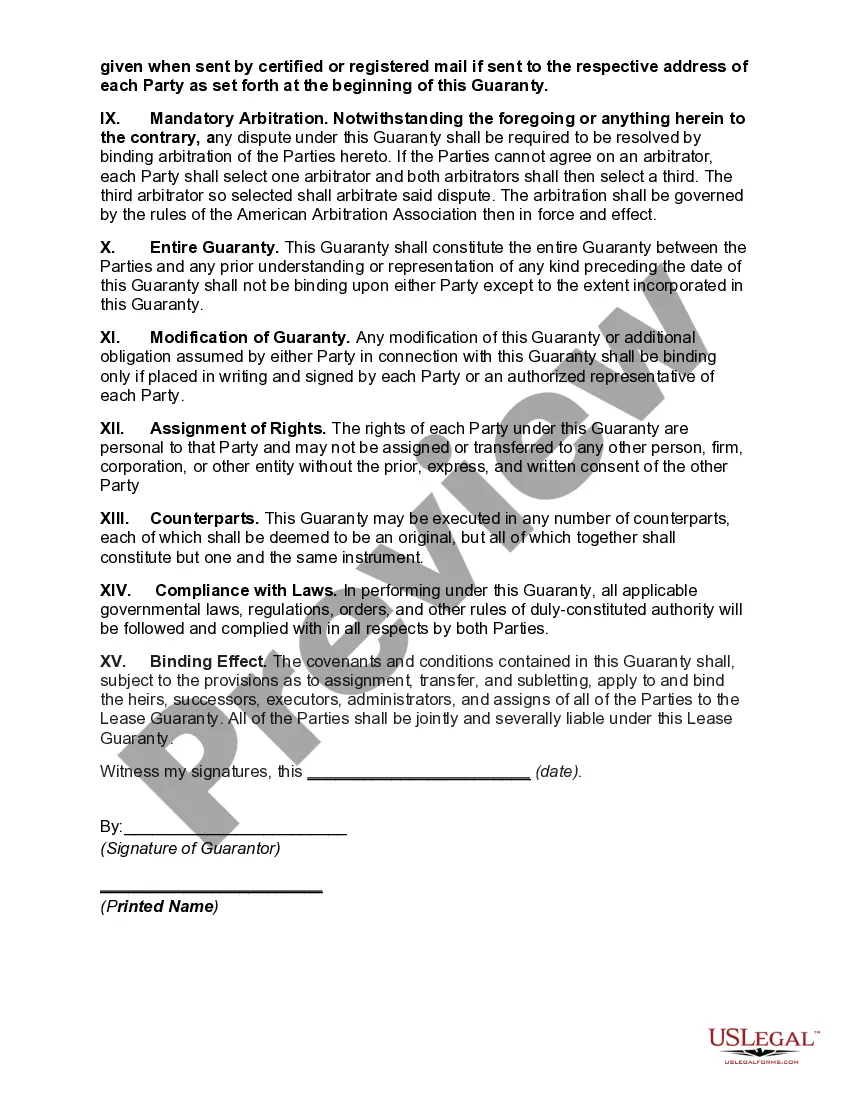

Absolute Special Guaranty of Payment of Obligation is a type of guarantee that is typically used in commercial transactions. It is a legally binding agreement between a guarantor and a creditor, where the guarantor promises to unconditionally pay off a debt should the borrower fail to do so. This guarantee is considered to be absolute since the guarantor is obligated to pay the debt regardless of any circumstances that may arise. There are two main types of Absolute Special Guaranty of Payment of Obligation: primary and secondary. A primary guarantee is when the guarantor agrees to pay the debt without the creditor having to take any additional action. A secondary guarantee is when the creditor is required to take action, such as filing a claim against the guarantor, before the guarantor is obligated to pay the debt.

Absolute Special Guaranty of Payment of Obligation

Description

How to fill out Absolute Special Guaranty Of Payment Of Obligation?

US Legal Forms is the most straightforward and cost-effective way to find suitable formal templates. It’s the most extensive web-based library of business and personal legal documentation drafted and verified by attorneys. Here, you can find printable and fillable blanks that comply with national and local regulations - just like your Absolute Special Guaranty of Payment of Obligation.

Getting your template requires just a few simple steps. Users that already have an account with a valid subscription only need to log in to the web service and download the form on their device. Later, they can find it in their profile in the My Forms tab.

And here’s how you can obtain a professionally drafted Absolute Special Guaranty of Payment of Obligation if you are using US Legal Forms for the first time:

- Look at the form description or preview the document to make certain you’ve found the one meeting your demands, or find another one utilizing the search tab above.

- Click Buy now when you’re sure of its compatibility with all the requirements, and choose the subscription plan you prefer most.

- Register for an account with our service, sign in, and purchase your subscription using PayPal or you credit card.

- Select the preferred file format for your Absolute Special Guaranty of Payment of Obligation and save it on your device with the appropriate button.

Once you save a template, you can reaccess it whenever you want - just find it in your profile, re-download it for printing and manual completion or upload it to an online editor to fill it out and sign more efficiently.

Benefit from US Legal Forms, your reliable assistant in obtaining the corresponding formal paperwork. Give it a try!

Form popularity

FAQ

A guaranty of the payment of an obligation, without words of limitation or condition, is construed as an absolute or unconditional guaranty.

Put another way, a guaranty of collection requires that the debtor must exhaust certain remedies against the debtor before proceeding against the guarantor, while a guaranty of payment means that the lender can proceed directly against the guarantor even if the debtor is solvent and otherwise able to pay.

An unlimited guarantee ? also known as an unconditional guarantee ? means guarantors are required to pay all amounts due until the note is paid in full.

A performance guarantee is an enforceable commitment by a corporate entity to supply the necessary resources to a prospective contractor and to assume all contractual obligations of the prospective contractor.

Guaranty of Collection. Guaranty agreements commonly provide that the guaranty is for "payment" and not simply a guaranty of "collection." If the agreement states that it is a "guaranty of payment," then the lender can seek recovery of the debt directly from the guarantor without first pursuing the borrower.

What is a Guaranty Of Payment? A guaranty of payment is a document that guarantees the person who signs it will pay any debts or liabilities incurred by another party. For example, this agreement can be helpful when a seller needs financial assurance from a buyer.

Guarantor unconditionally guarantees payment to Lender of all amounts owing under the Note. This Guarantee remains in effect until the Note is paid in full. Guarantor must pay all amounts due under the Note when Lender makes written demand upon Guarantor.

A guarantee is a promise by one party (the guarantor) to another party (the guaranteed party) to be responsible for the due performance of the obligations of another party (the principal) to the guaranteed party if the principal fails to perform such obligations.

What is a Guarantee of Payment (GOP)? A Guarantee of Payment (GOP) assures payment directly to a health care professional outside the U.S. for covered services. This helps prevent you from having to pay for services that would normally be covered under your plan.