Application for Open End Unsecured Credit is a type of credit card application that does not require the applicant to provide any form of collateral or security deposit. This type of application is typically used to obtain a line of credit with a predetermined limit and interest rate, and typically requires a credit check to be completed. There are two main types of Application for Open End Unsecured Credit: 1. Traditional Credit Card: This is the most common type of Application for Open End Unsecured Credit and typically requires a credit check, an annual fee, and a minimum monthly payment. 2. Secured Credit Card: This type of Application for Open End Unsecured Credit requires the applicant to provide some form of collateral, usually a savings account or certificate of deposit, to secure the line of credit. Secured credit cards typically have lower interest rates and fewer fees than traditional credit cards.

Application for Open End Unsecured Credit

Description

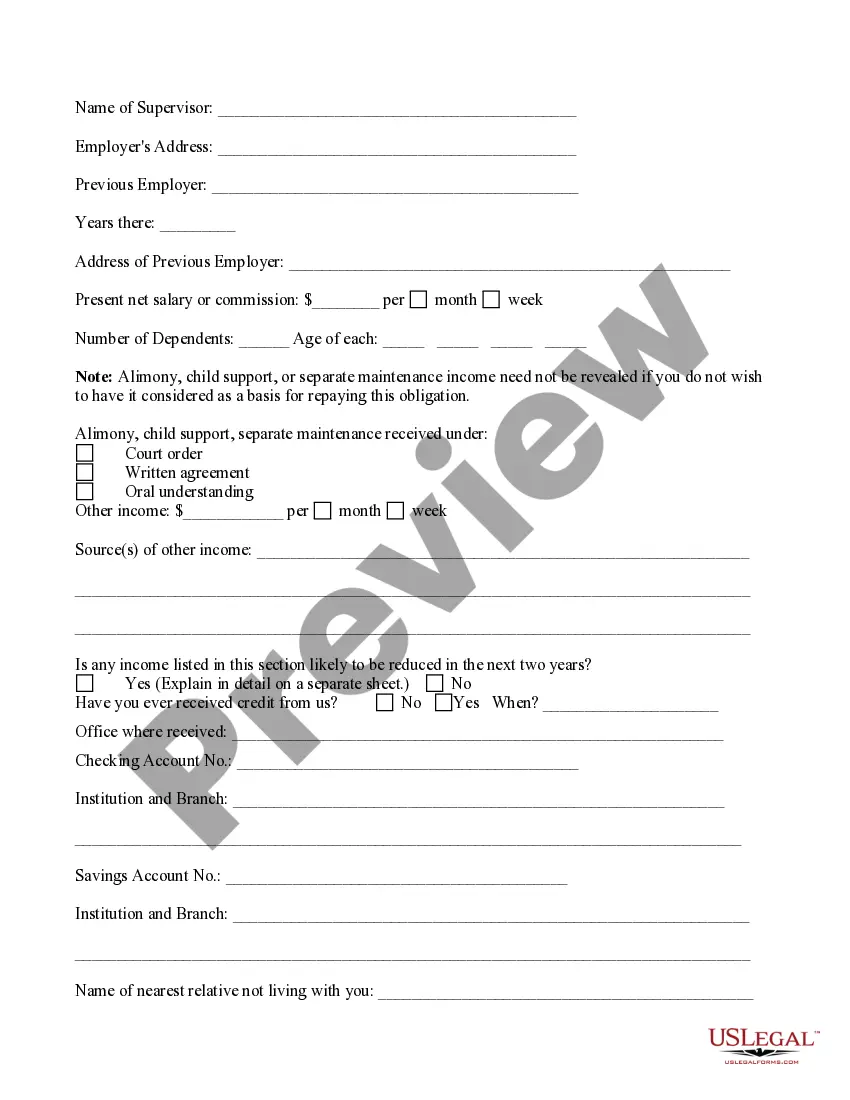

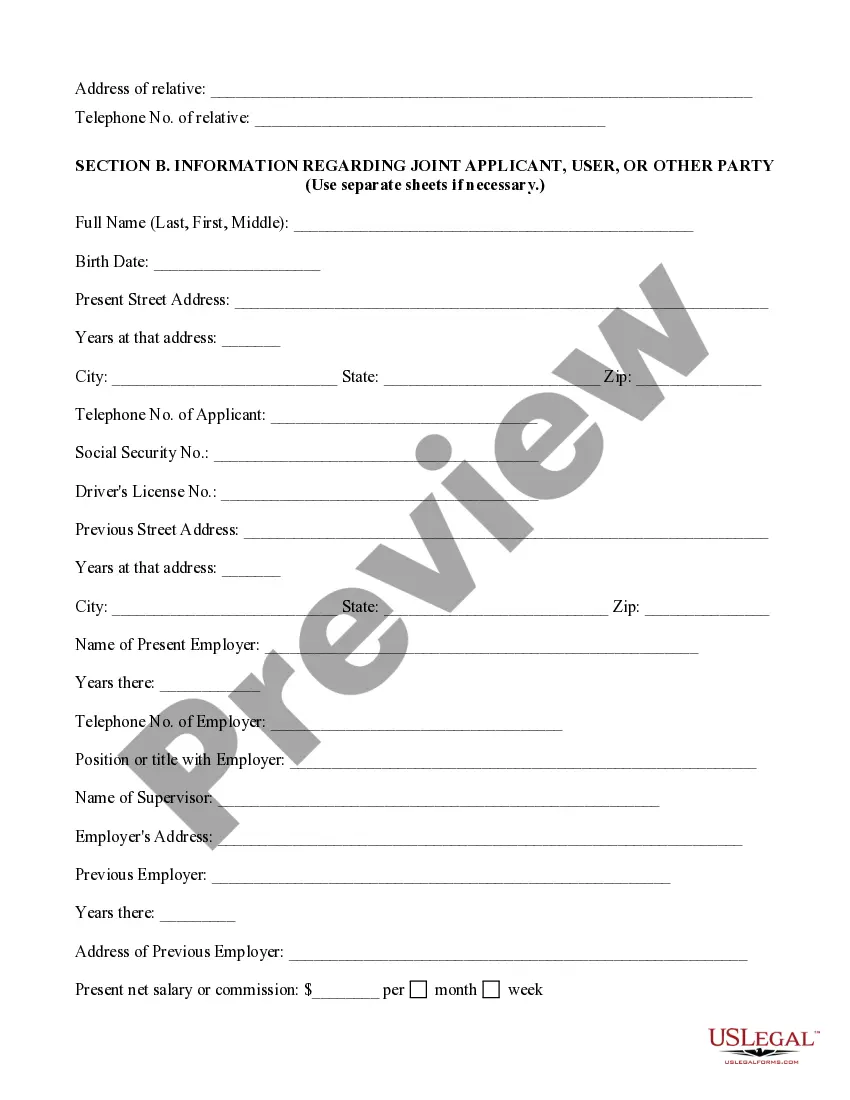

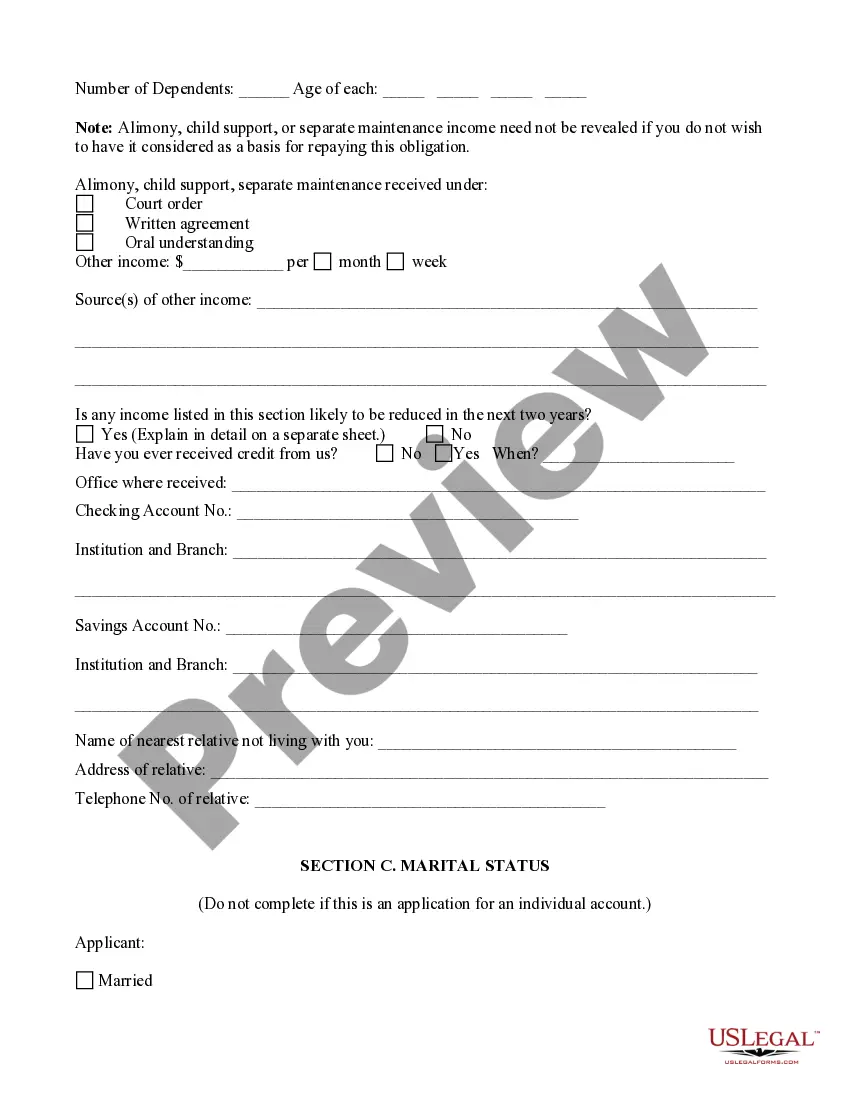

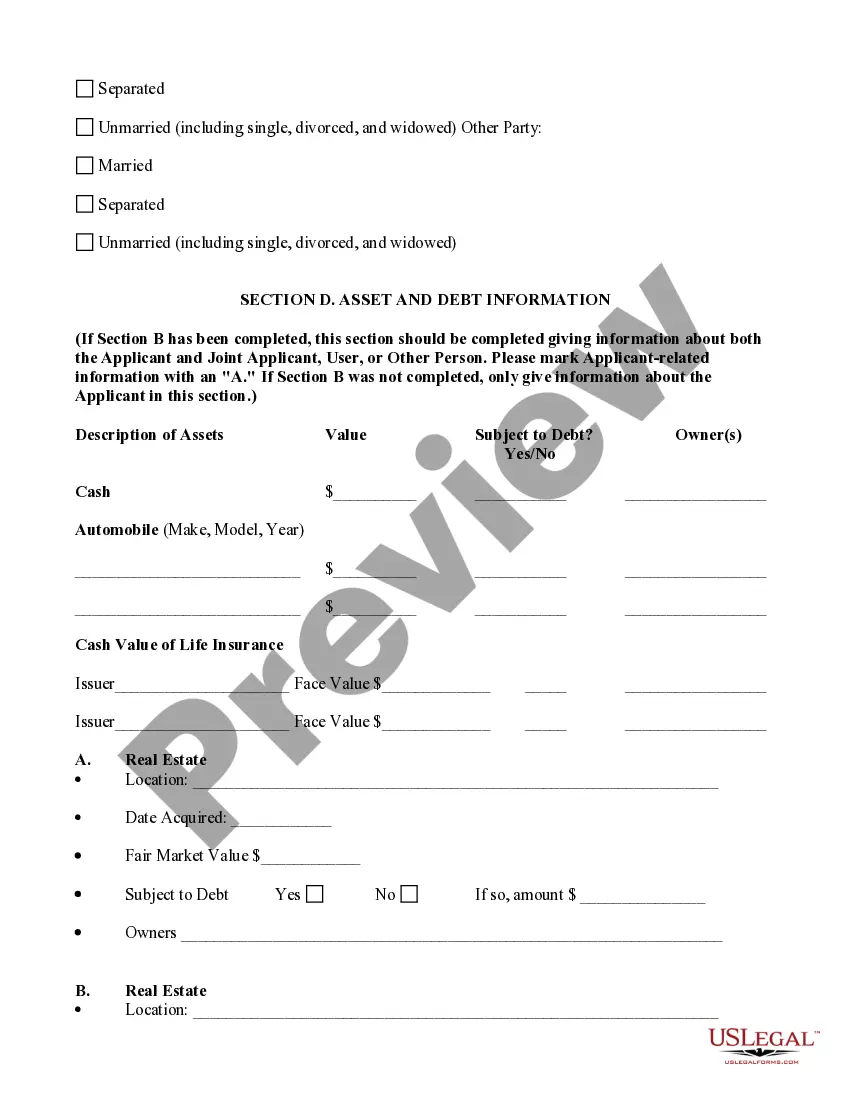

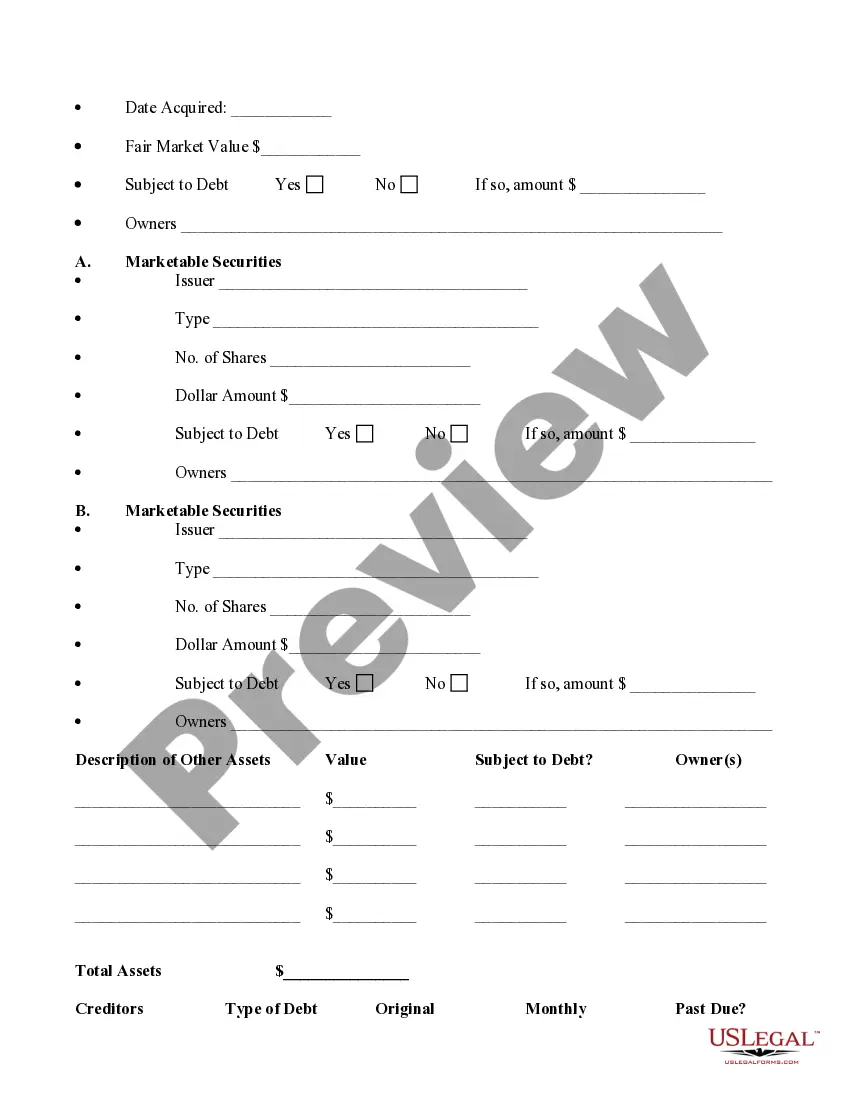

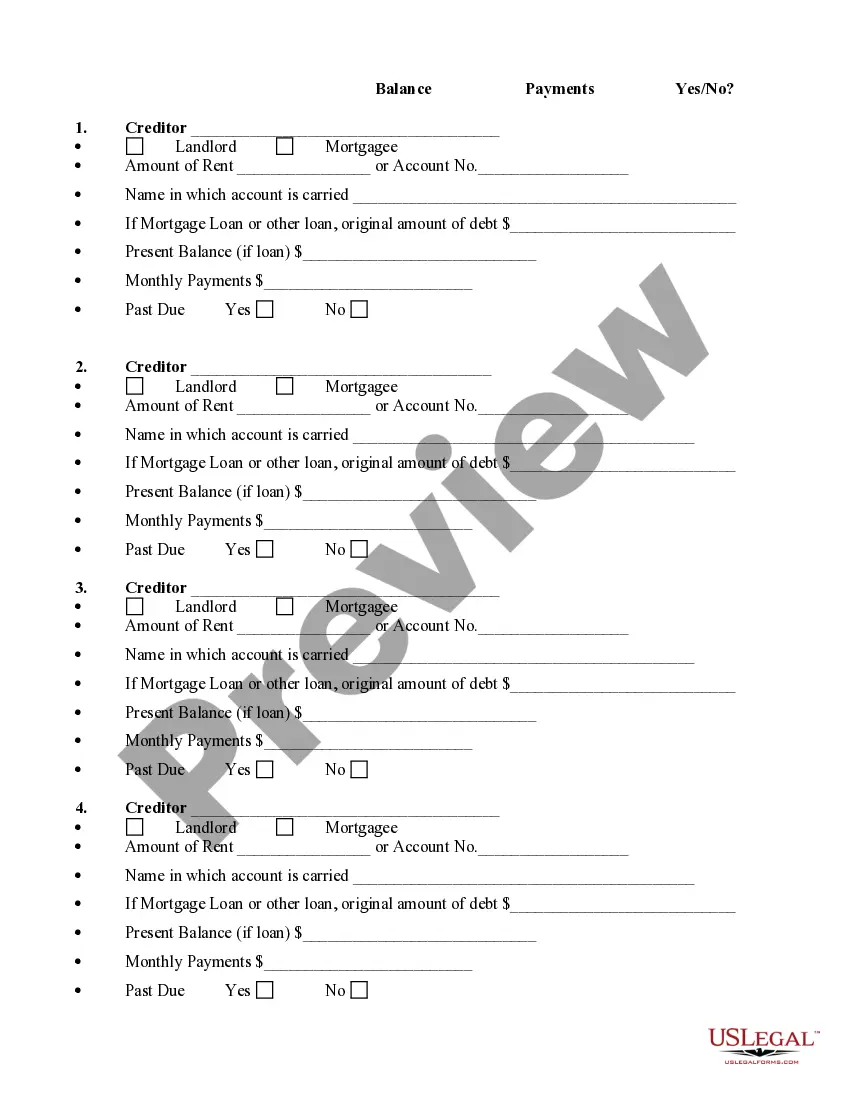

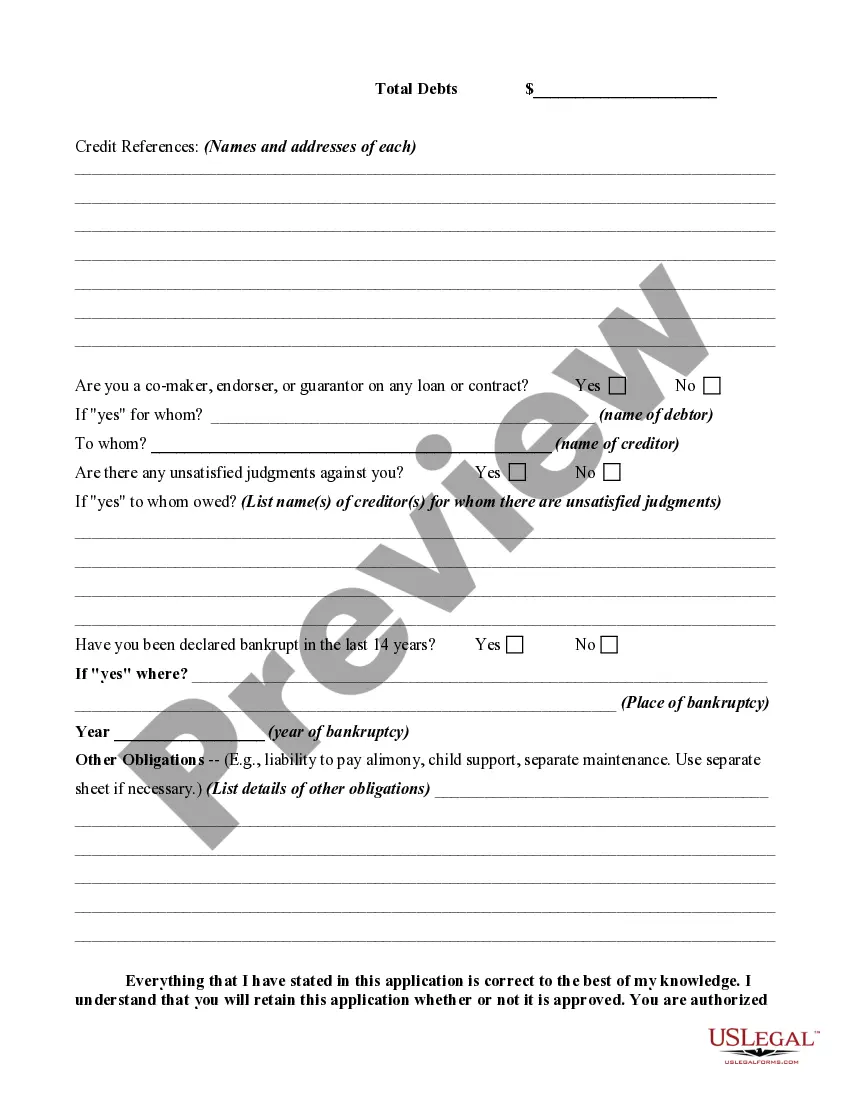

How to fill out Application For Open End Unsecured Credit?

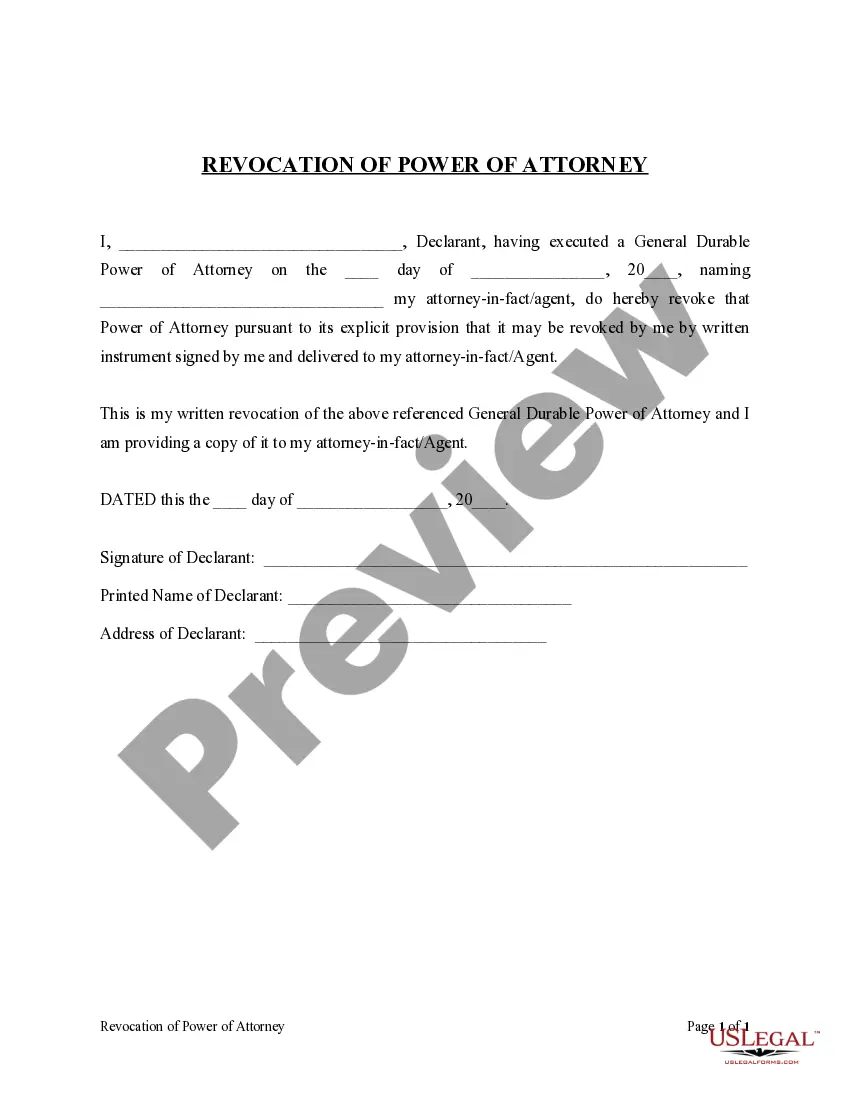

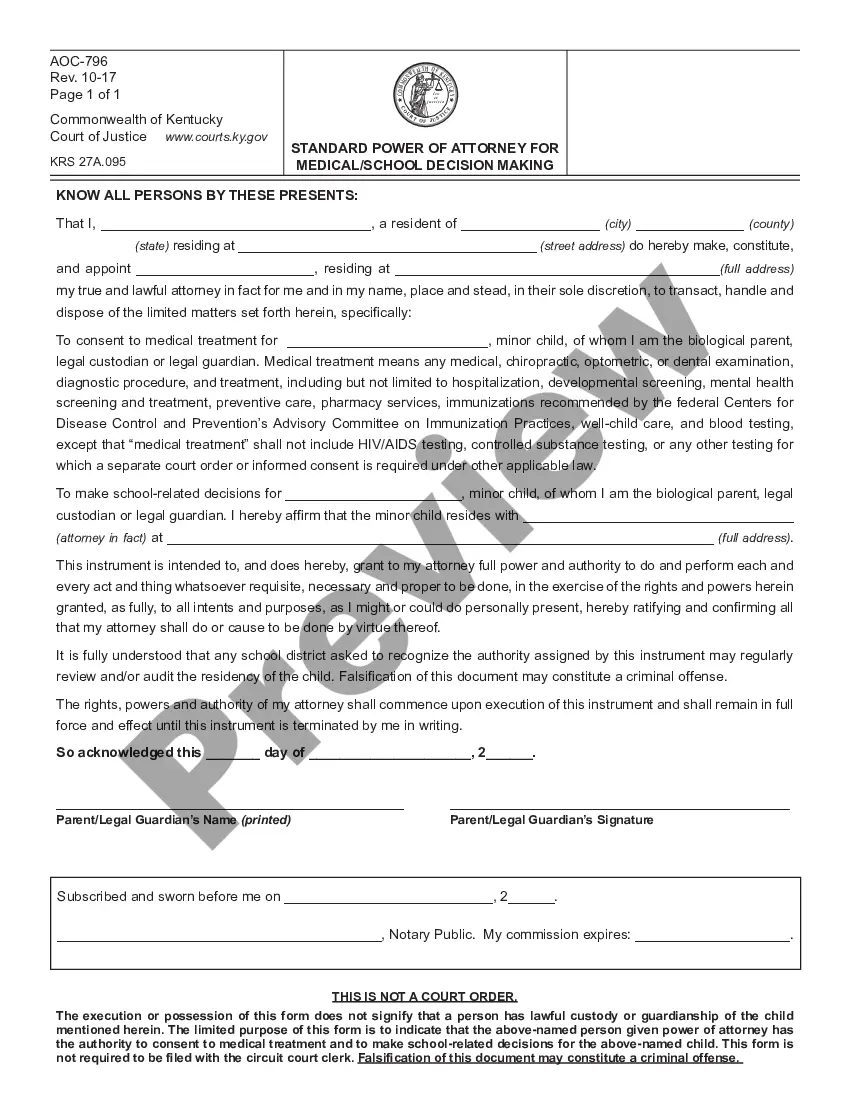

Coping with legal documentation requires attention, precision, and using well-drafted templates. US Legal Forms has been helping people countrywide do just that for 25 years, so when you pick your Application for Open End Unsecured Credit template from our service, you can be sure it meets federal and state laws.

Dealing with our service is straightforward and fast. To obtain the required document, all you’ll need is an account with a valid subscription. Here’s a brief guideline for you to obtain your Application for Open End Unsecured Credit within minutes:

- Make sure to attentively look through the form content and its correspondence with general and law requirements by previewing it or reading its description.

- Look for an alternative official blank if the previously opened one doesn’t suit your situation or state regulations (the tab for that is on the top page corner).

- Log in to your account and download the Application for Open End Unsecured Credit in the format you need. If it’s your first experience with our website, click Buy now to continue.

- Register for an account, choose your subscription plan, and pay with your credit card or PayPal account.

- Choose in what format you want to obtain your form and click Download. Print the blank or upload it to a professional PDF editor to prepare it paper-free.

All documents are drafted for multi-usage, like the Application for Open End Unsecured Credit you see on this page. If you need them in the future, you can fill them out without re-payment - just open the My Forms tab in your profile and complete your document whenever you need it. Try US Legal Forms and accomplish your business and personal paperwork rapidly and in full legal compliance!

Form popularity

FAQ

Topic 3 : Dummy Credit Application applicant has a good credit rating, the person behind the application has the opposite. Expectedly, the person who will pay the loan is the person behind the application which has a. low credit rating. Taking into consideration the 5 c's of credit, the applicant is not qualified.

A credit application is a borrower's formal request to a lender for an extension of credit. Credit applications can be made either orally or in written form, as well as online.

A personal credit application form allows an individual to apply for a personal loan or line of credit from a bank, credit union, or fintech company. Similar to a credit card, a personal line of credit is a set amount of money that accrues interest only when borrowed.

A credit application helps prevent delinquent payments and financial loss. An accurate and up-to-date credit application is one of the best ways to minimize risk. The application also allows the company to better implement their credit policy. Prevent Bad Debt Write-Offs.

Three things a credit card application will need are your full name, your Social Security number or Individual Taxpayer Identification Number, and information about your income. This information will help card issuers verify whether you are a real person and if you can afford making payments on a new credit card.

A mortgage denial letter is a disclosure that the federal government requires lenders to send to a borrower who is unable to meet the financing criteria for a home loan request.

The credit application (Application) is the. initial document used by Vendors to collect. information and establish contractual terms. with the Applicant.