Receipt for Balance of Account

Description

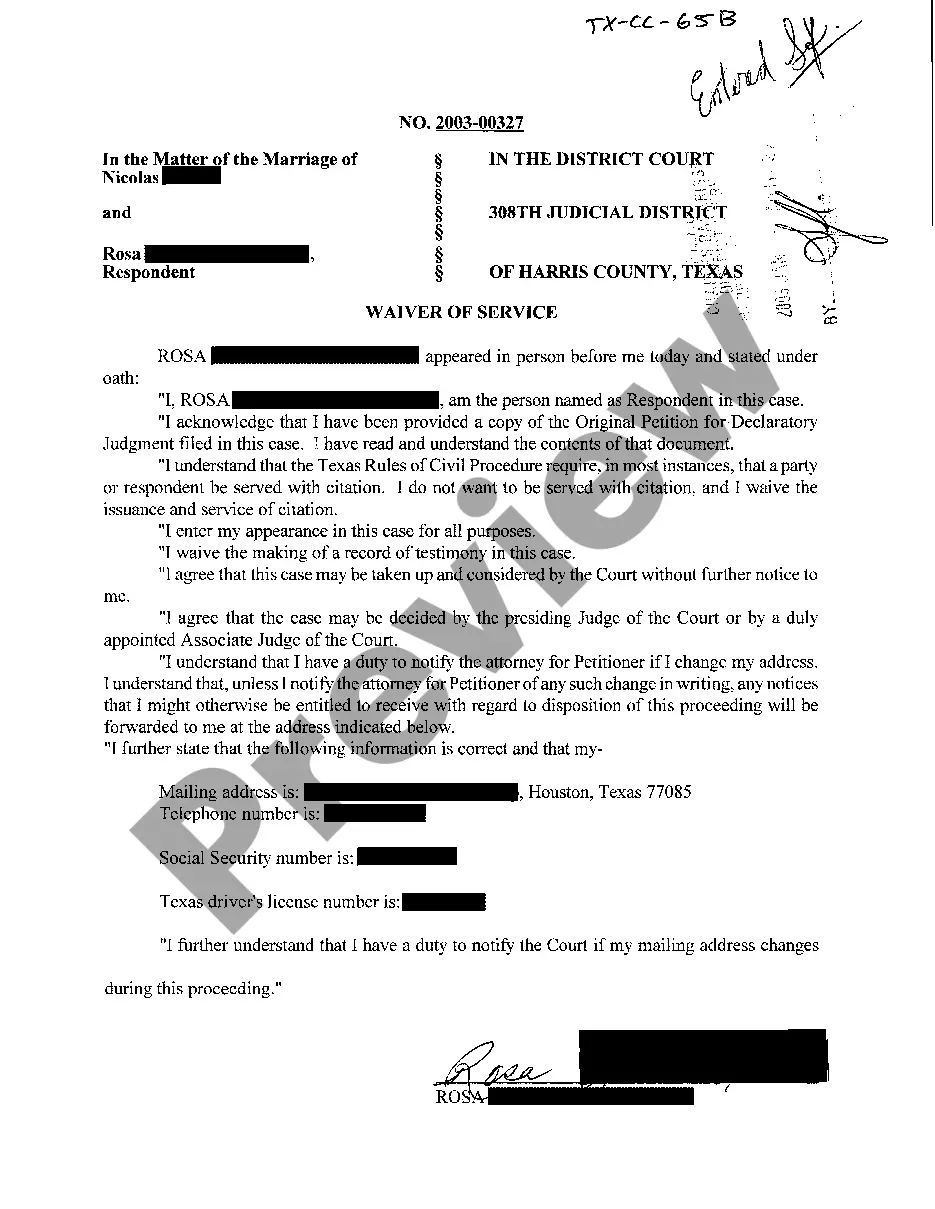

How to fill out Receipt For Balance Of Account?

Utilize the most extensive legal library of forms. US Legal Forms is the perfect place for finding up-to-date Receipt for Balance of Account templates. Our service provides 1000s of legal documents drafted by licensed legal professionals and grouped by state.

To obtain a sample from US Legal Forms, users simply need to sign up for an account first. If you are already registered on our service, log in and choose the template you need and buy it. Right after buying templates, users can see them in the My Forms section.

To obtain a US Legal Forms subscription online, follow the steps below:

- Find out if the Form name you’ve found is state-specific and suits your requirements.

- If the template has a Preview option, use it to review the sample.

- If the sample doesn’t suit you, make use of the search bar to find a better one.

- Hit Buy Now if the template meets your requirements.

- Select a pricing plan.

- Create an account.

- Pay via PayPal or with the credit/credit card.

- Select a document format and download the sample.

- After it is downloaded, print it and fill it out.

Save your effort and time with the platform to find, download, and complete the Form name. Join a large number of delighted subscribers who’re already using US Legal Forms!

Form popularity

FAQ

You can enter two types of receipts in Receivables: Standard receipts: Payment (such as cash or a check) that you receive from your customers for goods or services. Also known as cash receipts. Miscellaneous receipts: Revenue earned from investments, interest, refunds, stock sales, and other nonstandard items.

It is the sum of the balance of trade (net earnings on exports minus payments for imports), factor income (earnings on foreign investments minus payments made to foreign investors) and unilateral transfers.

Accounts Receivable receipts are moneys owed to the State by a customer and are posted as a Worksheet Payment within the AR module. These receipts are applied against an agency receivable item (invoice) in SFS. As a general rule, each deposit should contain only one payment sequence.

Current account = change in net foreign assets. If an economy is running a current account deficit, it is absorbing (absorption = domestic consumption + investment + government spending) more than that it is producing.

Combination of cash and creditRecord any cash payments as a debit in your cash receipts journal like usual. Then, debit the customer's accounts receivable account for any purchase made on credit. In your sales journal, record the total credit entry.

Write down the total dollar value of goods exported by the country. You can use the total for all goods, or you can focus on a specific product. Write down the total value of goods imported by the country. Subtract the imports from the exports.

Receipts are the amount of cash a business takes in during any one accounting period, regardless of whether the money came from a sale or other source, according to IRS rules. Receipts are cash sales, as well as money received in a customer's account.

Whenever a country has an outflow of funds, it is recorded as a debit on the balance of payments.BOP=Current Account+Financial Account+ Capital Account+Balancing Item. The current account records the flow of income from one country to another.

Balance of current account = Exports of goods + Imports of goods + Exports of services + Imports of services. = $3,50,000 + (-$4,00,000) + $1,75,000 + (-$1,95,000) = -$70,000 i.e. current account is in deficit.