Acceptance of Election in a Limited Liability Company LLC

Description Limited Liability Company

How to fill out Limited Liability Company Contract?

Make use of the most complete legal catalogue of forms. US Legal Forms is the best platform for getting up-to-date Acceptance of Election in a Limited Liability Company LLC templates. Our platform provides thousands of legal forms drafted by licensed legal professionals and categorized by state.

To obtain a template from US Legal Forms, users simply need to sign up for a free account first. If you’re already registered on our platform, log in and select the document you are looking for and purchase it. Right after purchasing templates, users can find them in the My Forms section.

To get a US Legal Forms subscription on-line, follow the steps listed below:

- Check if the Form name you have found is state-specific and suits your requirements.

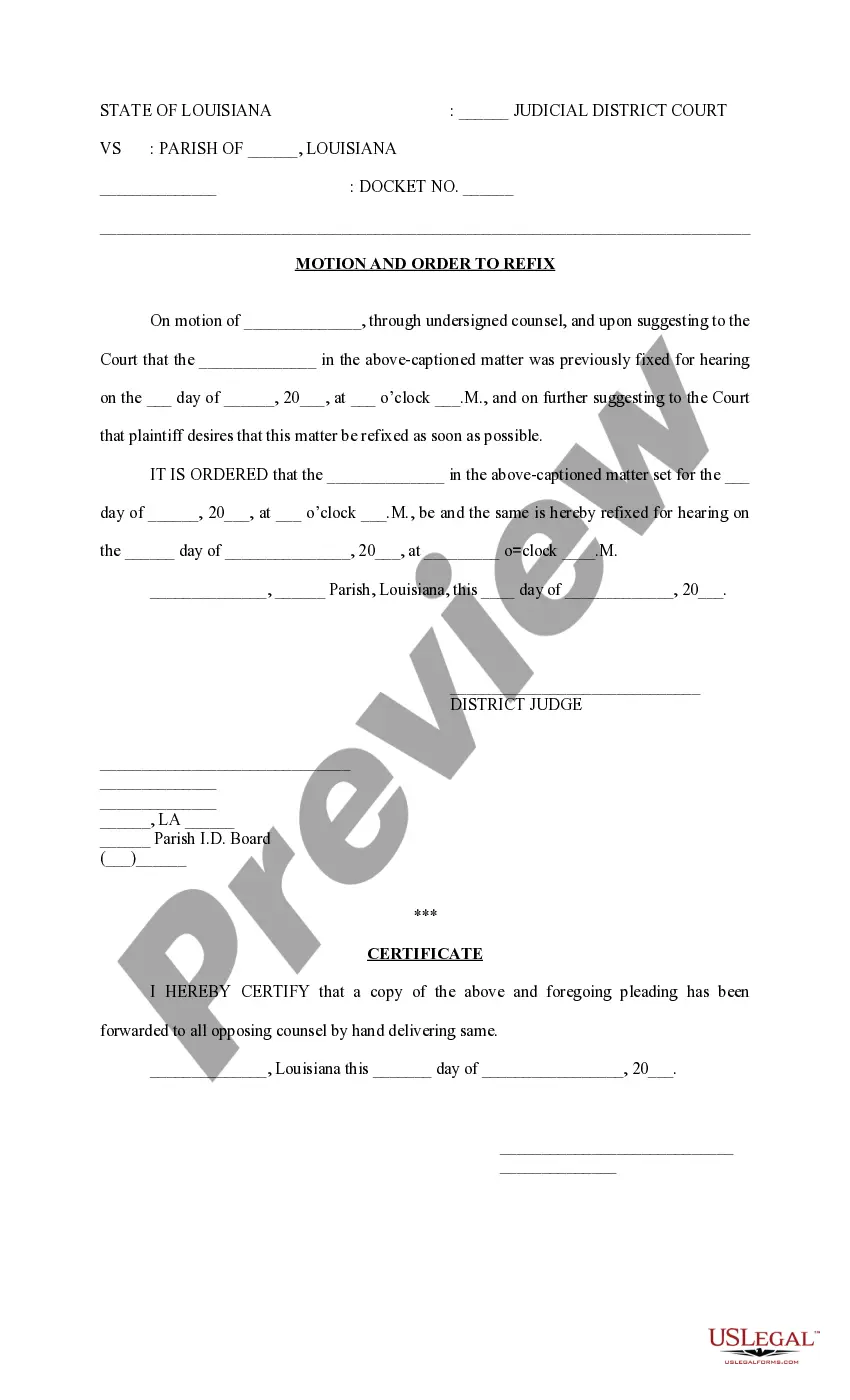

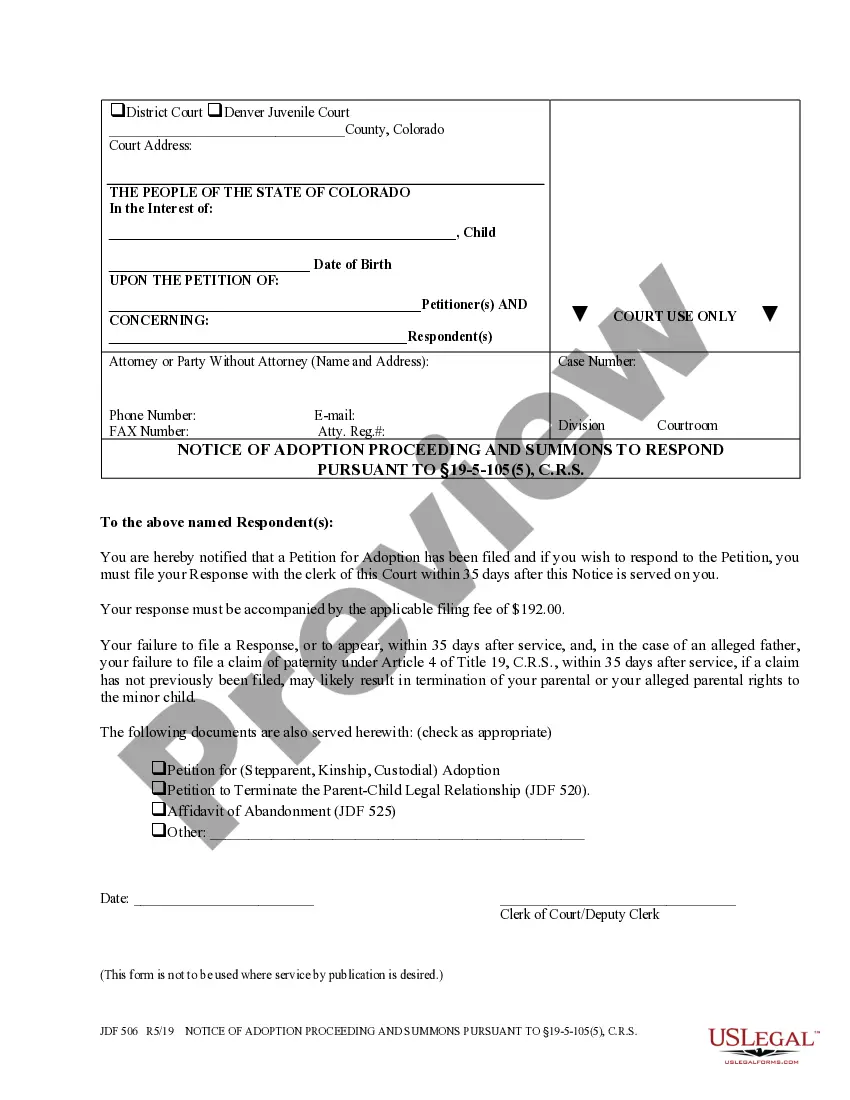

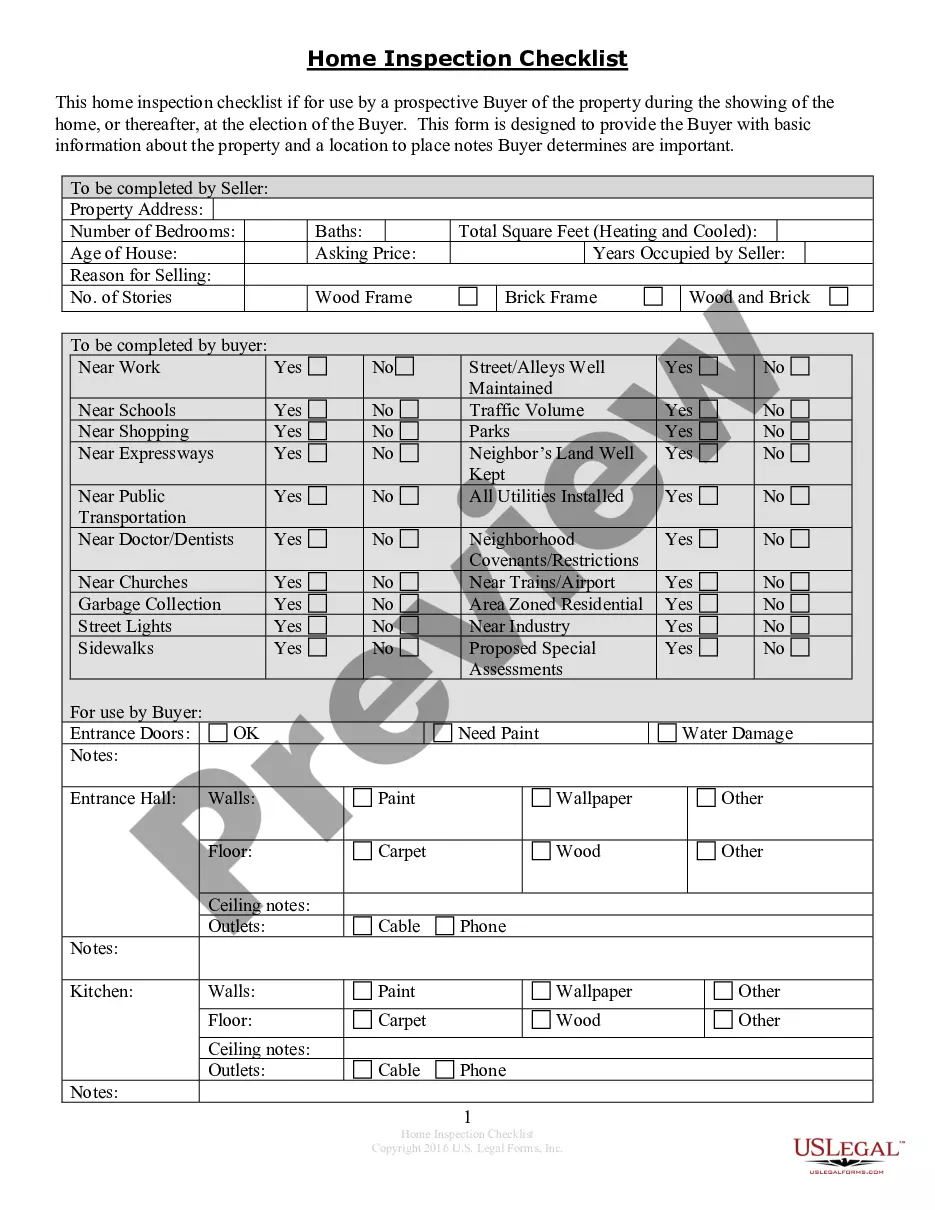

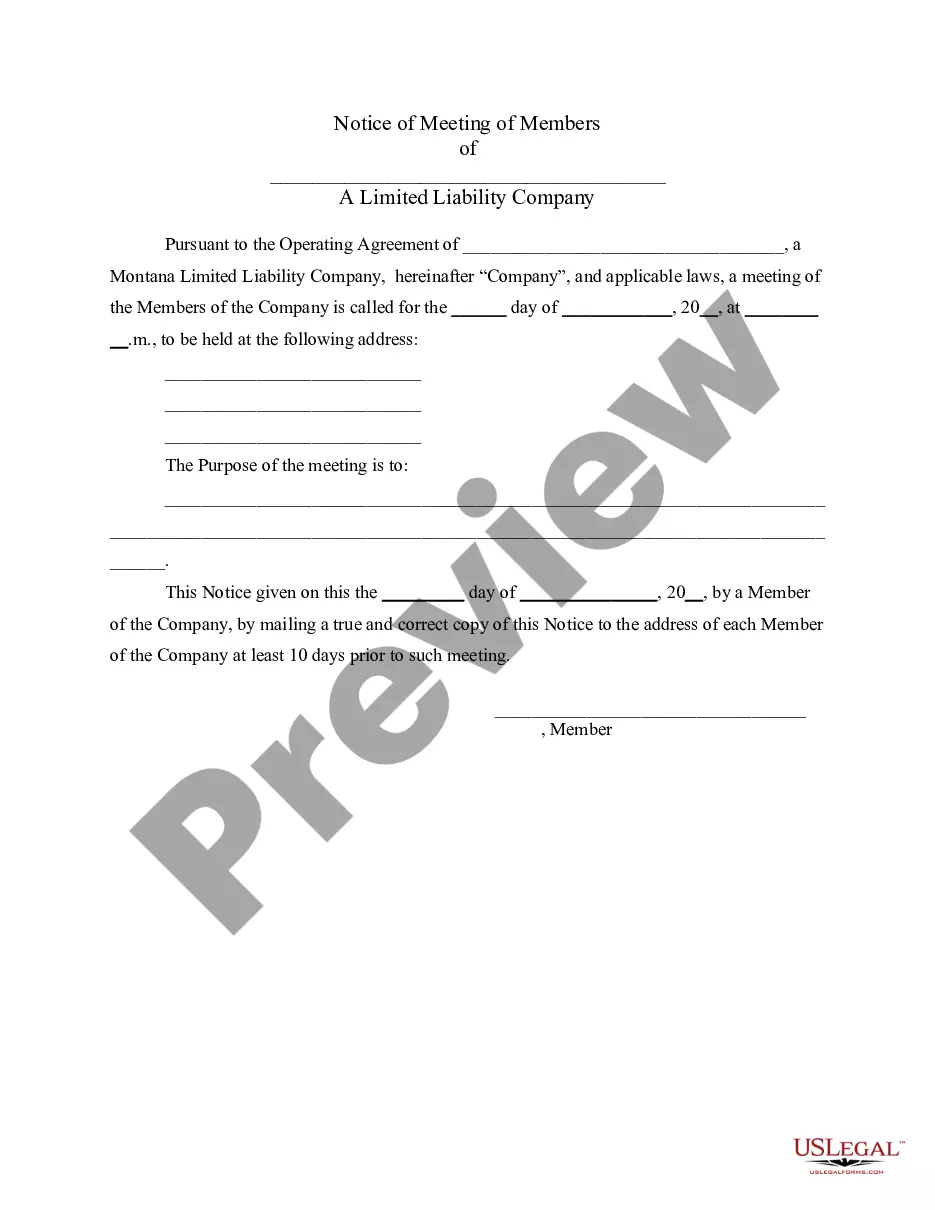

- In case the form features a Preview function, utilize it to check the sample.

- If the sample doesn’t suit you, utilize the search bar to find a better one.

- Hit Buy Now if the sample meets your requirements.

- Select a pricing plan.

- Create an account.

- Pay with the help of PayPal or with the credit/credit card.

- Choose a document format and download the sample.

- Once it’s downloaded, print it and fill it out.

Save your time and effort with the service to find, download, and fill out the Form name. Join a huge number of pleased subscribers who’re already using US Legal Forms!

In Limited Liability Form popularity

In Company Llc Form Other Form Names

Llc Elected Company FAQ

If you own all or part of an LLC, you are known as a member. LLCs can have one member or many members. In some LLCs, the business is operated, or managed by its members. In other LLCs, there are at least some members who are not actively involved in running the business. Those LLCs are run by managers.

If you're an LLC or partnership, use Form 8832 if you want to be taxed as a C-corp, partnership, or a sole proprietor. Meanwhile, Form 2553 is for LLCs or corporations that want to be taxed as S-corps. Keep this in mind: If you're filing Form 2553, you don't need to file Form 8832.

In the same way, as a corporation elects corporation tax status, an LLC may elect S corporation tax status by filing IRS Form 2553 with the IRS. The election must be made no more than two months and 15 days after the beginning of the tax year when the election is to go into effect.

Generally, LLCs taxed as partnerships may contribute to federal candidates. On the other hand, LLCs that elect corporate tax treatment are considered corporations by the FEC and are prohibited from contributing to federal candidates.

Organization of the Limited Liability Company Owners are called members though they are similar to shareholders. An LLC can have one member the owner of a sole proprietorship. An LLC can also have two or more members as in a partnership. These members can only lose the amount of capital they invested in the company.

For tax purposes, by default, an LLC with one member is disregarded as an entity.And, once it has elected to be taxed as a corporation, an LLC can file a Form 2553, Election by a Small Business Corporation, to elect tax treatment as an S corporation.

Most likely, this involves a choice between a limited liability company (LLC) or a corporation.All major decisions of the company must be made by the board and approved by a vote. These decisions are documented as formal resolutions and minutes of meetings of the board must be taken.

Owners (usually referred to as members in an LLC) may choose to manage the business personally, thereby keeping the decision-making power. However, they may also choose to delegate the decision-making authority to managers, those they select to run the business.

To avoid confusion and conflict among partners, business decisions are often made by consensus, through a democratic process, or by delegation. In partnerships that include both general partners and limited partners, the general partners will usually be responsible for all decision making.