Agreement Acquiring Share of Retiring Law Partner

Description

How to fill out Agreement Acquiring Share Of Retiring Law Partner?

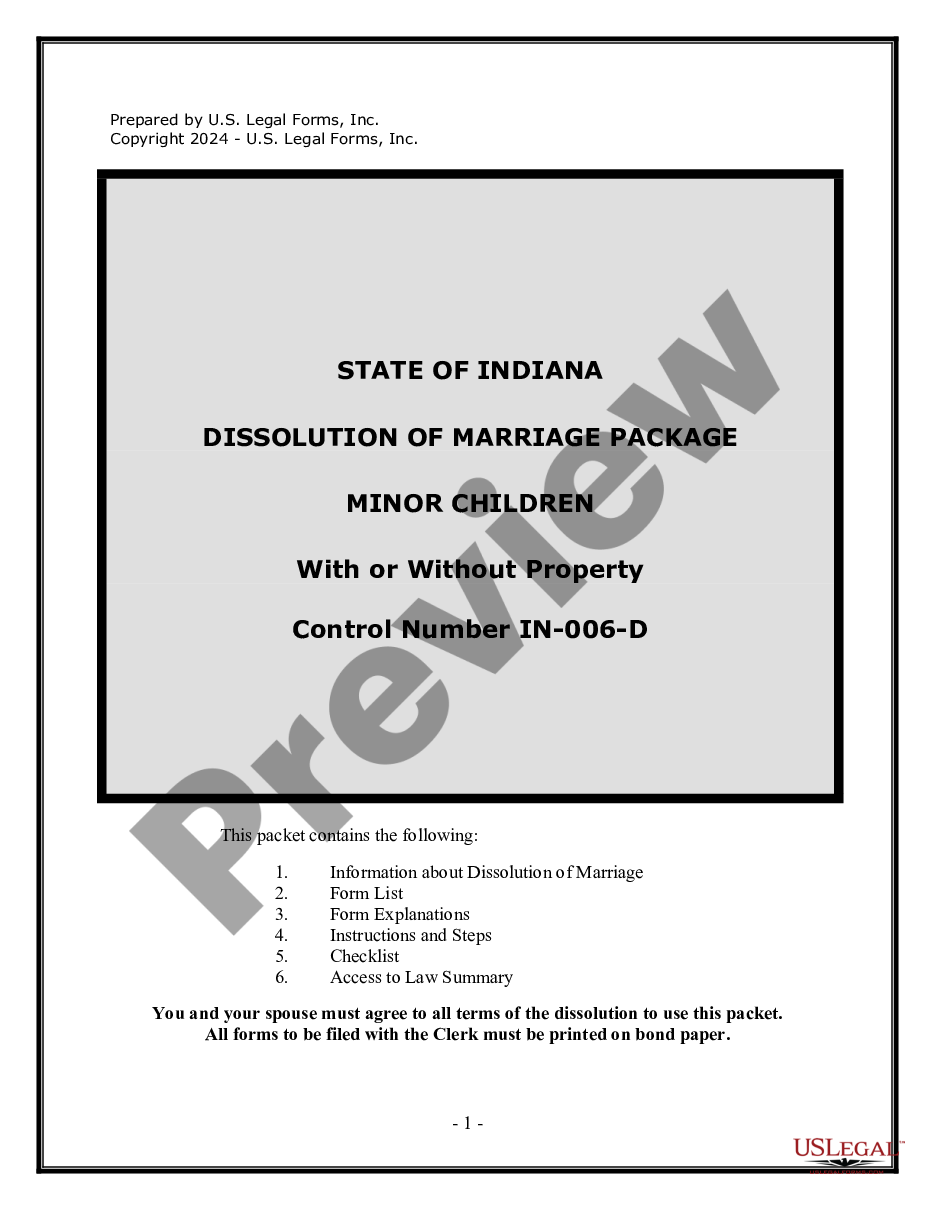

Employ the most comprehensive legal catalogue of forms. US Legal Forms is the best platform for finding updated Agreement Acquiring Share of Retiring Law Partner templates. Our service provides thousands of legal forms drafted by licensed lawyers and categorized by state.

To download a sample from US Legal Forms, users only need to sign up for an account first. If you’re already registered on our platform, log in and select the template you need and buy it. After buying templates, users can see them in the My Forms section.

To obtain a US Legal Forms subscription on-line, follow the guidelines below:

- Check if the Form name you’ve found is state-specific and suits your requirements.

- When the form has a Preview function, utilize it to review the sample.

- In case the sample does not suit you, use the search bar to find a better one.

- PressClick Buy Now if the sample corresponds to your needs.

- Choose a pricing plan.

- Create a free account.

- Pay with the help of PayPal or with yourr debit/visa or mastercard.

- Choose a document format and download the sample.

- As soon as it’s downloaded, print it and fill it out.

Save your time and effort using our service to find, download, and fill in the Form name. Join a huge number of happy customers who’re already using US Legal Forms!

Form popularity

FAQ

A retired partner continues to be liable to the third party for acts of the firm till such time that he or other members of the firm give a public notice of his retirement. However, if the third party deals with the firm without knowing that he was a partner in the firm, then he will not be liable to the third party.

A departing partner must notify other partners and clients in a timely fashion. To do otherwise would be to risk lawsuit by the firm for breach of fiduciary duty.It is technically illegal to solicit current or former clients when leaving a law firm and heading to another but it happens anyway.

At the time of retirement of partner, retiring partner is entitled to his share of goodwill i.e., in his profit sharing ratio in the firm. Goodwill is valued as per the agreement or partnership deed and is compensated by remaining partners in their gaining ratio.

In those cases, retiring partners receive a return of capital and any other retirement-type benefits are usually limited to funded pension plans. Most law firms require new partners to pay for shares and retiring partners receive value for selling their ownership interest in the firm.

Calculation of New profit sharing ratio and gaining ratio At the time of retirement of a partner, the business continues with the remaining partners. The ratio, in which the continuing partners decide to share the future profits and losses, is known as new profit sharing ratio.

What retirement means in this context is a partner gives up his or her equity in the firm and becomes an employee. Typically, retired partners are paid for their personal productivity and for new clients.

A lot of attorneys offer to keep the original wills they prepare for their clients, at no charge.If the will is in your attorney's safe, that will not happen. In your case, this backfired. After your attorney retired or died, his staff should have mailed the original wills to you and your husband.

Goodwill of the firm is valued in the manner prescribed by the partnership deed. If there is no such clause in the partnership deed, it will be valued by mutual consent or arbitration. Retiring partner's share of goodwill is then ascertained which depends on the share of profits the retiring partner has been getting.

At the time of retirement of a partner, the retiring partner is entitled to share the goodwill as per his/her profit share in the business. This share of goodwill will be compensated by the remaining partners in the ratio in which they have purchased the share of the retiring partner.