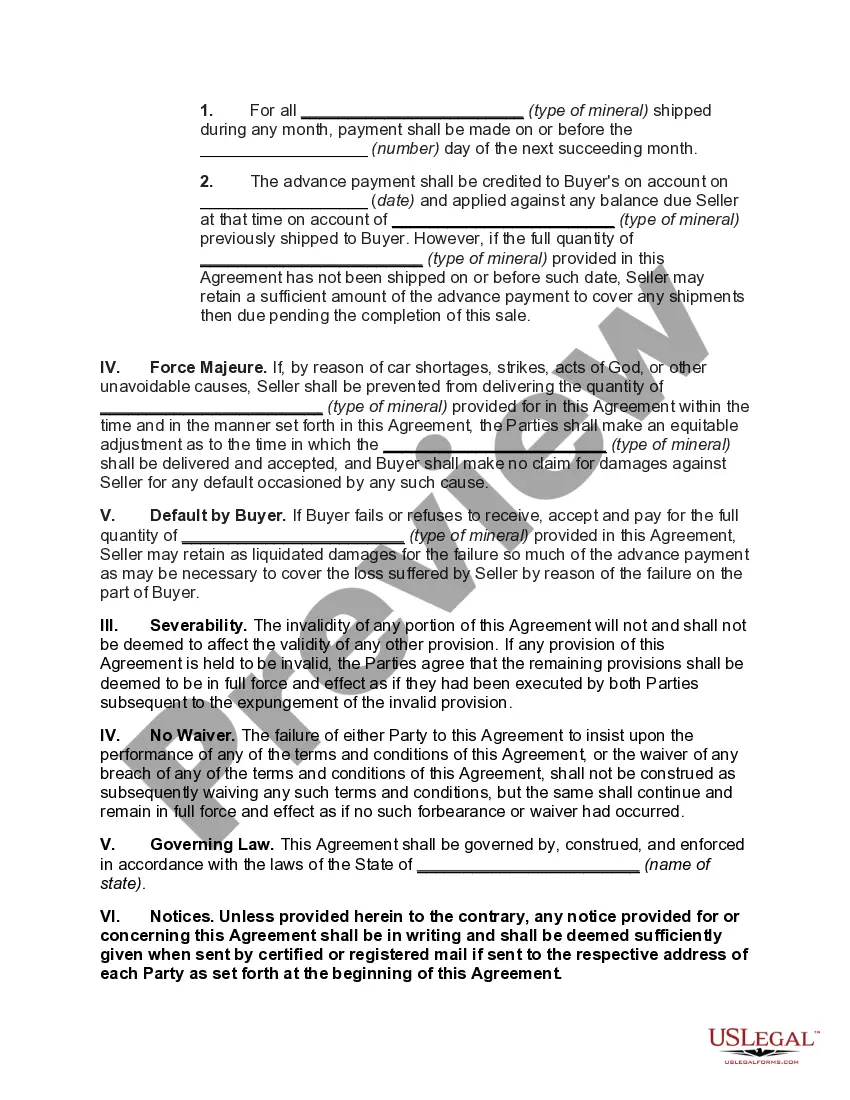

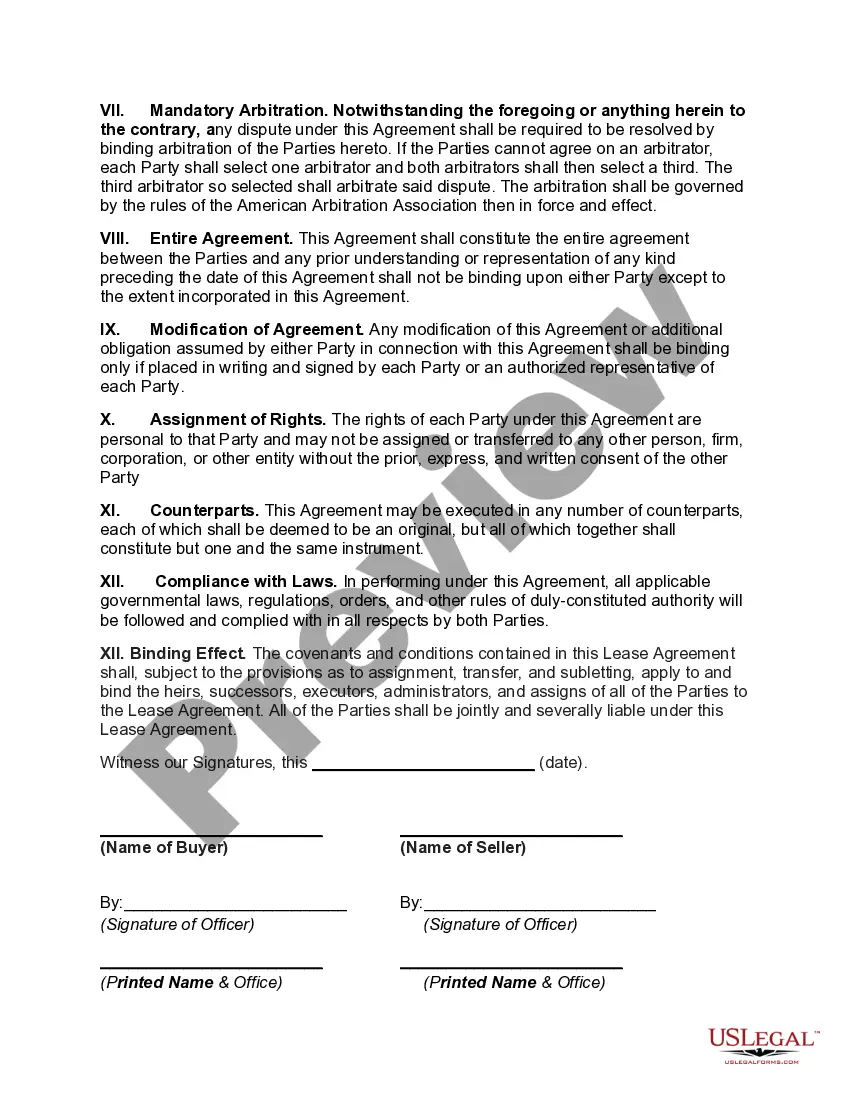

An Agreement for Sale of Fixed Amount of Mineral is a legal document that outlines the terms and conditions of a sale between a buyer and seller of a fixed amount of mineral. This agreement can be used to purchase minerals such as coal, iron ore, or natural gas. The agreement typically includes information such as the quantity of the mineral to be purchased, the price of the mineral, the delivery terms, payment terms, and the rights and responsibilities of both parties. Types of Agreement for Sale of Fixed Amount of Mineral include: 1. Lump-Sum Sale Agreement — This type of agreement allows for the buyer to purchase a fixed amount of mineral at a set price. 2. Price-Per-Unit Sale Agreement — This agreement allows for the buyer to purchase a fixed amount of mineral based on the price per unit of mineral. 3. Time-Based Sale Agreement — This agreement allows for the buyer to purchase a fixed amount of mineral over a set period of time. 4. Exclusive Sale Agreement — This agreement allows for the buyer to purchase a fixed amount of mineral exclusively from the seller.

Agreement for Sale of Fixed Amount of Mineral

Description

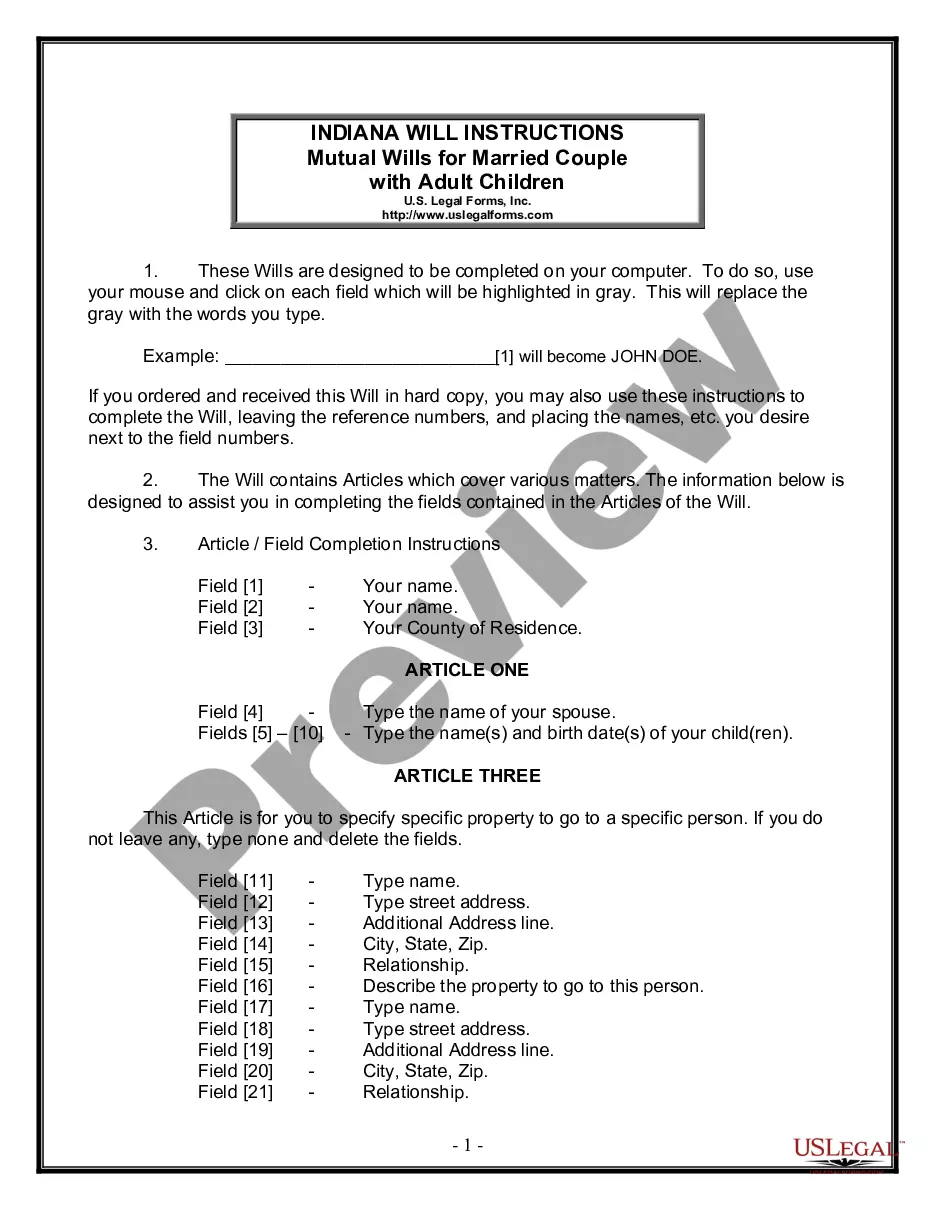

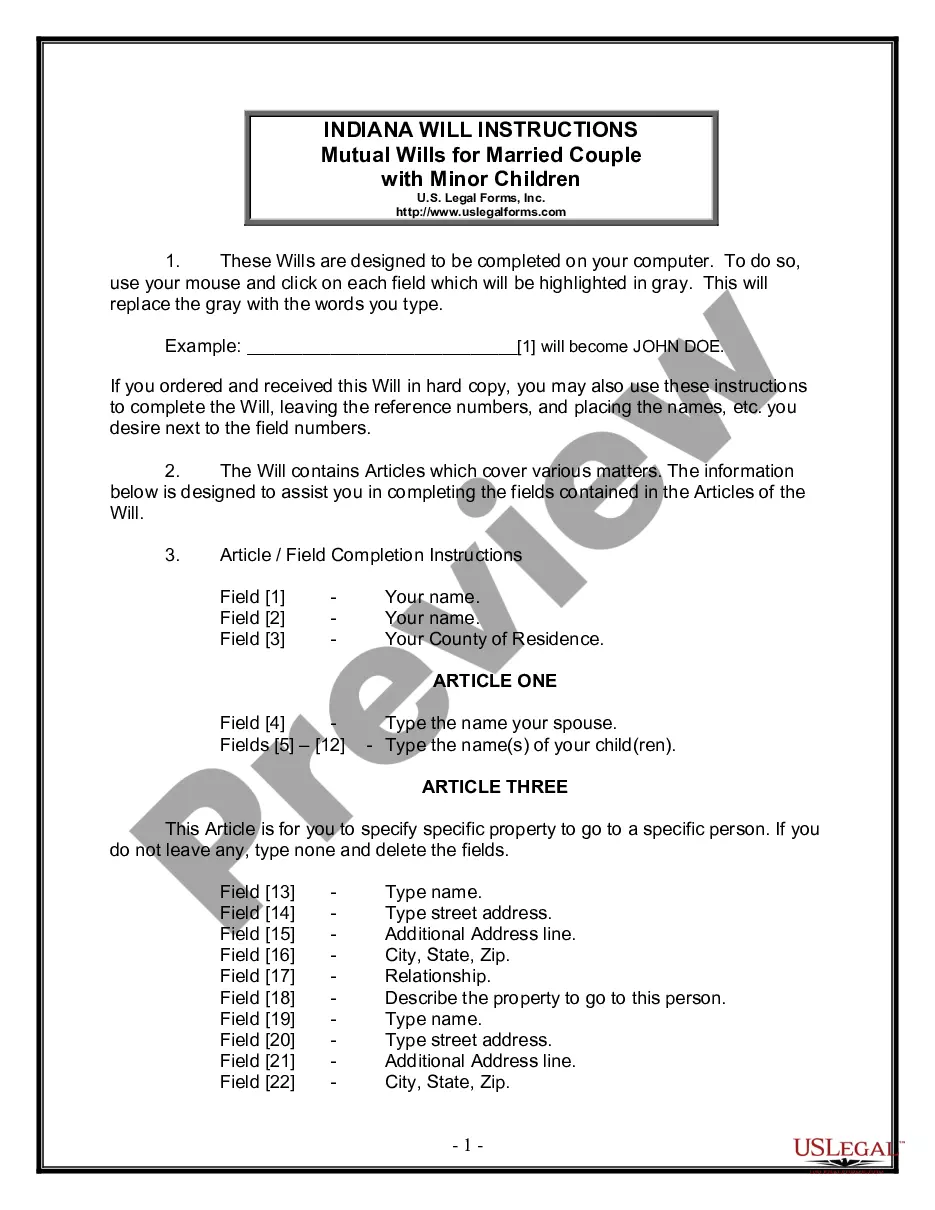

How to fill out Agreement For Sale Of Fixed Amount Of Mineral?

How much time and resources do you normally spend on composing official documentation? There’s a better opportunity to get such forms than hiring legal specialists or spending hours searching the web for an appropriate blank. US Legal Forms is the top online library that offers professionally drafted and verified state-specific legal documents for any purpose, such as the Agreement for Sale of Fixed Amount of Mineral.

To obtain and complete an appropriate Agreement for Sale of Fixed Amount of Mineral blank, follow these simple steps:

- Examine the form content to make sure it complies with your state laws. To do so, check the form description or take advantage of the Preview option.

- In case your legal template doesn’t meet your needs, locate a different one using the search bar at the top of the page.

- If you are already registered with our service, log in and download the Agreement for Sale of Fixed Amount of Mineral. Otherwise, proceed to the next steps.

- Click Buy now once you find the right document. Opt for the subscription plan that suits you best to access our library’s full service.

- Create an account and pay for your subscription. You can make a payment with your credit card or via PayPal - our service is totally safe for that.

- Download your Agreement for Sale of Fixed Amount of Mineral on your device and fill it out on a printed-out hard copy or electronically.

Another advantage of our service is that you can access previously acquired documents that you securely store in your profile in the My Forms tab. Get them at any moment and re-complete your paperwork as frequently as you need.

Save time and effort preparing legal paperwork with US Legal Forms, one of the most reliable web services. Sign up for us today!

Form popularity

FAQ

Mineral rights do not necessarily transfer with the property. Typically, a property conveyance (sale) transfers the rights of both the surface land and the minerals underneath until the mineral rights are sold. Mineral rights convey or are conveyed ? meaning transferred to a new owner ? through a deed.

A property owner with mineral rights may explore, extract, and sell natural deposits found underneath the land surface. But surface rights only refer to exclusive rights to all physical property on the land.

Mineral rights are automatically included as a part of the land in a property conveyance, unless and until the ownership gets separated at some point by an owner/seller. An owner can separate the mineral rights from land by: Conveying (selling or otherwise transferring) the land but retaining the mineral rights.

Mineral rights are ownership rights that allow the owner the right to exploit minerals from underneath a property. The rights refer to solid and liquid minerals, such as gold and oil. Mineral rights can be separate from surface rights and are not always possessed by the property owner.

While the royalties you could earn from your ownership of mineral rights are taxed as ordinary income, the IRS considers the amount gained from selling those rights to be a capital gain.

What does it mean to sell a property and retain mineral rights? A seller who wishes to sell a parcel of land can decide to limit the access of the new owner to everything above the surface, which is covered by the surface rights. As a result, the seller will still have rights over any minerals beneath the land.

Mineral rights generally include the right to sell all or part of the interest, the right to enter the land to produce and carry on production activities, the right to lease the mineral rights to others, and the right to create fractional shares of the mineral interest.