Hospital Audit Program

Description

How to fill out Hospital Audit Program?

Among lots of free and paid examples that you’re able to get on the web, you can't be certain about their accuracy and reliability. For example, who created them or if they are skilled enough to take care of what you require them to. Always keep calm and use US Legal Forms! Find Hospital Audit Program templates created by professional attorneys and prevent the costly and time-consuming procedure of looking for an attorney and after that paying them to write a papers for you that you can find on your own.

If you already have a subscription, log in to your account and find the Download button near the form you’re seeking. You'll also be able to access all of your earlier downloaded examples in the My Forms menu.

If you’re making use of our website for the first time, follow the tips listed below to get your Hospital Audit Program quickly:

- Make sure that the document you discover is valid in the state where you live.

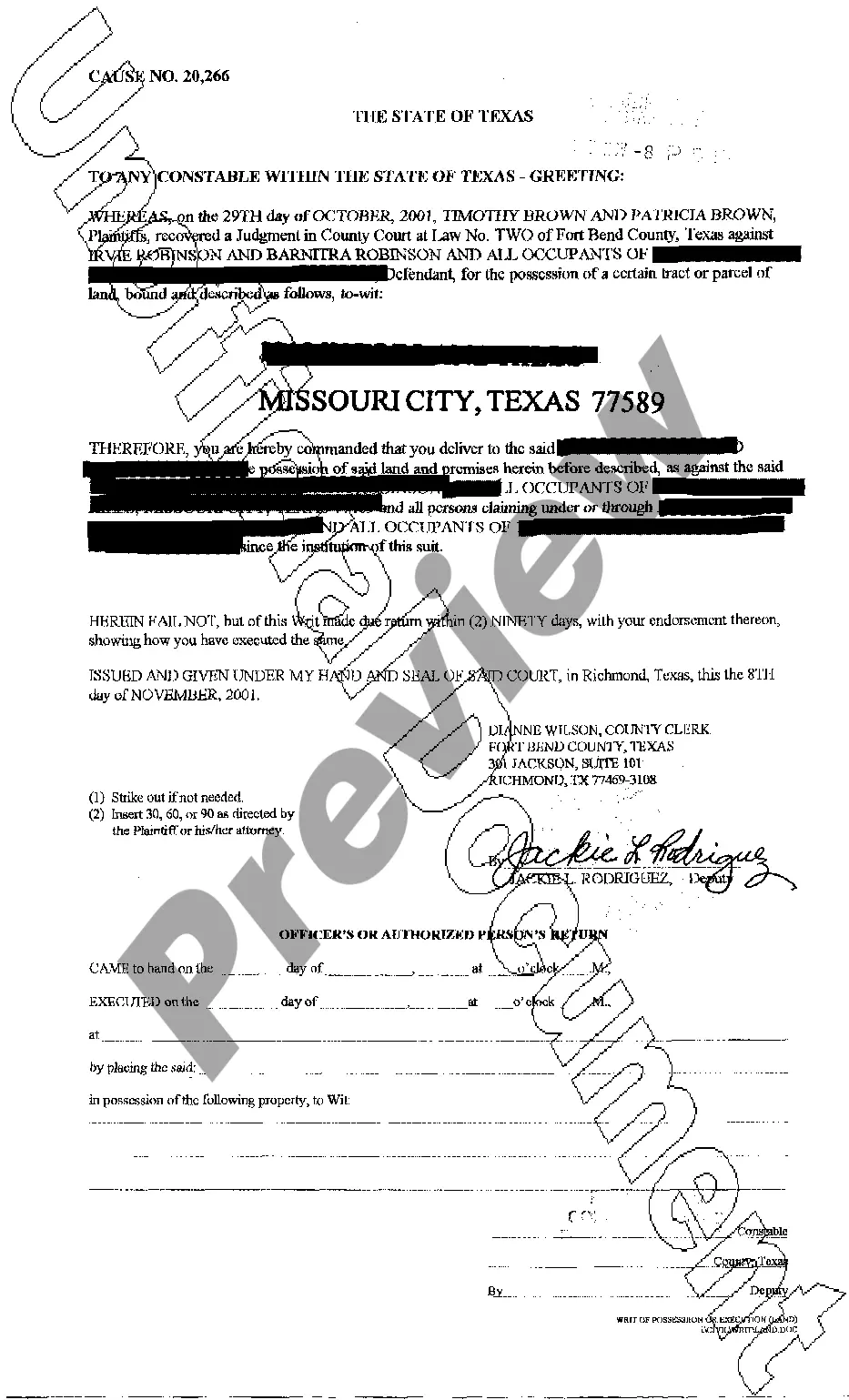

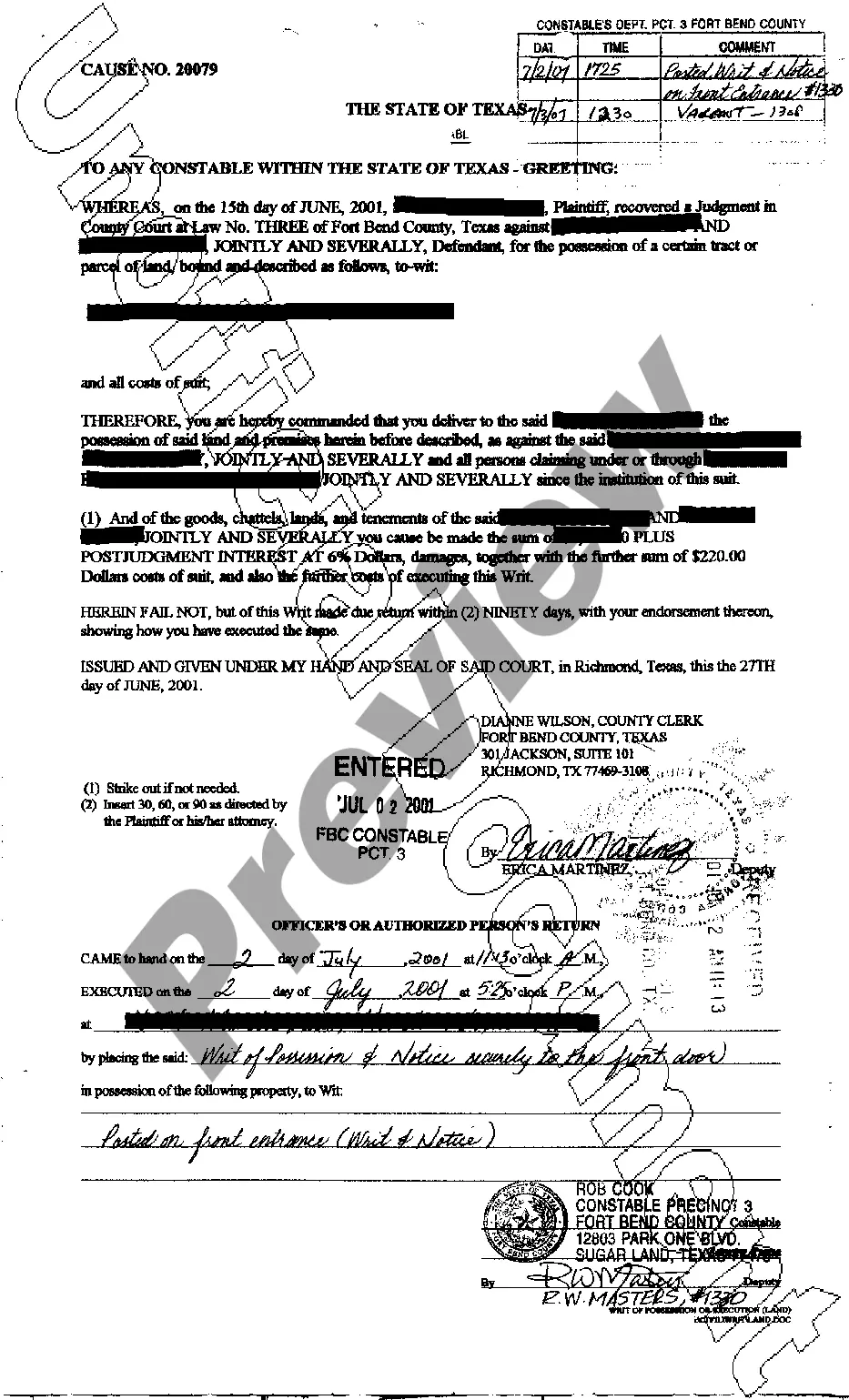

- Review the file by reading the description for using the Preview function.

- Click Buy Now to begin the purchasing procedure or find another sample utilizing the Search field located in the header.

- Select a pricing plan and create an account.

- Pay for the subscription using your credit/debit/debit/credit card or Paypal.

- Download the form in the needed file format.

As soon as you have signed up and bought your subscription, you can use your Hospital Audit Program as often as you need or for as long as it continues to be active in your state. Change it in your favorite online or offline editor, fill it out, sign it, and create a hard copy of it. Do much more for less with US Legal Forms!

Form popularity

FAQ

Pre-Planning. Planning. Fieldwork. Reporting. Corrective Action.

The simple meaning of qualified audit report is that the accounting information that presents in the financial statements is not correct.In the qualified audit report, there is a qualified audit opinion that expresses by auditors and stating the reason why the qualified opinion is expressed.

There are four types of audit reports: and unqualified opinion, a qualified opinion, and adverse opinion, and a disclaimer of opinion.

Internal audit is a process that evaluates an organization's operations, governing policies, risk management and quality control practices. The finery of an internal audit is the fact that it is done by an independent and unbiased organization outside of the management team of the organization being audited.

There are four types of audit reports issued by auditors on financial statements.Those audit reports included the Unqualified Audit Report (Clean Audit Report), Qualified Audit Report, Disclaimer Audit Report, and Adverse Audit Report. The following are the detail of audit reports.

There are three main types of audits: external audits, internal audits, and Internal Revenue Service (IRS) audits. External audits are commonly performed by Certified Public Accounting (CPA) firms and result in an auditor's opinion which is included in the audit report.

An Auditor should check the bill book, bill register and copy of bills. It should be verified that bills are prepared properly according to visit charges of doctors, medicine, stay charges, room rent, etc. Bills should be verified with the fees/charges structure.

Unqualified opinion-clean report. Qualified opinion-qualified report. Disclaimer of opinion-disclaimer report. Adverse opinion-adverse audit report.