A Declaration of Gift with Reservation of Interest from Gift (DR) is a legal document that records the transfer of a gift from the donor to the recipient with a reservation of interest in the gift. The document is used to protect the donor’s right to the gift if it is later determined that the gift should not have been given. It also serves as proof of the donor’s intention to transfer the gift. The two main types of DVRs are a Declaration of Gift with Reservation of Interest from Gift by Will and a Declaration of Gift with Reservation of Interest from Gift by Contract. A Declaration of Gift with Reservation of Interest from Gift by Will is a document used to transfer a gift from a donor to a recipient through a will or trust. This document protects the donor’s legal rights to the gift, since the donor may not be able to revoke the gift after it has been given. A Declaration of Gift with Reservation of Interest from Gift by Contract is a document used to transfer a gift from a donor to a recipient through a contract. This document protects the donor’s legal rights to the gift, since the donor may not be able to revoke the gift after it has been given. It is also used to establish the legal relationship between the parties involved in the gift. In both cases, the document serves to evidence the transfer of the gift and to protect the donor’s legal rights to the gift.

Declaration of Gift with Reservation of Interest from Gift

Description

How to fill out Declaration Of Gift With Reservation Of Interest From Gift?

Preparing official paperwork can be a real stress unless you have ready-to-use fillable templates. With the US Legal Forms online library of formal documentation, you can be confident in the blanks you obtain, as all of them comply with federal and state regulations and are checked by our specialists. So if you need to fill out Declaration of Gift with Reservation of Interest from Gift, our service is the perfect place to download it.

Getting your Declaration of Gift with Reservation of Interest from Gift from our catalog is as easy as ABC. Previously registered users with a valid subscription need only log in and click the Download button once they locate the proper template. Later, if they need to, users can take the same document from the My Forms tab of their profile. However, even if you are new to our service, registering with a valid subscription will take only a few moments. Here’s a brief instruction for you:

- Document compliance verification. You should carefully examine the content of the form you want and check whether it satisfies your needs and complies with your state law regulations. Previewing your document and reviewing its general description will help you do just that.

- Alternative search (optional). If there are any inconsistencies, browse the library using the Search tab on the top of the page until you find a suitable template, and click Buy Now once you see the one you need.

- Account creation and form purchase. Register for an account with US Legal Forms. After account verification, log in and select your preferred subscription plan. Make a payment to continue (PayPal and credit card options are available).

- Template download and further usage. Choose the file format for your Declaration of Gift with Reservation of Interest from Gift and click Download to save it on your device. Print it to fill out your paperwork manually, or use a multi-featured online editor to prepare an electronic copy faster and more efficiently.

Haven’t you tried US Legal Forms yet? Subscribe to our service now to get any formal document quickly and easily whenever you need to, and keep your paperwork in order!

Form popularity

FAQ

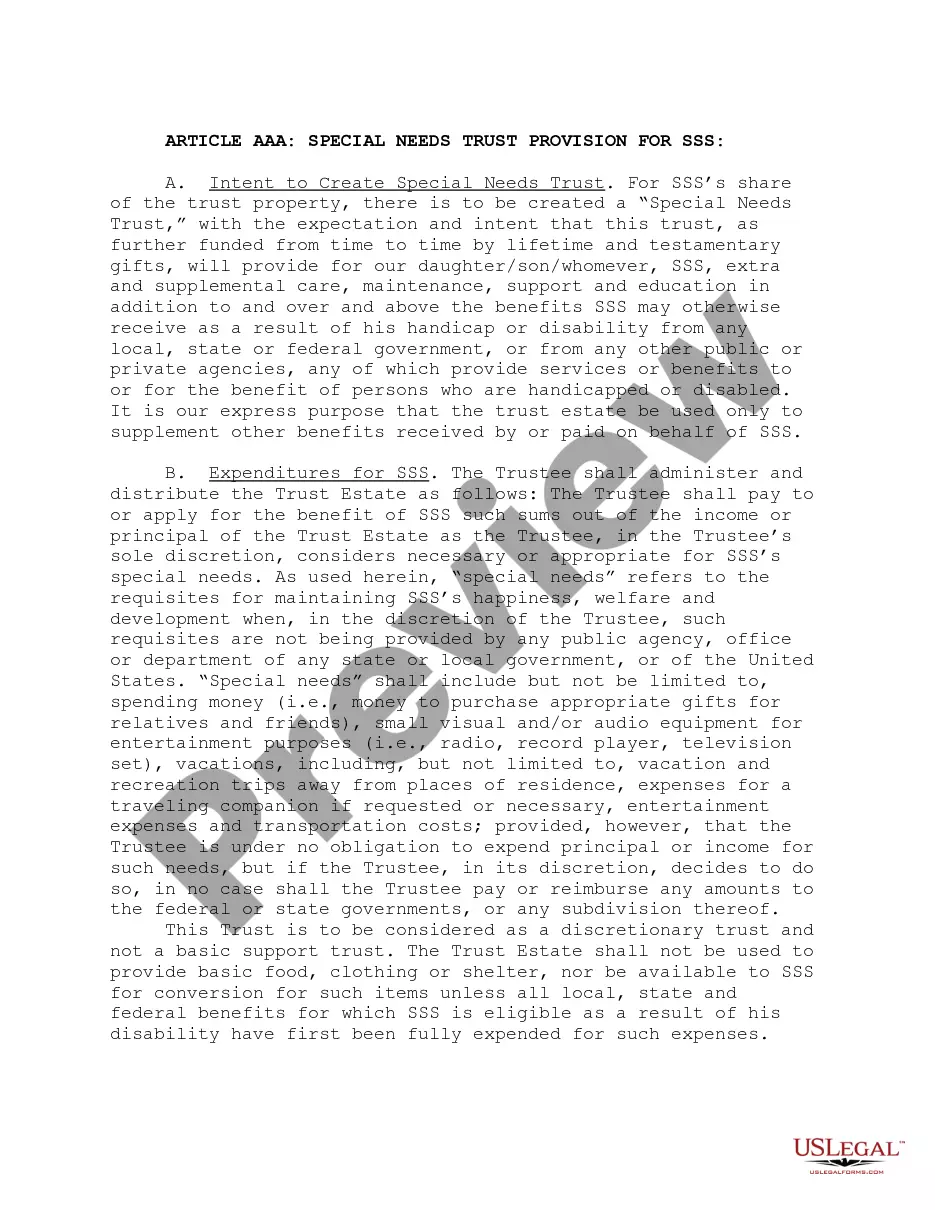

A gift with reservation (GWR) arises when an individual ostensibly makes a gift of his property to another person but retains for himself some or all of the benefit of owning the property.

A gift of a future interest is where the person who receives the gift does not yet have the unrestricted right to the immediate possession, use and enjoyment of the property, but will have these rights at a later time.

A present interest is an interest that can be presently exercised (that is, the interest holder can presently possess, use, encumber, transfer, or exclude others). A future interest is an interest that can only be exercised upon the happening of a future event, at which time it becomes a present interest.

A gift is considered a present interest if the donee has all immediate rights to the use, possession, and enjoyment of the property or income from the property.

Common examples of future-interest gifts are a life estate in real estate or money put into a trust. In either case, your beneficiary typically doesn't become the full and vested owner until your death.

How to Avoid Gift with Reservation of Benefit? If the donor continues to use an asset after they have given it away, but they pay a full market rent to the recipient for the use of the asset, the gift with reservation provisions may not apply.

If you receive a gift from a foreign individual or foreign estate, you must report it if the total value of the gift exceeds $100,000 during a given tax year.

It is important to note that a future interest, although it does not grant any present right of possession, can be transferred or even sold before it actually vests.