Credit Approval Form

Description

How to fill out Credit Approval Form?

Utilize the most complete legal catalogue of forms. US Legal Forms is the best platform for getting up-to-date Credit Approval Form templates. Our platform provides a large number of legal forms drafted by certified attorneys and sorted by state.

To download a template from US Legal Forms, users simply need to sign up for a free account first. If you are already registered on our service, log in and select the document you are looking for and buy it. After purchasing forms, users can see them in the My Forms section.

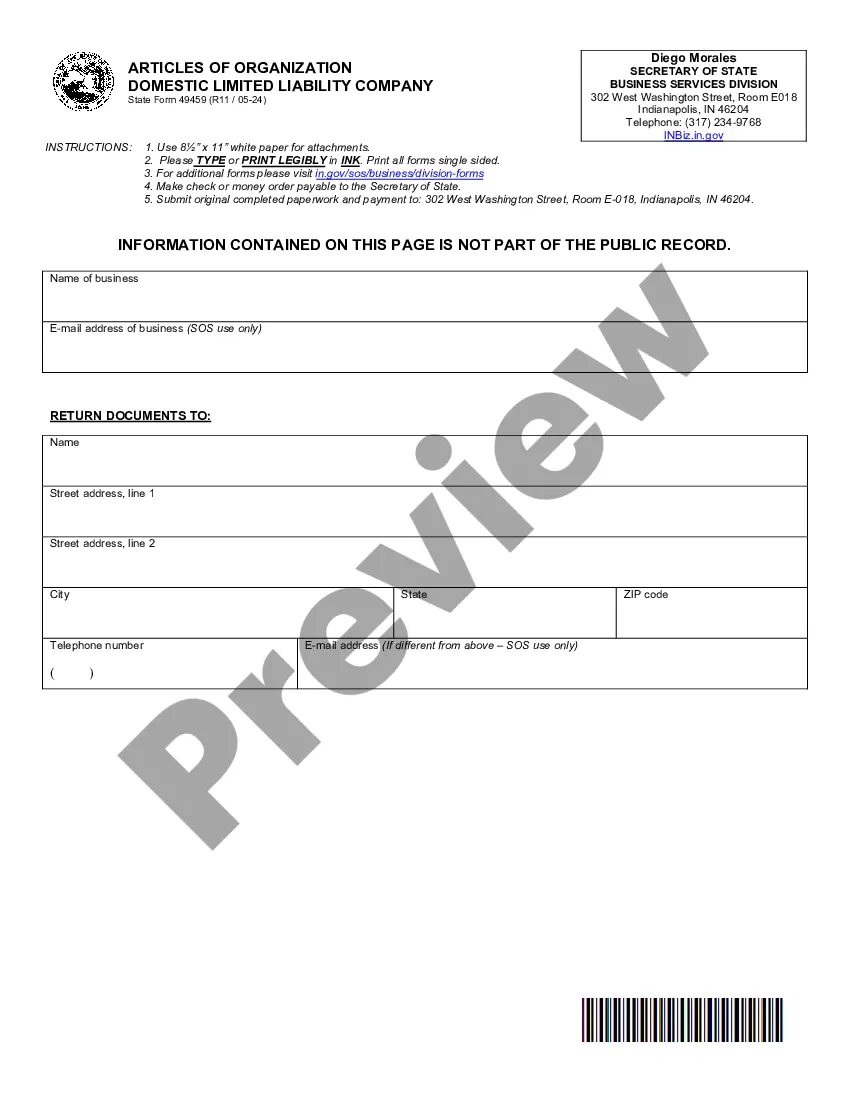

To get a US Legal Forms subscription online, follow the steps listed below:

- Find out if the Form name you have found is state-specific and suits your requirements.

- If the template has a Preview function, utilize it to review the sample.

- If the template doesn’t suit you, make use of the search bar to find a better one.

- PressClick Buy Now if the sample corresponds to your needs.

- Choose a pricing plan.

- Create a free account.

- Pay via PayPal or with the debit/bank card.

- Select a document format and download the sample.

- Once it is downloaded, print it and fill it out.

Save your effort and time with the platform to find, download, and fill in the Form name. Join thousands of satisfied clients who’re already using US Legal Forms!

Form popularity

FAQ

Check your credit report. Pay your bills on time. Pay off any collections. Get caught up on past-due bills. Keep balances low on your credit cards. Pay off debt rather than continually transferring it.

The present Unit on 'Process of Credit Application' covers various aspects like features and conditions for credit sales, identifying credit checks and getting authorisation, describing the process of credit requisitions, demonstrate the techniques for determining creditworthiness.

Pay bills on time. Make frequent payments. Ask for higher credit limits. Dispute credit report errors. Become an authorized user. Use a secured credit card. Keep credit cards open. Mix it up.

Credit approval is the process a business or an individual undergoes to become eligible for a loan or pay for goods and services over an extended period.Typically, businesses seek approval to obtain loans and also grant approval for loans to their customers.

Dispute Credit-Report Mistakes. Make a Big Debt Payment. Reduce Your Credit Card Statement Balance. Become an Authorized User. Dispute Negative Authorized-User Records. Ask for a Higher Credit Limit. Write a Goodwill Letter.

It will take about six months of credit activity to establish enough history for a FICO credit score, which is used in 90% of lending decisions. 1feff FICO credit scores range from 300-850, and a score of over 700 is considered a good credit score. Scores over 800 are considered excellent.

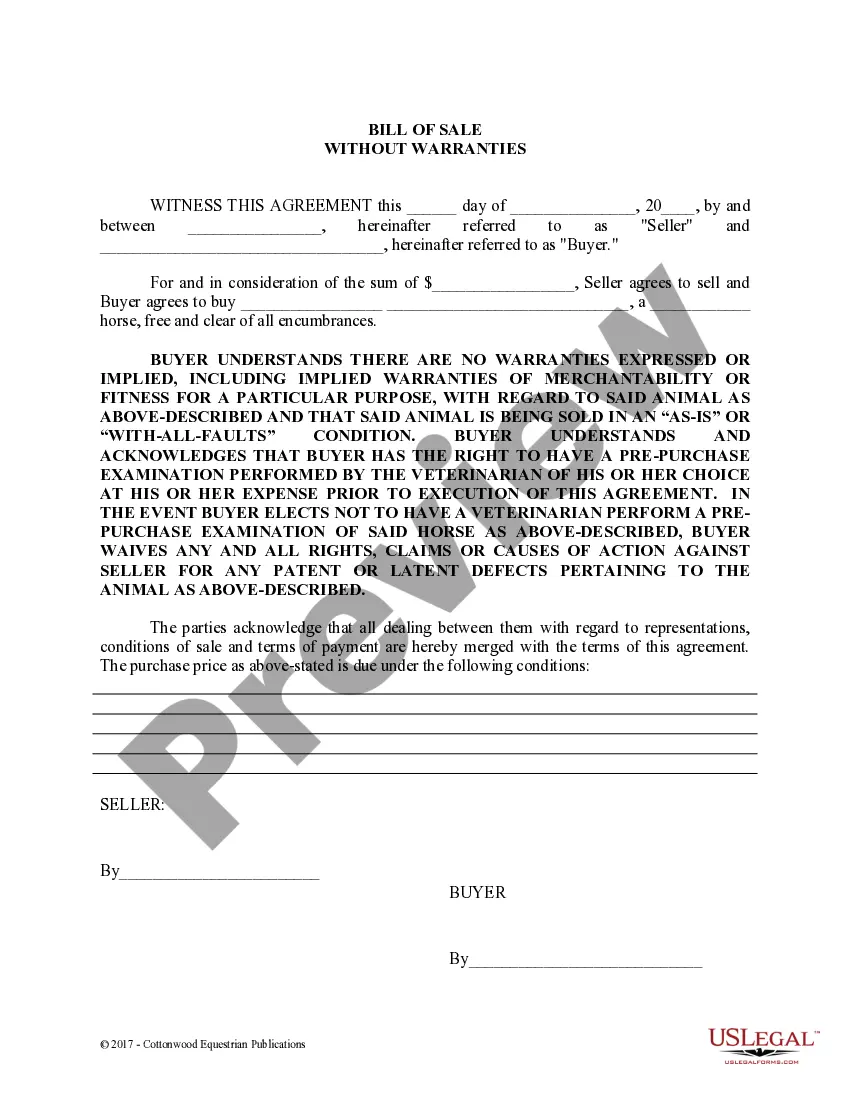

Customer's Name. Customer's Address and Telephone Number. Customer's Employer Identification Number (EIN) Customer's Bank Information and Credit References. Guarantor's Name, Address, Telephone, Social Security Number, Etc. Signature Line. Interest and Attorney's Fees. Confirm that the Customer's Name is Correct.

Become an authorized user. One of the simplest ways to build credit is by becoming an authorized user on a family member or friend's credit card. Apply for a secured credit card. Get credit for paying monthly utility and cell phone bills on time.

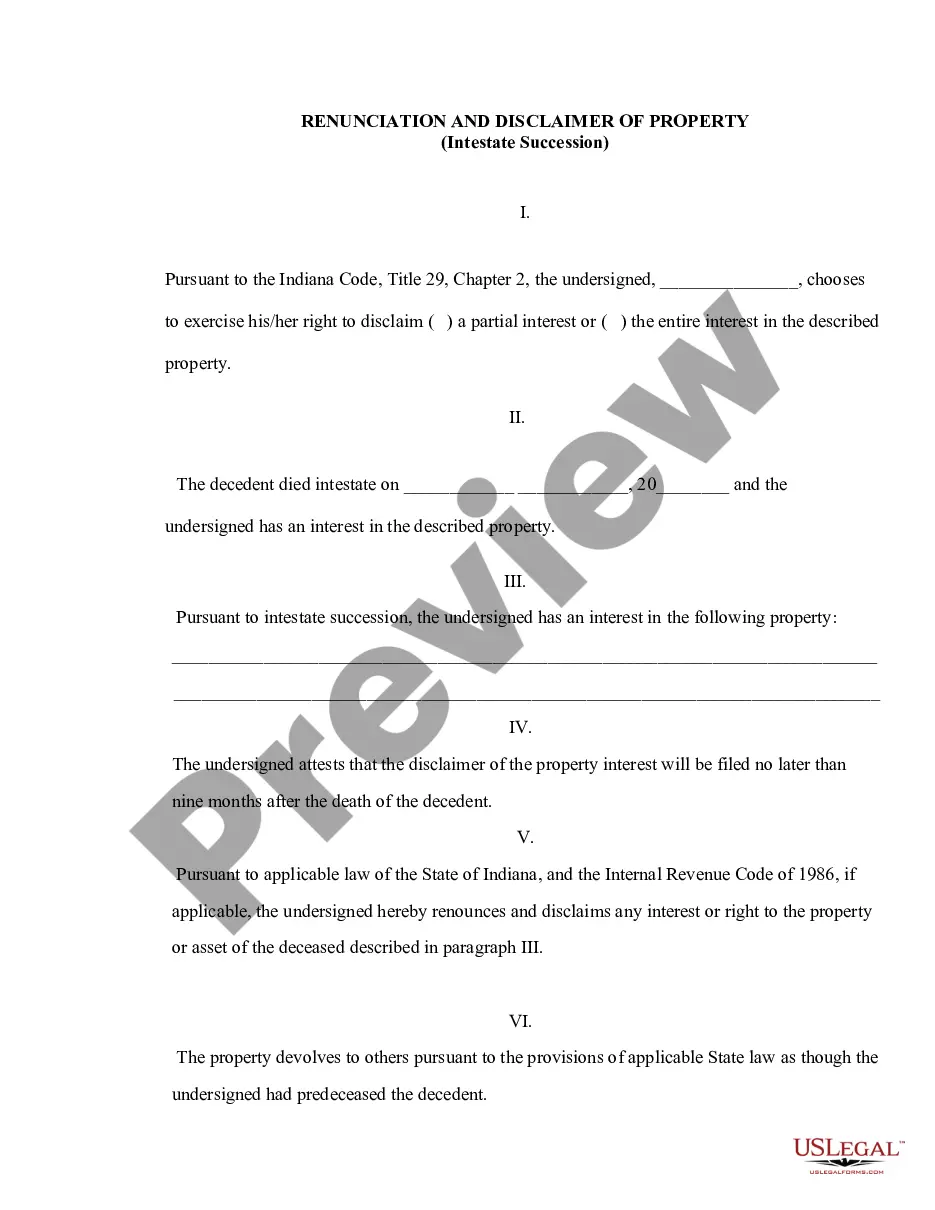

A credit application is a form used by potential borrowers to get approval for credit from lenders.The information provided on credit applications is regulated, and laws such as the Truth in Lending Act provide consumer protection and transparency.