Agreement to Partition Real Property among Surviving Spouse and Children of Decedent

Description Property Surviving Children

How to fill out Property Spouse Buy?

Utilize the most comprehensive legal library of forms. US Legal Forms is the best platform for finding up-to-date Agreement to Partition Real Property among Surviving Spouse and Children of Decedent templates. Our platform offers a huge number of legal documents drafted by licensed legal professionals and categorized by state.

To download a sample from US Legal Forms, users simply need to sign up for a free account first. If you’re already registered on our service, log in and select the template you are looking for and buy it. Right after purchasing templates, users can find them in the My Forms section.

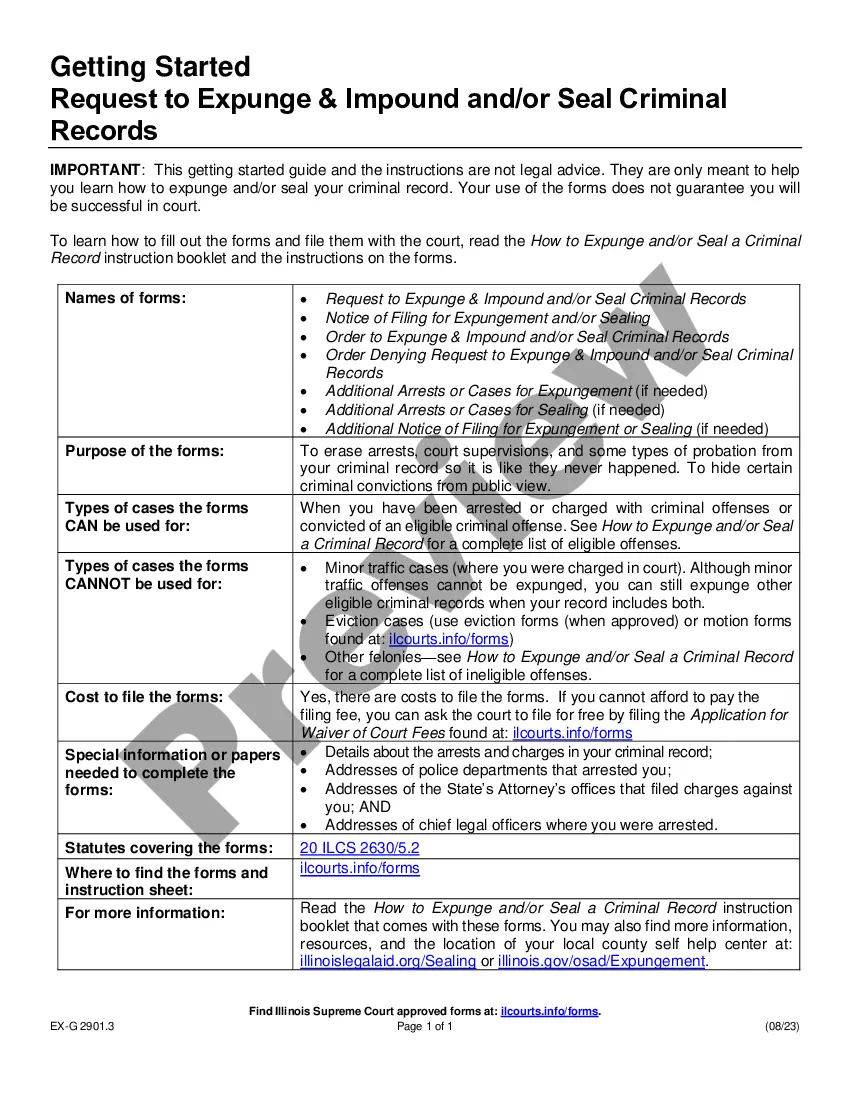

To get a US Legal Forms subscription online, follow the guidelines below:

- Find out if the Form name you’ve found is state-specific and suits your requirements.

- If the template has a Preview function, use it to review the sample.

- If the sample does not suit you, use the search bar to find a better one.

- Hit Buy Now if the template meets your requirements.

- Select a pricing plan.

- Create an account.

- Pay with the help of PayPal or with yourr credit/credit card.

- Select a document format and download the sample.

- As soon as it’s downloaded, print it and fill it out.

Save your effort and time using our service to find, download, and fill out the Form name. Join a huge number of pleased customers who’re already using US Legal Forms!

Property Spouse Statement Form popularity

Property Spouse Sample Other Form Names

Property Spouse Contract FAQ

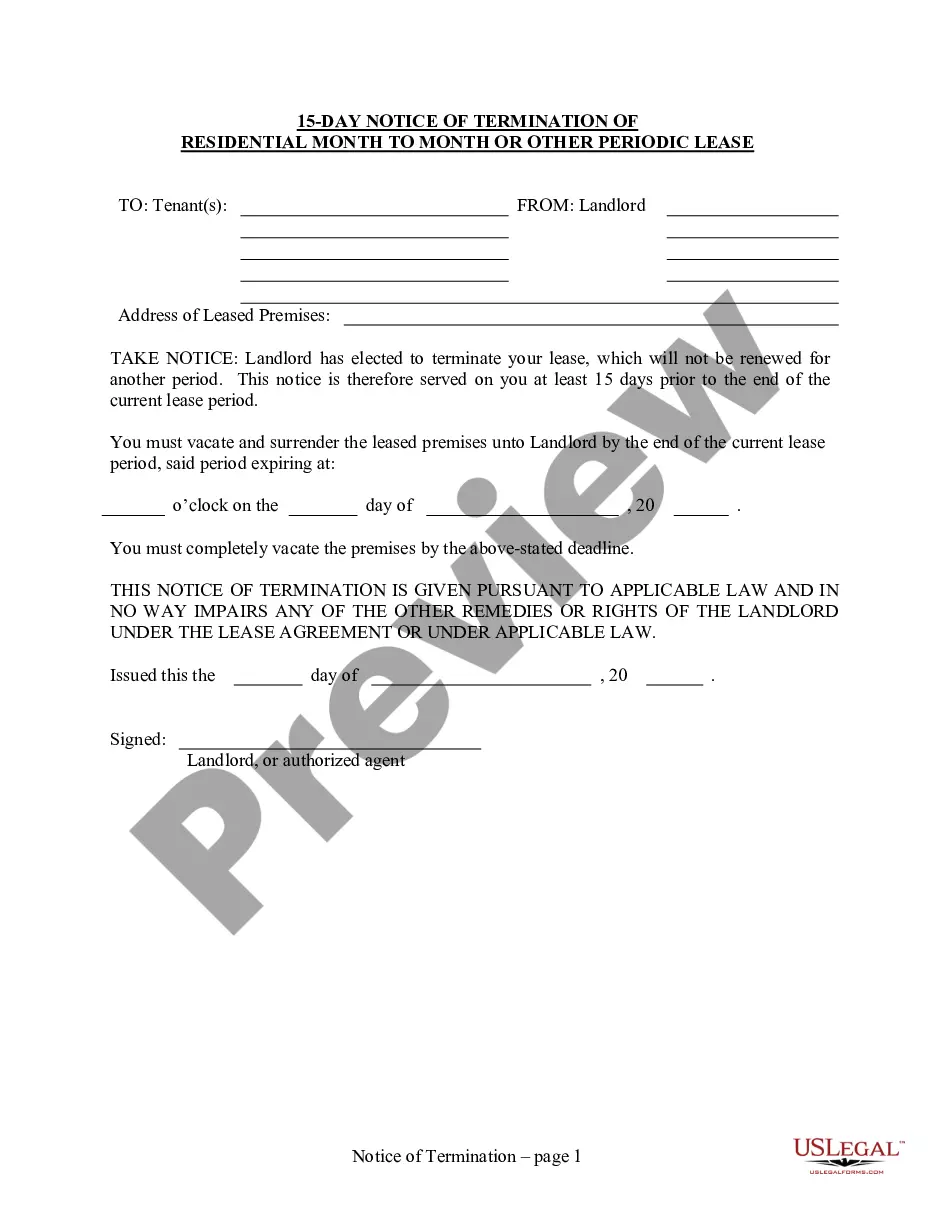

Property distribution upon death or separation: When one spouse passes away, his or her half of the community property passes to the surviving spouse. Their separate property can be devised to whomever they wish according to their will, or via probate without a will.

Divide up assets based on their value. Instruct your executor to divide assets equally. Instruct your executor to sell everything and then distribute the proceeds to your beneficiaries equally.

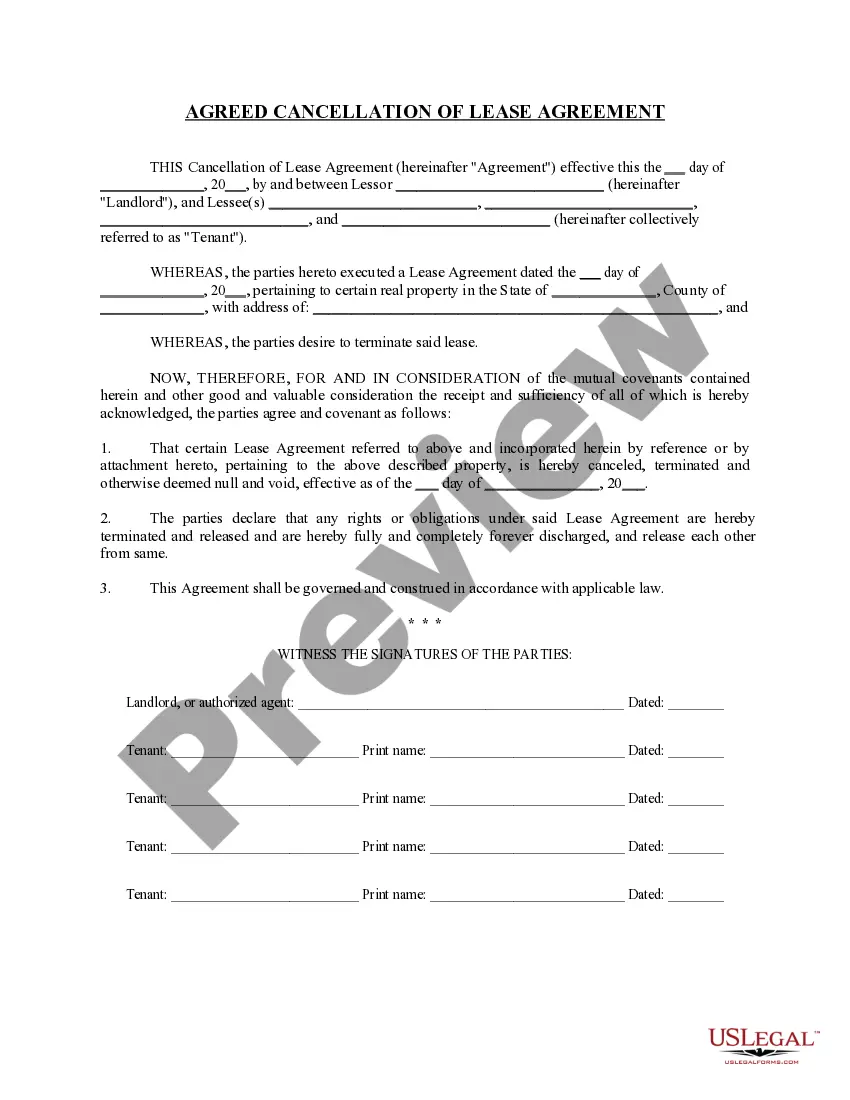

California is a community property state, which means that following the death of a spouse, the surviving spouse will have entitlement to one-half of the community property (i.e., property that was acquired over the course of the marriage, regardless of which spouse acquired it).

To transfer it, you will have to get a succession certificate (for moveable property) and a letter of administration (for Immoveable property). While doing so, get the son and daughter to give no objections in court that they have no objection if all the property is transferred to the widow.

How do you divide that three ways? In a best-case scenario, the siblings would agree unanimously on a fair and equitable settlement: Sell the home and split the proceeds, distribute other assets so one heir retains the property or negotiates buyouts for those wanting cash.

Get the proper estate distribution documents. Verify your role as executor or administrator. Bring the will to the city or county office in charge of estate disbursements. Open a bank account in the name of the decedent's estate. Itemize the property of the estate. Pay the estate's bills.

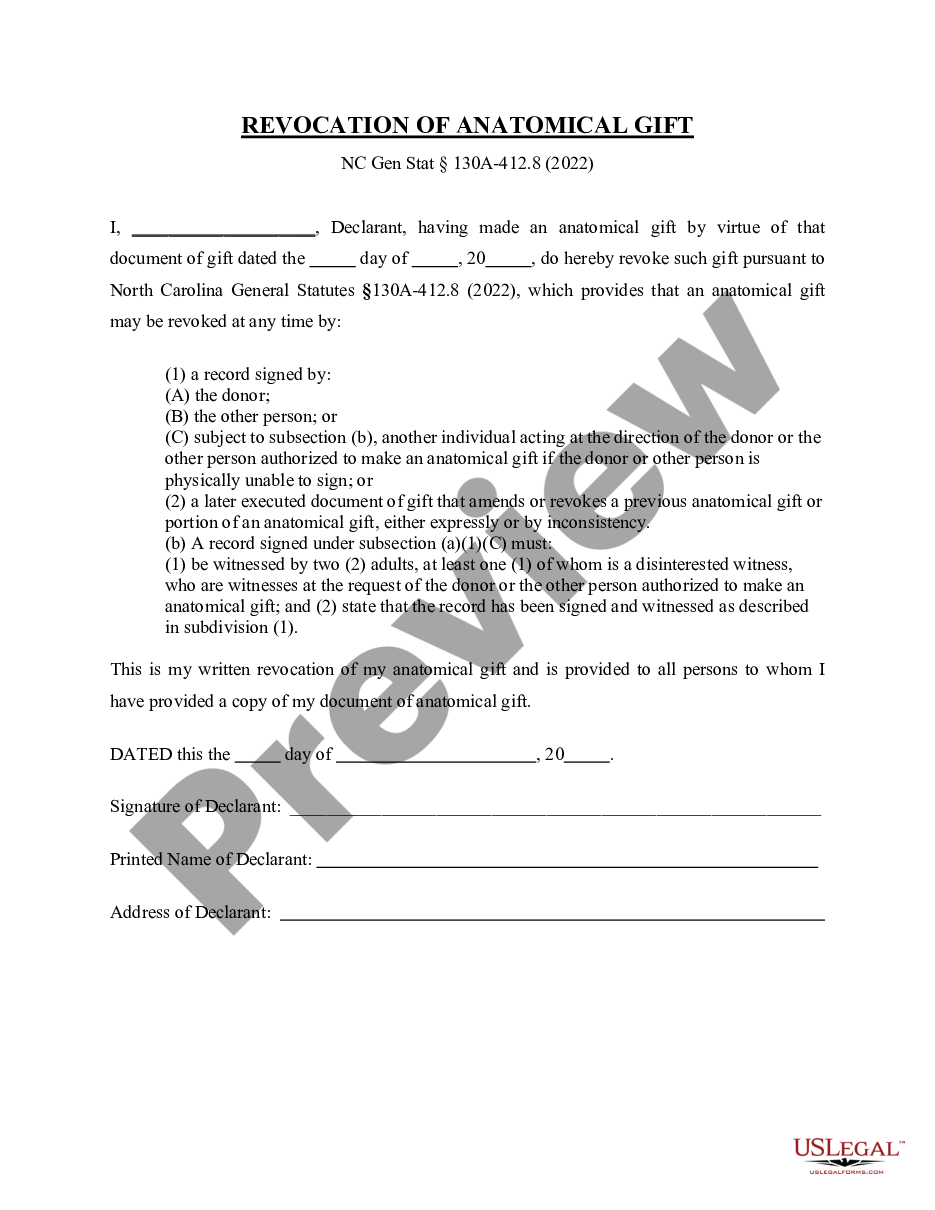

A partition deed for a property is executed to divide the property among different people - usually among the family members. A partition is a division of a property held jointly by several persons, so that each person gets a share and becomes the owner of the share allotted to him.

To transfer it, you will have to get a succession certificate (for moveable property) and a letter of administration (for Immoveable property). While doing so, get the son and daughter to give no objections in court that they have no objection if all the property is transferred to the widow.

Basis of Division The quantity of any particular form of property does not affect how it is distributed or divided. In most states, the fair market value of all the deceased's intestate property is added to together to form the intestate estate. It is this value that is divided among the heirs.