Equipment Lease Agreement with an Independent Sales Organization with Option to Purchase

Description Lease Agreement Option

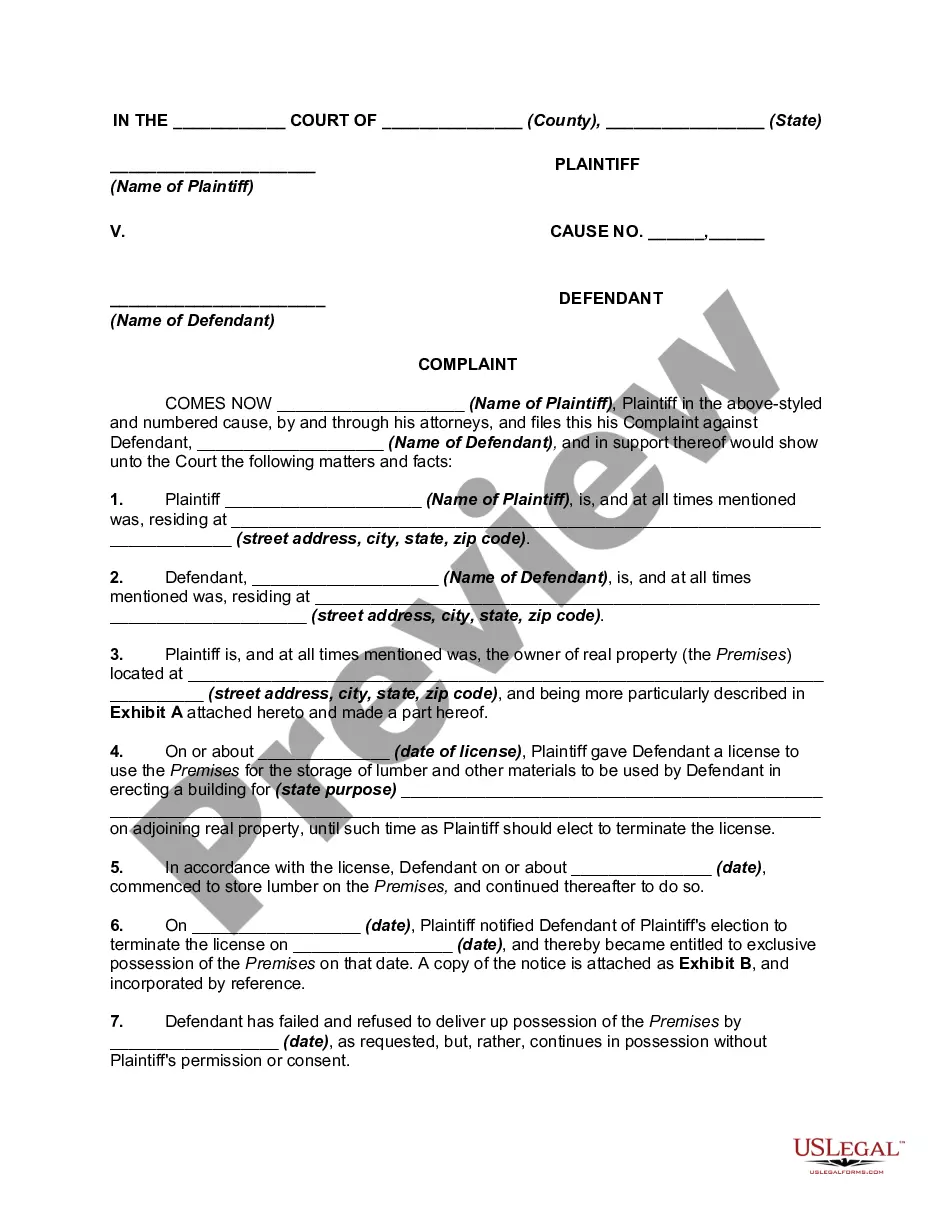

How to fill out Equipment Lease Agreement With Option Purchase Template?

Use the most comprehensive legal catalogue of forms. US Legal Forms is the best place for finding up-to-date Equipment Lease Agreement with an Independent Sales Organization with Option to Purchase templates. Our service provides a huge number of legal forms drafted by licensed legal professionals and sorted by state.

To get a sample from US Legal Forms, users just need to sign up for a free account first. If you’re already registered on our platform, log in and choose the document you need and buy it. After buying forms, users can find them in the My Forms section.

To get a US Legal Forms subscription online, follow the steps below:

- Find out if the Form name you have found is state-specific and suits your needs.

- If the template features a Preview function, use it to check the sample.

- In case the template does not suit you, make use of the search bar to find a better one.

- PressClick Buy Now if the sample meets your expections.

- Choose a pricing plan.

- Create a free account.

- Pay with the help of PayPal or with yourr debit/credit card.

- Select a document format and download the sample.

- As soon as it is downloaded, print it and fill it out.

Save your time and effort with our platform to find, download, and fill out the Form name. Join a huge number of happy customers who’re already using US Legal Forms!

Equipment Lease Sample Form popularity

Equipment Lease Purchase Other Form Names

Equipment Lease Document FAQ

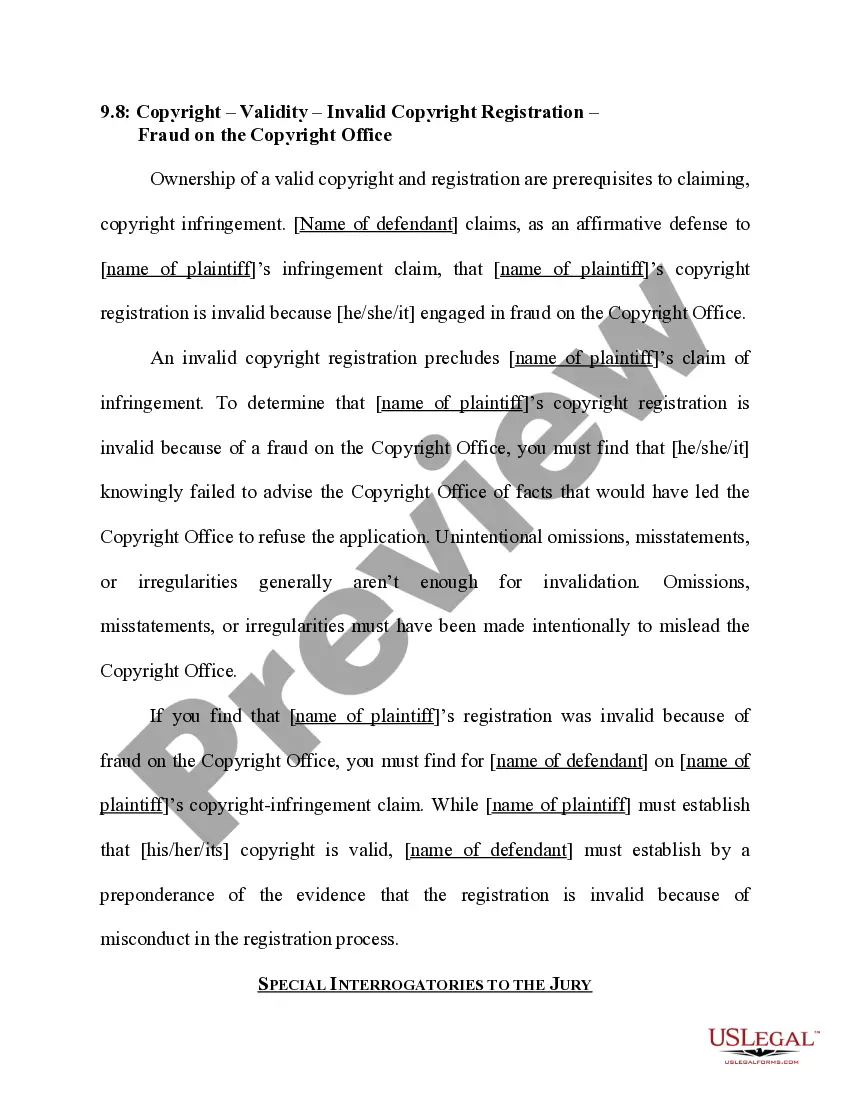

A lessee must capitalize a leased asset if the lease contract entered into satisfies at least one of the four criteria published by the Financial Accounting Standards Board (FASB). An asset should be capitalized if:The lease runs for 75% or more of the asset's useful life.

The equipment account is debited by the present value of the minimum lease payments and the lease liability account is the difference between the value of the equipment and cash paid at the beginning of the year. Depreciation expense must be recorded for the equipment that is leased.

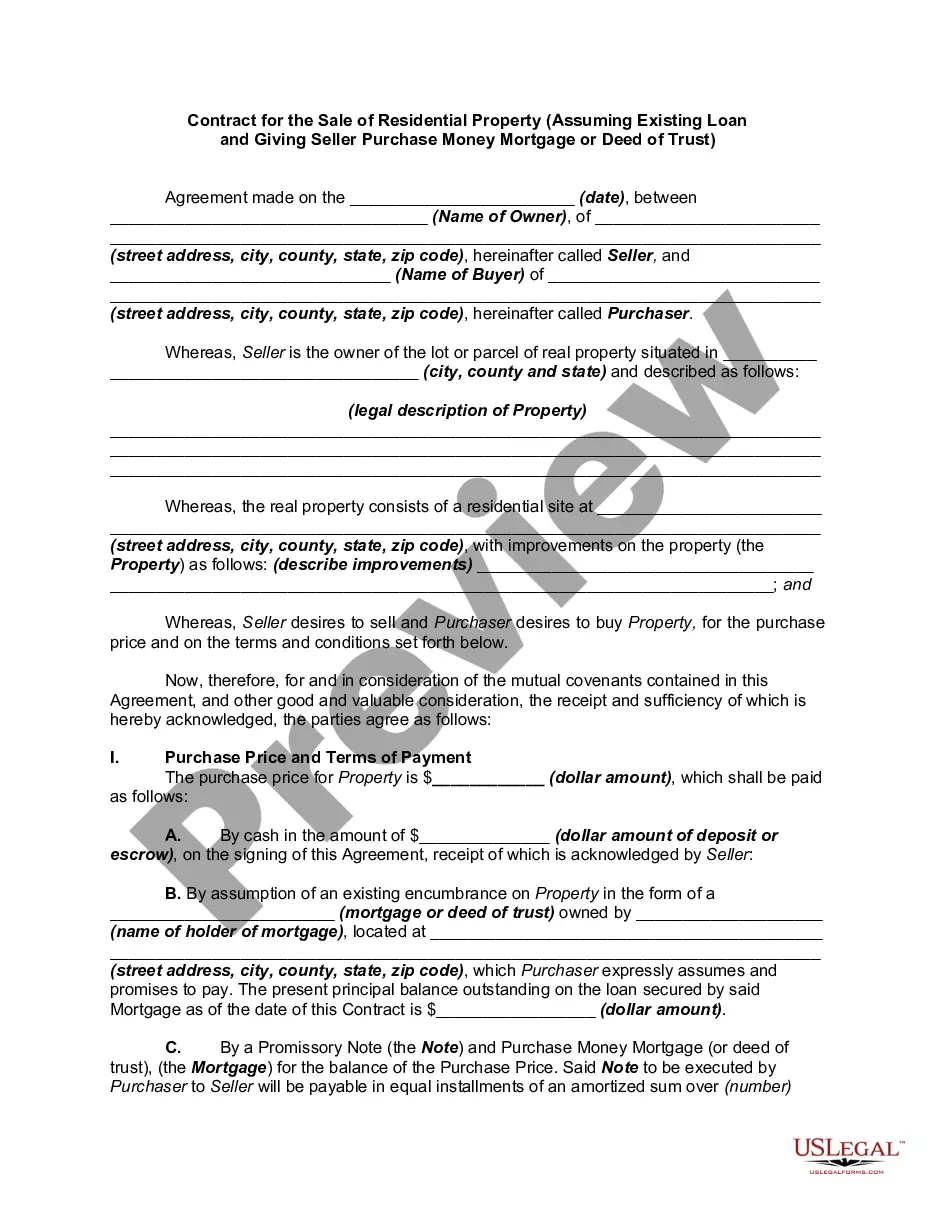

Lease-option contracts give you the right to buy the home when the lease expires, while lease-purchase contracts require you to buy it. You pay rent throughout the lease, and in some cases, a percentage of the payment is applied to the purchase price.

The equipment account is debited by the present value of the minimum lease payments and the lease liability account is the difference between the value of the equipment and cash paid at the beginning of the year. Depreciation expense must be recorded for the equipment that is leased.

Officially record the lease agreement and purchase option. The easiest way to do this is have the paperwork notarized and then recorded in your local public real estate records. Escrow the deed. Record a mortgage.

A lease purchase agreement in real estate is a rent-to-own contract between a tenant and a landlord for the former to purchase the property at a later point in time. The renter pays the seller an option fee at an agreed-upon purchase price, giving them exclusive rights to buy the property.

Assets being leased are not recorded on the company's balance sheet; they are expensed on the income statement. So, they affect both operating and net income.

Yes. An LLC is a legal entity. A legal entity can lease property from others, including from its owners, which of course would include a member of the LLC. Rental payments from the LLC can be paid but you should also review with both your...

Unlike an outright purchase or equipment secured through a standard loan, equipment under an operating lease cannot be listed as capital. It's accounted for as a rental expense. This provides two specific financial advantages: Equipment is not recorded as an asset or liability.