Partnership Buy-Sell Agreement with Purchase on Death, Retirement or Withdrawal of Partner with Life Insurance on Each Partner to Fund Purchase in Case of Death

Description

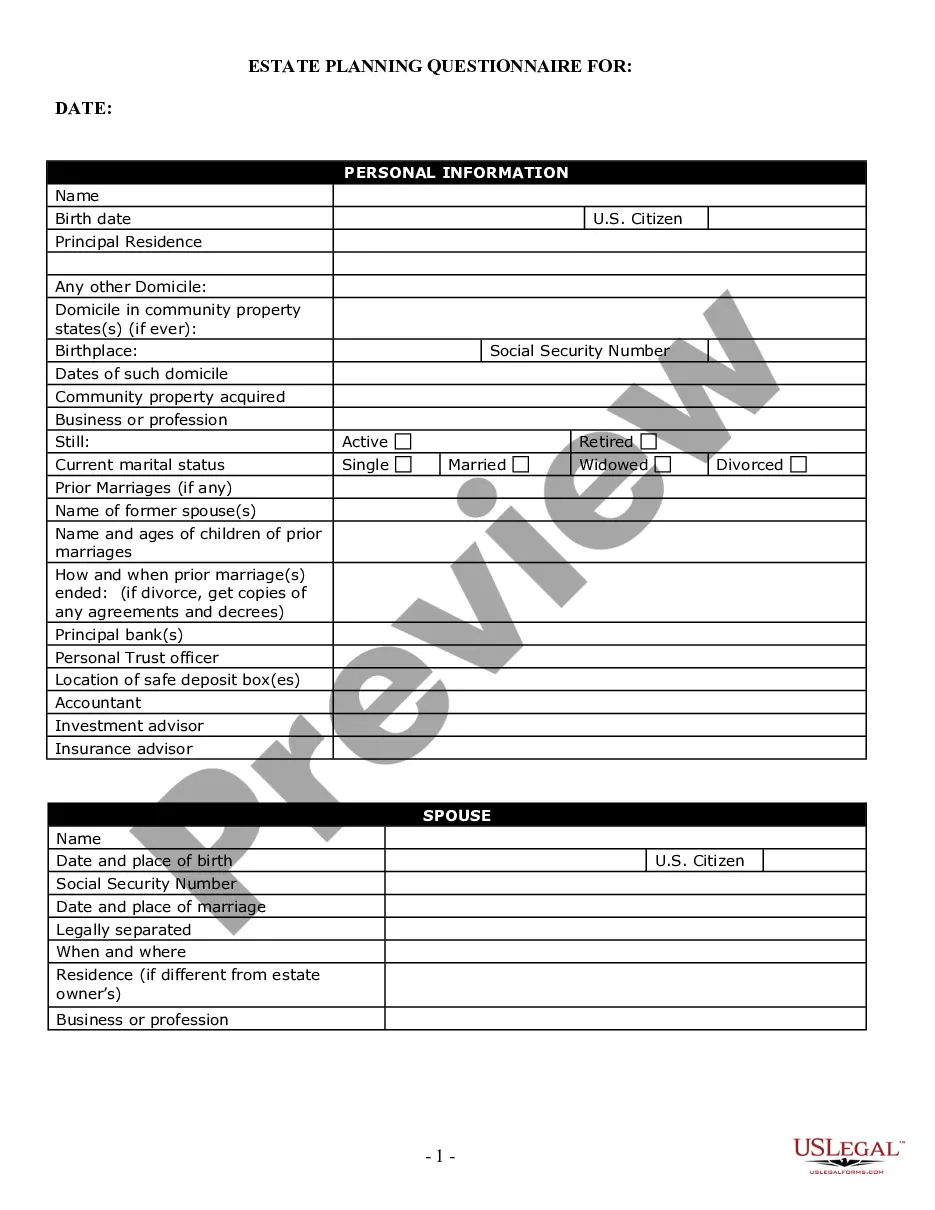

How to fill out Partnership Buy-Sell Agreement With Purchase On Death, Retirement Or Withdrawal Of Partner With Life Insurance On Each Partner To Fund Purchase In Case Of Death?

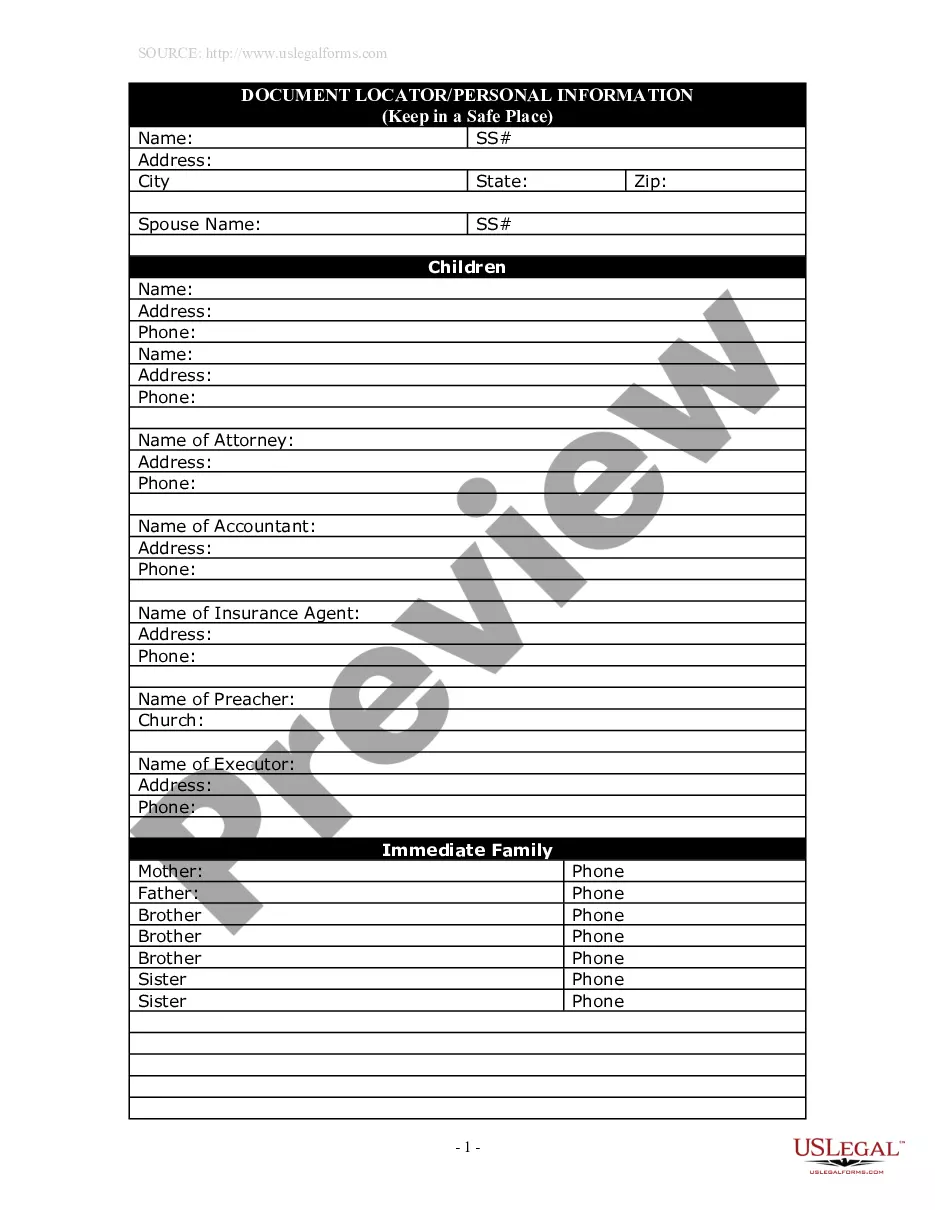

Employ the most extensive legal catalogue of forms. US Legal Forms is the best platform for getting up-to-date Partnership Buy-Sell Agreement with Purchase on Death, Retirement or Withdrawal of Partner with Life Insurance on Each Partner to Fund Purchase in Case of Death templates. Our service provides a large number of legal documents drafted by licensed lawyers and sorted by state.

To obtain a template from US Legal Forms, users simply need to sign up for an account first. If you’re already registered on our service, log in and select the template you need and purchase it. After buying forms, users can find them in the My Forms section.

To obtain a US Legal Forms subscription online, follow the guidelines listed below:

- Check if the Form name you’ve found is state-specific and suits your needs.

- In case the template has a Preview option, utilize it to check the sample.

- If the template does not suit you, use the search bar to find a better one.

- PressClick Buy Now if the template corresponds to your expections.

- Select a pricing plan.

- Create a free account.

- Pay via PayPal or with yourr debit/bank card.

- Select a document format and download the template.

- When it is downloaded, print it and fill it out.

Save your time and effort with our service to find, download, and fill out the Form name. Join a large number of satisfied subscribers who’re already using US Legal Forms!

Form popularity

FAQ

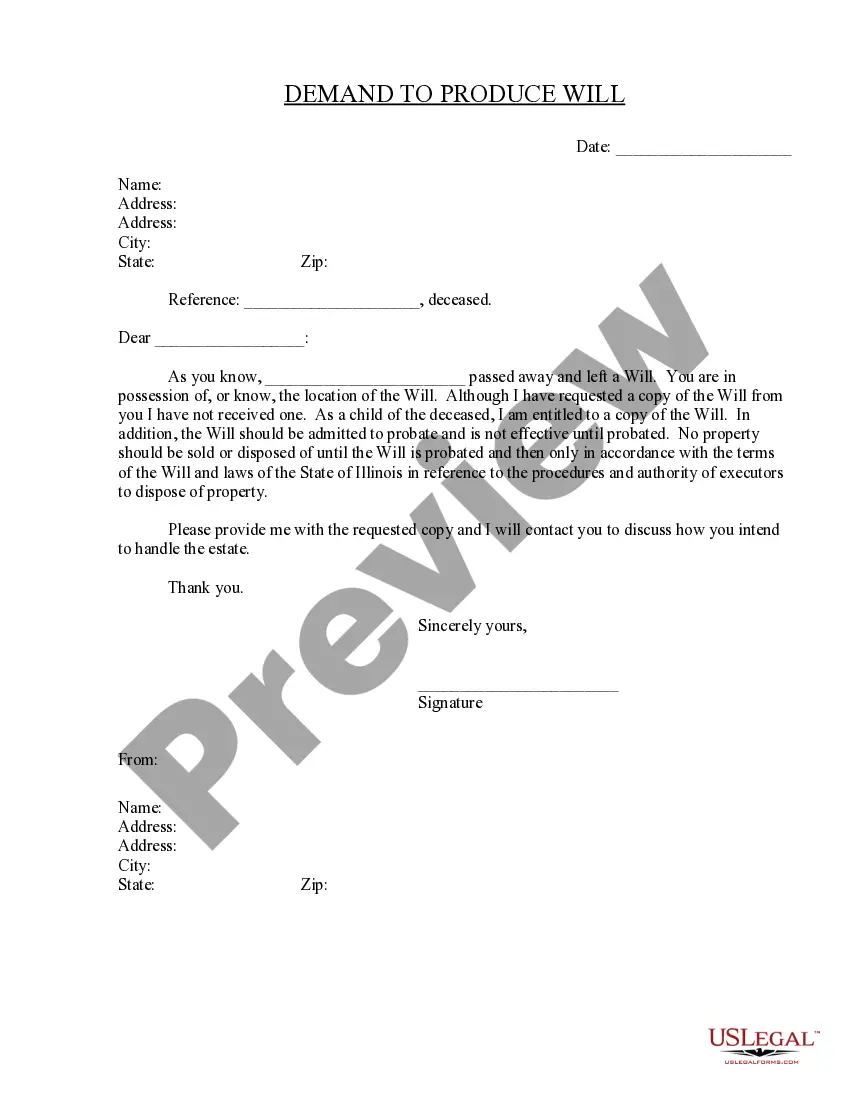

A buy and sell agreement is a legally binding contract that stipulates how a partner's share of a business may be reassigned if that partner dies or otherwise leaves the business.The buy and sell agreement is also known as a buy-sell agreement, a buyout agreement, a business will, or a business prenup.

A properly crafted agreement using life insurance will help reduce taxes, provide for a guaranteed buyer and market for all the hard-earned equity you have put into your business over the years.The life insurance option usually provides the most cost efficient way to fund a buy-sell agreement when the owner dies.

One common question we receive when discussing key person benefits is What is a buy/sell agreement? A buy/sell agreement, also known as a buyout agreement, is a contract funded by a life insurance policy that can help minimize the turmoil caused by the sudden departure, disability or death of a business owner or

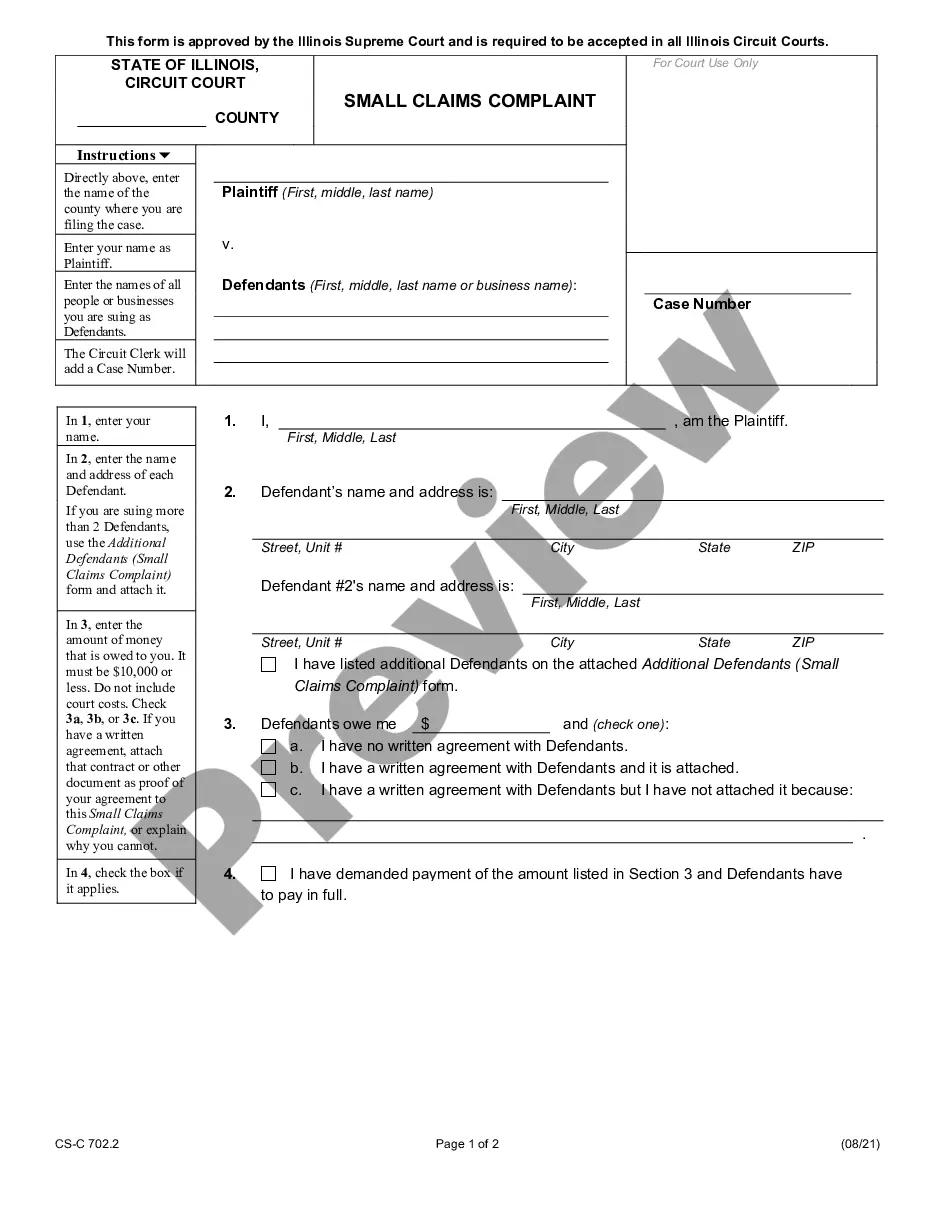

Business partner life insurance is just like any other life insurance you buy: the insurance company agrees to pay the deceased partner's beneficiary a specific amount of money. You can also have business partner life insurance that names the surviving partner or the business as the beneficiary of the policy.

A buy-sell agreement consists of three common elements: a triggering event, a valuation method and a funding strategy.

Most Common Uses of a Buy-Sell Agreement The buyout agreement stipulates what types of events trigger the contract. Each agreement is laid out to best meet the needs of each particular company. It can include specifications about who can buy stocks and the type of life situation that would trigger a buyout.

You can fund a buy-sell agreement with term or permanent life insurance. Each has its own benefits, says Muth. Term insurance provides temporary coverage for a specific window of time and has no cash value component.

Using a buy/sell agreement to establish the value of a business interest. A buy/sell agreement is a contract between the members of an LLC that provides for the sale (or offer to sell) of a member's interest in the business to the other members or to the LLC when a specified event or events occur.

Life insurance is an effective tool that business owners can use to implement the provisions of a buy-sell agreement by providing liquidity at the death of an owner to both his or her business and family.