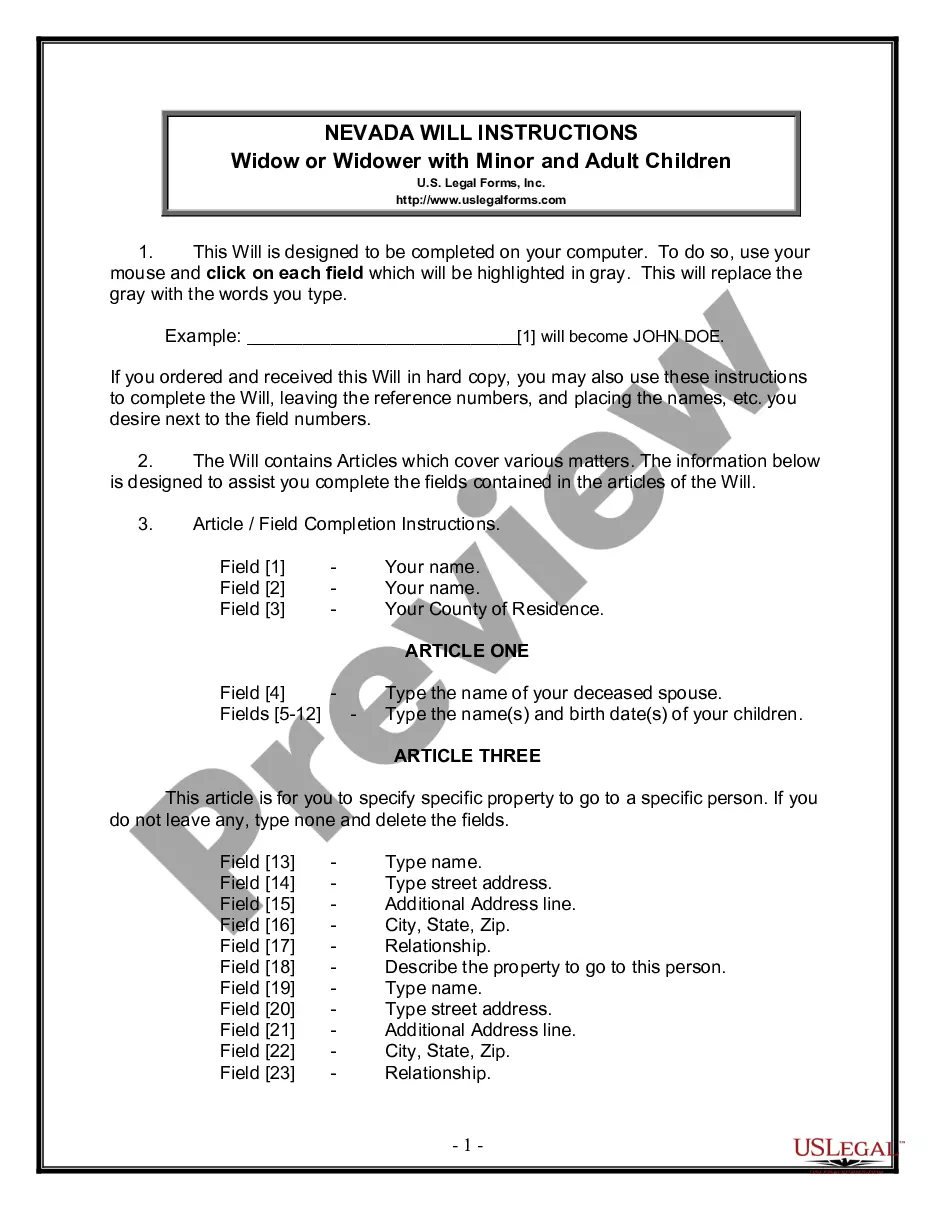

How to fill out Agreement To Partition Real Property Between Children Of Decedent?

Utilize the most extensive legal catalogue of forms. US Legal Forms is the perfect place for finding updated Agreement to Partition Real Property Between Children of Decedent templates. Our service provides 1000s of legal documents drafted by certified attorneys and grouped by state.

To download a sample from US Legal Forms, users only need to sign up for an account first. If you’re already registered on our service, log in and select the document you need and buy it. After buying forms, users can find them in the My Forms section.

To obtain a US Legal Forms subscription online, follow the guidelines listed below:

- Check if the Form name you have found is state-specific and suits your needs.

- In case the template features a Preview option, utilize it to review the sample.

- If the sample doesn’t suit you, utilize the search bar to find a better one.

- PressClick Buy Now if the template corresponds to your requirements.

- Choose a pricing plan.

- Create your account.

- Pay with the help of PayPal or with yourr credit/credit card.

- Choose a document format and download the sample.

- After it’s downloaded, print it and fill it out.

Save your effort and time with the platform to find, download, and fill in the Form name. Join a huge number of happy clients who’re already using US Legal Forms!

Form popularity

FAQ

Give the house, the land or the business to just one child and make up the difference with a monetary share for the others. Alternatively, stipulate that the asset be sold and the proceeds divided evenly. That way, the one who really wants the asset can buy the others out.

The short answer is that just receiving land as an inheritance usually will not trigger income taxes for you, but you will owe capital gains taxes if you sell the property later at a gain.

Draw lots and take turns picking items. Use colored stickers for each person to indicate what he wants. Get appraisals. Make copies. Use an online service like FairSplit.com to catalog and divide personal property in an estate.

Start by determining a value for the real estate in the estate, and then decide how to divide the total value of the inheritance between the heirs. There are several easy ways to do this. You can value the real estate and then decide how to divide it, where one heir take one piece and the other take the rest.

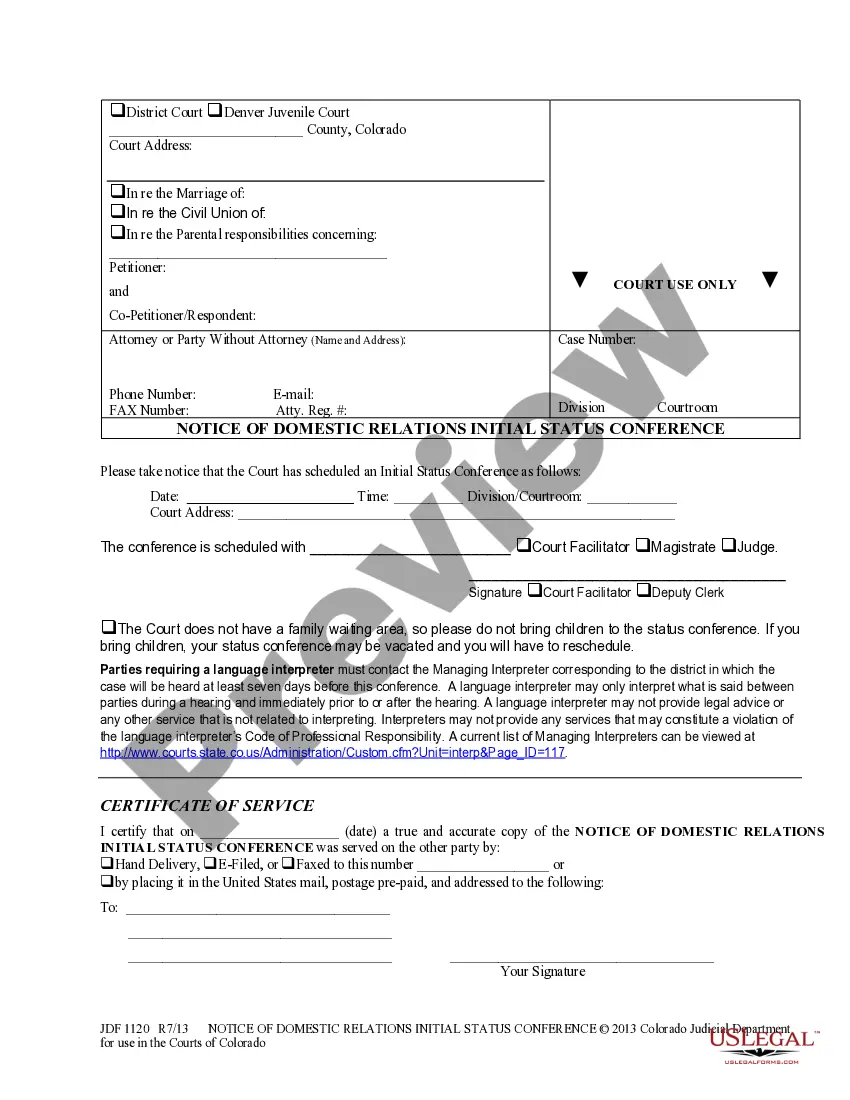

Get the proper estate distribution documents. Verify your role as executor or administrator. Bring the will to the city or county office in charge of estate disbursements. Open a bank account in the name of the decedent's estate. Itemize the property of the estate. Pay the estate's bills.

All forms of intestate property are divided among the heirs upon the basis of the fair market value, which is represented by a cash value. The quantity of any particular form of property does not affect how it is distributed or divided.

Generally the heirs don't decide if the house is sold unless somehow it is titled in all their names. If is a specific gift and the will requires it be transferred to all six, and one does not want to sell, that person can buy out the other 5. There of course is always a partition Acton.