Purchase Order for Payment

Description

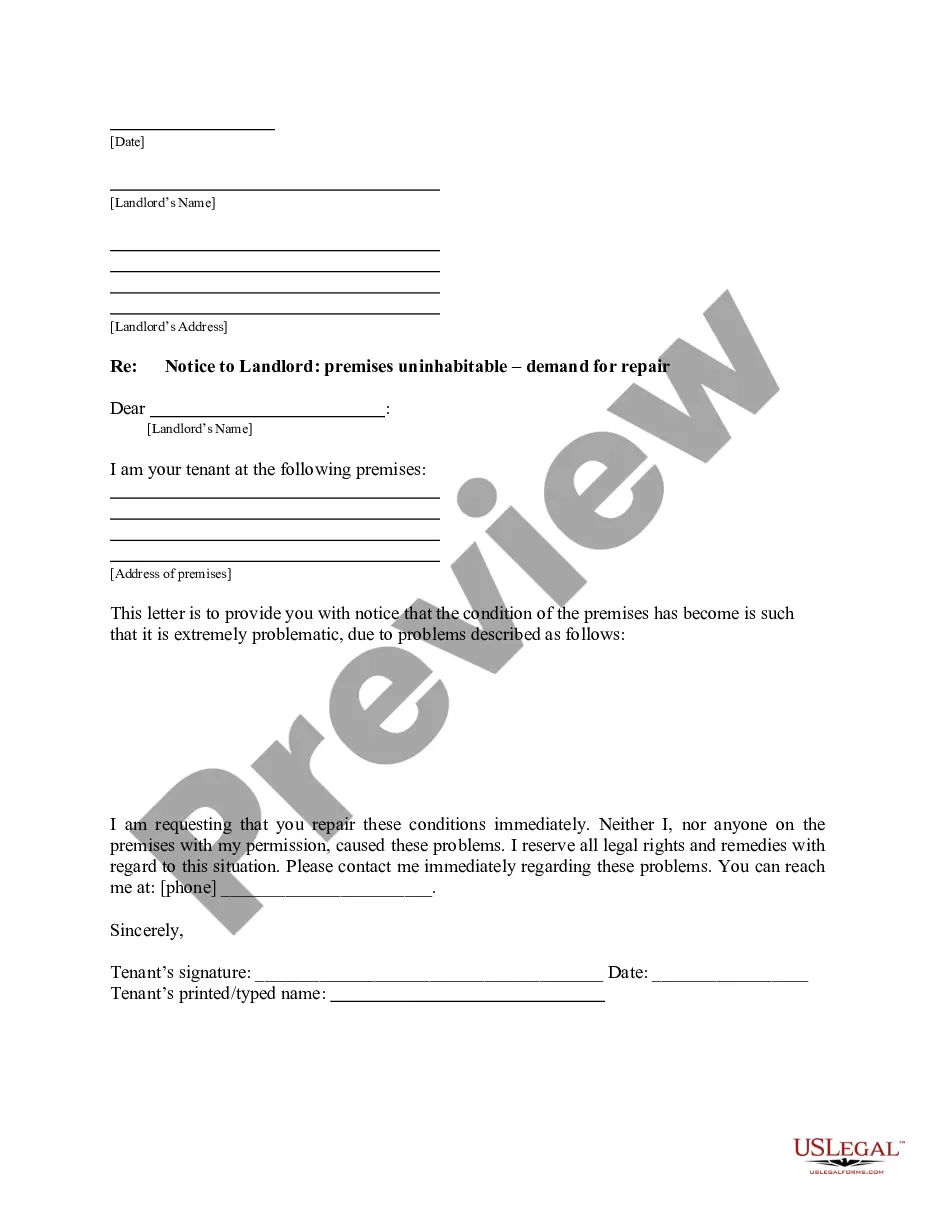

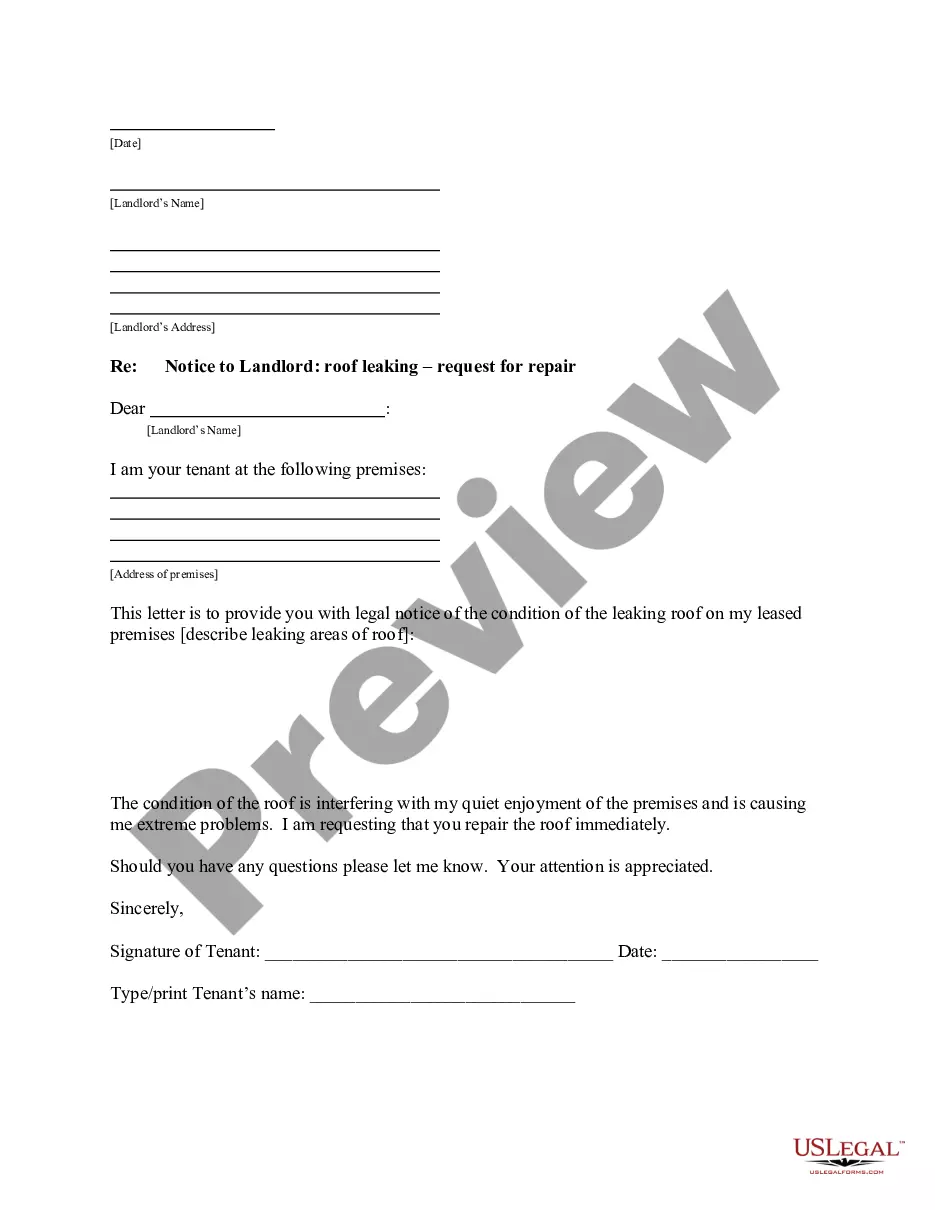

How to fill out Purchase Order For Payment?

Use US Legal Forms to obtain a printable Purchase Order for Payment. Our court-admissible forms are drafted and regularly updated by skilled lawyers. Our’s is the most extensive Forms catalogue on the internet and offers affordable and accurate samples for customers and legal professionals, and SMBs. The templates are grouped into state-based categories and many of them might be previewed before being downloaded.

To download samples, users need to have a subscription and to log in to their account. Press Download next to any template you need and find it in My Forms.

For people who don’t have a subscription, follow the following guidelines to quickly find and download Purchase Order for Payment:

- Check out to make sure you get the correct form in relation to the state it’s needed in.

- Review the form by looking through the description and by using the Preview feature.

- Press Buy Now if it is the template you want.

- Generate your account and pay via PayPal or by card|credit card.

- Download the template to your device and feel free to reuse it many times.

- Use the Search engine if you want to find another document template.

US Legal Forms provides a large number of legal and tax templates and packages for business and personal needs, including Purchase Order for Payment. Over three million users already have utilized our platform successfully. Select your subscription plan and get high-quality documents within a few clicks.

Form popularity

FAQ

A purchase order is used by a buyer to place an order and is issued before delivery. An invoice is issued by a seller using invoicing software after an order is delivered. It defines the amount the buyer owes for the purchased goods and the date by which the buyer needs to pay.

What is a Non-PO Invoice? Non-PO invoices do not have a purchase order associated and are the result of spend outside a regulated procurement process. This type of invoice is often called expense invoice and is used for various indirect purchases.

A purchase order (PO) is a commercial document and first official offer issued by a buyer to a seller indicating types, quantities, and agreed prices for products or services. It is used to control the purchasing of products and services from external suppliers.

Order receipts and packing slips are proof of payment and delivery. An order receipt will be supplied by the vendor during delivery and prove that the goods have been delivered to the buyer. Before an invoice can be paid, it must go through a series of checks with the accounts payable department.

A PO is generated when the customer places the order, while an invoice is generated after the order is complete. A PO details the contract of the sale, while an invoice confirms the sale. Buyers use POs to track accounts payable and sellers use invoices to track accounts receivable (in their accounting records).

For example: Maria's company needs to purchase new materials from a supplier to create their products. The company then creates a purchase order to present to the supplier from which they wish to order materials.When Maria's company receives the goods and the invoice, they compare them to the purchase order.

The purchase order is a document generated by the buyer and serves the purpose of ordering goods from the supplier. The invoice, on the other hand, is generated by the supplier and shows how much the buyer needs to pay for goods bought from the supplier.

The creation of a purchase order is the first step in a business transaction, it is issued by the buyer and authorizes a seller to provide a product or service at a specified price. The invoice is a bill issued by the seller when that product has been delivered or the service has been completed.