Jury Instruction - Failure To File Tax Return

Description

How to fill out Jury Instruction - Failure To File Tax Return?

Utilize the most comprehensive legal library of forms. US Legal Forms is the perfect place for finding updated Jury Instruction - Failure To File Tax Return templates. Our platform provides a huge number of legal forms drafted by licensed legal professionals and sorted by state.

To download a template from US Legal Forms, users only need to sign up for a free account first. If you are already registered on our service, log in and select the template you need and purchase it. After buying templates, users can see them in the My Forms section.

To obtain a US Legal Forms subscription on-line, follow the guidelines below:

- Check if the Form name you have found is state-specific and suits your needs.

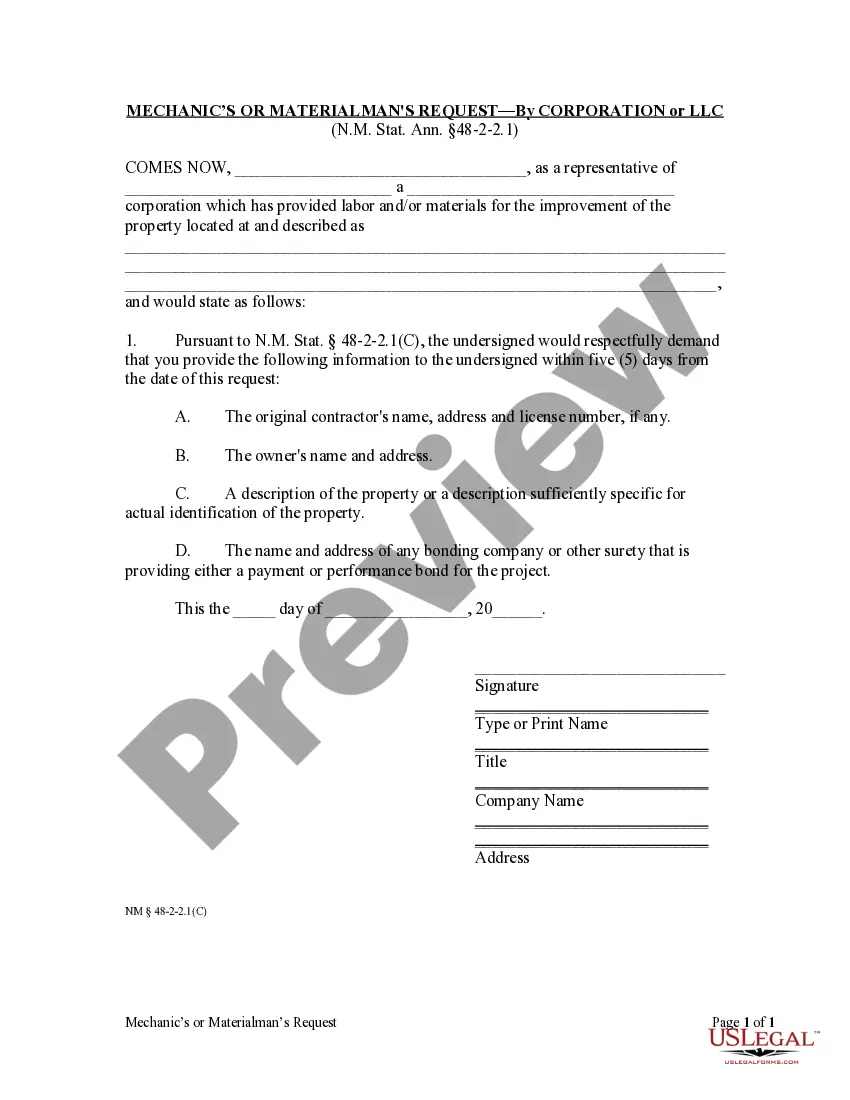

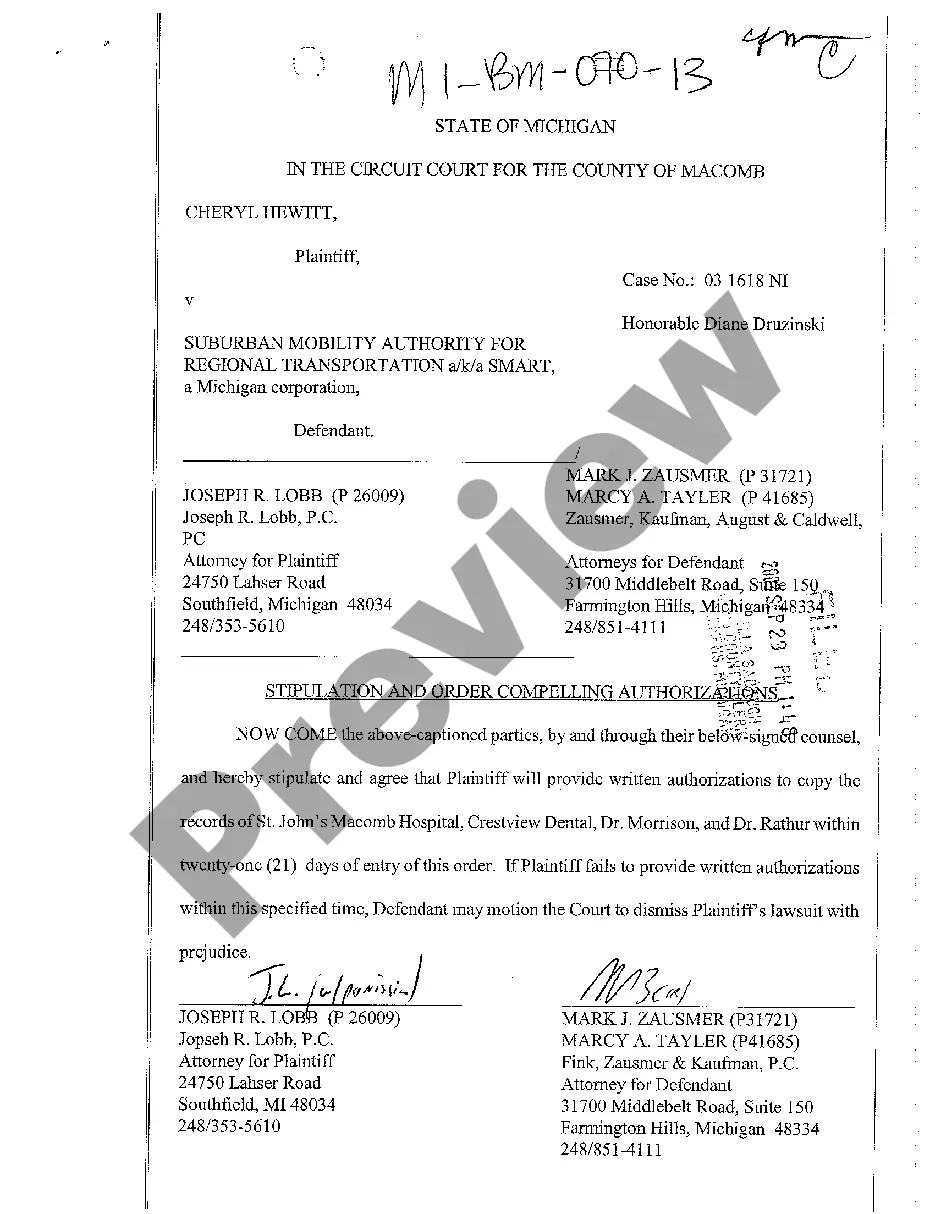

- If the form has a Preview function, utilize it to check the sample.

- If the sample doesn’t suit you, use the search bar to find a better one.

- Hit Buy Now if the template corresponds to your requirements.

- Choose a pricing plan.

- Create an account.

- Pay via PayPal or with the debit/credit card.

- Select a document format and download the sample.

- When it’s downloaded, print it and fill it out.

Save your effort and time with the platform to find, download, and fill out the Form name. Join a huge number of satisfied customers who’re already using US Legal Forms!

Form popularity

FAQ

Will The IRS Catch It If I Have Made A Mistake? The IRS will most likely catch a mistake made on a tax return. The IRS has substantial computer technology and programs that cross-references tax returns against data received from other sources, such as employers.

Penalty for Tax Evasion in CaliforniaTax evasion in California is punishable by up to one year in county jail or state prison, as well as fines of up to $20,000. The state can also require you to pay your back taxes, and it will place a lien on your property as a security until you pay.

Line 12a reports the total amount of the distribution and line 12b reports the taxable portion, if any. Next to line 12b, write "rollover." If you're rolling the money from one tax-deferred account to another, such as from a 401(k) to another 401(k) or traditional IRA, the entire rollover is tax-free.

Tax evasion is an illegal activity in which a person or entity deliberately avoids paying a true tax liability. Those caught evading taxes are generally subject to criminal charges and substantial penalties. To willfully fail to pay taxes is a federal offense under the Internal Revenue Service (IRS) tax code.

Usually, tax evasion cases on legal-source income start with an audit of the filed tax return. In the audit, the IRS finds errors that the taxpayer knowingly and willingly committed.The IRS calls these behaviors badges of fraud. They're hot buttons that indicate tax evasion.

It is believed that the IRS can track such information as medical records, credit card transactions, and other electronic information and that it is using this added data to find tax cheats.

Failing to file a tax return can be classified as a federal crime punishable as a misdemeanor or a felony. Willful failure to file a tax return is a misdemeanor pursuant to IRC 7203.If you are charged with a criminal tax violation, the punishment can be severe and may include fines and jail time.

The basic rule for the IRS' ability to look back into the past and conduct a tax audit is that the agency has three years from your filing date to audit your tax filing for that year. However, taxpayers who fail to include all sources of their income may face a longer time period.

Unreported income: If you fail to report income the IRS will catch this through their matching process. It is required that third parties report taxpayer income to the IRS, such as employers, banks and brokerage firms.