Resolution of Meeting of LLC Members to Dissolve the Company

Description Llc Dissolve Limited

How to fill out Dissolve Limited Companies?

Utilize the most comprehensive legal catalogue of forms. US Legal Forms is the perfect place for finding updated Resolution of Meeting of LLC Members to Dissolve the Company templates. Our service provides 1000s of legal forms drafted by certified lawyers and categorized by state.

To download a template from US Legal Forms, users just need to sign up for an account first. If you’re already registered on our service, log in and choose the document you need and purchase it. Right after buying templates, users can see them in the My Forms section.

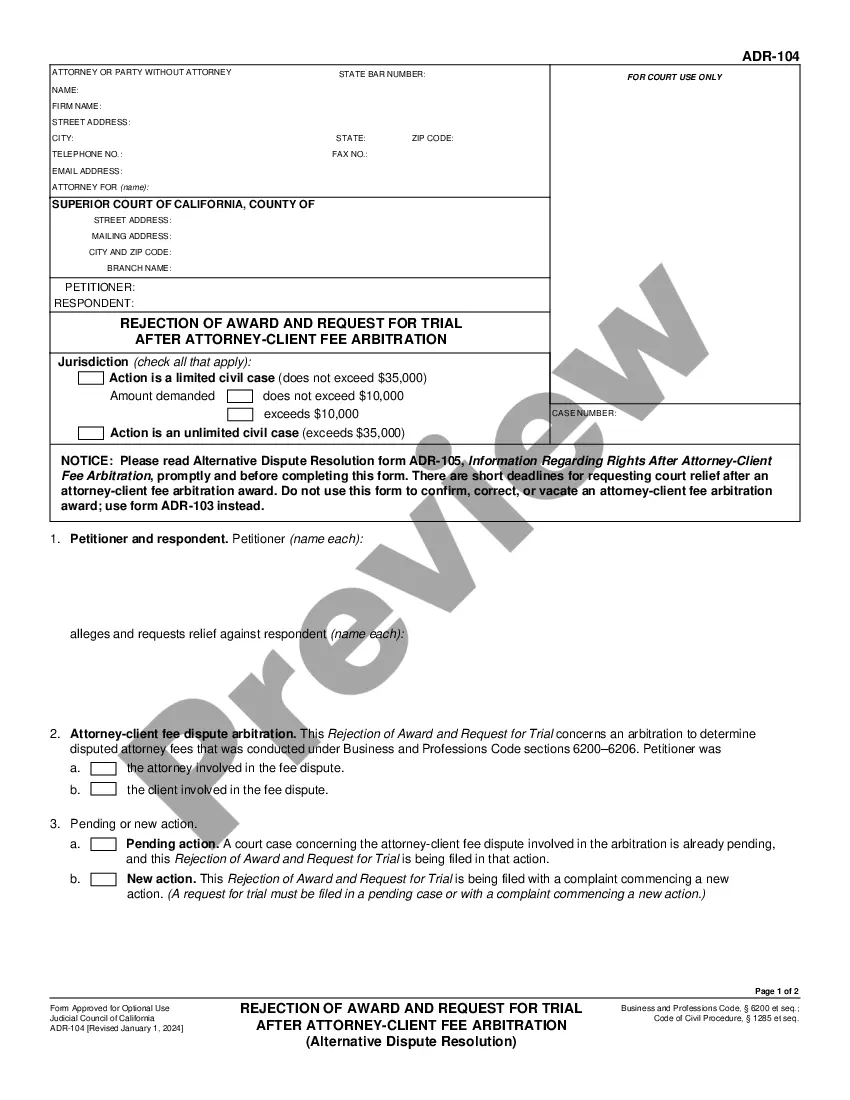

To obtain a US Legal Forms subscription online, follow the guidelines below:

- Find out if the Form name you have found is state-specific and suits your requirements.

- When the template has a Preview function, utilize it to review the sample.

- In case the template does not suit you, make use of the search bar to find a better one.

- Hit Buy Now if the template meets your expections.

- Select a pricing plan.

- Create an account.

- Pay with the help of PayPal or with the credit/visa or mastercard.

- Choose a document format and download the sample.

- When it’s downloaded, print it and fill it out.

Save your time and effort with our platform to find, download, and fill out the Form name. Join a huge number of pleased subscribers who’re already using US Legal Forms!

Resolution Dissolve Companies Sample Form popularity

Company Resolution Business Other Form Names

Dissolve Company Form FAQ

In a General Partnership, all partners are financially obligated to any debts incurred by the partnership. When a partner leaves, the partnership dissolves and the partners equally split debts and assets.

To close an LLC completely, you need to file a final tax return with the state and the IRS. Make sure you check the box to show this is the final return for the LLC. Fill out Schedule K-1 and give a copy to each member so that they know what to report on their own personal taxes in terms of losses and gains.

3 attorney answers A general partnership can be dissolved when a partner withdraws or dies. However, dissolution is only the beginning of the winding up process. Assets must be divided and liabilities paid.

Can one partner force the dissolution of an LLC partnership? The short answer is yes. If there are two partners, each holding a 50% stake in the business, one partner can force the LLC to dissolve.

Review Your Partnership Agreement. Discuss the Decision to Dissolve With Your Partner(s). File a Dissolution Form. Notify Others. Settle and close out all accounts.

Method 1: You can voluntarily dissolve your LLC. This requires a majority vote from all members or a certain percentage of votes as required per your operating agreement. With the required votes, you can move forward with the dissolution.

Date, time, and place of the meeting. Owners or members present. The nature of business or resolution to discuss, including members added or removed, loans made, new contracts written, or changes in business scope or method.

The Effect of Dissolution After you close your LLC in California, that LLC shall be canceled, and its powers, rights, and privileges shall end upon the filing of the Certificate of Cancellation. This means you can no longer conduct business using that LLC.

To close an LLC completely, you need to file a final tax return with the state and the IRS. Make sure you check the box to show this is the final return for the LLC. Fill out Schedule K-1 and give a copy to each member so that they know what to report on their own personal taxes in terms of losses and gains.