Liquidation of Partnership with Sale and Proportional Distribution of Assets

Description

How to fill out Liquidation Of Partnership With Sale And Proportional Distribution Of Assets?

Utilize the most extensive legal library of forms. US Legal Forms is the perfect place for finding updated Liquidation of Partnership with Sale and Proportional Distribution of Assets templates. Our platform provides a large number of legal forms drafted by certified attorneys and categorized by state.

To get a sample from US Legal Forms, users simply need to sign up for an account first. If you’re already registered on our platform, log in and choose the template you need and purchase it. After buying forms, users can find them in the My Forms section.

To get a US Legal Forms subscription online, follow the guidelines below:

- Check if the Form name you’ve found is state-specific and suits your requirements.

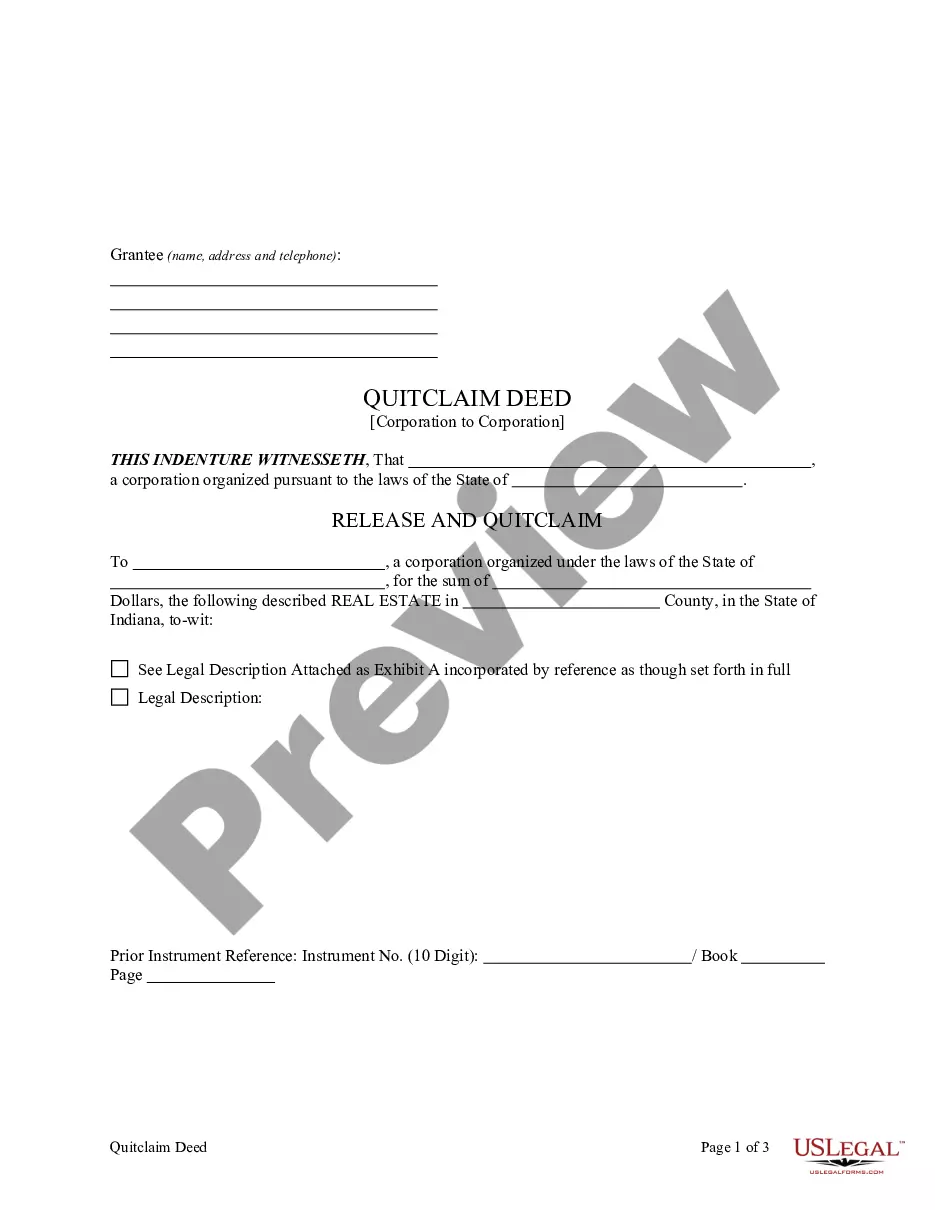

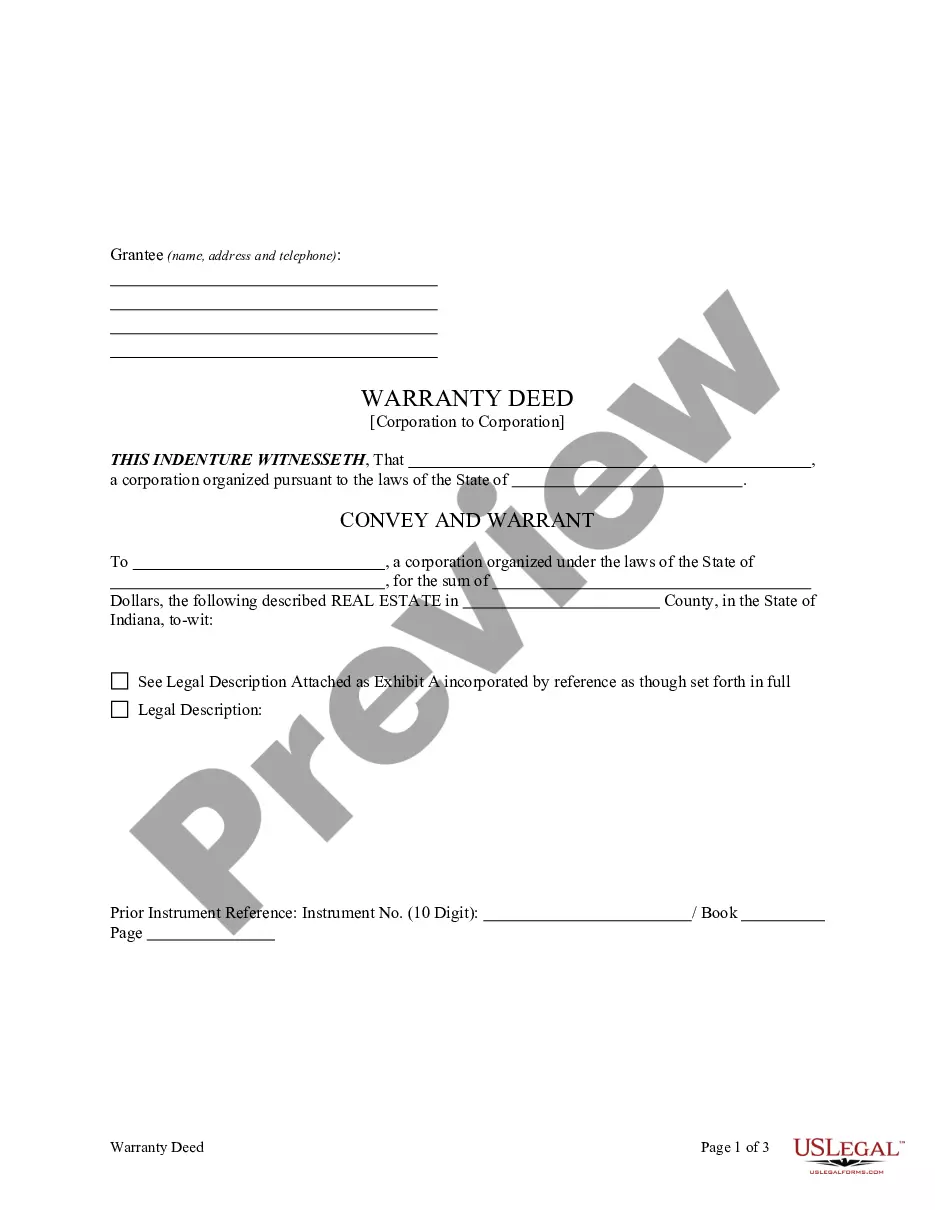

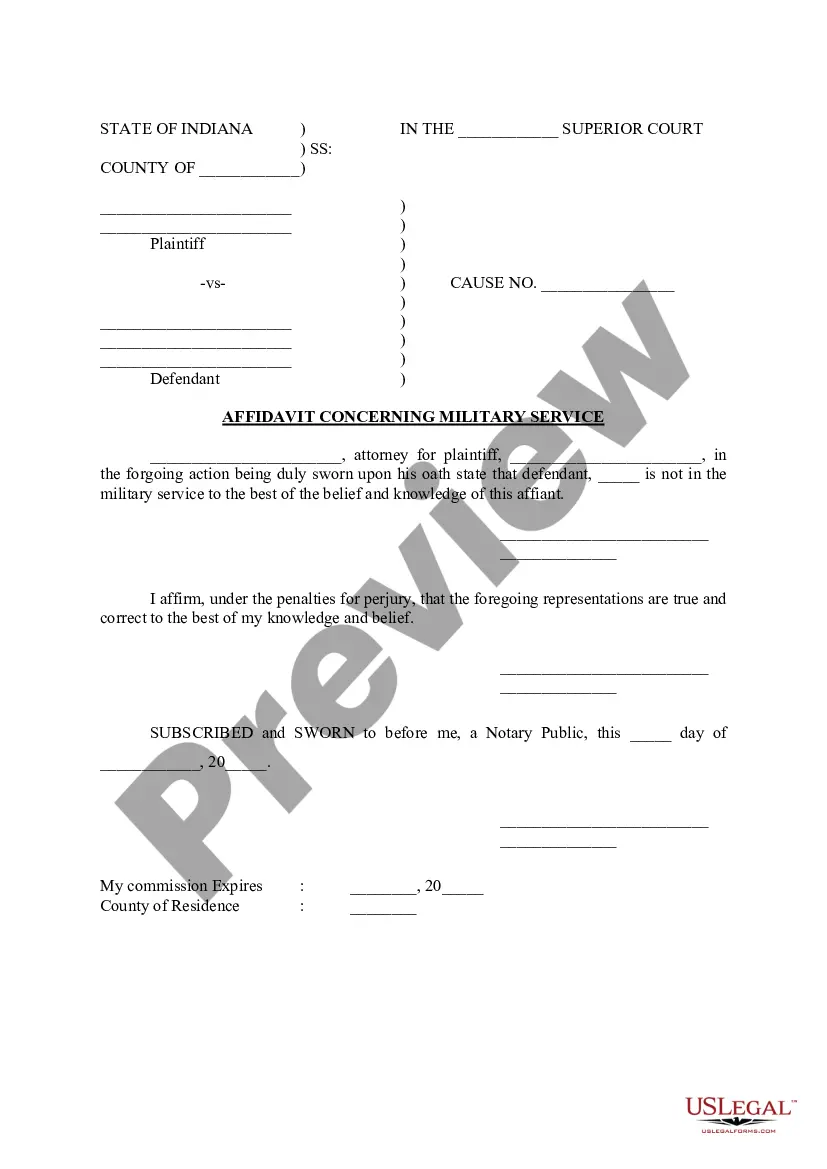

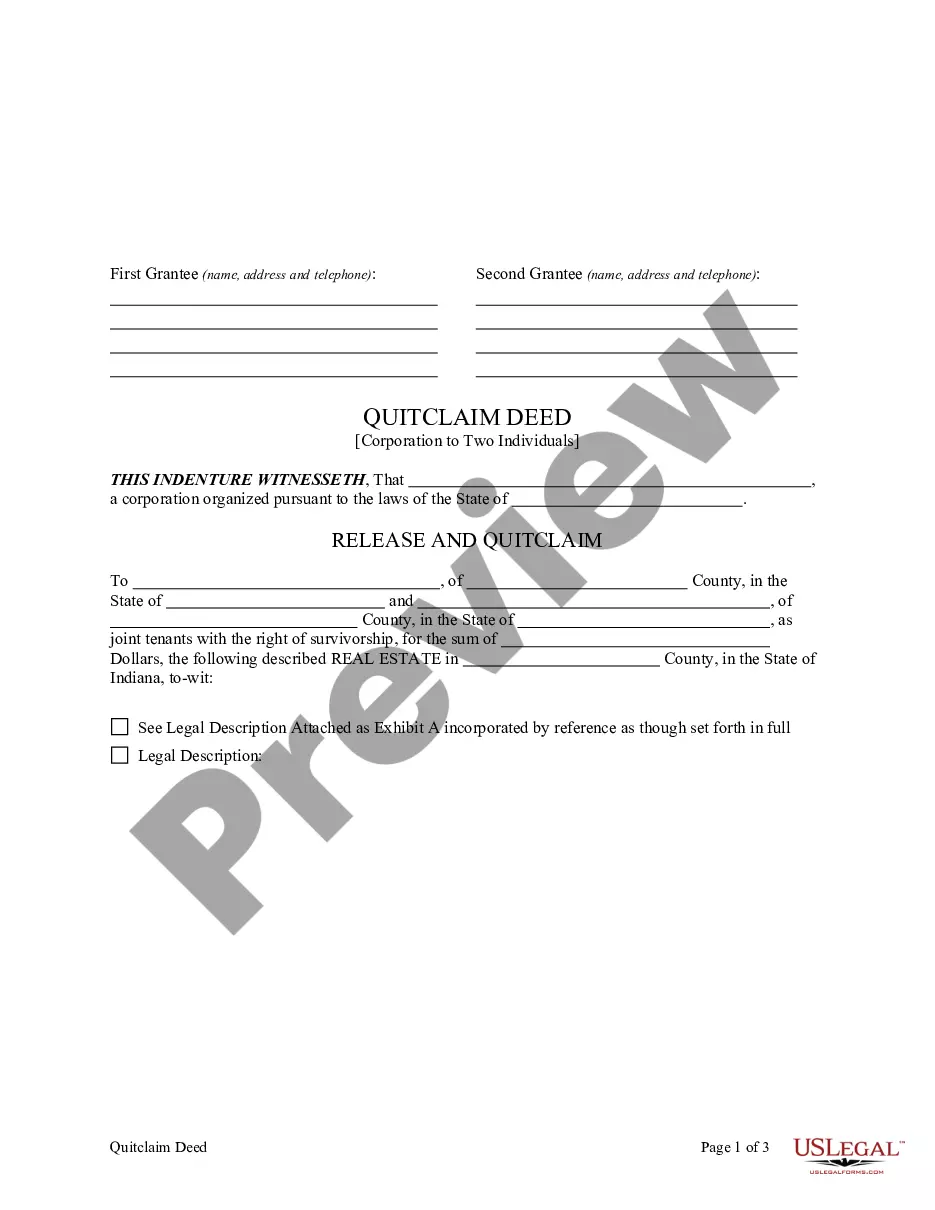

- In case the template has a Preview function, use it to review the sample.

- If the template does not suit you, use the search bar to find a better one.

- Hit Buy Now if the sample meets your requirements.

- Select a pricing plan.

- Create your account.

- Pay via PayPal or with yourr credit/credit card.

- Select a document format and download the sample.

- After it’s downloaded, print it and fill it out.

Save your time and effort with the service to find, download, and complete the Form name. Join a large number of happy subscribers who’re already using US Legal Forms!

Form popularity

FAQ

A liquidating distribution (or liquidating dividend) is a type of nondividend distribution made by a corporation or a partnership to its shareholders during its partial or complete liquidation.Instead, the entire amount of shareholders' equity is distributed.

A liquidating distribution is a distribution that completely terminates a partner's interest in the partnership. Just like with a current distribution, a partnership making a liquidating distribution does not recognize any gain or loss.

Proceeds from a cash liquidation distribution can be either a non-taxable return of principal or a taxable distribution, depending upon whether or not the amount is more than the investors' cost basis in the stock.Payments in excess of the total investment are capital gains, subject to capital gains tax.

Because of the one class of stock requirement, all S corporation distributions must be pro rata among the shareholders. Partnerships may make unequal distributions and allocations (as long as the allocations have substantial economic effect under Treas.

Under what conditions will a partner recognize gain in a liquidating distribution? In the situation in which a partnership distributes only money and the amount exceeds the partner's basis in her partnership interest, she will recognize a gain equal to the excess.

Accounting for the Liquidation of a Partnership Allocate any gain or loss on the sale of non cash assets to each partner using the income ratio. Pay any liabilities of the partnership. Distribute the remaining cash to the partners using the capital ratio.

A liquidation marks the official ending of a partnership agreement. To end the partnership, the parties involved sell the property the business owns, and each partner receives a share of the remaining money.

If the partnership decides to liquidate, the assets of the partnership are sold, liabilities are paid off, and any remaining cash is distributed to the partners according to their capital account balances.