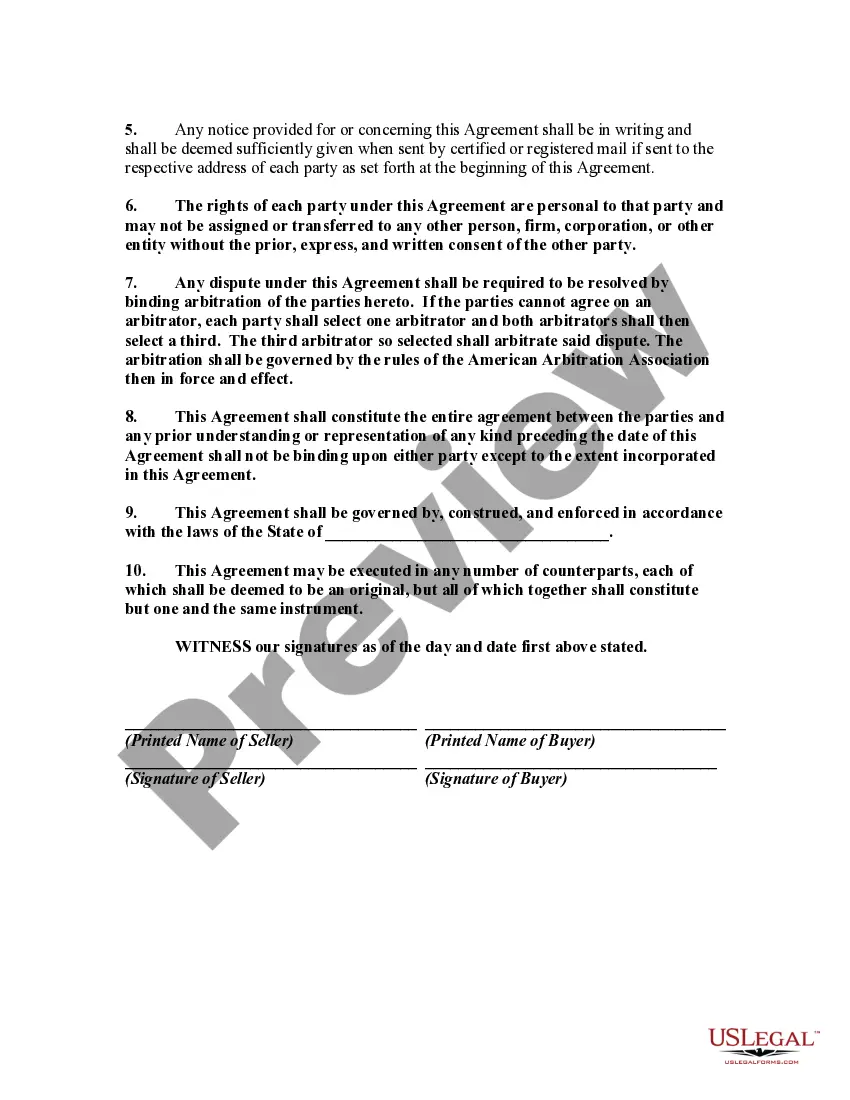

An Agreement for Sale and Purchase of Accounts Receivable is a contract between a seller and a purchaser of accounts receivable. It specifies the terms under which the seller agrees to transfer ownership of its accounts receivable to the purchaser. This agreement typically includes the purchase price of the accounts receivable, the length of the contract, and any conditions that must be met by either party for the sale and purchase to be completed. The agreement also outlines the process for transferring ownership of the accounts receivable, as well as any other relevant details, such as the seller's right to collect payments on the accounts receivable. There are two main types of Agreement for Sale and Purchase of Accounts Receivable: recourse and non-recourse. A recourse agreement allows the purchaser to seek compensation from the seller if the accounts receivable are not paid. A non-recourse agreement, on the other hand, does not allow the purchaser to seek compensation from the seller in the event of non-payment.

Agreement for Sale and Purchase of Accounts Receivable

Description Sale Of Receivables

How to fill out Agreement For Sale And Purchase Of Accounts Receivable?

If you’re searching for a way to appropriately prepare the Agreement for Sale and Purchase of Accounts Receivable without hiring a lawyer, then you’re just in the right place. US Legal Forms has proven itself as the most extensive and reputable library of official templates for every private and business scenario. Every piece of paperwork you find on our online service is designed in accordance with nationwide and state laws, so you can be sure that your documents are in order.

Adhere to these simple instructions on how to acquire the ready-to-use Agreement for Sale and Purchase of Accounts Receivable:

- Ensure the document you see on the page meets your legal situation and state laws by examining its text description or looking through the Preview mode.

- Type in the form name in the Search tab on the top of the page and select your state from the list to locate another template in case of any inconsistencies.

- Repeat with the content verification and click Buy now when you are confident with the paperwork compliance with all the requirements.

- Log in to your account and click Download. Sign up for the service and opt for the subscription plan if you still don’t have one.

- Use your credit card or the PayPal option to pay for your US Legal Forms subscription. The document will be available to download right after.

- Choose in what format you want to get your Agreement for Sale and Purchase of Accounts Receivable and download it by clicking the appropriate button.

- Add your template to an online editor to fill out and sign it rapidly or print it out to prepare your paper copy manually.

Another wonderful thing about US Legal Forms is that you never lose the paperwork you purchased - you can find any of your downloaded blanks in the My Forms tab of your profile whenever you need it.

Sale Purchase Statement Form popularity

FAQ

A purchase of receivables agreement (PORA) is not a loan. It's a financing agreement where we purchase a percentage of your future revenue. In exchange, you receive a lump sum of funds. Think of it as a cash advance on your business's future revenue.

You either retain or pass the receivables to the buyer. The choice of whether to keep or to let go depends on various factors. Since most buyers prefer a clean and free business, you are likely to retain account receivables when selling your business.

An accounts receivable purchase agreement is a contract between a buyer and seller. The seller sells receivables to get cash up front, and the buyer has the right to collect the receivables from the original customer.

Receivables purchase agreements (RPAs) are financing arrangements that can unlock the value of a company's accounts receivable. Here's how they work: A "Seller" will sell its goods to a customer (1). The customer becomes an "Account Debtor" since it owes the Seller a Debt for those goods (2).

A receivable purchase agreement is a contract between a seller and a financial institution that allows the seller to sell unpaid invoices from buyers to the financial institution. This means that the seller can enable cash flow until payment is received from the buyer.

Purchase of Accounts Receivable refers to the bank buying the creditor's rights in accounts receivable possessed by the seller (creditor) against the buyer (debtor) under the commercial contract while maintaining the recourse to the debtor. The bank may have the right of recourse to the creditor or not.

Did it make you wonder why a company would sell its receivables to another company? The answer is quite simple, to quickly and easily increase their working capital. The process is called factoring or accounts receivable financing and is an excellent alternative to traditional bank financing.