Jury Instruction - 1.9.4.2 Joint Employers

Description

How to fill out Jury Instruction - 1.9.4.2 Joint Employers?

Utilize the most comprehensive legal library of forms. US Legal Forms is the best platform for getting updated Jury Instruction - 1.9.4.2 Joint Employers templates. Our service offers thousands of legal forms drafted by licensed attorneys and sorted by state.

To download a sample from US Legal Forms, users only need to sign up for a free account first. If you’re already registered on our platform, log in and select the document you are looking for and purchase it. Right after buying forms, users can find them in the My Forms section.

To get a US Legal Forms subscription on-line, follow the steps listed below:

- Find out if the Form name you’ve found is state-specific and suits your needs.

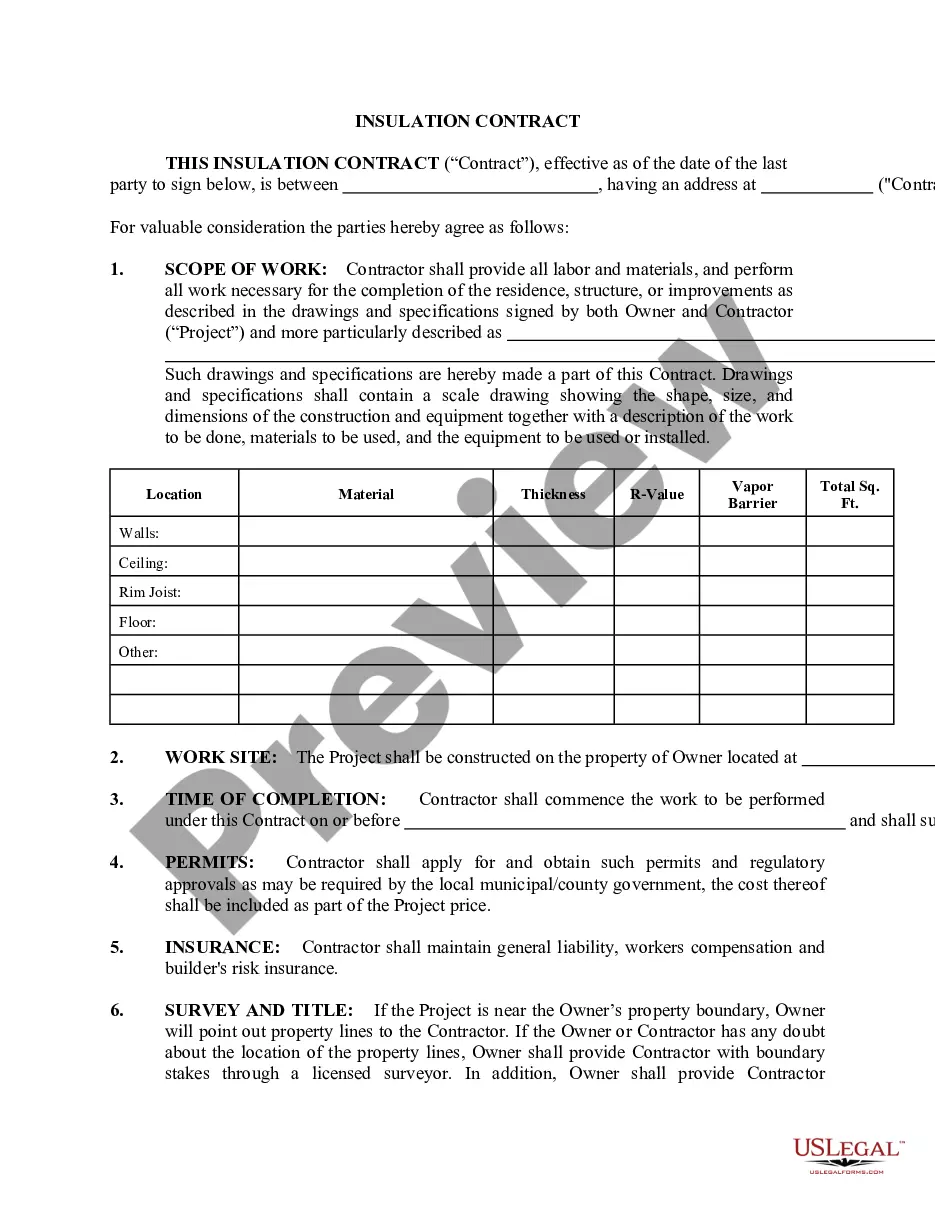

- When the template features a Preview function, utilize it to check the sample.

- In case the sample doesn’t suit you, utilize the search bar to find a better one.

- PressClick Buy Now if the sample meets your needs.

- Choose a pricing plan.

- Create an account.

- Pay with the help of PayPal or with yourr credit/credit card.

- Choose a document format and download the template.

- As soon as it is downloaded, print it and fill it out.

Save your time and effort with our platform to find, download, and fill in the Form name. Join thousands of pleased subscribers who’re already using US Legal Forms!

Form popularity

FAQ

They perform work for the same business that hired them. However, some employees are shared by two or more businesses that act as joint employers. When two or more businesses share workers, disagreements can occur over which company is responsible for complying with federal or state employment laws.

A person can't work as a whole time employee in 2 company but he can work in 1 company as full time & in other company as part time. what u need to do Is that u need to have appointment letter of both company showing as par time time & full time employee.

The central question in the joint employer analysis is whether the corporation is also their employer. If it is their employer, it is jointly and severally liable for the temp workers' minimum wage, child labor, and overtime violations.

Co-employment is a contractual relationship, in which a business and a professional employer organization (PEO) share certain employment responsibilities.Outsourcing with a co-employer also allows owners and executive leaders to focus more of their efforts on growing their business and less on HR.

Employers Who Are Covered The FLSA applies only to employers whose annual sales total $500,000 or more or who are engaged in interstate commerce. You might think that this would restrict the FLSA to covering only employees in large companies, but, in reality, the law covers nearly all workplaces.

Fortunately, California has a broad joint employer doctrine that allows workers to sue entities other than their immediate employers-including both businesses and individuals-for such wages.

Integrated Employers. A corporation is a single employer under the FMLA rather than its separate establishments or divisions; all employees of the corporation, at all locations, are counted for coverage purposes.