Employment of Chief Executive Officer with Stock Incentives

Description

How to fill out Employment Of Chief Executive Officer With Stock Incentives?

Utilize the most extensive legal catalogue of forms. US Legal Forms is the best platform for getting updated Employment of Chief Executive Officer with Stock Incentives templates. Our platform offers a huge number of legal documents drafted by licensed legal professionals and grouped by state.

To obtain a template from US Legal Forms, users just need to sign up for a free account first. If you are already registered on our platform, log in and choose the document you need and purchase it. After buying templates, users can find them in the My Forms section.

To obtain a US Legal Forms subscription online, follow the steps listed below:

- Find out if the Form name you have found is state-specific and suits your needs.

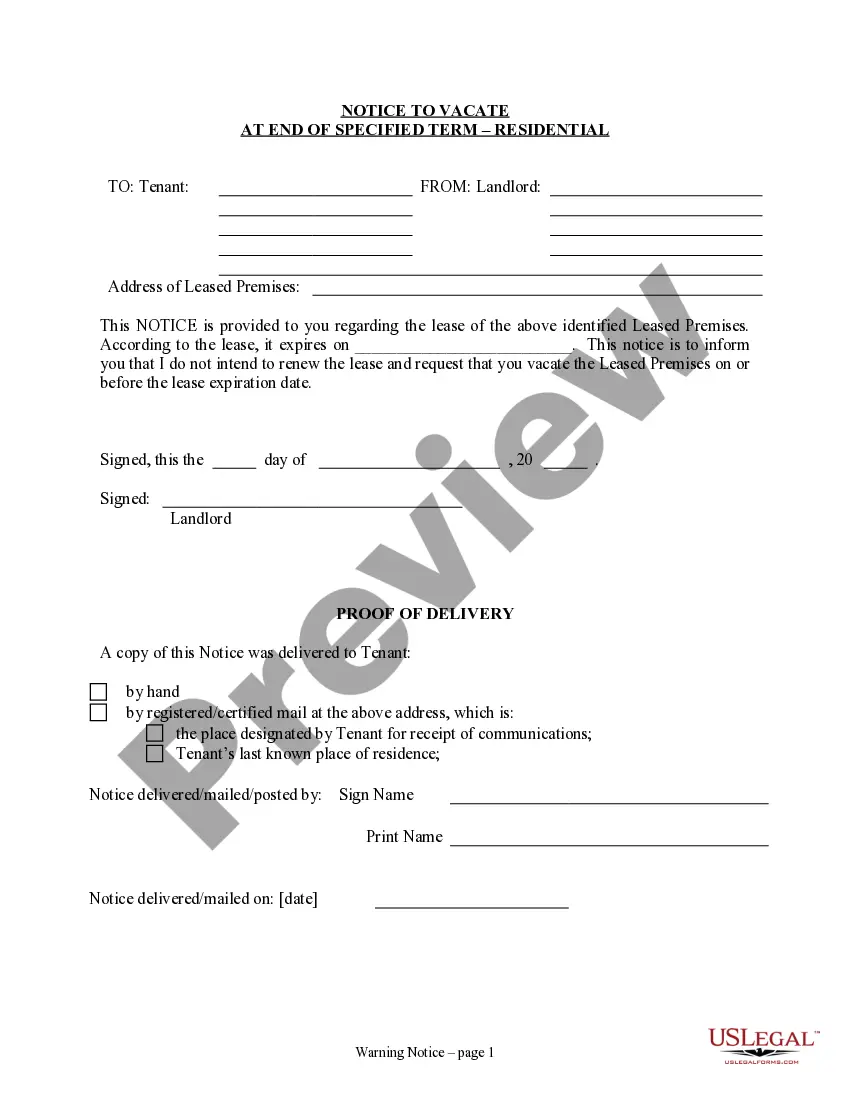

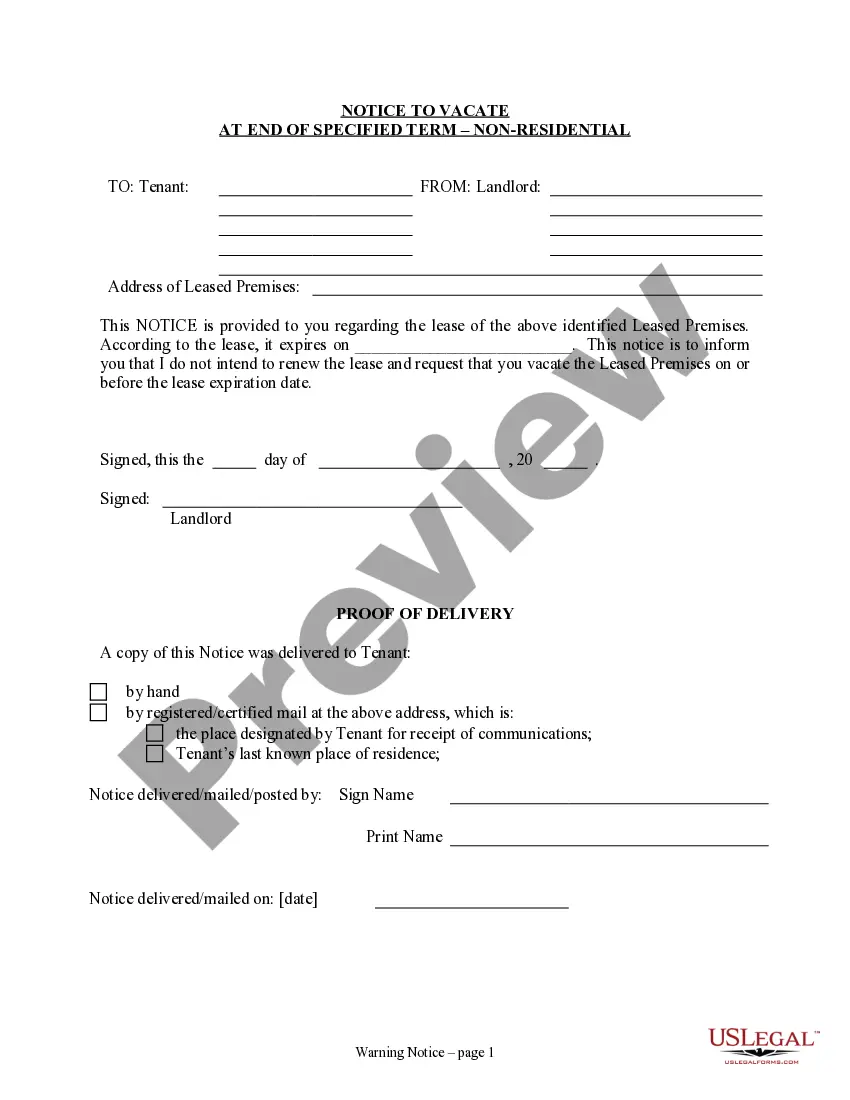

- In case the form features a Preview function, use it to check the sample.

- In case the sample doesn’t suit you, make use of the search bar to find a better one.

- Hit Buy Now if the template corresponds to your expections.

- Choose a pricing plan.

- Create a free account.

- Pay via PayPal or with yourr credit/visa or mastercard.

- Choose a document format and download the template.

- Once it’s downloaded, print it and fill it out.

Save your time and effort using our service to find, download, and fill in the Form name. Join thousands of pleased customers who’re already using US Legal Forms!

Form popularity

FAQ

An executive stock option is a contract that grants the right to buy a specified number of shares of the company's stock at a guaranteed "strike price" for a period of time, usually several years.

Median CEO compensation is 4.6 percent of revenue CEO Update.

Executive stock options incentivize CEOs to preform at the highest level. These increases in compensationdriven by improved business performancewould not represent a transfer of wealth from shareholders to executives.

Stock Options When shares go up in value, executives can make a fortune from options. But when share prices fall, investors lose out while executives are no worse off. Indeed, some companies let executives swap old option shares for new, lower-priced shares when the company's shares fall in value.

According to the Center on Executive Compensation, "Executive pay arrangements typically consist of six distinct compensation components: salary, annual incentives, long-term incentives, benefits, perquisites and severance/change-in-control agreements."1 See High-Performing Companies Pay Executives Differently.

The price at which the options may be "exercised" is usually the price of the company's stock on the date the options are granted. If the company performs well, the stock price will increase over the exercise price, giving the options value and rewarding the executive for his role in the company's success.

Since options increase in value with the volatility of the underlying stock, executive stock options provide managers with incentives to take actions that increase firm risk.There is a statistically significant relationship between increases in option holdings by executives and subsequent increases in firm risk.

CEOs of public corporations get paid based on the recommendations of the board of directors. The pay package can include salary, bonus, stock options, and deferred compensation, along with use of the company jet to fly to the company villa in Tuscany or Aspen and a limo to drive you to an expense account lunch.

Stock Options When shares go up in value, executives can make a fortune from options. But when share prices fall, investors lose out while executives are no worse off. Indeed, some companies let executives swap old option shares for new, lower-priced shares when the company's shares fall in value.