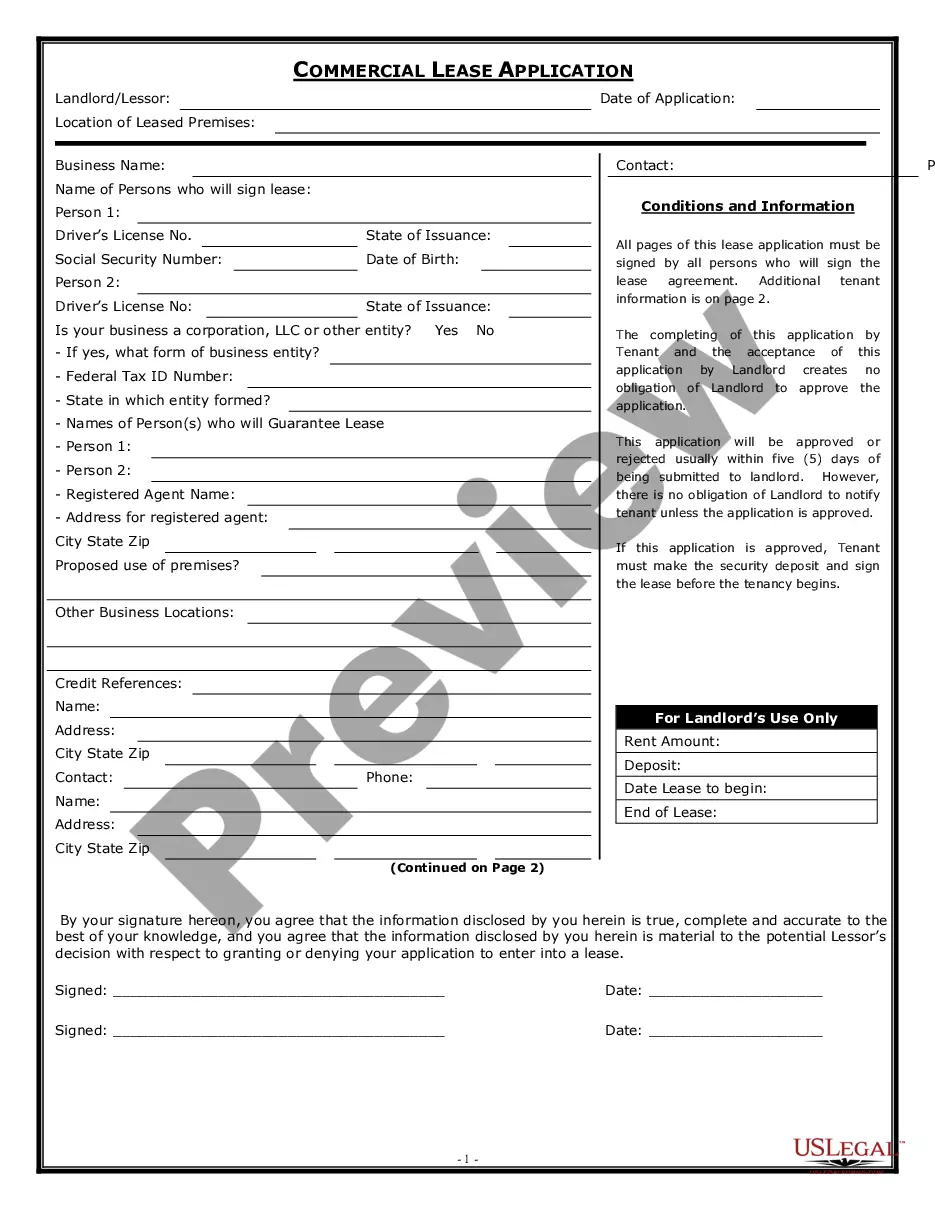

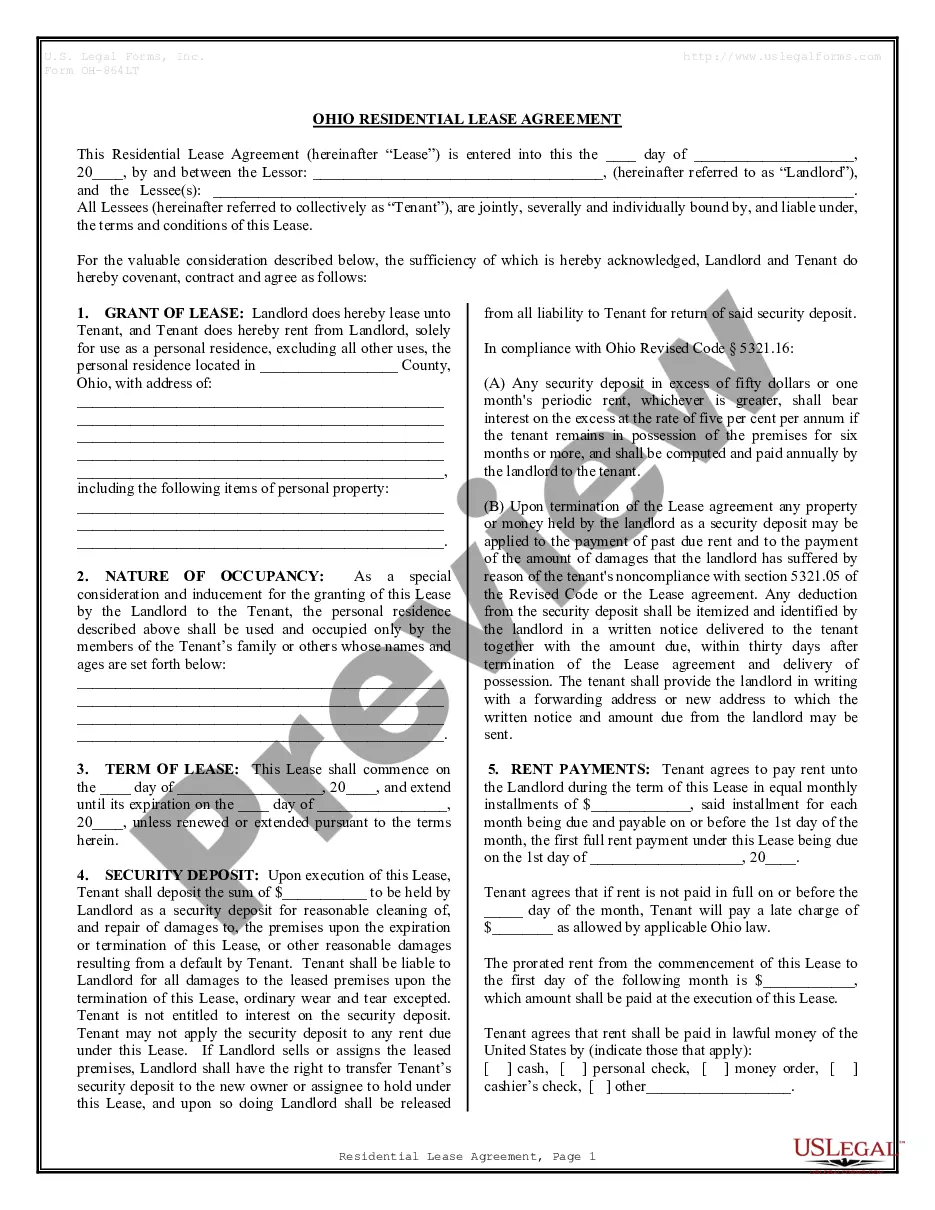

Credit Application

Description

How to fill out Credit Application?

Utilize the most comprehensive legal catalogue of forms. US Legal Forms is the perfect platform for finding updated Credit Application templates. Our service provides a large number of legal forms drafted by certified legal professionals and grouped by state.

To obtain a sample from US Legal Forms, users simply need to sign up for an account first. If you’re already registered on our platform, log in and choose the template you are looking for and buy it. Right after buying forms, users can see them in the My Forms section.

To get a US Legal Forms subscription online, follow the steps below:

- Find out if the Form name you have found is state-specific and suits your needs.

- In case the template features a Preview function, utilize it to check the sample.

- In case the template does not suit you, use the search bar to find a better one.

- Hit Buy Now if the sample corresponds to your expections.

- Select a pricing plan.

- Create a free account.

- Pay via PayPal or with the debit/bank card.

- Select a document format and download the template.

- As soon as it’s downloaded, print it and fill it out.

Save your effort and time with our service to find, download, and fill in the Form name. Join a large number of pleased subscribers who’re already using US Legal Forms!

Form popularity

FAQ

Check your credit report. Pay your bills on time. Pay off any collections. Get caught up on past-due bills. Keep balances low on your credit cards. Pay off debt rather than continually transferring it.

This information is reported to Equifax by your lenders and creditors and includes the types of accounts (for example, a credit card, mortgage, student loan, or vehicle loan), the date those accounts were opened, your credit limit or loan amount, account balances, and your payment history.

Become an authorized user. One of the simplest ways to build credit is by becoming an authorized user on a family member or friend's credit card. Apply for a secured credit card. Get credit for paying monthly utility and cell phone bills on time.

Receive sales order. The order entry department sends a copy of each sales order to the credit department. Issue credit application. Collect and review credit application. Assign credit level. Hold order (optional). Obtain credit insurance (optional). Verify remaining credit (optional). Approve sales order.

Pay bills on time. Make frequent payments. Ask for higher credit limits. Dispute credit report errors. Become an authorized user. Use a secured credit card. Keep credit cards open. Mix it up.

It will take about six months of credit activity to establish enough history for a FICO credit score, which is used in 90% of lending decisions. 1feff FICO credit scores range from 300-850, and a score of over 700 is considered a good credit score. Scores over 800 are considered excellent.

The credit application is designed to help credit professionals make the best, informed decisions about a customers' ability and willingness to meet obligations within credit terms, according to NACM's publication.

Dispute Credit-Report Mistakes. Make a Big Debt Payment. Reduce Your Credit Card Statement Balance. Become an Authorized User. Dispute Negative Authorized-User Records. Ask for a Higher Credit Limit. Write a Goodwill Letter.

A credit application is a form used by potential borrowers to get approval for credit from lenders.The information provided on credit applications is regulated, and laws such as the Truth in Lending Act provide consumer protection and transparency.