Vehicle Policy

Description

How to fill out Vehicle Policy?

Among lots of free and paid examples that you’re able to find online, you can't be certain about their accuracy and reliability. For example, who made them or if they are competent enough to take care of what you need them to. Always keep relaxed and make use of US Legal Forms! Locate Vehicle Policy samples developed by professional legal representatives and avoid the costly and time-consuming process of looking for an lawyer or attorney and after that having to pay them to draft a papers for you that you can easily find yourself.

If you have a subscription, log in to your account and find the Download button near the form you’re looking for. You'll also be able to access all your previously saved documents in the My Forms menu.

If you’re utilizing our platform the first time, follow the tips below to get your Vehicle Policy quick:

- Make sure that the file you see applies where you live.

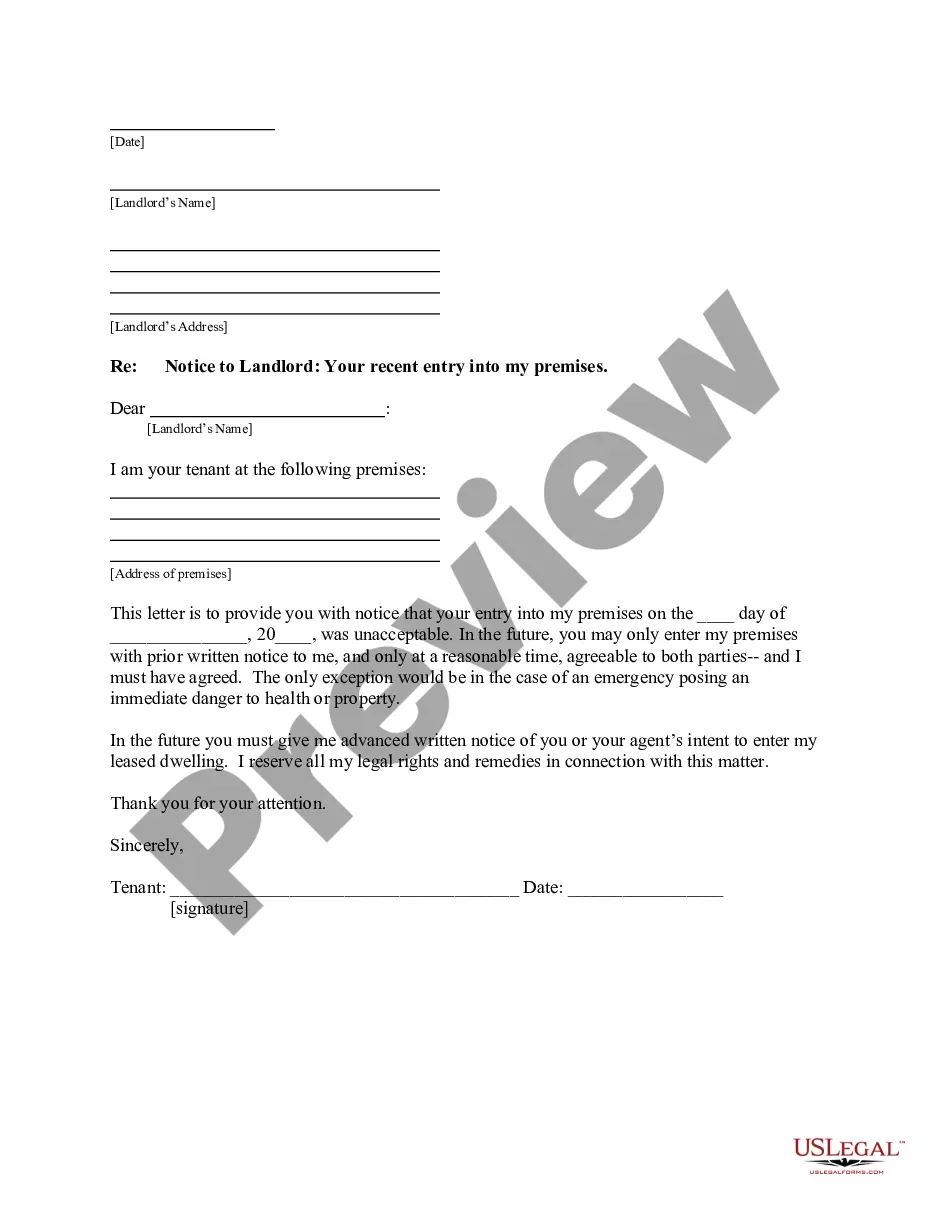

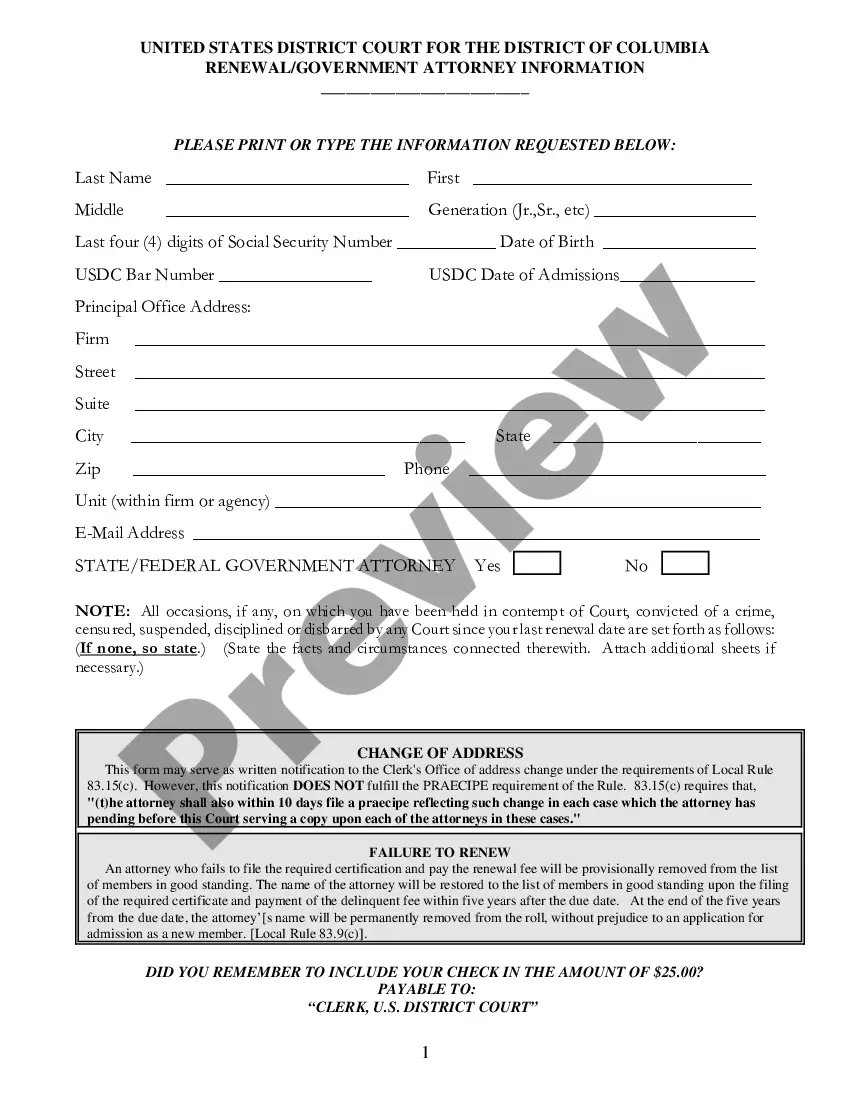

- Review the file by reading the description for using the Preview function.

- Click Buy Now to start the ordering process or find another sample utilizing the Search field located in the header.

- Select a pricing plan sign up for an account.

- Pay for the subscription using your credit/debit/debit/credit card or Paypal.

- Download the form in the required file format.

When you have signed up and purchased your subscription, you can use your Vehicle Policy as often as you need or for as long as it remains valid in your state. Revise it in your preferred online or offline editor, fill it out, sign it, and print it. Do a lot more for less with US Legal Forms!

Form popularity

FAQ

A company vehicle policy, or company vehicle use agreement, establishes which employees are eligible for a company fleet vehicle. It also outlines the requirements for qualifying for a company car, basic rules employees must follow when using company vehicles, and disciplinary action for misusing vehicles.

An auto insurance policy will cover you and other family members on the policy, whether driving your car or someone else's car (with their permission). Your policy also provides coverage to someone who is not on your policy and is driving your car with your consent. Personal auto insurance only covers personal driving.

Duly filled and signed claim form. Tax receipt. Copy of the insurance policy. Copy the vehicle's registration certificate (RC) License copy of the driver driving the vehicle at the time of the accident. Copy of the FIR/Police Panchanama registered.

How does your address affect car insurance? Car insurance proof of address for national insurance companies is required because they have to consider how much you're exposed to risk when they are setting an adequate and personalized rate.

While different states mandate different types of insurance and there are several additional options (such as gap insurance) available, most basic auto policies consist of: bodily injury liability, personal injury protection, property damage liability, collision, comprehensive and uninsured/underinsured motorist.

Although insuring a car not in your name isn't as common and might involve refusal or unwillingness from insurance companies to insure you, there are times when you can insure a car not in your name. These are: If you have an insurable interest. When you add the vehicle owners name to your auto policy.

Liability Coverage. Auto liability coverage is mandatory in most states. Uninsured and Underinsured Motorist Coverage. Comprehensive Coverage. Collision Coverage. Medical Payments Coverage. Personal Injury Protection.

Car insurance companies don't allow you to put your policy on hold or suspend a policy for a period of time. Instead, you have to cancel your policy and then restart it when you want your coverage active again.

Copy of your insurance policy. First Information Report (FIR) filed with the police. Duly filled up and signed Claim Form. Copy of the registration certificate of your car. Copy of your driving license. A detailed estimate of the repairs. Medical receipts in case of physical injuries.