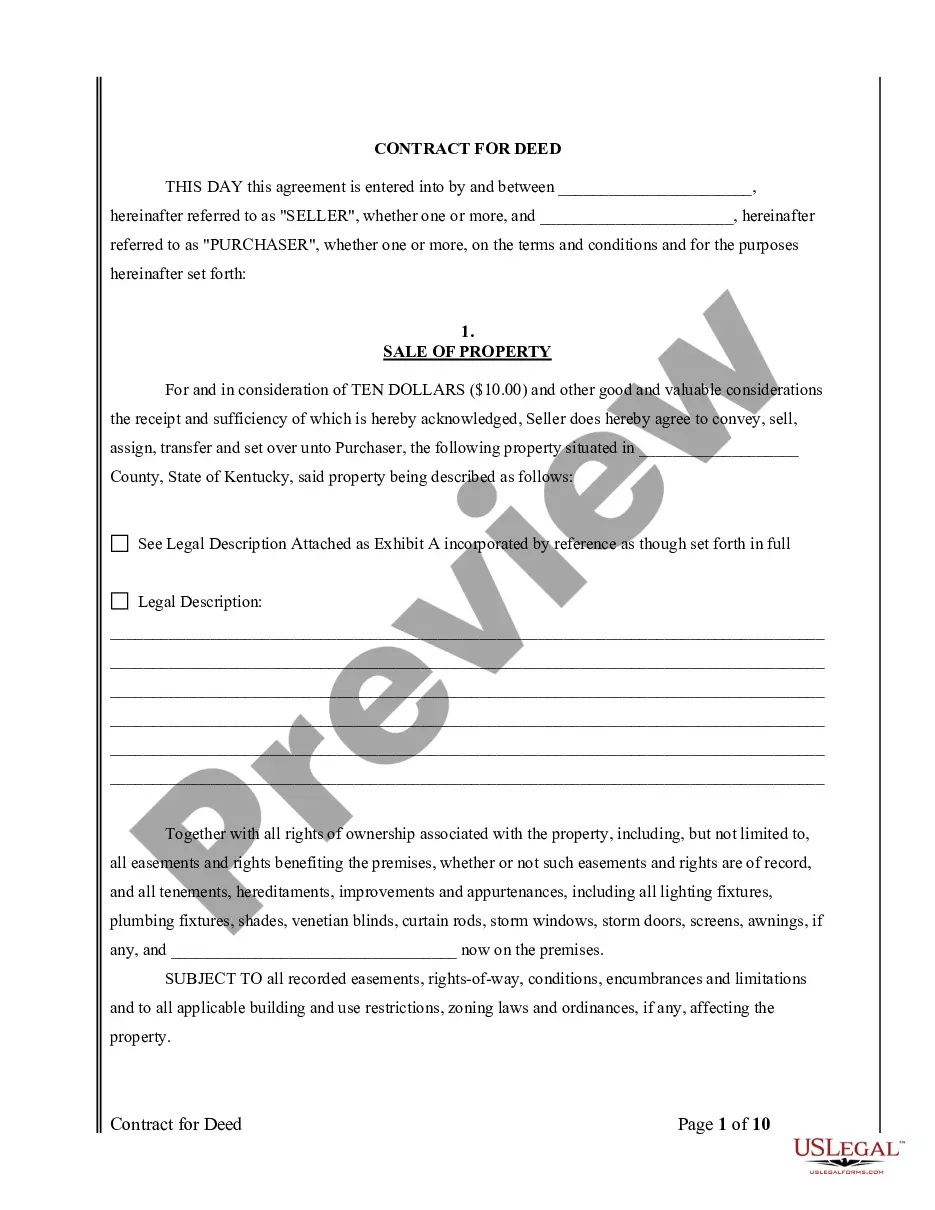

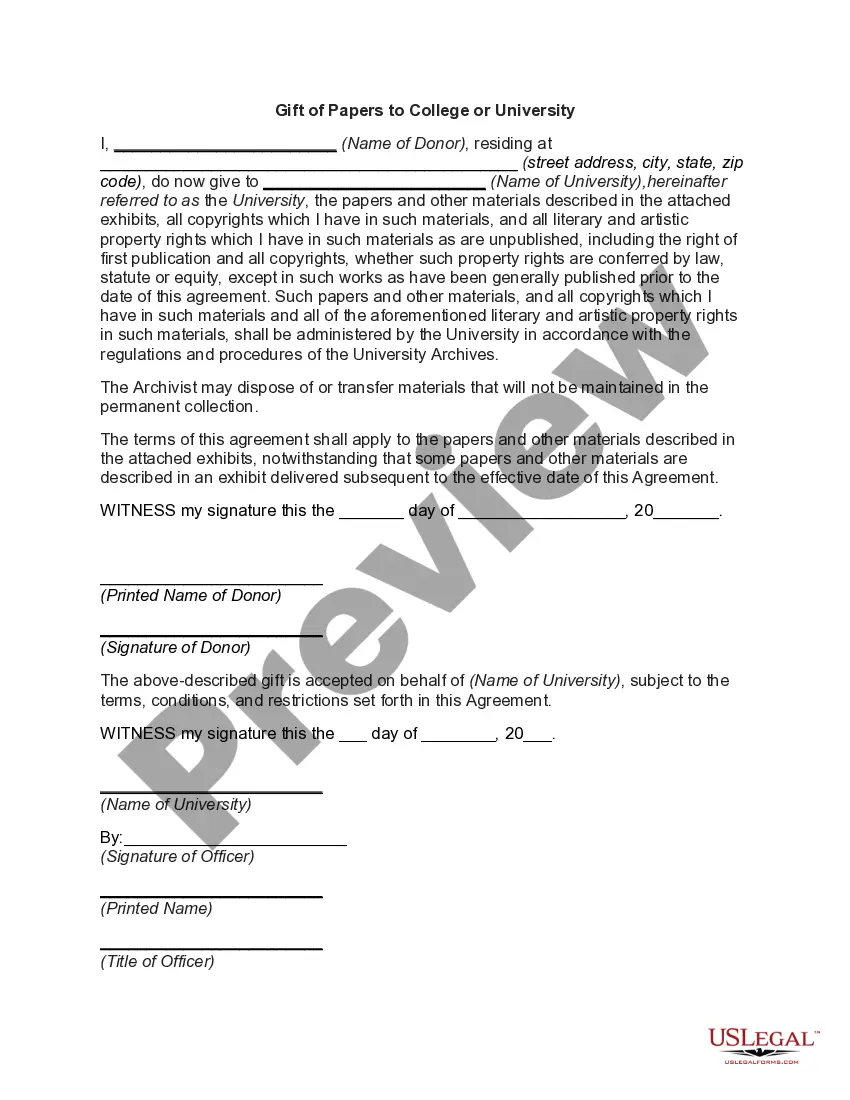

Gift of Papers to College or University is a type of donation that allows alumni and generous donors to contribute to the educational mission of the institution. This type of donation is typically used to fund scholarships, research, and other activities that benefit the institution. Gifts of Papers can take the form of bequests, stocks, bonds, and other investments. It can also include tangible items such as books, artwork, and other items of significant value. In the case of a bequest, a donor can designate a specific amount of money or other assets to the college or university that would be used for a particular purpose. For example, the donor may choose to designate a portion of the bequest to be used for student scholarships or faculty research. The donor may also choose to have the funds held in a trust, which can be used to provide ongoing support for the institution. Stocks and bonds are another way to make a Gift of Papers to College or University. A donor can donate stocks and bonds to the college or university and designate how the funds should be used. For instance, the donor may designate that the funds be used for student financial aid, faculty research, or to purchase new equipment. Other investments that can be made as a Gift of Papers to College or University include real estate, art, and antiques. Donors can donate these types of gifts to the college or university and specify how the funds should be used. Finally, tangible items such as books, artwork, and other items of significant value can also be donated as a Gift of Papers to College or University. These items can be used to support the educational mission of the institution or to enhance its reputation.

Gift of Papers to College or University

Description

How to fill out Gift Of Papers To College Or University?

If you’re searching for a way to properly complete the Gift of Papers to College or University without hiring a lawyer, then you’re just in the right spot. US Legal Forms has proven itself as the most extensive and reliable library of formal templates for every individual and business situation. Every piece of documentation you find on our online service is designed in accordance with federal and state regulations, so you can be certain that your documents are in order.

Adhere to these straightforward guidelines on how to obtain the ready-to-use Gift of Papers to College or University:

- Make sure the document you see on the page corresponds with your legal situation and state regulations by examining its text description or looking through the Preview mode.

- Enter the document name in the Search tab on the top of the page and select your state from the dropdown to find an alternative template in case of any inconsistencies.

- Repeat with the content verification and click Buy now when you are confident with the paperwork compliance with all the requirements.

- Log in to your account and click Download. Sign up for the service and opt for the subscription plan if you still don’t have one.

- Use your credit card or the PayPal option to pay for your US Legal Forms subscription. The blank will be available to download right after.

- Choose in what format you want to get your Gift of Papers to College or University and download it by clicking the appropriate button.

- Import your template to an online editor to fill out and sign it rapidly or print it out to prepare your paper copy manually.

Another wonderful thing about US Legal Forms is that you never lose the paperwork you acquired - you can find any of your downloaded templates in the My Forms tab of your profile any time you need it.

Form popularity

FAQ

The Deed of Gift is a formal and legal agreement between you, the donor, and Special Collections that transfers ownership of and legal rights to the donated materials.

With a generous annual gift of $50,000, these contributors provide vital support for the dean's priorities. They are recognized at a Harvard Yard Society event and on the donor wall during the subsequent academic year.

The Elements of a Deed of Gift The typical deed of gift identifies the donor, describes the materials, transfers legal ownership of the materials to the repository, establishes provisions for use, specifies ownership of intellectual property rights, and indicates disposition of unwanted materials.

It's not $500,000. It's not $1 million. It's not $5 million. It's $10 million or more ? from someone with an established, preexisting relationship with the school (not from a parent with no ties to Harvard whose child is ? surprise ? applying next year.

Valuing your school donations The IRS allows you to deduct the value of cash and property you contribute to a nonprofit school during the year. Contributions of property require you to assess its fair market value on the date you make the donation. Various valuation methods are used, depending on the type of property.

Yes. Harvard University accepts both checks and credit cards. Are donations tax-deductible in the United States? Yes.

If you would like to make a gift today to the University, Schools, or affiliates, you may do so by credit card, stock transfer, or mutual fund transfer using our online giving forms.

It's not $5 million. It's $10 million or more ? from someone with an established, preexisting relationship with the school (not from a parent with no ties to Harvard whose child is ? surprise ? applying next year. And even $10 million will not guarantee your child's case for admission to Harvard.