Fair Credit Act Disclosure Notice

Description Fair Credit Act Disclosure

How to fill out Fair Credit Act Disclosure Notice?

Among countless free and paid samples that you’re able to get on the web, you can't be certain about their accuracy. For example, who created them or if they’re competent enough to take care of what you need these to. Always keep relaxed and make use of US Legal Forms! Locate Fair Credit Act Disclosure Notice templates created by professional attorneys and get away from the costly and time-consuming procedure of looking for an attorney and then paying them to draft a papers for you that you can find yourself.

If you have a subscription, log in to your account and find the Download button near the form you’re trying to find. You'll also be able to access all your earlier downloaded files in the My Forms menu.

If you’re utilizing our website the very first time, follow the instructions listed below to get your Fair Credit Act Disclosure Notice quick:

- Make sure that the file you find is valid in your state.

- Look at the file by reading the description for using the Preview function.

- Click Buy Now to start the ordering procedure or find another example using the Search field in the header.

- Choose a pricing plan sign up for an account.

- Pay for the subscription using your credit/debit/debit/credit card or Paypal.

- Download the form in the required file format.

As soon as you have signed up and purchased your subscription, you may use your Fair Credit Act Disclosure Notice as many times as you need or for as long as it stays valid in your state. Change it in your favored offline or online editor, fill it out, sign it, and create a hard copy of it. Do far more for less with US Legal Forms!

Character Fair Act Form popularity

Fair Credit Disclosure Form Other Form Names

FAQ

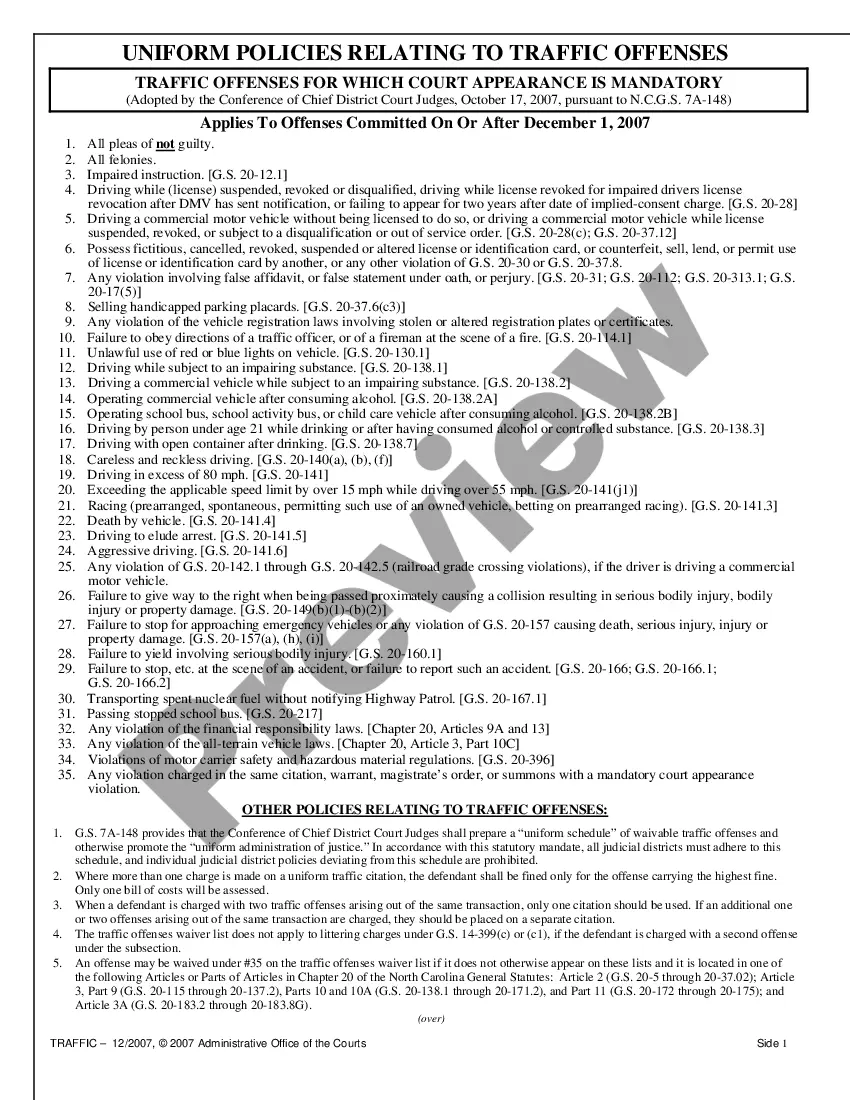

Criminal background checks will reveal felony and misdemeanor criminal convictions, any pending criminal cases, and any history of incarceration as an adult.Disclosure of convictions more than seven years old is forbidden in California, Kansas, Massachusetts, Maryland, Montana, New Hampshire, New York and Washington.

The federal Fair Credit Reporting Act (FCRA) promotes the accuracy, fairness, and privacy of information in the files of. consumer reporting agencies.

Under this new rule, lenders must provide consumers with a Risk-Based Pricing notice when a company grants credit on material terms that are materially less favorable than the most favorable terms available to a substantial proportion of the consumers. Lenders include banks, credit unions, mortgage lenders, auto

Common violations of the FCRA include: Creditors give reporting agencies inaccurate financial information about you. Reporting agencies mixing up one person's information with another's because of similar (or same) last name or social security number. Agencies fail to follow guidelines for handling disputes.

FCRA compliance is designed to protect consumers.The FCRA applies anytime an employer obtains a background check for employment purposes from a third party. These reports could include criminal history, employment and education verifications, motor vehicle reports, health care sanctions and professional licenses.

Access to Your Credit Report The act requires credit reporting agencies to provide you with any information in your credit file upon request once a year. You must have proper identification. You have a right to a free copy of your credit report within 15 days of your request.

A statement of action taken by the creditor. Either a statement of the specific reasons for the action taken or a disclosure of the applicant's right to a statement of specific reasons and the name, address, and telephone number of the person or office from which this information can be obtained.

A creditor must disclose a consumer's credit score and information relating to a credit score on a risk-based pricing notice when the score of the consumer to whom the creditor extends credit or whose extension of credit is under review is used in setting the material terms of credit.

The statement that a dispute meets the requirements of the FCRA means both that the consumer filed a formal dispute, and that the CRA has issued a formal Notice of Results of Reinvestigation finding the asserted inaccuracy has been verified as accurate.