Agreement to Dissolve and Wind up Partnership with Sale to Partner and Disproportionate Distribution of Assets

Description

How to fill out Agreement To Dissolve And Wind Up Partnership With Sale To Partner And Disproportionate Distribution Of Assets?

Use the most comprehensive legal library of forms. US Legal Forms is the perfect place for finding updated Agreement to Dissolve and Wind up Partnership with Sale to Partner and Disproportionate Distribution of Assets templates. Our platform offers thousands of legal forms drafted by certified attorneys and sorted by state.

To get a template from US Legal Forms, users only need to sign up for a free account first. If you are already registered on our platform, log in and choose the document you need and buy it. After purchasing templates, users can see them in the My Forms section.

To get a US Legal Forms subscription on-line, follow the guidelines listed below:

- Find out if the Form name you have found is state-specific and suits your requirements.

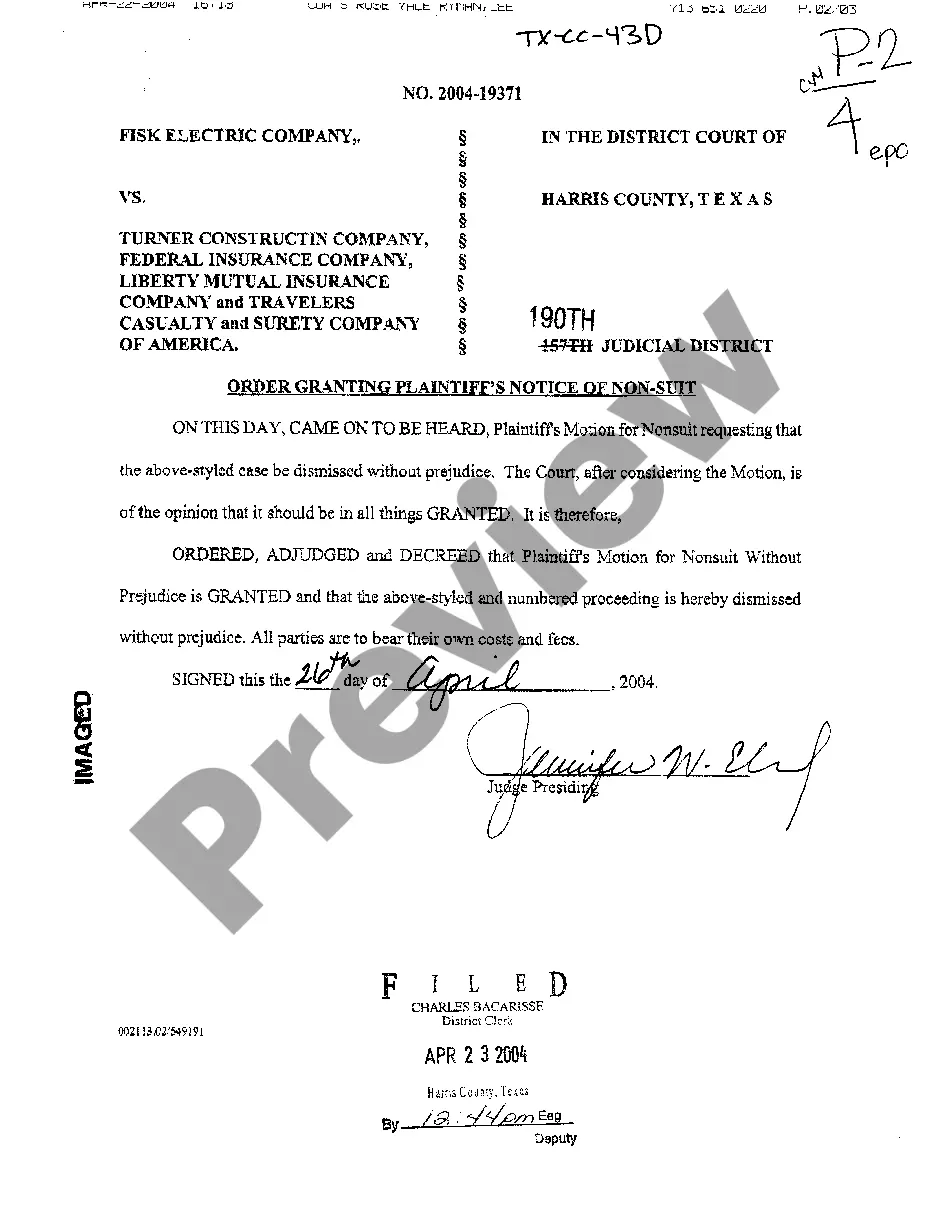

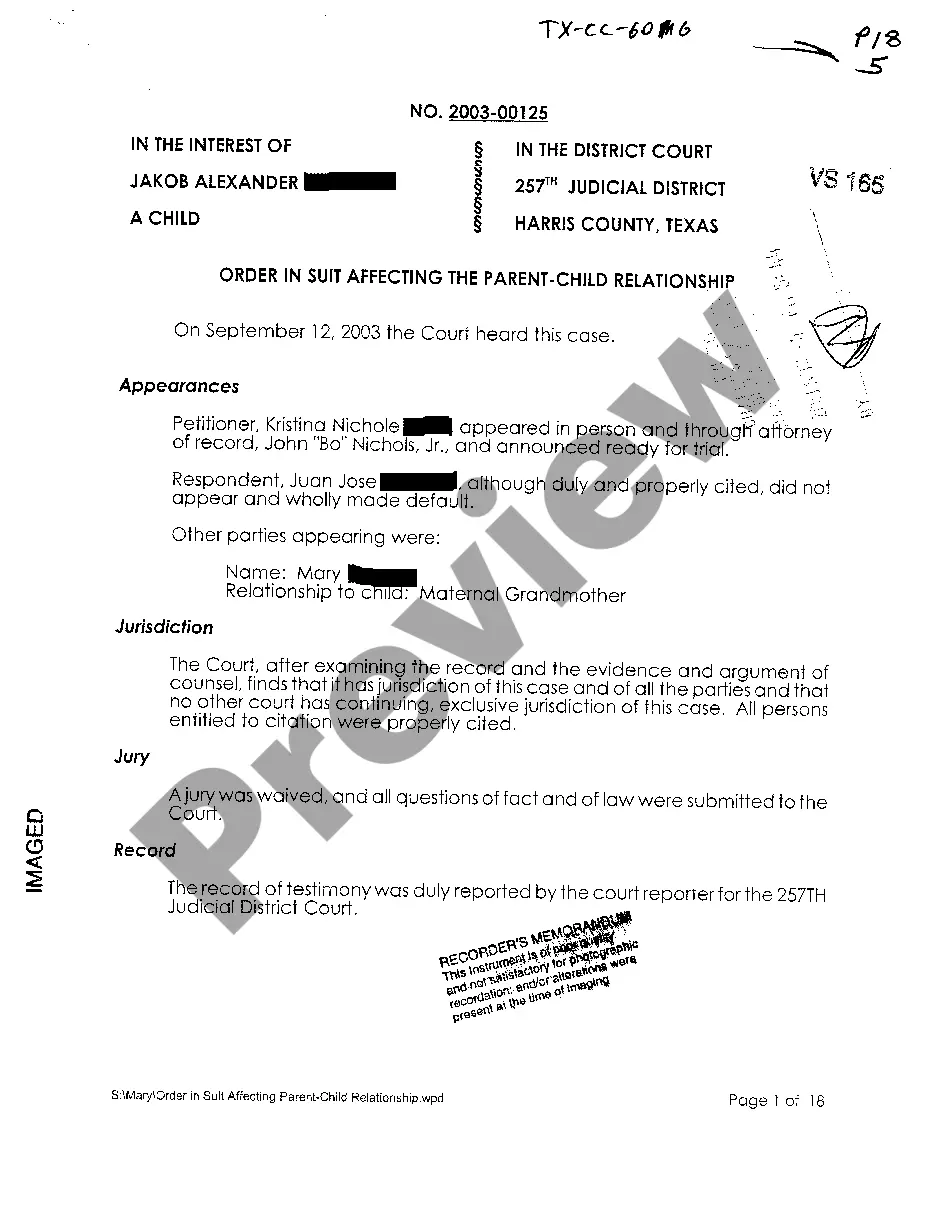

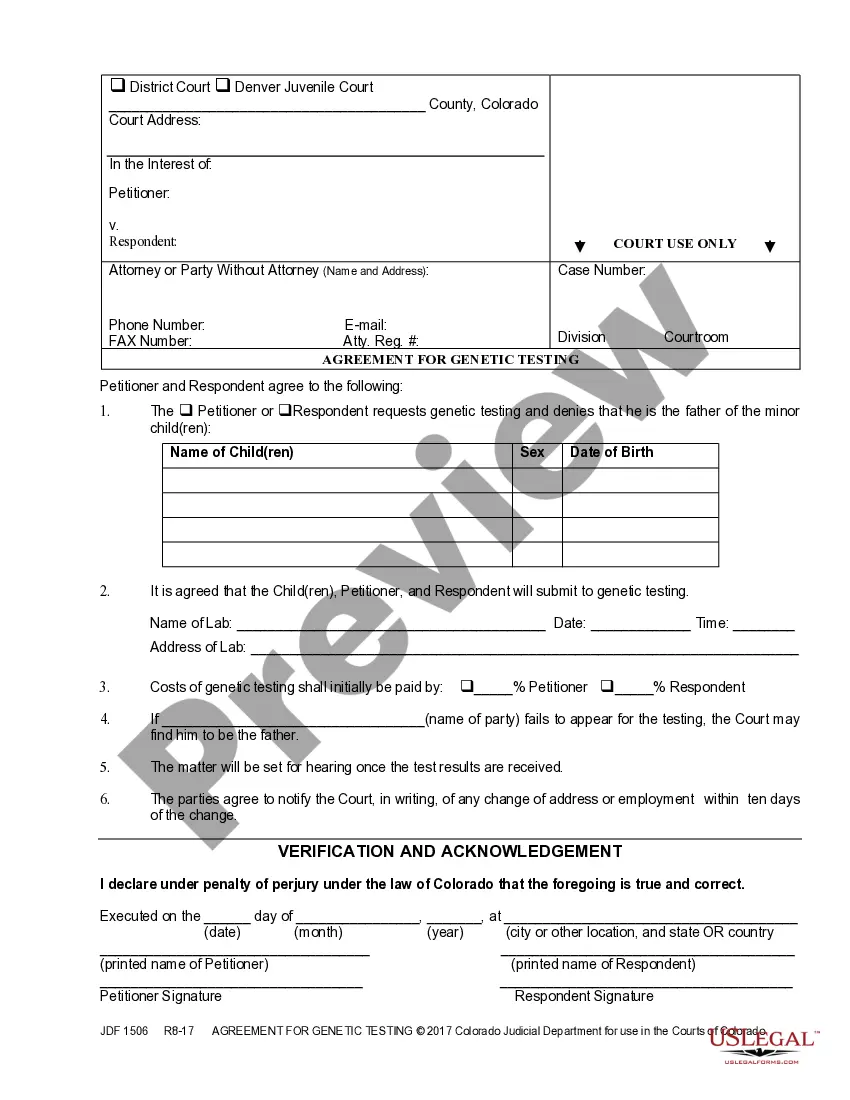

- If the form has a Preview function, use it to check the sample.

- In case the sample does not suit you, utilize the search bar to find a better one.

- PressClick Buy Now if the sample corresponds to your requirements.

- Select a pricing plan.

- Create a free account.

- Pay via PayPal or with the credit/credit card.

- Choose a document format and download the template.

- When it’s downloaded, print it and fill it out.

Save your effort and time with the platform to find, download, and complete the Form name. Join a large number of satisfied subscribers who’re already using US Legal Forms!

Form popularity

FAQ

Partnerships and LLC agreements will sometimes allow investors to distribute assets to investors disproportionately, although many partnership agreements call for these disproportionate distributions to be cured at some later date (such as upon winding up of the business or the sale of the ownership interest).

Disproportionate distribution rules apply if an actual or constructive distribution to a partner changes his or her proportionate interest in a partnership's unrealized receivables or inventory.

When their corporation is dissolved, the corporation's creditors must be paid first before any money or property is distributed to the shareholders.After all the creditors' claims are paid, any money or property left over is distributed to the shareholders.

When either a current or liquidating disproportionate distribution is made, IRC section 751 applies to prevent the shifting of ordinary income among the LLC's members.As a result, both the member receiving the distribution and the LLC may recognize gain or loss.

Hence, the partnership must wind up its affairsliquidate assets, pay off debts, and distribute the remainder between the partners.Instead, the partnership must buy out the dissociating partner's interest. The partnership remains intact, unless the partners vote to dissolve.

The first step in termination is known as dissolution. Dissolution occurs when any partner discontinues his or her involvement in the partnership business or when there is any change in the partnership relationship. The second step is known as winding up.Once winding up is complete, the partnership is terminated.

The term "dissolution" refers to the systemic closing down of a business entity, while "winding up" refers to the selling of assets and payment of debts prior to closing a business.

Do partnership distributions have to be equal? Partner equity does not typically equate to equivalent investment contributions from all business partners. Instead, partners can make equal contributions to the company and possess equal ownership rights, but make contributions in a variety of different forms.

Taxation of Distributions An LLC that does not choose to be taxed as a corporation is not a separate taxpayer. Instead, each of its members is required to report his or her proportionate share of the company's profits on his or her personal tax returns.