A Consolidation Agreement is a legal contract between two or more parties that combines multiple debts into one single payment. This agreement is typically used to reduce the overall debt burden of the parties involved and can include various types of debt, such as mortgages, auto loans, credit card debt, student loans, and other secured and unsecured debt. It is important to note that Consolidation Agreements do not necessarily reduce the total amount of debt owed, but instead can spread the payments out over a longer period of time, resulting in lower monthly payments. Types of Consolidation Agreements include debt consolidation loans, debt management plans, debt settlement programs, and debt consolidation companies. Debt consolidation loans involve taking out a new loan to pay off multiple existing debts. Debt management plans involve working with a credit counseling agency to negotiate with creditors to lower interest rates and/or waive fees. Debt settlement programs involve working with a debt settlement company to negotiate with creditors to reduce the amount of debt owed. Debt consolidation companies provide services to help individuals consolidate multiple debts into one single payment.

Consolidation Agreement

Description

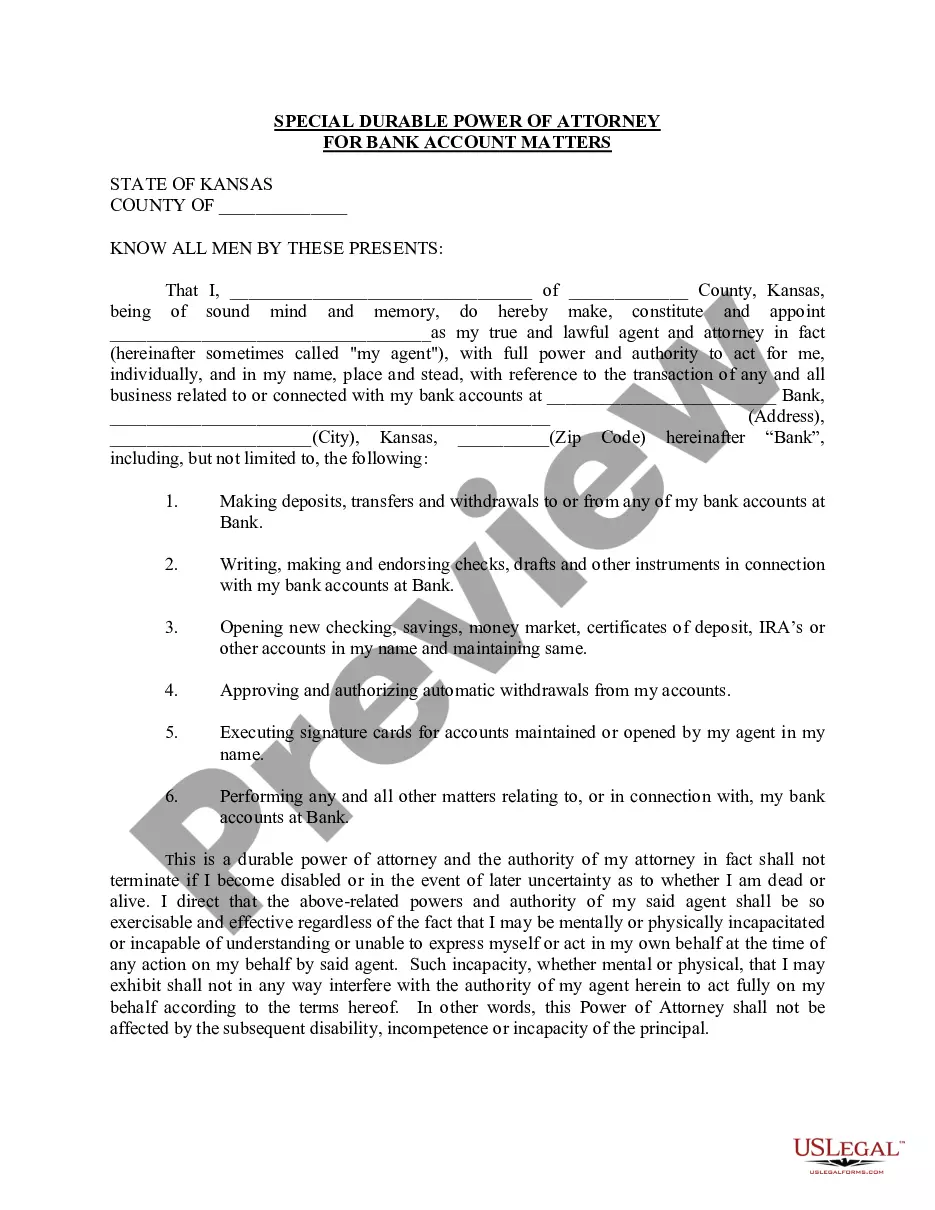

How to fill out Consolidation Agreement?

Preparing legal paperwork can be a real stress unless you have ready-to-use fillable templates. With the US Legal Forms online library of formal documentation, you can be confident in the blanks you obtain, as all of them correspond with federal and state laws and are examined by our experts. So if you need to prepare Consolidation Agreement, our service is the perfect place to download it.

Obtaining your Consolidation Agreement from our library is as simple as ABC. Previously registered users with a valid subscription need only log in and click the Download button once they locate the correct template. Afterwards, if they need to, users can pick the same document from the My Forms tab of their profile. However, even if you are new to our service, signing up with a valid subscription will take only a few minutes. Here’s a quick instruction for you:

- Document compliance check. You should carefully review the content of the form you want and make sure whether it satisfies your needs and fulfills your state law requirements. Previewing your document and reviewing its general description will help you do just that.

- Alternative search (optional). If there are any inconsistencies, browse the library through the Search tab on the top of the page until you find a suitable blank, and click Buy Now when you see the one you want.

- Account creation and form purchase. Create an account with US Legal Forms. After account verification, log in and choose your most suitable subscription plan. Make a payment to proceed (PayPal and credit card options are available).

- Template download and further usage. Select the file format for your Consolidation Agreement and click Download to save it on your device. Print it to fill out your paperwork manually, or use a multi-featured online editor to prepare an electronic version faster and more efficiently.

Haven’t you tried US Legal Forms yet? Subscribe to our service today to get any official document quickly and easily whenever you need to, and keep your paperwork in order!

Form popularity

FAQ

In other words, it's when two companies (or more) merge and become one. Many of the world's largest corporations were formed by business consolidation, while more recent examples include Facebook's acquisition of Instagram and Disney's acquisition of Fox.

Debt consolidation means that your various debts?whether credit card bills or other loan payments?are rolled into one loan or monthly payment. If you have multiple credit card accounts or loans, consolidation may be a way to simplify or lower payments.

Contract consolidation is when a number of contracts for similar goods or services are combined together to form one single, larger contract. This can help governments and local authorities save money and cut down on admin.

The benefits may include cost savings, quality improvements, reductions in acquisition cycle times, better terms and conditions, and any other identifiable benefits. exceed the benefits of each of the alternative strategies. This is the threshold for a benefit analysis involving a consolidation.

It makes all data management information available quickly and easily, and having all data in one place increases productivity and efficiency. Consolidation also reduces operational costs and facilitates compliance with data laws and regulations.

: the act or process of consolidating : the state of being consolidated. : the process of uniting : the quality or state of being united. specifically : the unification of two or more corporations by dissolution of existing ones and creation of a single new corporation.