A Checklist of Matters to be Considered when Drafting Certificates in Connection with Conduct of Business under Fictitious or Assumed Name is a document which outlines the legal requirements for businesses operating under a fictitious or assumed name. This document is designed to help legal professionals understand the requirements that must be met in order to conduct business under a fictitious or assumed name. The checklist typically includes items such as: • Verifying the name of the business is distinct from any other business registered in the state or locality; • Obtaining a fictitious or assumed name certificate from the state; • Publishing notice of the assumed name in a local newspaper; • Filing the certificate with the state’Secretarstatuettete; • Registering the business name with the state’s department of taxation; • Obtaining necessary permits or licenses; • Posting a notice of assumed name in the business establishment; • Notifying banks, creditors, customers, and other parties of the assumed name; • Obtaining an Employer Identification Number (EIN) from the Internal Revenue Service (IRS); and • Adopting a corporate resolution or partnership agreement to adopt the assumed name. Different types of Checklist of Matters to be Considered when Drafting Certificates in Connection with Conduct of Business under Fictitious or Assumed Name include: • Sole Proprietorship: This type of checklist is typically used by entrepreneurs operating as a sole proprietor. • Partnership: This type of checklist is typically used by partnerships conducting business under a fictitious or assumed name. • Corporation: This type of checklist is typically used by corporations conducting business under a fictitious or assumed name. • Limited Liability Company (LLC): This type of checklist is typically used by LCS conducting business under a fictitious or assumed name.

Checklist of Matters to be Considered when Drafting Certificates in Connection with Conduct of Business under Fictitious of Assumed Name

Description

How to fill out Checklist Of Matters To Be Considered When Drafting Certificates In Connection With Conduct Of Business Under Fictitious Of Assumed Name?

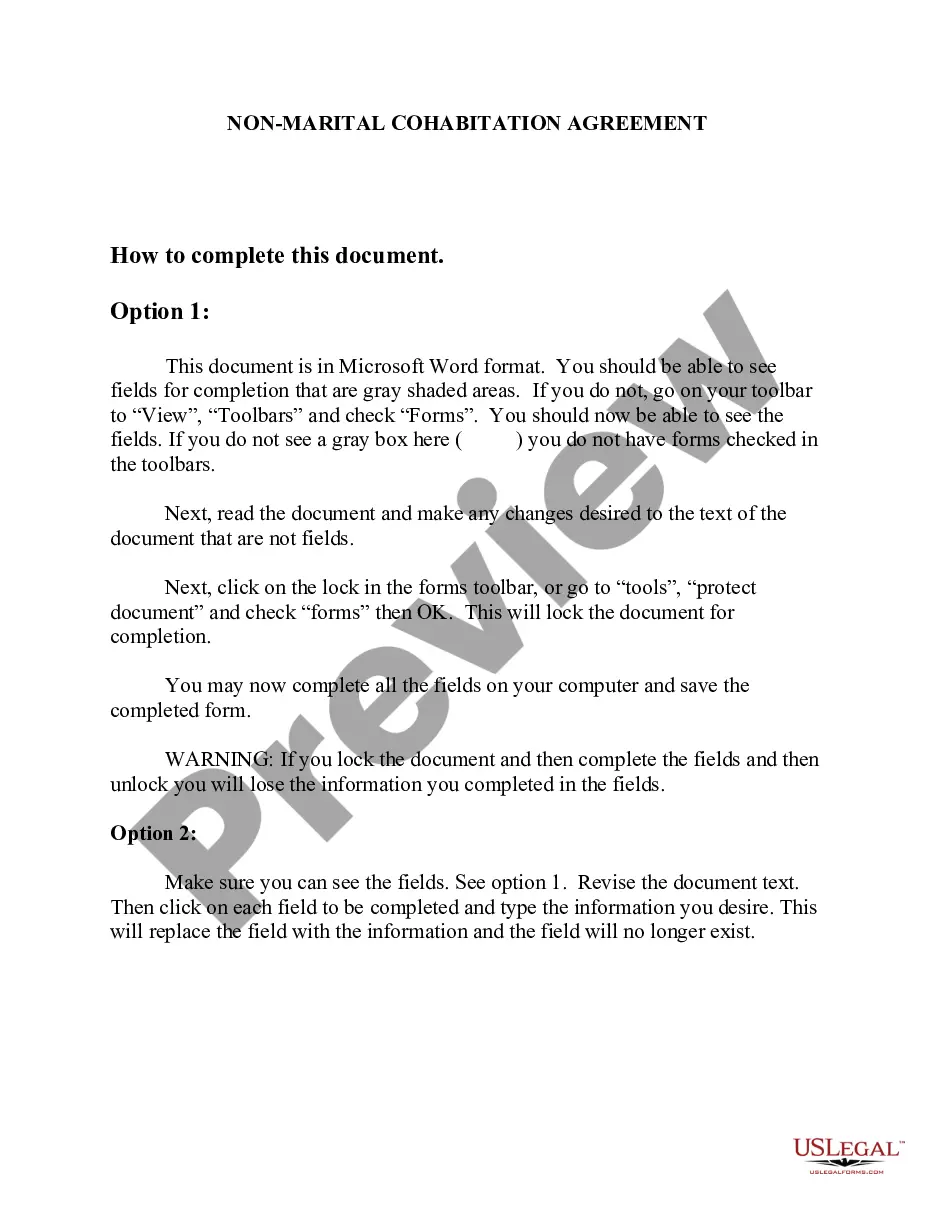

If you’re looking for a way to appropriately complete the Checklist of Matters to be Considered when Drafting Certificates in Connection with Conduct of Business under Fictitious of Assumed Name without hiring a legal professional, then you’re just in the right spot. US Legal Forms has proven itself as the most extensive and reliable library of formal templates for every private and business scenario. Every piece of documentation you find on our web service is designed in accordance with federal and state laws, so you can be sure that your documents are in order.

Adhere to these straightforward guidelines on how to get the ready-to-use Checklist of Matters to be Considered when Drafting Certificates in Connection with Conduct of Business under Fictitious of Assumed Name:

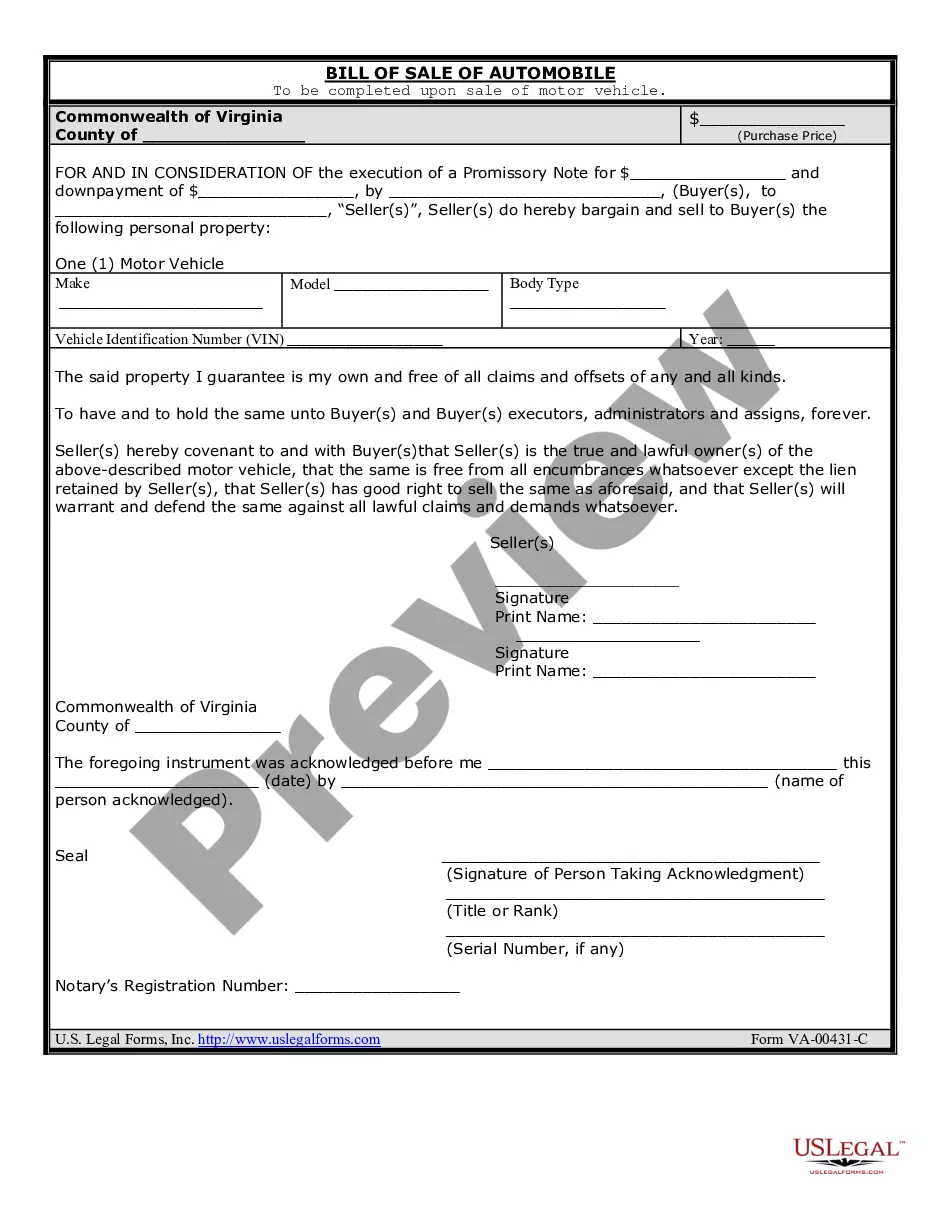

- Make sure the document you see on the page corresponds with your legal situation and state laws by checking its text description or looking through the Preview mode.

- Type in the form name in the Search tab on the top of the page and select your state from the list to find another template if there are any inconsistencies.

- Repeat with the content verification and click Buy now when you are confident with the paperwork compliance with all the requirements.

- Log in to your account and click Download. Register for the service and select the subscription plan if you still don’t have one.

- Use your credit card or the PayPal option to purchase your US Legal Forms subscription. The blank will be available to download right after.

- Decide in what format you want to save your Checklist of Matters to be Considered when Drafting Certificates in Connection with Conduct of Business under Fictitious of Assumed Name and download it by clicking the appropriate button.

- Add your template to an online editor to fill out and sign it rapidly or print it out to prepare your hard copy manually.

Another great thing about US Legal Forms is that you never lose the paperwork you purchased - you can find any of your downloaded blanks in the My Forms tab of your profile whenever you need it.

Form popularity

FAQ

A fictitious name is an artificial name deliberately created or adopted. For example, a business may have a fictitious business name. Fictitious names may also be used when filing a lawsuit against someone whose name is unknown to the plaintiff or to conceal a person's identity. See also: doing business as (DBA)

In the case of entities, such as corporations, a fictitious business name is any name different from that used in the articles of incorporation. For a natural person, an example is when Jane Doe (legal name) starts a catering business called JD Catering (fictitious business name).

In the case of a business owned by an individual, a ?fictitious business name? is any name that does not include the last name (surname) of the owner, or which implies additional owners (such as "Company", "and Company", "and Sons", "Associates", etc.).

A fictitious name is an artificial name deliberately created or adopted. For example, a business may have a fictitious business name. Fictitious names may also be used when filing a lawsuit against someone whose name is unknown to the plaintiff or to conceal a person's identity.

Examples: "Joyce Smith Catering" is not a Fictitious Business Name. "Smith and Company Catering" is a Fictitious Business Name.

An assumed business name, also called a DBA (doing business as) name, is used by an entity that is conducting business under a name that is not its legal name. Any business that uses an assumed name should take steps to comply with the assumed name statutes in the state(s) in which it does business.

A DBA (which stands for ?doing business as?) name is when the person or company does business under a name other than the legal name.

There are two important reasons for registering a fictitious business name. By registering the business, the owner can be found in case of any problems related to the enterprise. Also, a business owner with a signed contract and registered business name can better enforce a contract.