Letter to Recording Office for Recording Assignment of Mortgage

Description Letter Real Estate Trust

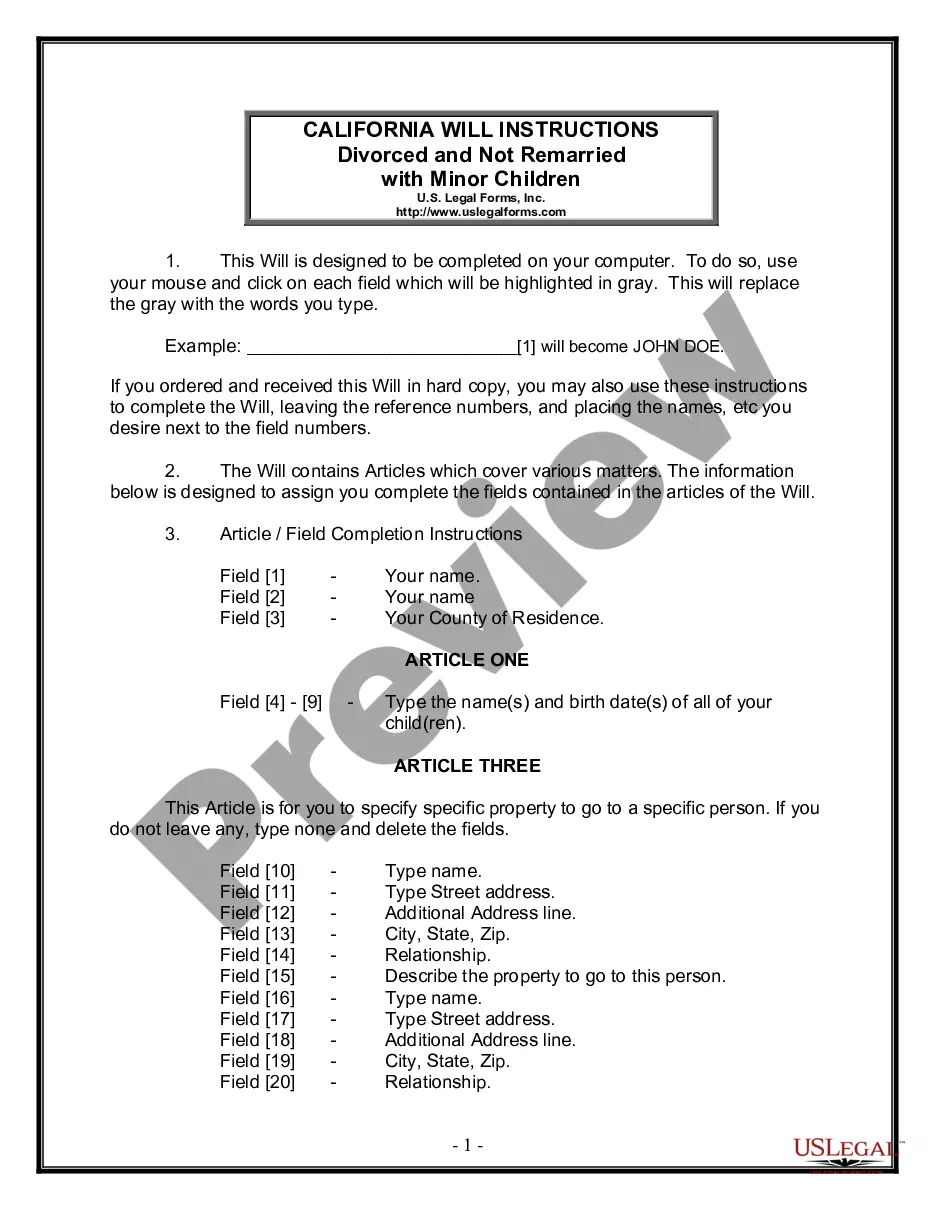

How to fill out Recording Assignment?

Utilize the most extensive legal library of forms. US Legal Forms is the best place for getting updated Letter to Recording Office for Recording Assignment of Mortgage templates. Our service provides 1000s of legal documents drafted by certified legal professionals and sorted by state.

To obtain a sample from US Legal Forms, users just need to sign up for an account first. If you are already registered on our service, log in and select the template you are looking for and buy it. After buying templates, users can see them in the My Forms section.

To obtain a US Legal Forms subscription on-line, follow the guidelines listed below:

- Check if the Form name you have found is state-specific and suits your needs.

- If the form features a Preview option, use it to check the sample.

- In case the sample does not suit you, use the search bar to find a better one.

- Hit Buy Now if the template corresponds to your requirements.

- Choose a pricing plan.

- Create an account.

- Pay via PayPal or with yourr debit/visa or mastercard.

- Choose a document format and download the template.

- After it is downloaded, print it and fill it out.

Save your effort and time with the platform to find, download, and fill in the Form name. Join a huge number of delighted customers who’re already using US Legal Forms!

Recording Real Estate Form popularity

Assignment Real Estate Agreement Other Form Names

Recording Mortgage Deeds FAQ

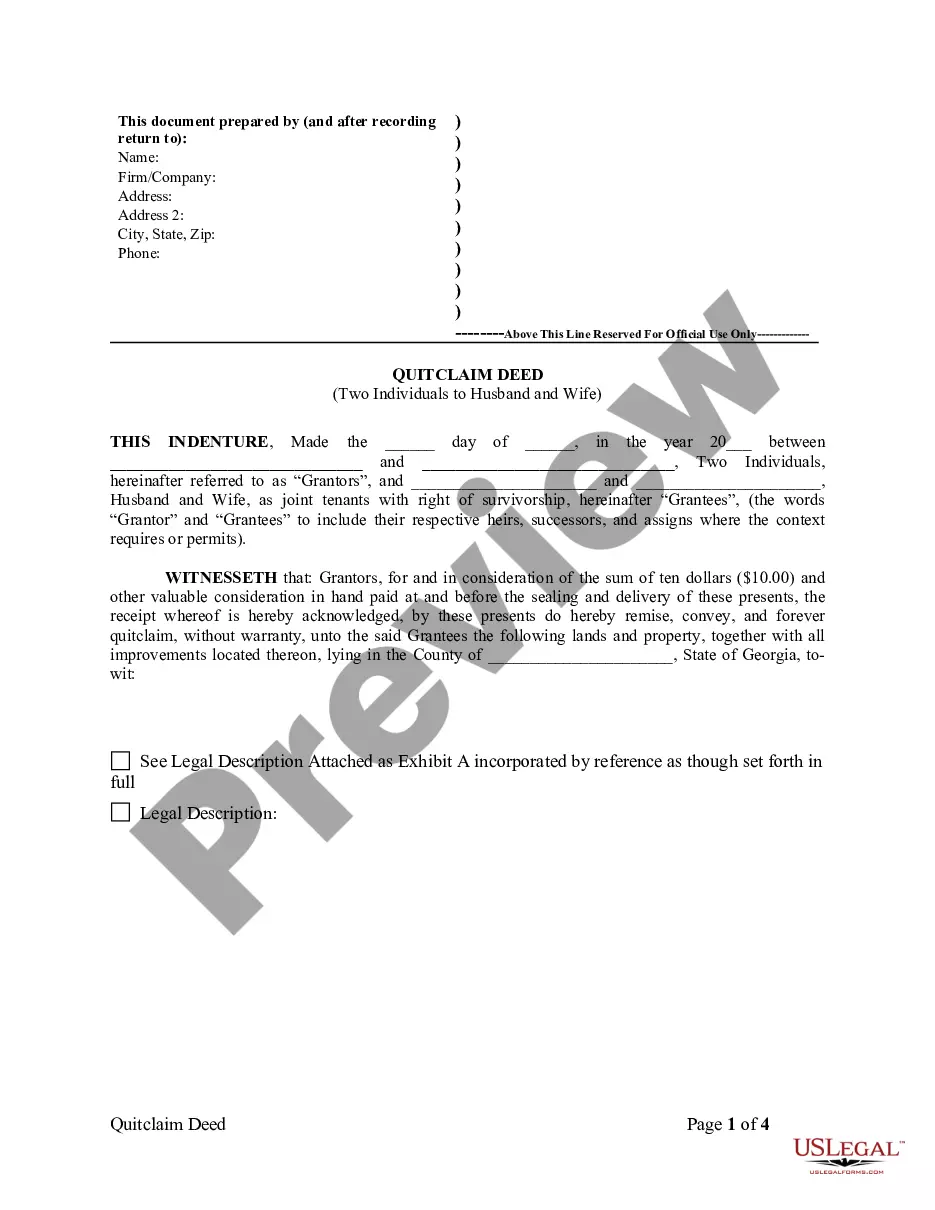

Although recording statutes vary between U.S. states, they virtually all require that an interest in real property be formally recorded in the appropriate county office in order to be valid.If your deed has not been recorded, you are not recognized as the legal owner of your property.

It requires County Recorders throughout California to charge an additional $75 fee at the time of recording every real estate instrument, paper, or notice, except those expressly exempted from payment of recording fees, per each transaction per parcel of real property, not to exceed $225 per single transaction.

To have a document recorded, it must comply with state and local requirements and be accompanied by a fee. A recorder's office will index it and assign a unique ID code. The original document is returned to the document submitter and archived in the recorder's office and assessable to the public.

Any document affecting title to real property that is authorized or required by law to be recorded. This includes, but is not limited to, Grant Deeds, Deeds of Trust, Mechanic's Liens, Tax Liens, and Reconveyances. The recording requirements for documents are established by the codes for the State of California.

A properly recorded deed provides constructive notice of its contents, which means that all parties concerned are considered to have notice of the deed whether or not they actually saw it.

Mortgages are interests in property, and so can and should be recorded as soon as possible after the closing. Most states have recording statutes that impose restrictions on when and how a document conveying property rights can be legally created.

Real Estate Recording Systems In any case, it is the responsibility of the local county or state to make sure that these official documents are kept on file.In the case of mortgage liens, courts use the date of a recording to determine the priority for which liens should receive payment first.

Key Takeaways. Recording is the act of putting a document into official county records, especially for real estate and property transactions, that provides a traceable chain of title. Recorded documents do not establish who owns a property.

As a general rule, all recorded documents should be notarized.