Settlement Agreement between the Estate of a Deceased Partner and the Surviving Partners

Description Settlement Deceased Online

the remaining partners of a business partnership.

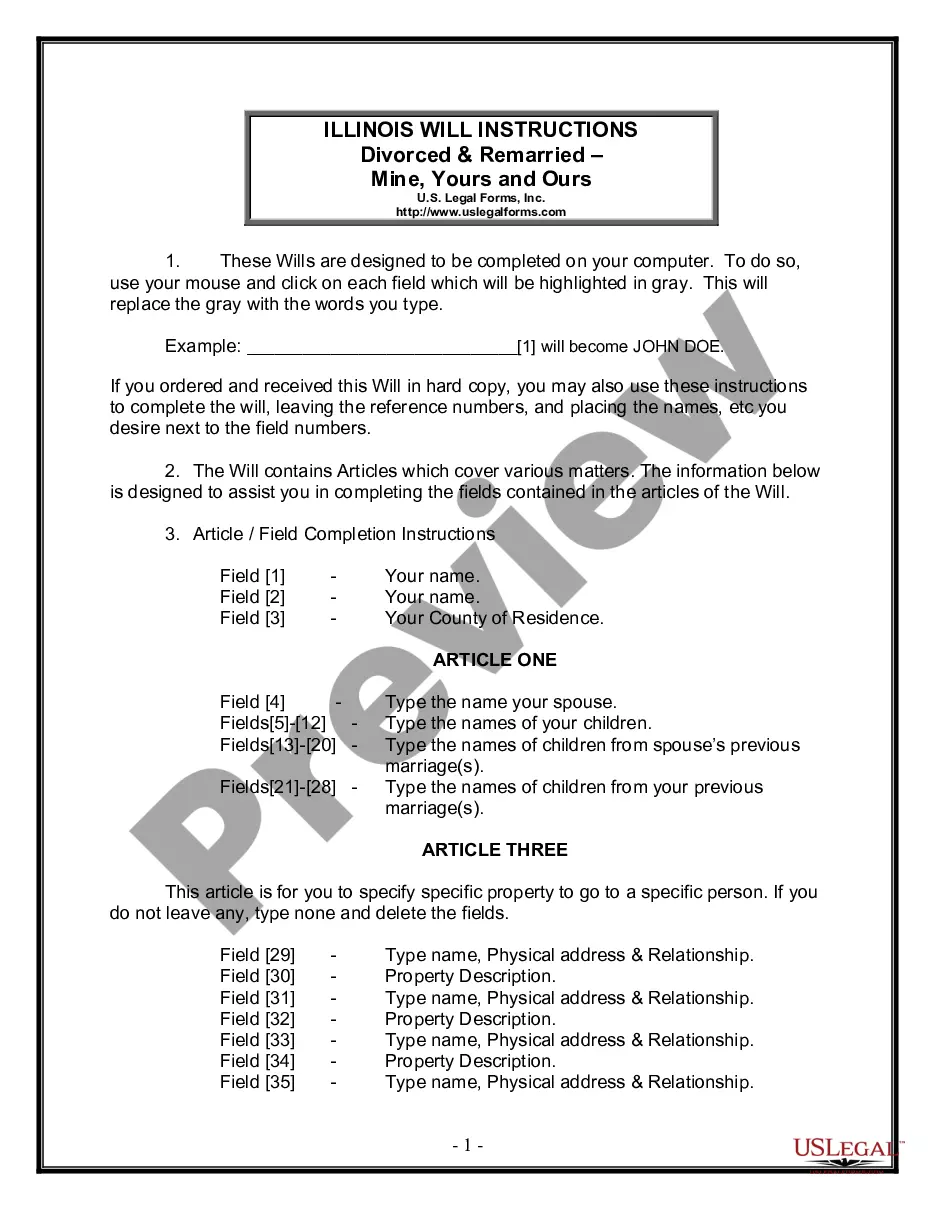

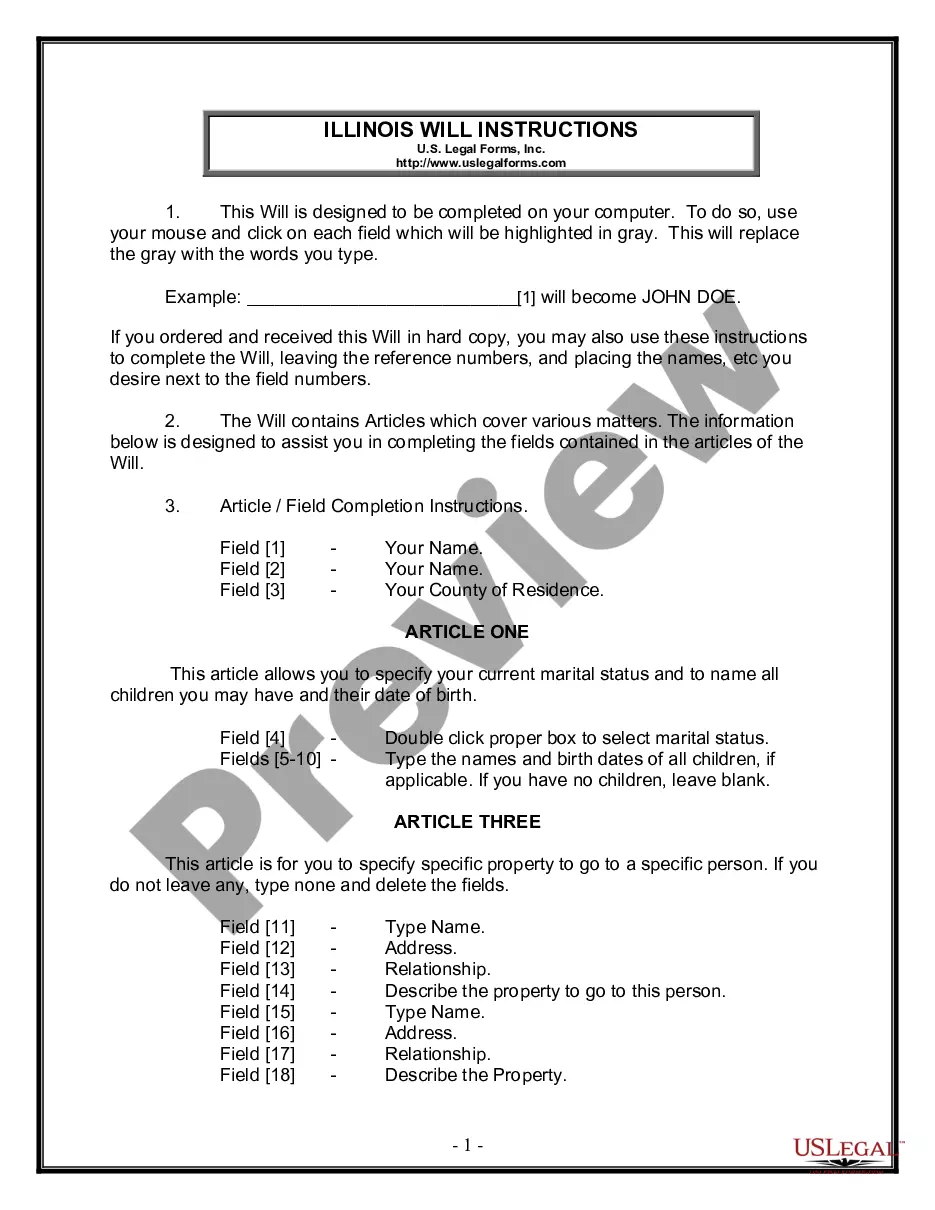

How to fill out Settlement Estate File?

Utilize the most complete legal catalogue of forms. US Legal Forms is the perfect platform for getting updated Settlement Agreement between the Estate of a Deceased Partner and the Surviving Partners templates. Our service provides 1000s of legal forms drafted by certified legal professionals and categorized by state.

To obtain a template from US Legal Forms, users only need to sign up for a free account first. If you’re already registered on our platform, log in and select the template you need and buy it. Right after purchasing templates, users can find them in the My Forms section.

To obtain a US Legal Forms subscription online, follow the guidelines listed below:

- Find out if the Form name you have found is state-specific and suits your needs.

- When the template has a Preview function, utilize it to review the sample.

- In case the template does not suit you, utilize the search bar to find a better one.

- Hit Buy Now if the sample meets your needs.

- Select a pricing plan.

- Create an account.

- Pay via PayPal or with yourr credit/bank card.

- Select a document format and download the sample.

- Once it’s downloaded, print it and fill it out.

Save your time and effort with the service to find, download, and fill out the Form name. Join a huge number of satisfied clients who’re already using US Legal Forms!

Settlement Deceased Agreement Form popularity

Settlement Deceased Other Form Names

Estate Surviving FAQ

A partnership terminates under Sec. 708(b)(1) when the business of the partnership is no longer carried on in partnership form. This can occur because the partnership elects out of partnership status, incorporates, or has only one partner remaining (for example, as the result of a sale or the death of a partner).

On the dissolution of the firm, every partner is entitled to certain rights in connection with the winding up of the firm.Right to have the property of the firm utilized in payment of its debts and liabilities. 2. Right to have the surplus distributed among all the partners as per their rights.

A dissolution of a partnership generally occurs when one of the partners ceases to be a partner in the firm. Other causes of dissolution are the BANKRUPTCY or death of a partner, an agreement of all partners to dissolve, or an event that makes the partnership business illegal.

Accordingly, if a partner resigns or if a partnership expels a partner, the partnership is considered legally dissolved. Other causes of dissolution are the BANKRUPTCY or death of a partner, an agreement of all partners to dissolve, or an event that makes the partnership business illegal.

Death of A Partner The partnership comes to an end immediately, whenever a partner dies although the firm may continue with the remaining partners. The deceased partner is entitled to get his share in the firm as per the provision of a partnership agreement.

The Supreme Court held as under: Section 42(c) of the Partnership Act can appropriately be applied to a' partnership where there are more than two partners. If one of them dies, the firm is dissolved; but if there is a contract to the contrary, the surviving partners will continue the firm.

After the Death of a Business Partner The deceased's estate takes over their share of the partnership. A transfer happens of the other partner's share to you on a payment to the estate. You buy the share of the partnership using a financial formula.

In other words, in a partnership firm of two partners, when one of the partners dies then the partnership automatically dissolved even if the deed of partnership was made clearly instructed to appoint heir of the deceased as a new partner.