Law Partnership Agreement with Profits and Losses Shared on Basis of Units of Participation

Description Partnership Agreement Profits Losses

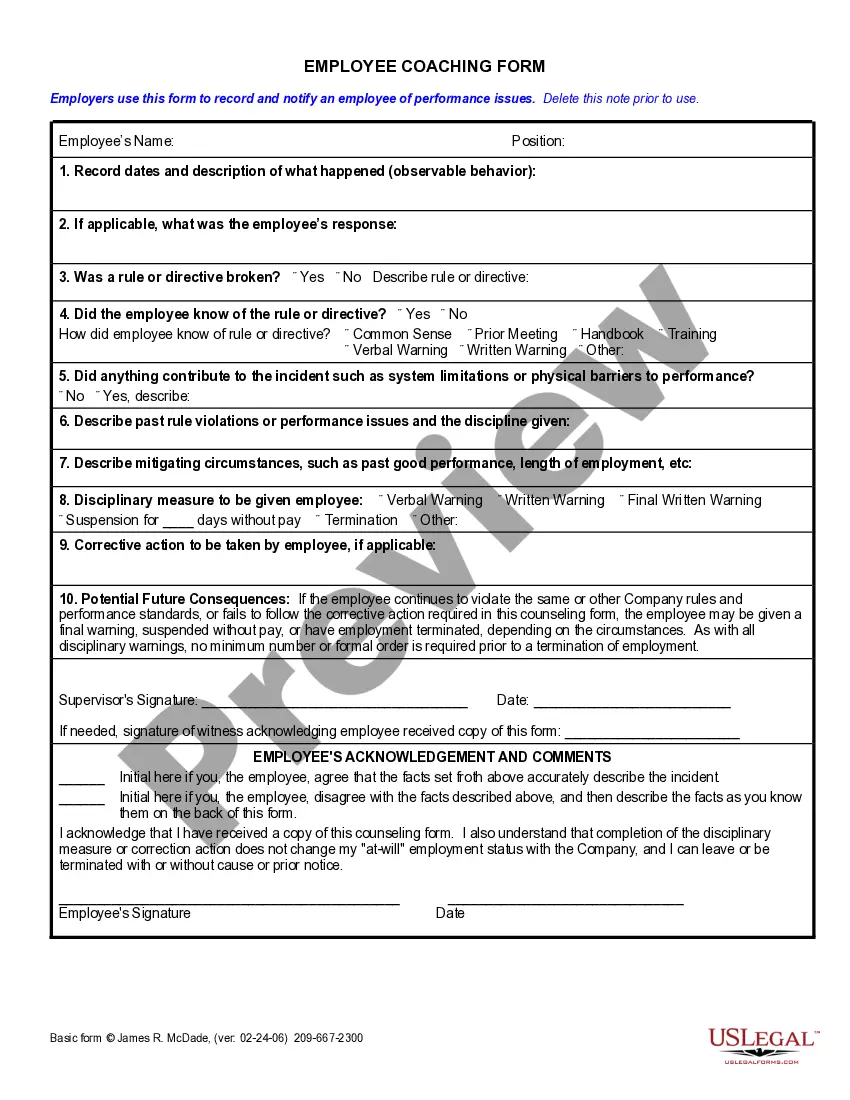

How to fill out Agreement Shared?

Employ the most complete legal library of forms. US Legal Forms is the best place for getting up-to-date Law Partnership Agreement with Profits and Losses Shared on Basis of Units of Participation templates. Our platform provides a huge number of legal forms drafted by certified lawyers and categorized by state.

To obtain a template from US Legal Forms, users just need to sign up for an account first. If you are already registered on our platform, log in and select the template you need and purchase it. After purchasing templates, users can find them in the My Forms section.

To obtain a US Legal Forms subscription on-line, follow the guidelines listed below:

- Find out if the Form name you’ve found is state-specific and suits your requirements.

- In case the template has a Preview function, use it to check the sample.

- If the sample doesn’t suit you, utilize the search bar to find a better one.

- Hit Buy Now if the template corresponds to your needs.

- Select a pricing plan.

- Create an account.

- Pay with the help of PayPal or with yourr credit/visa or mastercard.

- Choose a document format and download the template.

- As soon as it’s downloaded, print it and fill it out.

Save your time and effort with the service to find, download, and complete the Form name. Join a large number of satisfied customers who’re already using US Legal Forms!

Partnership Losses Buy Form popularity

Partnership Losses Form Other Form Names

Profits Shared File FAQ

In a business partnership, you can split the profits any way you want, under one conditionall business partners must be in agreement about profit-sharing. You can choose to split the profits equally, or each partner can receive a different base salary and then the partners will split any remaining profits.

Absent an agreement, profits are shared equally. Absent an agreement, losses are shared like profits.

Allocation of Income and Loss The entries for a partnership are: Debit each revenue account and credit the income section account for total revenue.If the partnership had income, debit the income section for its balance and credit each partner's capital account based on his or her share of the income.

No - it must be distributed to the partners. If you can't deduct your share of partnership loss in the current year (in your individual tax return), you can defer your loss for use in a later year.

The partnership profits are allocated and taxed based on a stated ratio for each partner, sharing based on each partner's capital balance, sharing based on partner's service, and a sharing based on a combination of stated ratios, capital balance, and services.

Divide the Partnership Loss The net loss is divided according to each partner's contribution percentage, according to Henssler Financial. For example, Partner A gets 50 percent of the profits and losses, Partner B gets 30 percent and Partner C gets 20 percent of the partnership's profits and losses.

In a partnership, profits and losses typically get distributed to owners of the business based on their percentage interests in the partnership. For example, imagine a business that has a partnership structure with four partners: Partner A, Partner B, Partner C, and Partner D.

In a partnership, profits and losses made by the business are shared among the partners based on their initial contribution percentage, unless agreed otherwise and set out in the partnership agreement.

In the general partnership, the limited liability partnership, the limited liability limited partnership and the limited partnership, profits and losses are passed through to the partners as specified in the partnership agreement. If left unspecified, profits and losses are shared equally among the partners.