Balance Sheet Notes Payable

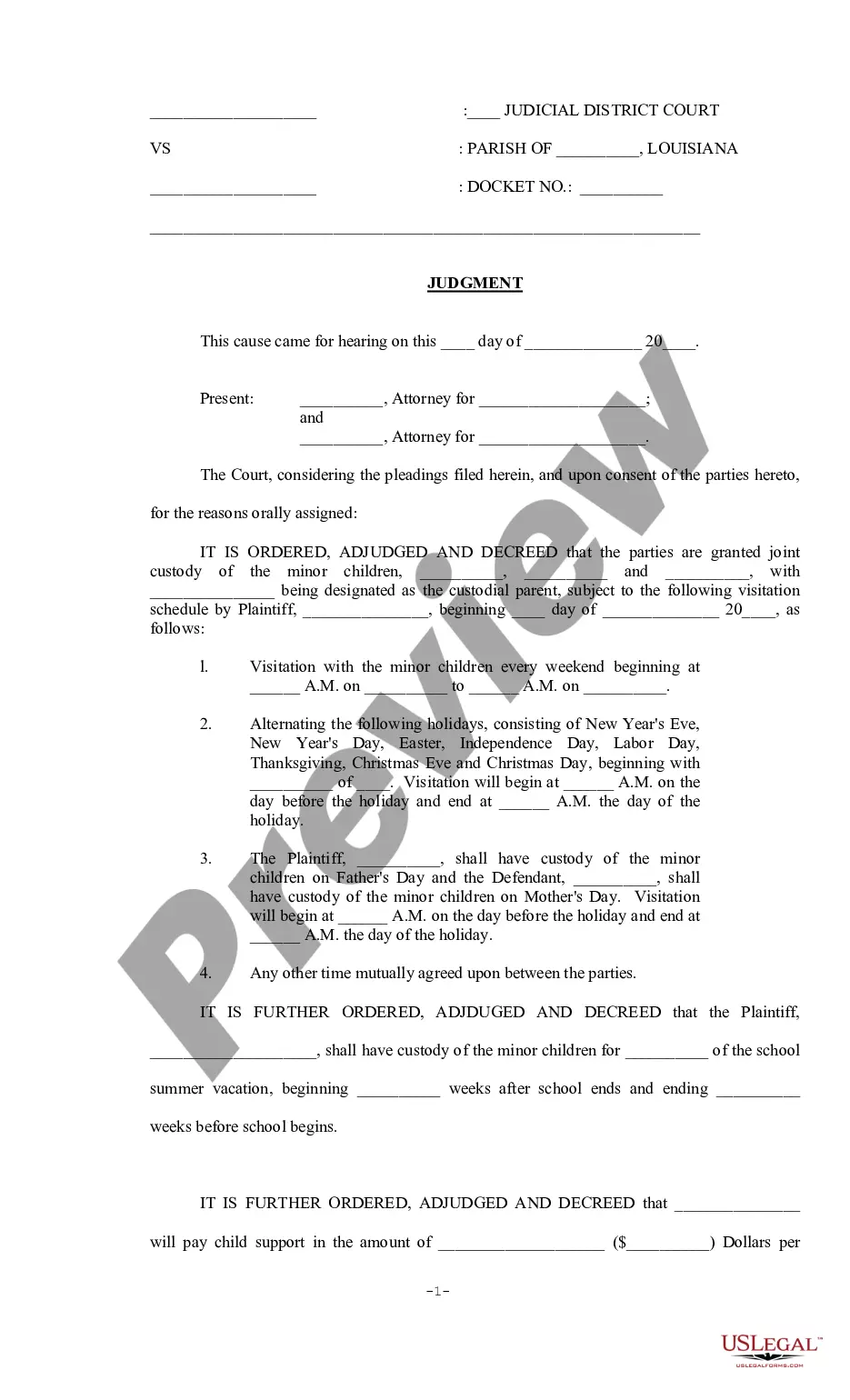

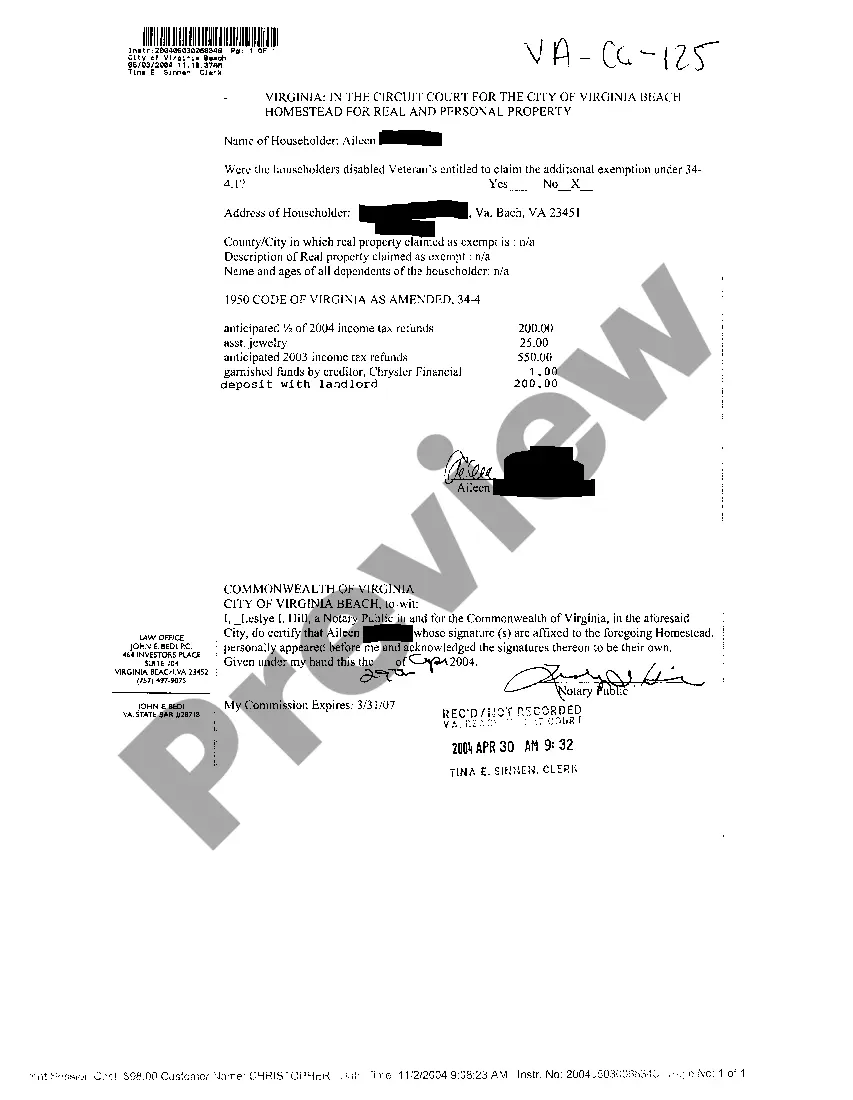

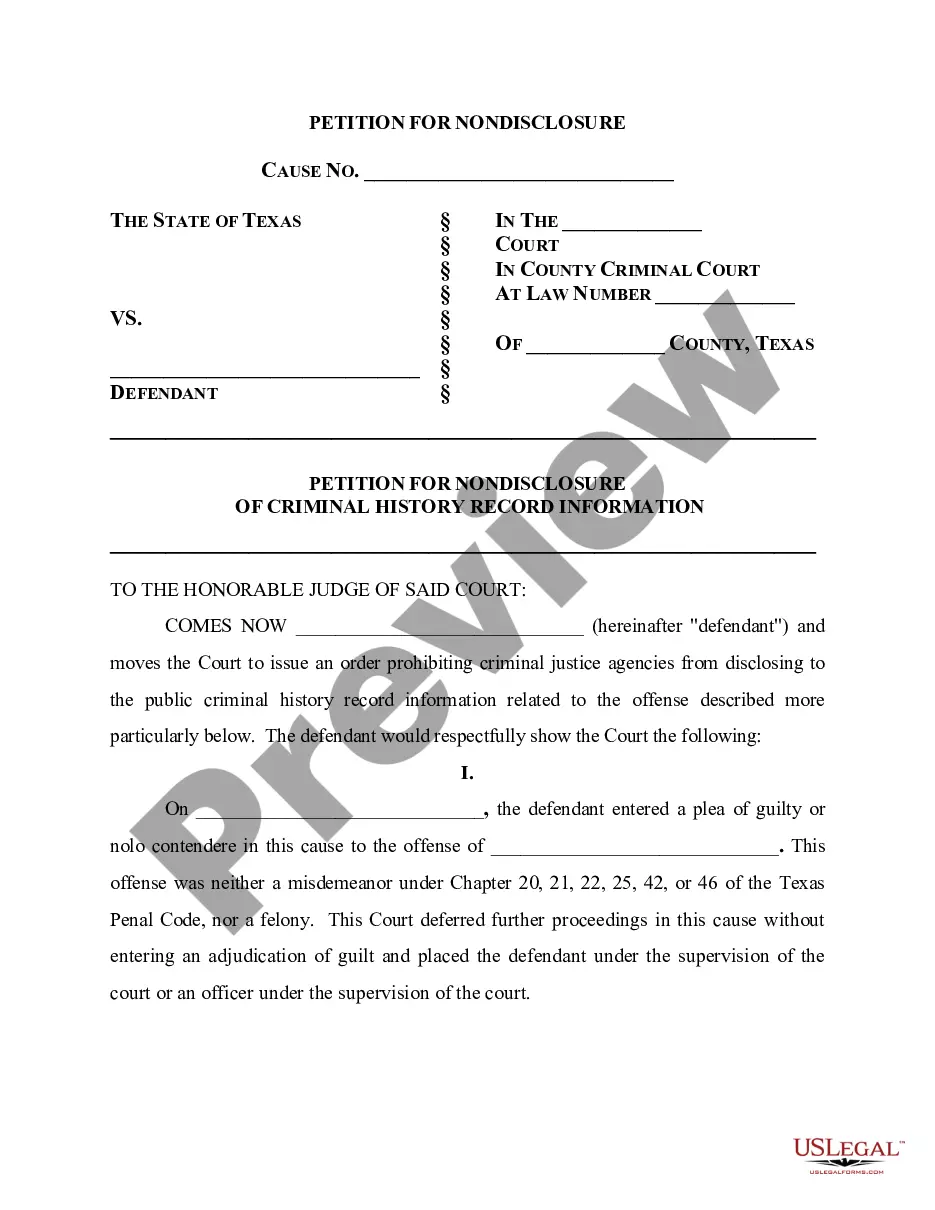

Description Form Note Payable

How to fill out Notes Payable On A Balance Sheet?

Employ the most comprehensive legal catalogue of forms. US Legal Forms is the perfect platform for finding up-to-date Balance Sheet Notes Payable templates. Our platform offers thousands of legal forms drafted by licensed lawyers and sorted by state.

To obtain a sample from US Legal Forms, users just need to sign up for a free account first. If you’re already registered on our service, log in and select the template you are looking for and buy it. After purchasing forms, users can see them in the My Forms section.

To obtain a US Legal Forms subscription on-line, follow the steps below:

- Find out if the Form name you’ve found is state-specific and suits your needs.

- When the template has a Preview option, use it to review the sample.

- In case the template does not suit you, make use of the search bar to find a better one.

- PressClick Buy Now if the template meets your needs.

- Select a pricing plan.

- Create a free account.

- Pay with the help of PayPal or with the credit/credit card.

- Choose a document format and download the sample.

- Once it is downloaded, print it and fill it out.

Save your time and effort with our platform to find, download, and fill out the Form name. Join a huge number of delighted clients who’re already using US Legal Forms!

Balance Sheet Form Printable Form popularity

Balance Sheet Form Template Other Form Names

Where Is Notes Payable On Balance Sheet FAQ

Recording the purchase of office equipment through notes payable requires that the notes payable is placed as a credit and the office equipment as a debit. This is because assets increase with debits and debits equal credits. Related interest expense is recorded as a debit and interest payable as a credit.

Notes Payable on a Balance SheetNotes payable appear as liabilities on a balance sheet.When a note's maturity is more than one year in the future, it is classified with long-term liabilities. An example of different accounts on a balance sheet: Notice how notes payable can be short-term or long-term in nature.

When repaying a loan, the company records notes payable as a debit entry, and credits the cash account, which is recorded as a liability on the balance sheet.

Accounts payable is listed on a company's balance sheet. Accounts payable is a liability since it's money owed to creditors and is listed under current liabilities on the balance sheet. Current liabilities are short-term liabilities of a company, typically less than 90 days.

Notes payable appear as liabilities on a balance sheet.When a note's maturity is more than one year in the future, it is classified with long-term liabilities. An example of different accounts on a balance sheet: Notice how notes payable can be short-term or long-term in nature.

The notes payable is in the liabilities section of the balance sheet. If you will pay off the principal in less than a year, it is in current liabilities. If it takes more than a year, it is a long-term liability.

Recording the purchase of office equipment through notes payable requires that the notes payable is placed as a credit and the office equipment as a debit. This is because assets increase with debits and debits equal credits. Related interest expense is recorded as a debit and interest payable as a credit.

Current liabilities are typically settled using current assets, which are assets that are used up within one year. Examples of current liabilities include accounts payable, short-term debt, dividends, and notes payable as well as income taxes owed.

Notes payable is a liability account where a borrower records a written promise to repay the lender. When carrying out and accounting for notes payable, "the maker" of the note creates liability by borrowing from another entity, promising to repay the payee with interest.