Depreciation Schedule

Description Depreciation Schedule Form

How to fill out Depreciation Schedule?

Use the most complete legal library of forms. US Legal Forms is the perfect place for getting updated Depreciation Schedule templates. Our service provides 1000s of legal forms drafted by licensed attorneys and categorized by state.

To get a sample from US Legal Forms, users only need to sign up for a free account first. If you are already registered on our platform, log in and choose the template you need and buy it. Right after buying forms, users can find them in the My Forms section.

To get a US Legal Forms subscription online, follow the guidelines below:

- Check if the Form name you’ve found is state-specific and suits your needs.

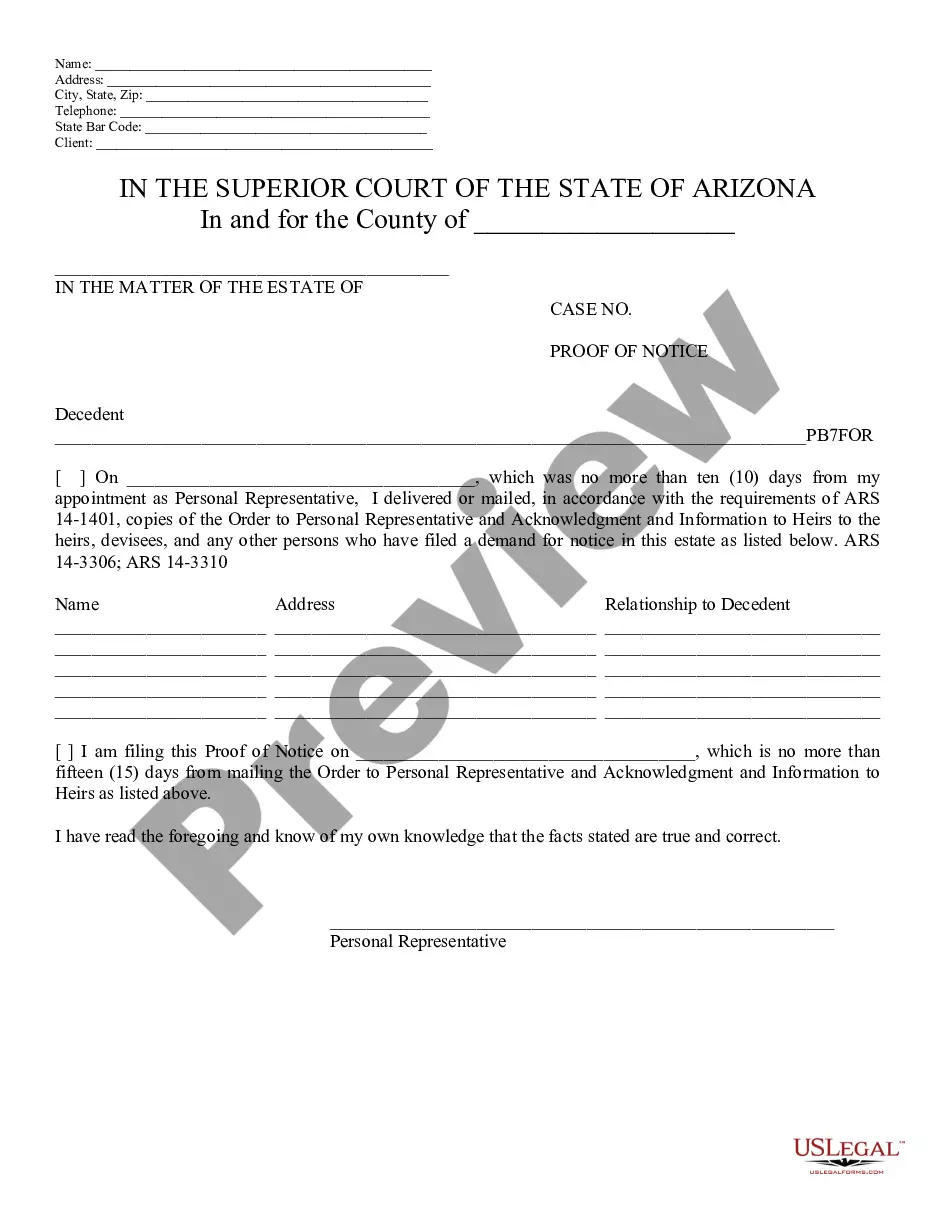

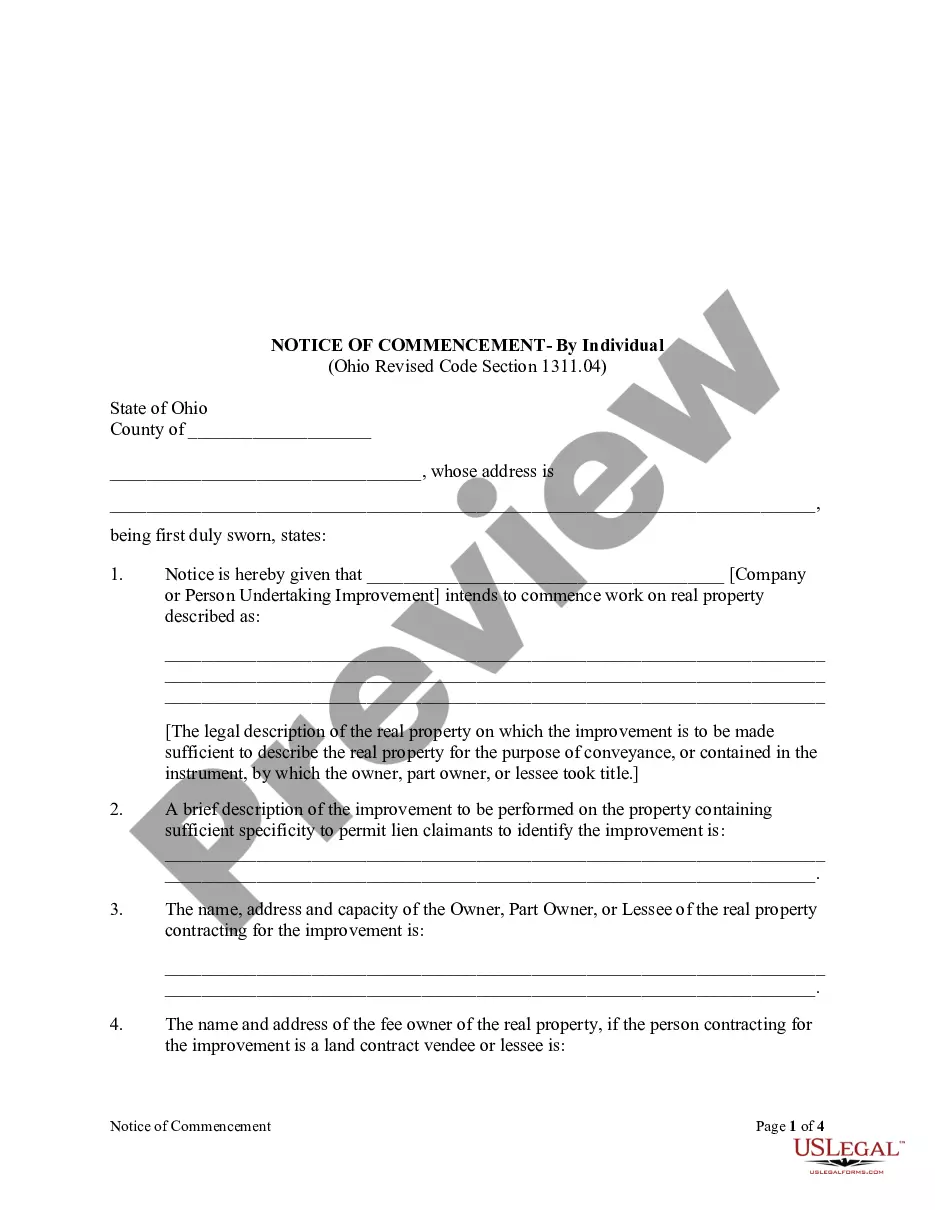

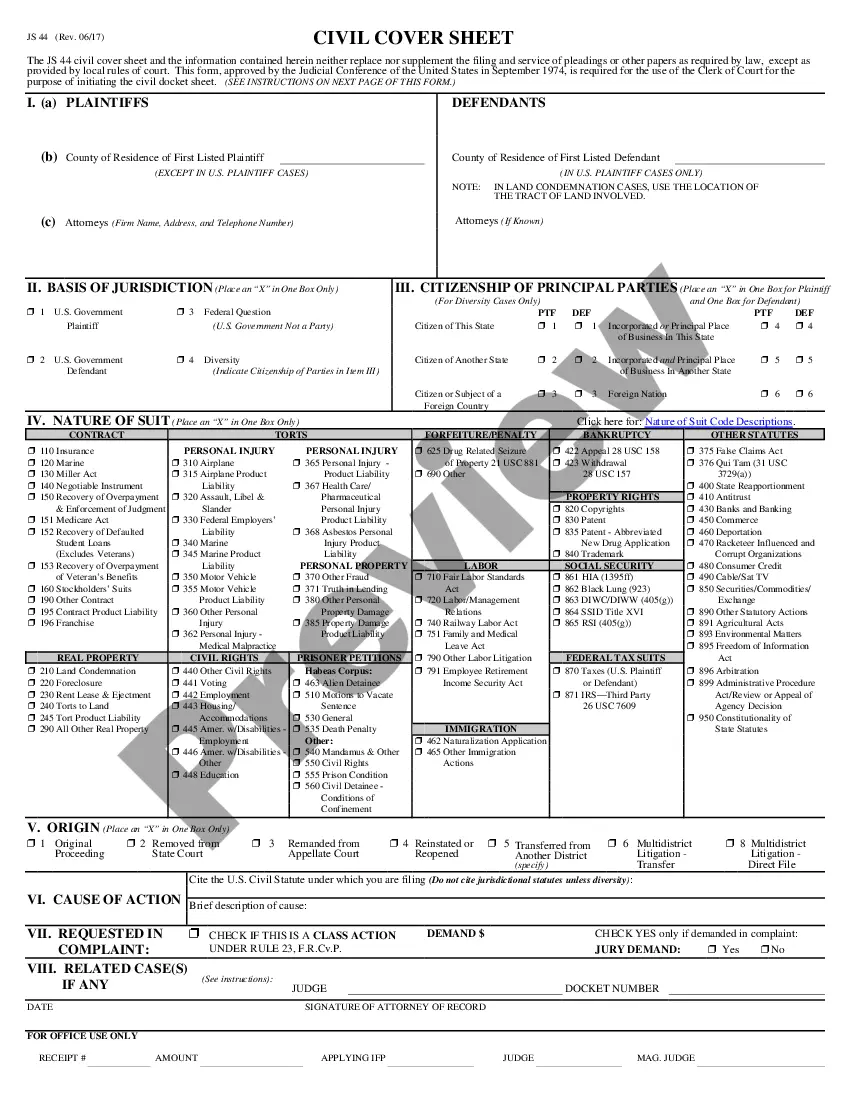

- In case the form has a Preview option, use it to check the sample.

- In case the template does not suit you, utilize the search bar to find a better one.

- Hit Buy Now if the sample meets your expections.

- Choose a pricing plan.

- Create your account.

- Pay via PayPal or with the credit/visa or mastercard.

- Choose a document format and download the sample.

- As soon as it is downloaded, print it and fill it out.

Save your effort and time with the service to find, download, and fill out the Form name. Join a large number of delighted customers who’re already using US Legal Forms!

Schedule Form Form popularity

Depreciation Schedule Other Form Names

FAQ

Claim your deduction for depreciation and amortization. Make the election under section 179 to expense certain property. Provide information on the business/investment use of automobiles and other listed property.

Depreciation of rental property is generally reported on Schedule E of a standard 1040, although there are situations in which you would use other forms. For example, Form 4562 may be used if you claim depreciation on a property in the year that you put it into service as a rental property.

You are only obligated to file Form 4562 if you're deducting a depreciable asset on your tax return. A depreciable asset is anything you buy for your business that you plan on using for more than one financial year.You'll need to file Form 4562 for every year that you continue to depreciate your asset.

There is no such thing as deferred depreciation. Depreciation as an expense must be taken in the year that it occurs. Depreciation occurs each year, as defined by the IRS guidelines, whether you choose to claim it as an expense or not.

Determine the cost of the asset. Subtract the estimated salvage value of the asset from the cost of the asset to get the total depreciable amount. Determine the useful life of the asset. Divide the sum of step (2) by the number arrived at in step (3) to get the annual depreciation.

You are only obligated to file Form 4562 if you're deducting a depreciable asset on your tax return. A depreciable asset is anything you buy for your business that you plan on using for more than one financial year.You'll need to file Form 4562 for every year that you continue to depreciate your asset.

The straight-line method is the simplest and most commonly used way to calculate depreciation under generally accepted accounting principles. Subtract the salvage value from the asset's purchase price, then divide that figure by the projected useful life of the asset.

Make sure your asset is eligible. To qualify for a Section 179 deduction, your asset must be: Tangible. Start using the asset. Section 179 rules require you to start using the asset in your business to take the deduction. Claim the deduction. You claim the Section 179 deduction on Part I of Form 4562.

Use Form 4562 to: Claim your deduction for depreciation and amortization. Make the election under section 179 to expense certain property. Provide information on the business/investment use of automobiles and other listed property.